Employees’ Provident Fund, or EPF, is a scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Furthermore, it is under the management of the Employees’ Provident Fund Organization or the EPFO. Under the PF scheme, an employee and his employer pay a certain monthly contribution. Thus, this results in the aggregation of a lump sum, with interest, which is given to the employee upon his retirement.

The PF unified online portal was launched in 2014, to help PF members avail online services for their PF withdrawal, UAN generation, passbook download, etc. But for this to happen, each PF member needs a UAN for his account. Previously, PF accounts of members who had left PF before 2014, did not have the UAN generate option. But now, this is possible.

Additionally, an important point to note here is that the feature of generating UAN for older PF accounts prior to 2014 is only available on the Employer’s Member Portal. This is because the Unified Portal was launched in 2014. So as an Employee member, you will have to take your employer’s assistance to get your UAN generation done if your PF account was set up before 2014.

Table of Contents

How to generate UAN generate for PF accounts prior to 2014?

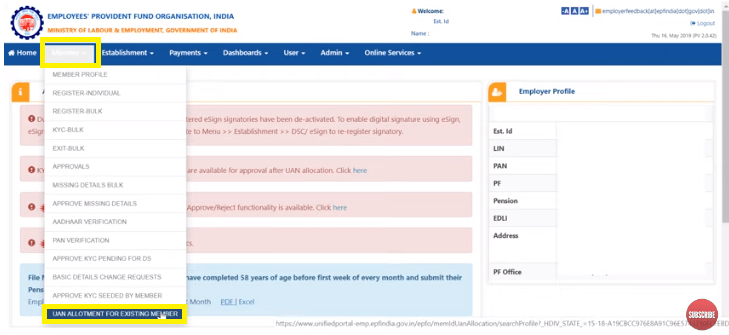

- Have your employer login to the PF Employer Member Portal.

- Use the establishment Username and Password to Sign In.

- On the new page, click on Member drop-down list and further click on the last option, UAN allotment for existing member.

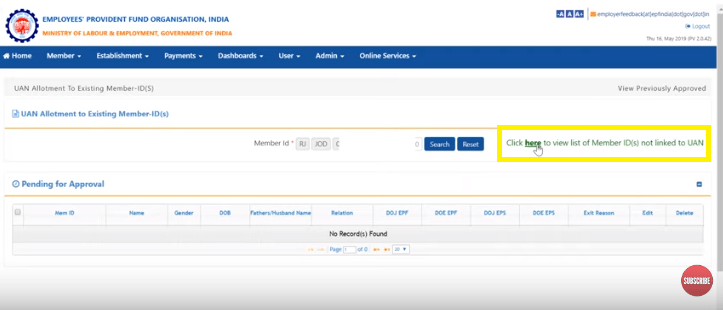

- If the employee’s PF Member ID is known, then fill it up in the Search bar.

- If the employee’s PF Member ID is not known, then click on Click here to view list of member ID(s) not linked to UAN.

- This will display all the employees who have a PF account but no UAN.

- From this list, you can pick out the employee you are searching for, and click on Submit.

- The PF account member linked to that employee will automatically appear on the screen. Next, click on the Search button.

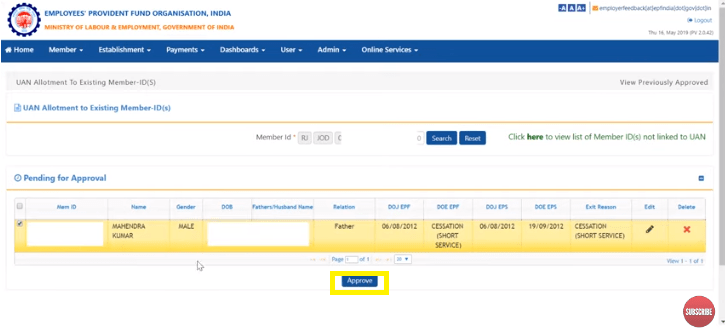

- All the member information available to the PF portal will appear on the screen.

- You need to fill in all the unavailable member information, such as the employee’s exit date for EPF and EPS, exit reason, etc.

- Next, click on Save. A window will appear to ask, Are you sure you want to save the member detail? Click on OK.

- Similarly, multiple employee details can be entered and edited.

- Once you are sure that all details are correct, select the member entries and click on Approve.

- A window appears to ask, Are you sure you want to approve selected members? Click on OK.

- Now a prompt will appear saying, UAN has been successfully allocated for member(s), click here to view allocated UAN. Click to find the new UAN generate for the member.

- For some ex-employee members, a lot of information might be missing from the portal. These need to be confirmed with the employee and updated on the portal to generate UAN.

- After knowing the UAN, you need to activate it. Learn the process of UAN activation via this video and this blog.

To view our video on this topic:

How to activate your UAN Number?

Here are the steps to activate your UAN Number.

- Visit the UAN Portal.

- Select the “Activate UAN” option.

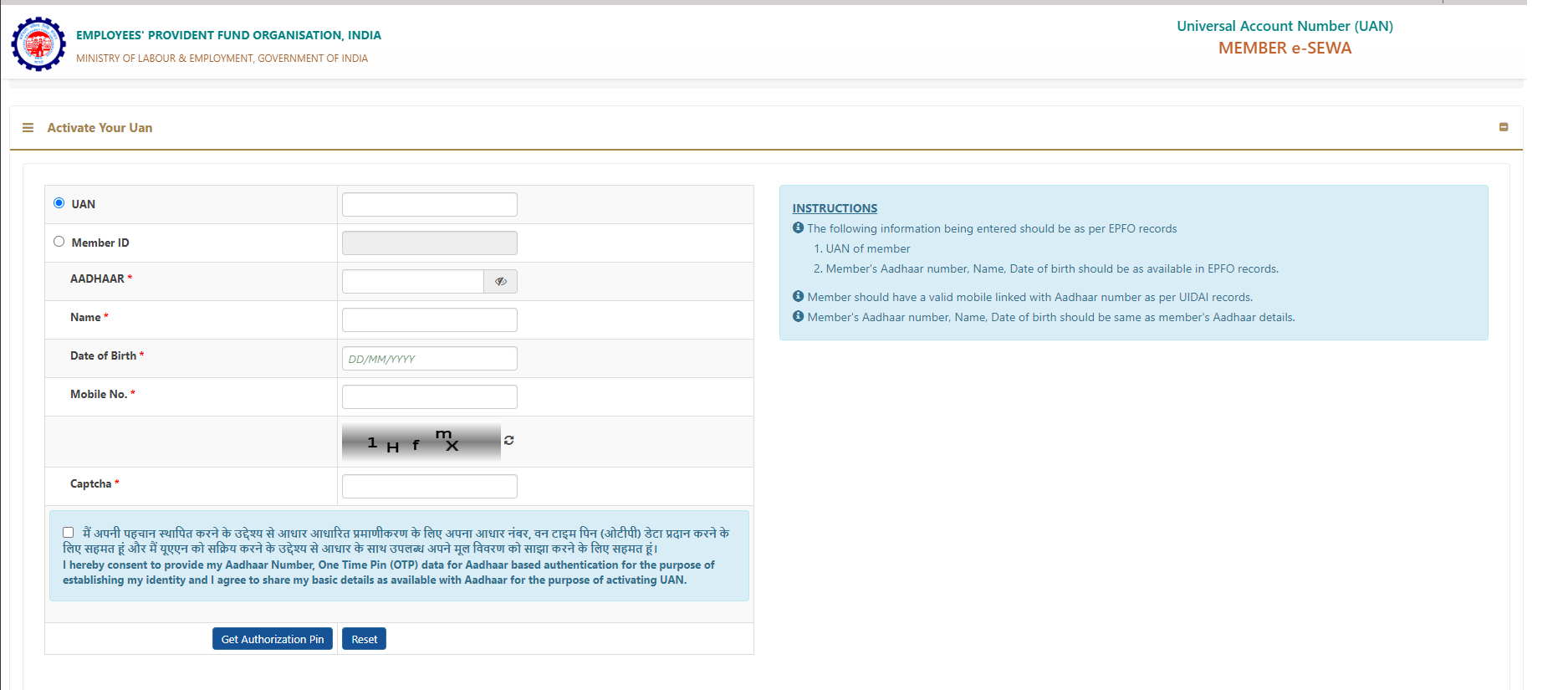

- You will be re-directed to a page with “Activate your UAN” at the top.

- The user can enter their UAN, followed by the Aadhar number, name, Date of Birth and Mobile phone number.

- The following information entered should be as per EPFO records:

- UAN of member

- Member’s Aadhaar number, Name, and Date of birth should be as available in EPFO records.

- Member should have a valid mobile linked with Aadhaar number as per UIDAI records.

- Member’s Aadhaar number, Name, and Date of birth should be the same as the member’s Aadhaar details.

- Last, enter the Captcha code correctly.

- Then check the box agreeing to provide your Aadhar-based OTP for verification.

- The user should then choose the “Get Authorization Pin” option after entering all the necessary data.

- A PIN will then be sent to the user’s registered mobile number. The PIN must be entered into the required area before the user can click the button that says “Validate OTP and get UAN.”

How to find out UAN from your Aadhar?

Until now, EPFO has issued the UAN to the employer in accordance with standard criteria, and the firm has then given it to the employee. When an employer fails to disclose an employee’s UAN or when an employee loses their UAN, EPFO has made it possible for them to obtain their UAN online. Current employees, the unemployed, and even prospective employees can use this facility.

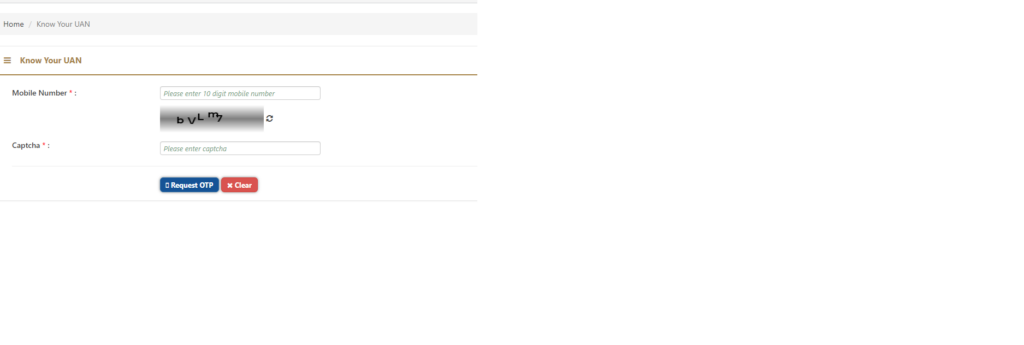

- Visit the UAN Portal. Select the “Know your UAN” option.

- You will be re-directed to a page with “Know your UAN” at the top.

- The user can enter their Mobile phone number registered with the EPFO.

- Then, enter the Captcha code correctly.

- Then click on “Request OTP”. An OTP would be sent to your registered mobile number.

- Enter the OTP and click on “Validate OTP” after re-entering the Captcha code.

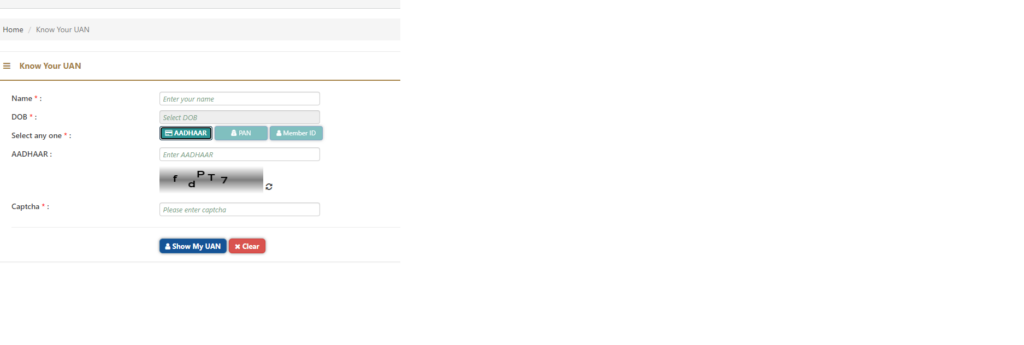

- After that, the User will be re-directed to another page. Here, you can check your UAN if you have any one of these 3 details:

- Aadhar number

- PAN

- PF Member ID

- Enter the name and Date of Birth. Then, select any one of the above 3.

- In case you have the Aadhar updated in your EPFO records, you can select Aadhar.

- In case you have the PAN updated in your EPFO records, you can select PAN.

- In case you have your Member ID registered by your establishment, you can select this and enter the State, Establishment ID, Establishment Extension and Member ID.

- Then enter the Captcha code correctly and click on “Show my UAN”.

- Users will now be able to see their UAN on the screen.

Can you check UAN from your PAN Number?

The same procedure as laid out above can be used for finding out your UAN from your PAN.

How to see UAN if you have a Member ID?

The same procedure as laid out above can be used for finding out your UAN from your Member ID.

Are UAN and PPO Numbers the same?

While the UAN allows users to maintain track of their different Employees’ Provident Fund (EPF) accounts, the PPO (Pension Payment Order) is a unique number assigned to each pensioner under the EPF. It serves as a reference number for Employee Pension Scheme (EPS) transactions and communication. They are both 12 digit numbers. An employee’s UAN remains the same throughout his or her career, regardless of how many jobs they change.

Are UAN and PRAN Numbers the same?

No, they are different. If you have EPF, then you would have UAN. If you contribute to NPS then you would have PRAN. PRAN stands for Permanent Retirement Account Number and is a 12-digit number that identifies persons who have registered for the National Pension Scheme (NPS). PRAN card registration is required for all Central and State Government employees and may be completed through National Securities Depository Limited (NSDL).

Under PRAN, there are two types of NPS accounts:

- Tier-I: This non-withdrawable account is intended for retirement savings.

- Tier II: It’s similar to a savings account in that you can withdraw your money. It does not, however, provide tax benefits.

Are the EPF and EPS Numbers the same?

No, the numbers are not the same for EPS and EPF. Though these two accounts come under the same UAN of a member, the numbers are different for each account. Both the employer and the employee contribute 12% of the employee’s salary to EPF. However, the employee’s entire part is submitted to EPF, 8.33% of the employer’s portion is contributed to the Employees’ Pension Scheme (EPS), and 3.67% is contributed to EPF each month.