Table of Contents

What are Equity Funds?

An equity fund is a type of mutual fund which essentially invests in listed stock market securities. Equity funds are quite popular as an investment option. Since they give great long term returns. According to the SEBI Mutual Fund regulations, an equity fund has to invest 65% of its assets in equities and equity-related instruments. The remaining 35% can be invested in debt or money market securities. Equity funds can be actively or passively managed as well. This article lists the different types of equity funds available in depth. For beginners in investing, this will be a great guide to help you differentiate among the types of equity funds and choose one as per your requirement.

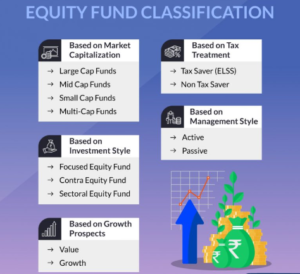

Types of Equity Funds:

The Securities and Exchange Board of India (SEBI) classifies the different types of equity funds as follows:

1. Market Capitalization

This categorizes types of equity funds on the basis of the size of listed companies in which they invest, as follows:

Large cap equity mutual funds – These funds have to invest at least 80% assets inlarge cap companies. Such companies rank among the top 100 in terms of their total market capitalization. You should invest in them if you want a stable portfolio since they are less volatile. Although, they have lower returns compared tomid cap andsmall cap funds.Mid cap equity mutual funds – These funds have to invest a minimum of 65% of their assets inmid cap companies. The companies which rank between 101 and 250, in terms of their market capitalization, are called themid cap companies. These have higher returns compared tolarge cap funds. But also are more volatile and have higher risks.- Large and

Mid cap equity funds – These funds invest 35% assets inlarge capmid cap equity funds. Hence, thelarge cap funds have low risk and themid cap funds have high returns, thus giving a perfect blend of risk and returns. Small cap equity mutual funds – These funds invest a minimum of 65% insmall cap companies. Such companies rank beyond 250, in terms of market capitalization. 95% of the companies listed in India’s stock exchange are thesesmall cap companies. These funds are most risky as they have either very high returns or very high loses. Hence, it is not recommended to invest in them in you want to create a steady wealth.- Multi-cap equity funds – These funds invest a minimum of 65% in

large cap ,mid cap andsmall cap companies. Hence, they experience the best of all possibilities. The fund manager can shift funds betweenlarge cap ,mid cap and small cap, as he sees fit. In such cases where the investors tries to shift between the three caps, he has to bare the exit load and taxes.

2. Profit Distribution and Growth Prospects

- Dividend yields equity funds – These funds invest 65% assets in companies with high dividend-yielding capabilities. But although this fund invests in stocks which are capable of having good dividends; it is not under any obligation to declare and give dividends. Since companies have the right to retain dividends.

- Value equity funds – These funds invest in those stocks which are currently underperforming and hence inexpensive. But they have great future potential to grow. Hence, this fund consistently hunts for cheap stocks which have the potential to become expensive in future.

- Growth equity funds – These funds invest in companies with high growth potential and good corporate earnings, which further reinvest their profits for growing the company. Additionally, they either do not pay or pay minimal dividends.

3. Investment Strategy

- Contra equity funds – This fund goes against ongoing marketing trends to invest in under-performing companies. Basis of the assumption that the current under-performers will recover in the long term as soon as the short-term problems are over.

- Focused equity funds – Most equity funds invest in between 50 to 100 companies. But these funds invest at least 65% in a maximum of 30 company stocks. Hence, they have higher risks but also the potential for higher returns.

- Sectoral/Thematic equity funds – These funds invest 80% of its assets in a particular sector of companies only. It can be banking or IT or pharmaceuticals, etc. These funds are highly risky since an entire sector can have a loss and all those companies stocks might fall. But if that sector does really well, then it can yield great returns too.

4. Management Style

- Active equity funds – These funds have fund managers actively managing them. The fund managers regulate your funds daily to pick and invest in stocks with higher returns. The fund managers thus also charge a high fund management fee.

- Passive equity funds – These funds track the market index or any particular market segment to decide where to invest in. Such funds are known as index funds. Similarly, there are Exchange Traded Funds or ETF. They are also not actively managed by fund managers. ETFs copy an index and try to replicate their performance.

5. Tax Treatment

- ELSS – ELSS or Equity Linked Saving Scheme is an open-ended equity fund with additional tax-saving benefits. ELSS funds invest 80% assets in equities and equity-related instruments. They have a statutory lock-in period of 3 years. If you comply with this then you are eligible for a tax deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act.

- Non-tax saving equity funds – All other equity funds fall under this category. You have to pay tax on all short-term and long-term capital gain as per the holding period.

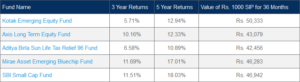

Top 5 Best Performing Types of Equity Mutual Funds:

If you invested in a SIP of Rs 1,000 for a period of 36 months starting April 2016 to March 2019 in any of the below mentioned top 5 equity funds, then the value of your investment as on March 31, 2019, would have been as follows:

Watch our video on the different types of mutual funds available below.

Also read, How To Invest In Mutual Funds Online In Just 5 Minutes Using Smartphone.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!