On 13th August 2020, PM Modi announced the initiation of Transparent Taxation. A scheme that believes in the thinking that “the owner is honest”. This was the beginning of faceless assessment and appeal as well as the taxpayer’s charter. Faceless appeal will be available for all Indian citizens starting from 25th September 2020. This article takes an in-depth look at these new reforms and how it will affect the common man.

Table of Contents

What was the need for this new transparent taxation reform?

The government of our country actually runs by the citizen’s tax money. When citizens pay taxes, the government receives the revenue to make the development schemes and changes for the betterment of the country. Without the taxpayers’ money, the government is unable to go ahead with any new developments. This may make citizens unhappy and they may vote out the current governing body for a new one in the next elections. Hence, it is essential for the government that more citizens pay their taxes, regularly each year, and with honesty. One way to achieve this is by implementing easy to understand and follow taxation laws and providing easy channels for tax payments. The other way our government aims to achieve this is by reducing the fear of the tax department from the common man. This will thus encourage them to come forward with their actual income and pay their taxes honestly, instead of trying to hide them and pay less tax. This is the ultimate goal of the new tax reform, the Transparent Taxation Scheme.

How does the current taxation system work?

In the current scenario, the common man pays his income tax according to the income tax slab rate, on his earnings in a full financial year. He files his Income Tax Return (ITR) for this purpose to list all his earnings and exemptions. The IT Department checks this ITR to look for any anomalies. For this, the IT Department first goes through Form 16 in case of salaried individuals. Form 16 is a form submitted by employees to their employer, listing down all their exemptions, deductions and allowances to get lower TDS deduction. Secondly, the Finance Act, 2014 makes it obligatory for individuals to furnish the statement of financial transaction or reportable account. This means all citizens need to reveal their Statement of Financial Transaction (SFT). This clause enables the government to be informed if any citizen makes a large financial transaction with any bank or other corporate body.

Suppose person A has submitted Form 16 showing an income of Rs 10 lakh while his ITR filing shows an income of Rs 6 lakh. This will lead to a mismatch and the IT Department will send person A an intimation under Section 143(1) of the IT Act. Therefore, an official from the IT Department will meet him to scrutinize his earnings and ITR filings. If the official is still not satisfied then he will ask person A for additional invoices and receipts as proof of his income and expenditure. This is known as an assessment. If the official is still unhappy with his documents, he can put a penalty on person A for wrongful tax payments. Person A can then apply for an appeal to the IT Commission. But the meeting between the IT official and person A can also lead to untoward corruption if they go off the record and have a settlement.

As per the records in 2012-13, out of all tax deters recorded, 0.94% were scrutinized. Meanwhile, in 2018-19, only 0.26% of the tax deters were scrutinized. Therefore, there has obviously been a drop in the numbers since more off the record settlements have taken place between the tax deterrents and the officials. This has led to a rise in corruption in official bodies.

New reforms under transparent taxation

1. Faceless assessment and faceless appeal

Under these new transparent taxation reforms for the IT Department, there will be a centralized computer that will analyze your income tax filing. The computer will cross-check your ITR with your Form 16 and SFT input. In case the computer finds a discrepancy then it will assign your case randomly to an Assessing Officer. Neither the Assessing Officer nor the person involved in the case will know each other’s identities. A citizen of one city may get an Assessing Officer of another city. Moreover, all communication between both parties will occur via emails. Thus, the avoidance of any telephonic or face-to-face communication between both parties will lower the chances of any bribery or harassment. This Faceless Assessment reform is active from 13th August 2020. Additionally, if you are unhappy with the Assessing Officer’s decision then you can even opt for a Faceless Appeal which is live from 25th September 2020 onwards.

2. Taxpayer’s charter

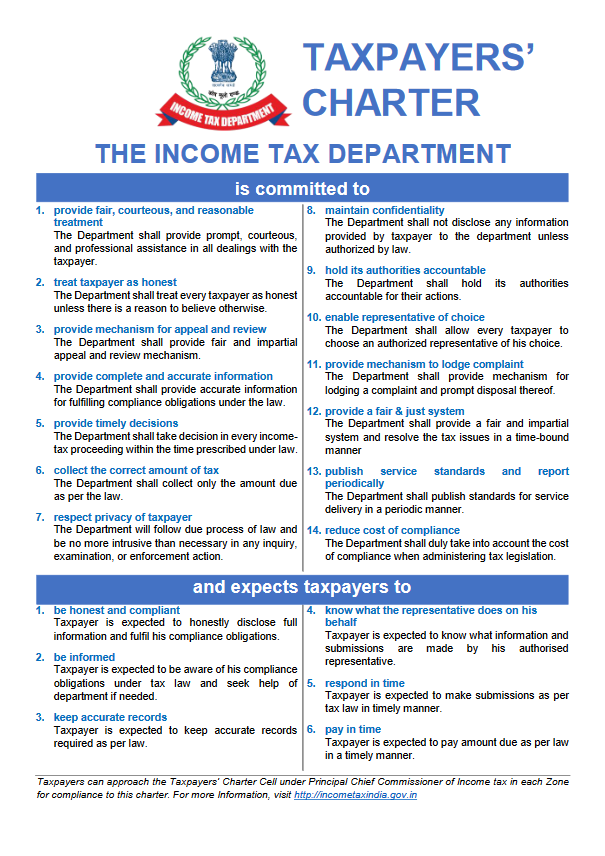

The second benefit of this new transparent taxation reform is called the taxpayer’s charter. Charter stands for “a written grant by the sovereign or legislative power of a country, by which a body such as a city, company, or university is founded or it’s rights and privileges defined.”

Hence, this charter will give citizens multiple new powers. It will save them from harassment by tax officers. It will also give them the opportunity for faceless assessments and appeals unless they have committed a major tax default. All income tax related matters will be timely including all appeals, refunds, etc. Additionally, it will also put some obligations on the citizens to be honest and comply with all rules and regulations.

Scope of SFT under transparent taxation

Under SFT, all financial institutions like banks had to inform the government of any big transactions from any citizen and forward their identity details to the government. Under the new reforms, now all small and recurring financial transactions will also be informed to the government. These include:

- Payment of educational fees or donations above Rs 1 lakh

- Electricity consumption above Rs 1 lakh

- Domestic or international air travel in business class

- Payment to hotel above Rs 20,000

- Purchase of jewellery or any good of above Rs 1 lakh

- Deposit or credit in current bank account above Rs 50,000

- Deposit or credit in non-current bank account above Rs 25 lakh

- Payment of property tax above Rs 20,000 p.a.

- Life insurance premium above Rs 50,000

- Health insurance premium above Rs 20,000

- Sharing of all transactions or Demat accounts or bank lockers

All these details are held by the IT Department under Form 26AS. A mismatch in figures of income and expenditure from the Form details will lead to scrutiny. Earlier, people would claim certain expenses under Section 80C and 80D for tax refund since no documented proof was needed for it, even if it did not apply to them. This malpractice will also stop now as document proof will be needed for all expenses filed and Form 26AS will keep a note of all such transactions. This new reform will curb such tax defaults which usually happen with tax deduction, exemptions, etc. too.

Watch a consolidated video on the new transparent taxation reforms below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!