When companies want to raise funds they can opt for one of two ways. They can either liquidate their equity by selling shares in the stock market or they can issue bonds. A bond is basically giving a loan to the company. The bond will mention its face value, interest rate, maturity period, and interest payment schedule. The principle amount is always returned to investor at the end of maturity in a bond. Debt mutual funds are not the only method of investing in bonds. One can even invest directly into bonds. In fact, there are some bonds that have low to no credit risk involved. This article details how to invest in bonds directly to get a fixed income while also minimizing credit risk.

Table of Contents

Why should one invest in bonds directly?

The primary reason to invest in bonds directly would be to diversify one’s portfolio. Diversifying the portfolio means investing across multiple assets so that all your investment is not in one place. Having all investments in just one resource can make it volatile since a drop in it would lead one to lose all their investment. Thus, spreading the investments around helps in balancing and lowering risk of it.

So while one can also diversify their portfolio by investing in debt mutual funds, that option also incurs an additional expense ratio. Expense ratio is paid to the fund manager for managing the mutual fund account. However, investing in bonds directly does not incur an expense ratio.

Lastly, investing in bonds directly is a great option when one wants to invest a sum of amount altogether to generate a fixed income but take low risk. This can happen when one suddenly comes into money and does not know what to do with it. Then bonds are a good option.

How to invest in bonds directly?

There are two methods of investing in bonds directly.

Primary market

Just like IPOs are launched in the market, same way bonds are also issued for subscription in the primary market. One can apply for bonds directly via a broker or the website of the company issuing the bond or through their bank. But it is important to own a demat account for buying a bond. Since no physical bond certificates are issued and all bonds are saved on one’s demat account digitally.

Secondary market

Just as after the initial issue, mutual funds are listed on the stock market and available anytime to purchase, bonds too get listed and are available for purchase. So if the bond is listed in the stock market then one needs to search for its code on their demat account and purchase it. However, this process is difficult because firstly one needs to know the exact code of the bond. Secondly, apart from price of the bond no other detail is mentioned on the demat app. One cannot find out the face value, accrued interest, YTM or any other detail of the bond. Lastly, liquidity of bonds is not easy. Since buying and selling of bonds on secondary market is not an easy process.

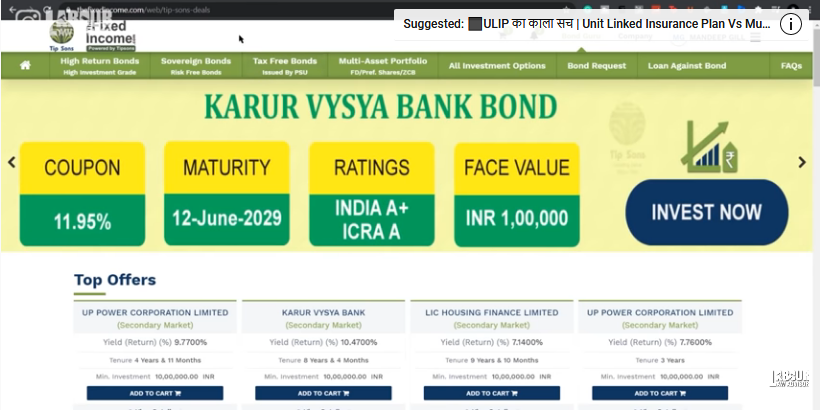

The Fixed Income – best way to purchase bonds

TheFixedIncome.com solves many of the problems related to purchasing bonds. The company is promoted by Tip Sons Group which is a SEBI registered company. The Fixed Income is a debt broker but not an exchange platform. They do not maintain one’s brokerage account or match orders. Rather one’s transactions get stored in their demat account directly. The coupon rate of the bond, paid by the bond issuer to the bond holder, also goes directly to one’s account holder instead of any brokerage or demat account. The Fixed Income takes no transaction charges, maintenance charges and account opening charges.

The company maintains a stock of bonds in its inventory. This also explains how they are able to immediately allocate bonds upon purchase. They charge a profit margin of 5 paise – 10 paise on every Rs 100. This profit margin determines the cost price of the bond finally.

Type of bonds

Government bonds

This is zero credit risk bonds since it comes directly from the Central Government and it never defaults. Whenever the Central Government is in need of funds, it issues new bonds to the RBI and raises funds. Government bonds are also called G-Sec or Government Securities.

Corporate bonds

This has credit highest risk involved. companies may default on payment even after having the best ratings.

PSU bonds

These companies are again under the governance of the Central Government and hence have low credit risk involved. Under PSU bonds there are again three kinds of bonds. Firstly, PSU taxable bond wherein one pays tax on the interest received on the bond. Secondly, PSU tax-free bond wherein no tax is paid on the interest earned. Thirdly, PSU bonds under Section 54EC where if one invests under Rs 50 lakh earned from sale of land, within 6 months of sale, in a PSU bond under Section 54EC, then no tax is charged on the profit of sale of land. However, the interest earned from this bond investment will be taxable.

What is Yield To Maturity (YTM)?

If a certain coupon rate is mentioned on a bond, that does not mandate that it will also be the interest rate one earns on the bond. The interest earned on a bond actually calculated on its cost price and selling price. To understand the concept of YTM, we take a look at the examples below.

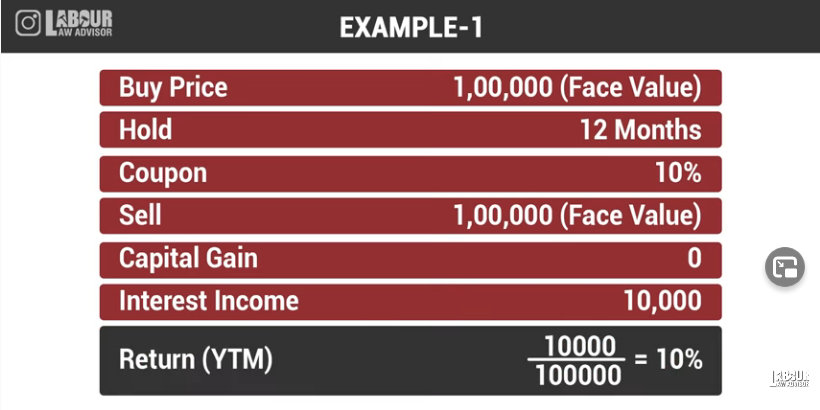

Example 1

In example 1, suppose person A purchases a bond at Rs 1 lakh and holds it for the full maturity period of 12 months. After 12 months, company returns full amount of Rs 1 lakh to A. The coupon rate was 10%.

Since A held onto the bond and did not sell it in the secondary market, he did not get any capital gain. But A earns an interest of Rs 10,000 at 10% coupon rate. Hence, his annual return, i.e. YTM, comes to 10%.

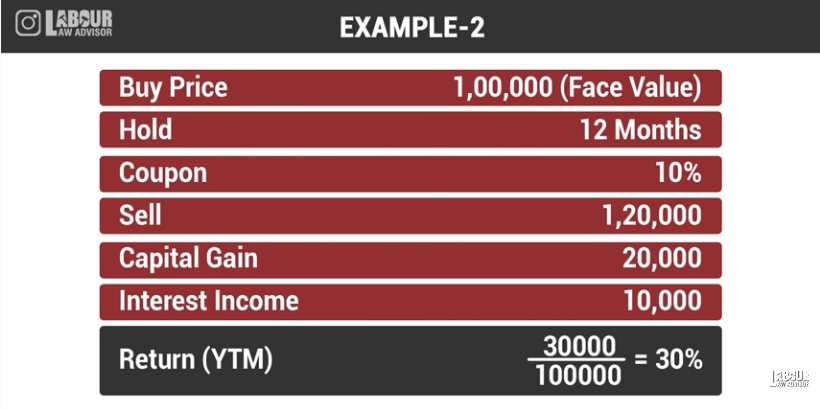

Example 2

In example 2, suppose B purchases a bond at Rs 1 lakh for 5 years. But B sells it after 1 year itself at Rs 1.2 lakh because the bond value has risen. Hence, here B earns a capital gain of Rs 20,000, which is the difference between the buy price and sell price of the bond. Additionally, B also earns an interest of Rs 10,000 at 10% coupon rate by holding th bond for 1 year.

Hence, the annual return or YTM for B comes to 30%.

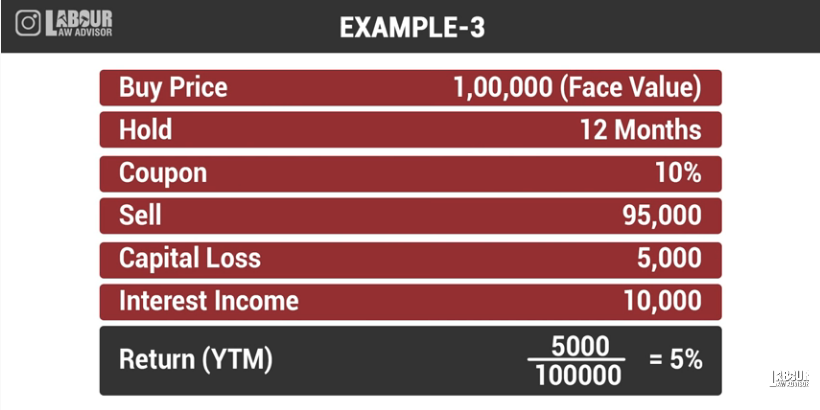

Example 3

In example 3, suppose C buys a bond at Rs 1 lakh for 12 months. He then sells at Rs 95,000 because the bond value has fallen. Hence, C has a capital loss of Rs 5000. But he also earns an interest of Rs 10,000 at 10% coupon rate for holding the bond for 1 year.

Hence, the YTM for C is only 5%.

Thus, YTM as a number is taken into consideration when it is assumed that one will hold the bond to maturity. It is also an important factor to check before purchasing any bond.

What is accrued interest?

Another factor that affects the price of bonds is accrued interest. Accrued interest is simply the amount of interest earned on the bond but not yet collected. The interest keeps adding up from the date of issue of the bond to the time it’s held.

For example, person A buys a bond where the company will pay the interest once annually on 31st December. A holds the bond from January until September. He then sells it to B in October. Now when the company gives the interest, it will go altogether to B’s account. Hence, A asks B to pay him the interest for 9 months of holding the bond at the time of purchase itself. This concept is known as accrued interest.

The Fixed Income lists the accrued interest on the website with clear breakdown as well.

How to select bonds to invest?

- Visit thefixedincome.com and make an account on the platform.

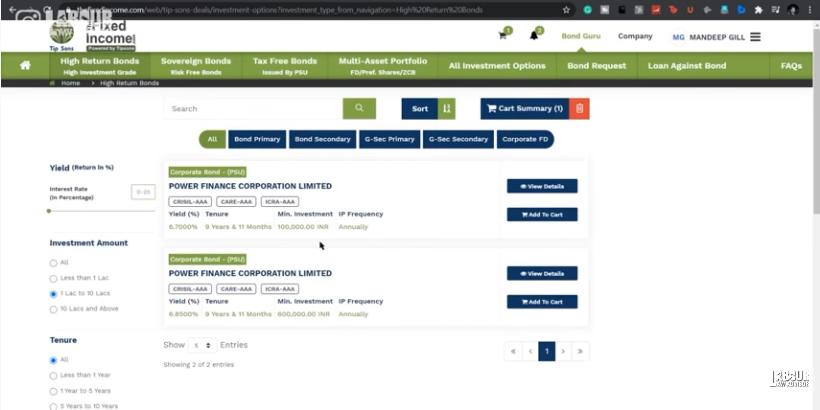

- After signing up, one can view different categories of bonds available on the website such as High Return Bonds, Sovereign (or Government) Bonds, Tax-free Bonds, etc. Click on the category that one is interested in investing.

- Each category will list multiple bonds so it is advisable to put filter as per one’s requirements to shortlist the bonds further.

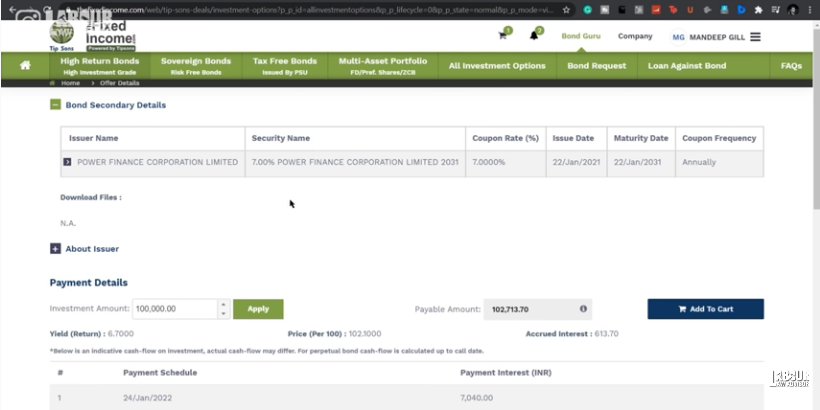

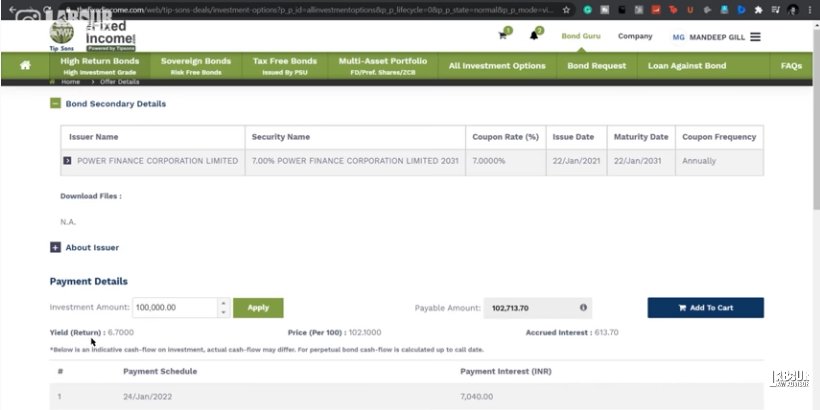

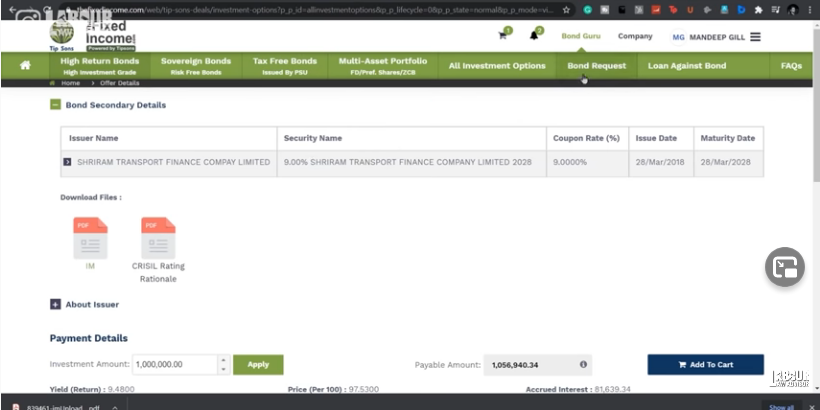

- Once bonds have been shortlisted, click on the View Details option. /now one can see bond details such as Issuer Name, Security Name, Coupon Rate, Issue Date, Maturity Date and Coupon Frequency.

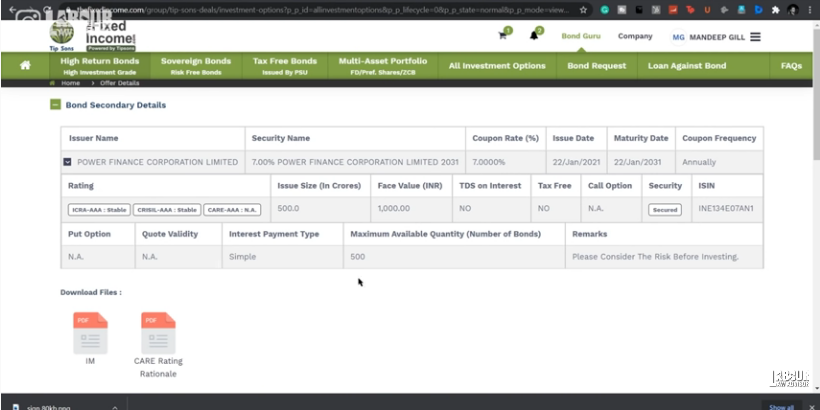

- One can also click on the arrow icon next to Issuer Name and view further advanced details of the bond such as the Bond Ratings, Issue Size, Face Value, Security (whether there are any assets can be sold to recover the investors bond value), etc.

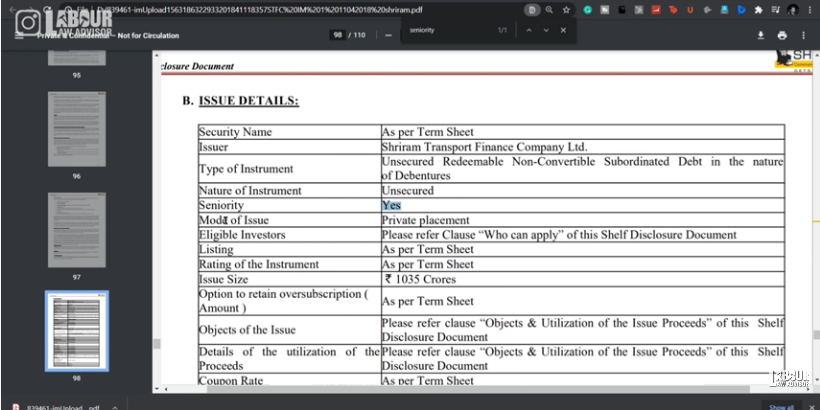

- One should also check the IM PDF under Download Files. IM stands for Information Memorandum and it is an official document provided by the bond issuer with all details relating to the bond. Since these documents are usually very long, we just find the information pertaining to Seniority to check if it is affirmative. If Seniority says Yes or Senior then it means that if the company goes under, then the investor has primary hold on the money from the company.

- Next one needs to check the Yield (Return), Price (per 100) and Accrued Interest values to know the actual Payable Amount for the bond.

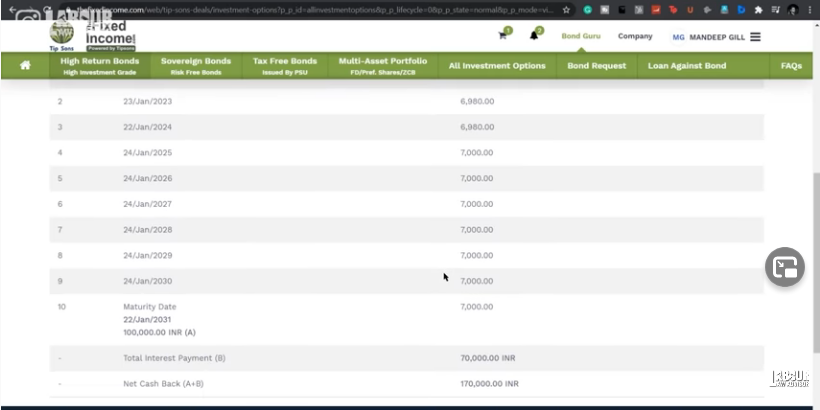

- If one scrolls down a little, they will be able to also see the Interest Payment Schedule. It will list the dates for interest payment and the interest amount to be paid.

- If one wants to sell a bond, then they must go to Bond Request tab and put it up for sale. There is also the option to take loan against a bond in the Loans against Bond tab.

Which bonds to invest in?

Ideally, the best type of bonds to invest in are either Government or PSU bonds. Since they entail investing a large sum of money together and give a high income. Moreover, at a time when even creditable companies with high ratings default on payments, government and PSU bonds have low to no risk involved.

Tax on bonds

In the case of bonds which are listed on the stock market, it is regarded as LTCG only when held for over 12 months and then sold off. But if bond is sold before 12 months, then it is regarded as STCG. In both cases tax applicable is same as equity funds.

For STCG, the profit earned is added to one’s income and tax is payable as per slab rate. On the other hand, for LTCG, one has to pay 20% plus get indexation benefits. For LTCG, there is also the option of paying 10% tax without any indexation benefit.

In the case of unlisted bonds, holding bond for less than 3 years is STCG and more than 3 years is LTCG. STCG is added to one’s income and tax is applicable as per tax slab rate. LTCG incurs 20% tax with indexation benefits. LTCG also provides 10% tax without indexation benefits but only for NRIs.

The above pointers were only for capital gain from bonds. For regular interest earning on bonds, it gets added to income and tax is applicable as per slab rate.

Loan against bond

One can also take loan against a bond on the fixed income portal. In this case, one is not transferring the ownership of the bond against the loan. One is only keeping it on rent so to say. Hence the interest earned on the bond will still go to the bond owner. Additionally, bond owner will pay loan interest to the bank or NBFC.

Cons of bond

Liquidity of bonds is low if one wants to sell it before maturity. In the case of selling bonds before maturity on the fixed income portal, either the brand may decide to buy your bond or they may not. In that case, one may have to wait a few days until a buyer comes along.

Watch the full video to know more on invest in bonds directly.

Types of bonds – classified as per risk factor

- Unsecured

- Secured

- Covered

Bonds usually have following challenges:

- Lack of information – Retail investors can study a company to a limit. If their investment is not made in the correct company’s bond, then their entire investment can become nil if the company defaults.

- High ticket size – Bonds are priced quite expensive at Rs 5 lakhs and above.

- High risk or low return – Big brand companies offering secured bonds generally offer low interest rate. Meanwhile, companies ofeering high interest rate bnds are usually unsecured or rated low.

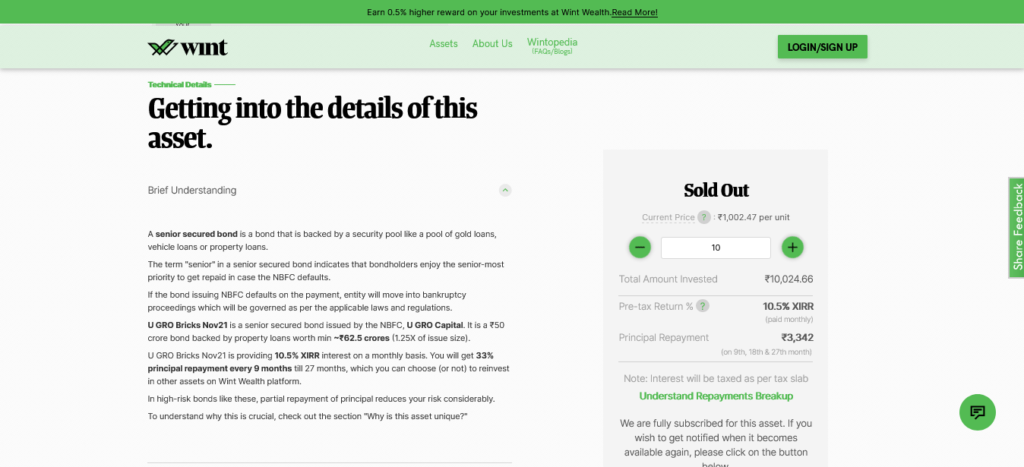

What are senior secured bonds?

In secured bonds, the company sets aside some collateral which if later needed can be liquidated to return the investors their money. This serves as insurance for the investors. When a company defaults, all its assets are presented in court for bankruptcy proceedings. The first attempt is always to revive the company wherein other companies bid to buy it out and present their proposals of repaying the creditors.

The Committee of Creditors gets to decide which proposal they want to accept. If none of the proposals are accepted and the company is liquidated. When the process of repaying the creditors begins, the first payment is always given to the senior secured bondholders. Then the rest of the payment is given to the creditors.

DHFL case study

In June 2019, DHFL defaulted approx Rs 90,000 crores. Finally, the Piramal Group won its bid in acquiring the company. Piramal Group proposed to repay the category 1 senior secured bondholders 100% of their principal investment amount. The rest of the secured bondholders in other categories got partial repayment of principal amount. However, unsecured bondholders only got 5% of investment back, suffering the most.

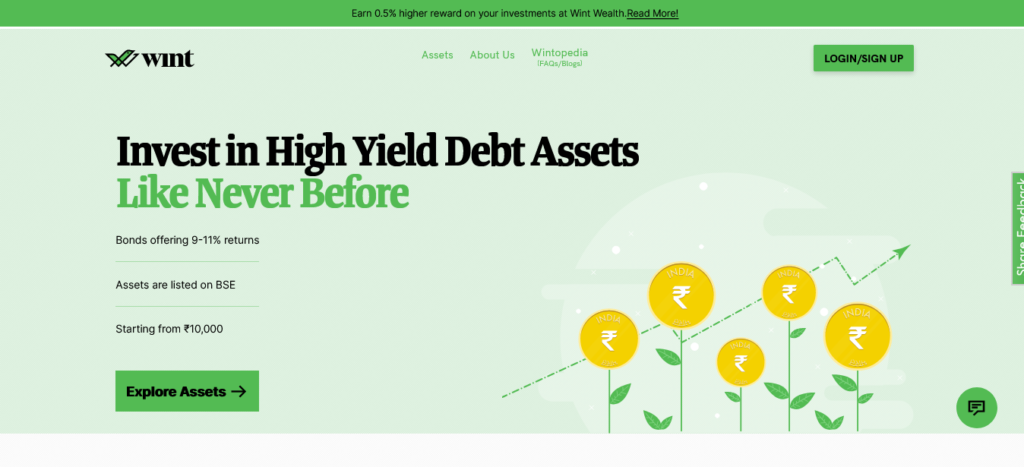

What is Wint Wealth?

Wint Wealth is a new startup backed by most of the Fintech leaders in the country. Wint Wealth provides retail investors with the opportunity to invest in fixed income products which were earlier deemed too risky and difficult to get for them. It got the retail investors big assets within small investments and less risk.

How does Wint Wealth solve bond problems?

- Picking bonds themselves – Wint Wealth is not a listing site for every company to register their bond on it. Rather Wint Wealth studies the bonds of all companies on offer, scrutinizes them and fnally handpicks the best options to partner with and list it on their site.

- Pick company collateral pool – The collateral which a company puts for its bond issues is personally handpicked by Wint Wealth. Hence, they try pciking quality assets from the full list of assets to make a good collateral pool which will be recoverable.

- Bonds which were earlier high ticket sized can now be bought in multiples of as minimum as Rs 10,000.

- Provides high returns on bonds ranging from 9-11% in terms of XIRR.

- There are short-term bonds available as well.

How to invest in bonds directly via Wint Wealth?

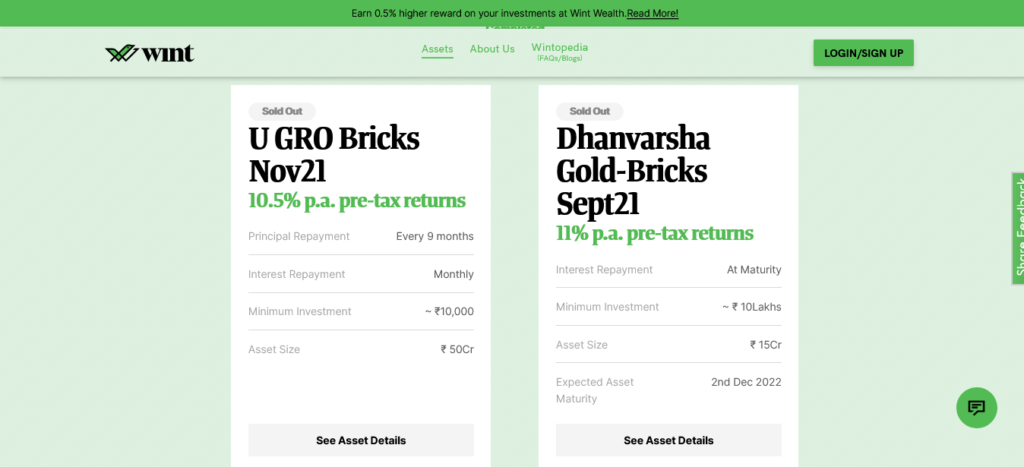

- Open the Wint Wealth website and click on Assets on top.

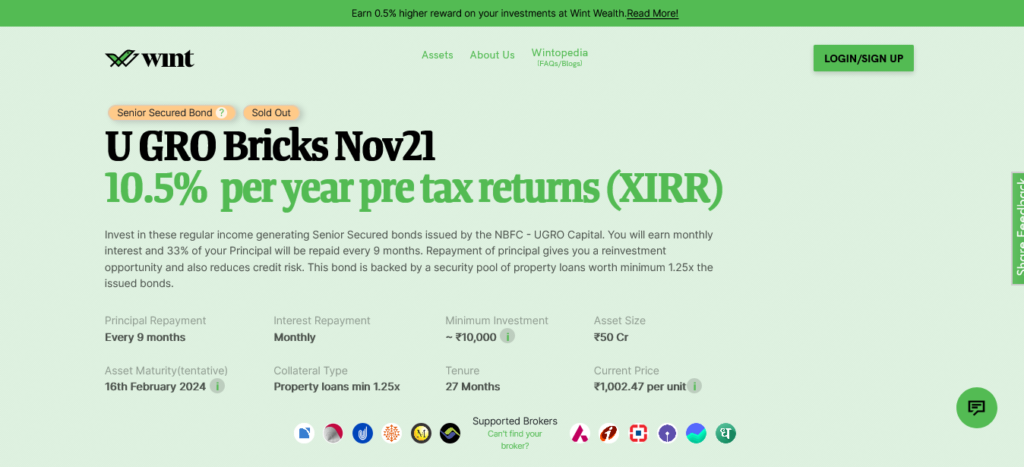

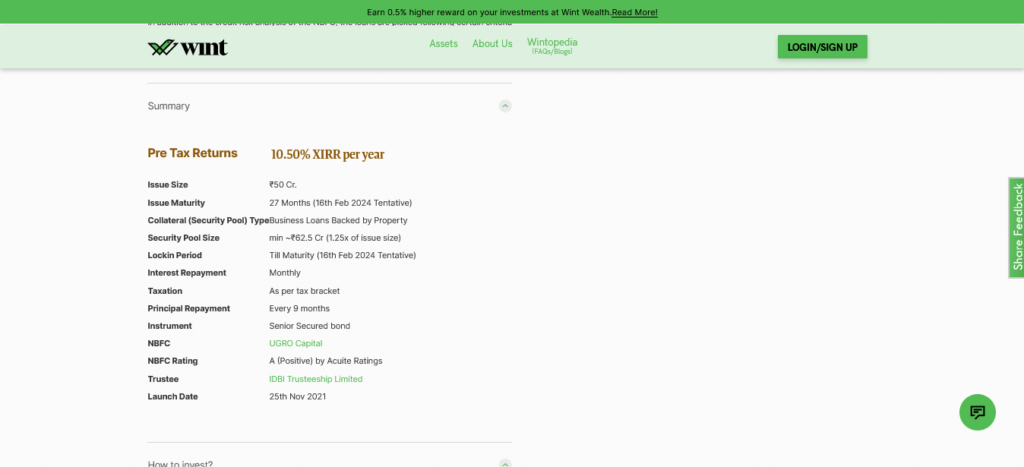

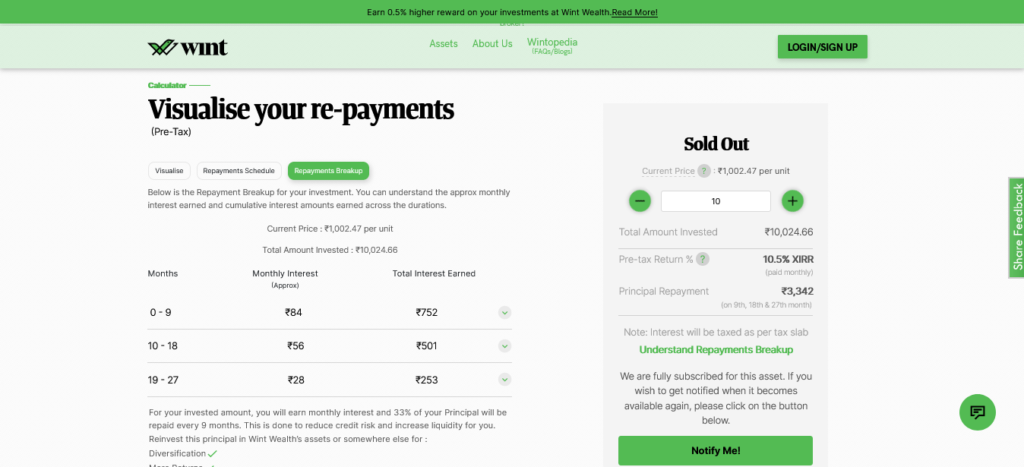

- This will show details of all the upcoming bond issues. In this case it is U GRO Bricks issue with 10.5% XIRR returns that are payable monthly with issue size of Rs 50 crore.

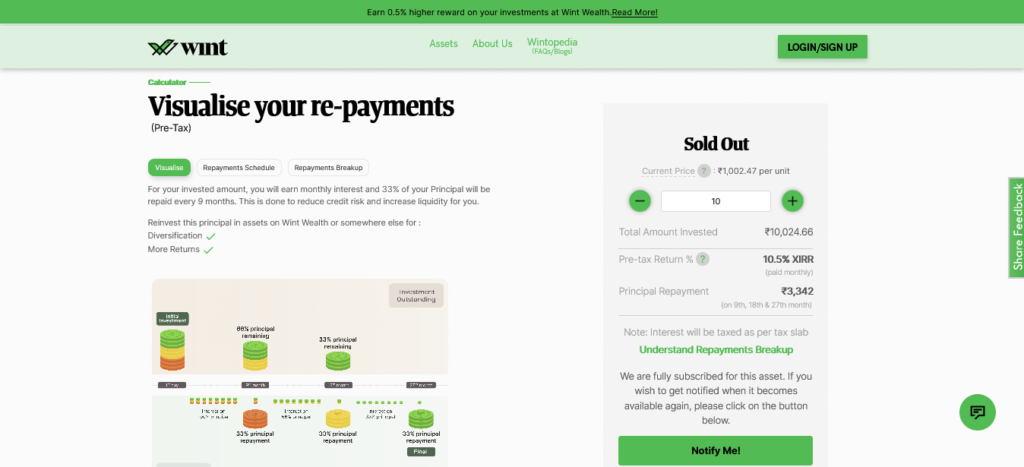

- For further details, one can click on See Asset Details. This will reveal collateral pool, tenure, repayment schedule of interest and principal amounts, etc. These bonds are unique. They are called amortizing bonds, wherein investor receives one-third of principal amount after every 9 months. Hence, investor does not need to wait till end of tenure to receive full principal back.

- However, once one-third principal is returned to investor, the other interest payments are made only on the remaining principal amount. Therefore, while interest payment may decrease it is also lowering credit risk. Combined with the short term tenure, this is quite great overall.

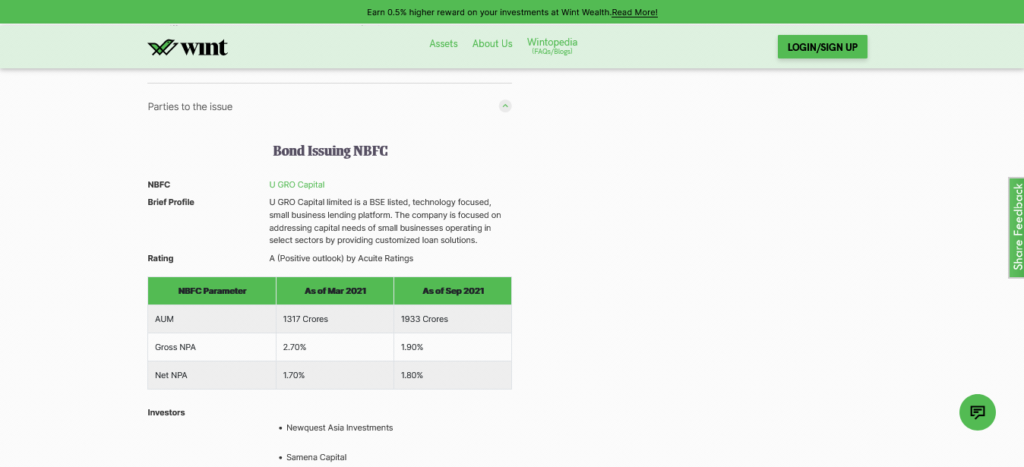

- Next, one can scroll down the page and click on Brief Understanding to get more details of the company and the bond issue. This will include the NBFC partner and details on the bond collateral.

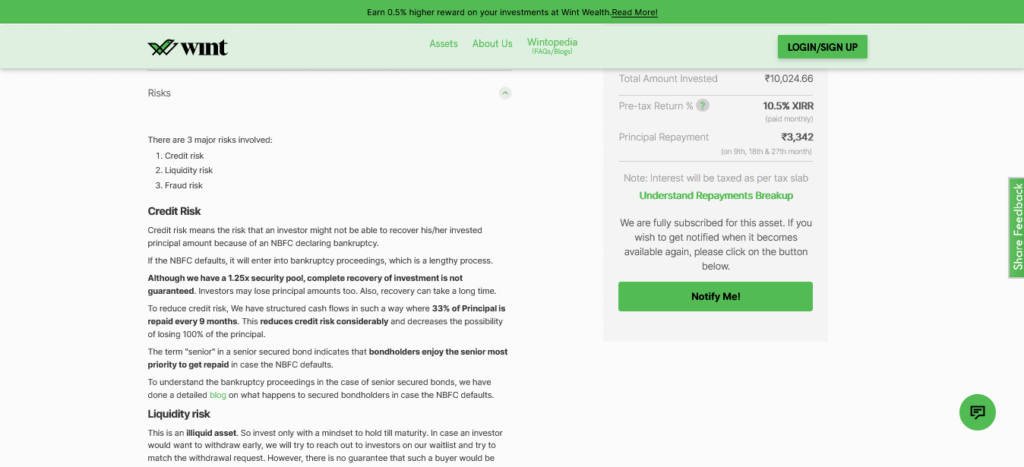

- The succeeding Risk section details the credit, liquidity and fraud risk factors involved with the bond issue.

- This is followed by the details of the security pool. Including state profile, loan to value ratio, and property type. Followed by the Summary of all the important bond details.

- Next, one can find more details of the partner, NBFC in this case.

- Lastly, the Prospectus will give all details of the company.

- To invest, one can go to the Start Investing section. The price of one unit is Rs 1000, hence one will need to purchase 10 units of it. 10.5% is the XIRR after paying everything including all margins and principal repayment is Rs 3342. Click on Notify Me to get notified once this bond issue is launched.

- One also needs a demat account to purchase bonds on Wint Wealth since they will be held in the demat account only. The amount for purchase will also be taken from demat account.

Additional security

Generally, the senior secure bonds may be the Pari Passu Charge type. In this case, an asset is not kept exclusively for collateral damage pool. It may be a shared asset, which the company might lose in time, as long as it maintains total assets worth collateral pool amount in its balance sheet. Hence, here it is not clear which assets will be sold to repay senior secure bondholders.

However, Wint Wealth offers senior secure bonds with First Charge. Here, assets are exclusively kept for senior secure bondholders and they are repaid first without any questions.

Who should invest?

Retails investors who can afford to invest Rs 50,000 to Rs 1 lakh should invest in Wint Wealth. It will provide them with monthly income as well. Investments lower than Rs 50,000 are not worth the hassle in this case. Additionally, it is also advisable to not invest all the funds in just one company’s bonds. Rather one should spread out investment over a few different company bonds. Thus, reducing their risk factor in case one company defaults.

Watch the full video on Wint Wealth below.

How does Wint Wealth select bonds for issue?

- One of the major features of Wint Wealth is that it is not an open platform where any and every bond will be available. Wint Wealth carefully selects bonds for on-boarding on the platform to create a curated selection.

- The first fundamental is looking at the sector of the company. Historically speaking, most bond defaulters have been in either builder or infrastructure sectors. So these two sectors are best avoided.

- Next fundamental point is the performance of the bond itself. This can be gauged by the percentage of loans defaulted by the bond. Thus, an NPA value in double digits is a red flag to take note of. Moreover, Wint Wealth selects only those entities which have the lowest possible NNPA value.

- The next important fundamental is the entity’s leverage. When taking bonds, it is a safe choice to select entities which have as much of their own money involved, as much as the loan amount they are asking for. Hence, Wint Wealth selects those entities which have a leverage of four or less.

- Next fundamental to check is the entity’s equity investors. Whether it is a promoter run entity or are there credible institutional investors backing the entity. Wint Wealth prefers entities with private or institutional investors or venture capital funds.

Example

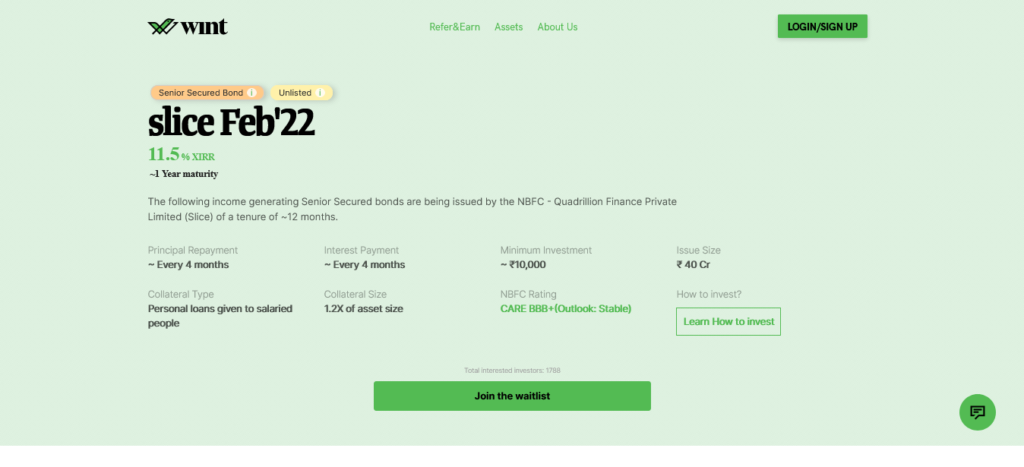

Recently, Wint Wealth issued bond named Slice with an XIRR worth 11.5%. When selecting this entity for its platform, Wint Wealth looked at following parameters:

- The issue was done be the NBFC – Quadrillion Finance Private Limited (Slice).

- The equity leverage or debt/equity ratio was less than three.

- The NBFC parent had recently raised Rs 1000 crore through marquee equity investors with deep pockets and is deemed a unicorn.

- The NNPA value for the entity is under two, which stayed consistent even during the pandemic.

- The entity’s borrowers are predominantly from the salaried segment, which have a steady income.

How does Wint Wealth decide the bond structure of the entity?

- Since the listed bonds are all senior secured bonds, they are comparatively risk-free. Firstly, being secured, they do not have any collaterals involved. Secondly, if the bond were to default then senior secured bond holders get top most priority for recovery followed by senior unsecured bond holders and lastly junior bond holders.

- The collateral taken for senior secured bonds is 1.2x usually.

- Other stringent criteria for picking the bond are having salaried borrowers only, maximum ticket size, etc.

- At any point of time, all the customers of the bond should be paying on-time. Incase, some are defaulting then they need to be replaced.

- Bond tenures do not exceed 18 months thus ensuring that in case of default, the recovery does not take a long duration too.

- Also, maximum ticket size per loan or borrower is INR 10 lakh.

- The entity is an amortizing bond hence the principal (face value) on the bond is paid down regularly, along with its interest expense over the life of the bond. So if the company were to default, then all of the investor money would not be stuck as some of it would have been returned already. Thus, reducing risk compared to a bullet bond.

Who should not invest in bonds?

- Even though the entities listed on Wint Wealth are low risk, they are not completely risk-free. Hence, people who cannot afford taking a risk, such as senior citizens, should not opt for this investment.

- Since the bond has a lock-in period, one should only invest that much amount which they can afford to lock-in for that period. Since, it is not possible to break the bond mid-duration and there is no liquidity guaranteed.

- People who have already completed their bond portfolio should not take on investment in further bonds.

- If people are planning to invest in another asset then funds should be reallocated accordingly instead of just investing everything in one asset.

- If the entity does not align with one’s investment requirements.

Watch more details on how to invest in bonds directly through Wint Wealth in the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!