In this era, where competition exists at every step, running and managing a business is very difficult. Moreover, complying with the n number of tax laws further worsens the situation. Although in a practical scenario, small businesses suffer the most. They end up giving additional taxes to the government every year which can easily be avoided. This is where tax planning comes into play. It is not only reducing the taxable income and thereby reducing the tax liability but also controlling the time when the correct amount of tax is to be deposited to the government.

There are various ways that every proprietor should follow to avoid paying additional tax. Most of these are very normal which every individual is doing in one way or the other but is either not recording or under-recording or unplanned as per tax point of view. One such example is the tuition fees of the children. Every small businessman pays tuition fees, however only a few claim deductions u/s 80C. There are various other examples of tax planning. Thus, this blog lists similar best practices of tax planning which every proprietor should know.

Table of Contents

Basics of business income with salary

Types of income sources

When filing for ITR, an individual can show five kinds of income sources:

- Income from salary

- An income from house property

- Income from business and profession

- Capital gain

- Income from other sources

However, the Income Tax Act does not limit an individual from having and showing multiple income sources. However, an employer can contractually bound an employee from having other income sources such as freelance or business.

Minimum income for filing ITR

If an individual’s annual gross receipt is over Rs 2.5 lakh, then they must file their ITR. Moreover, it is recommended to file ITR even if one’s annual gross receipt is under Rs 2.5 lakh since they can then take the benefits of – carrying forward losses, processing of documents, application of VISA, claiming losses, and serve it as income proof.

What is business/professional income?

As per the perspective of the Income Tax Act, one’s Total Income = Total Revenue – Expenses (including depreciation). Running a business includes multiple expenses such as the salary of employees, rent, travel expenses, commissions, electricity, water rent, internet rent, marketing, bank charges, software tools, etc., to name a few. The amount of funds left after excluding all these expenses is considered the net taxable income.

Asset is anything whose utilization occurs over multiple years instead of at one go. Hence, one can claim it over multiple years as well in their ITR filing. Expense, on the other hand, is consumed at one go. A salaried individual running a business can claim deductions for his salary as well as his business expenses simultaneously.

Accounting methods

There are two major methods of maintaining one’s accounts.

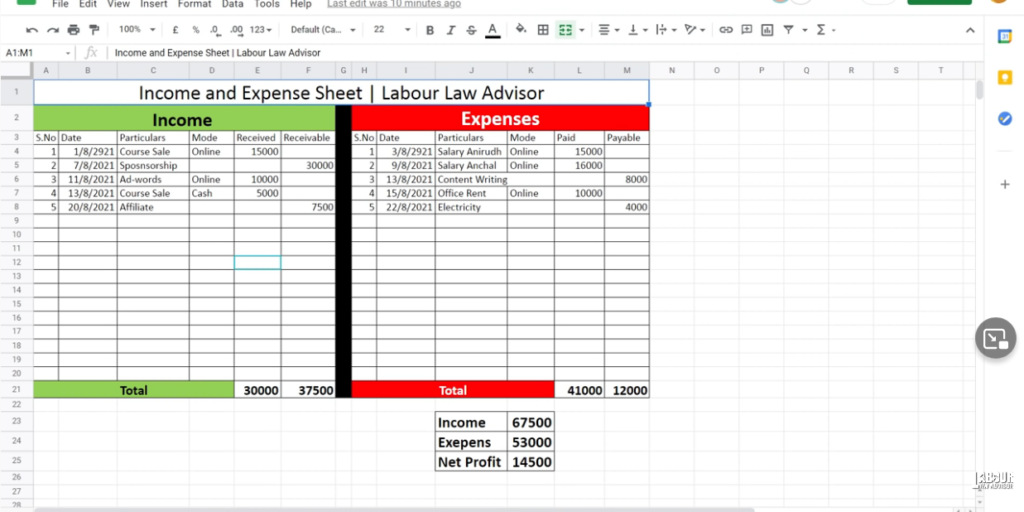

In the image above, LHS has all the income and RHS has all the expenses.

Income sources include – sales of course, sponsorship, AdWords, and affiliate marketing. Moreover, each income source comes either under Received if payment has already come or Receivable if payment is pending.

Similarly, the Expense sources include – salary for employees, content writing freelancer, office rent and electricity bill. Moreover, each expense source comes under either under Paid if payment is already done or Payable if payment is pending.

Accrual Method

In Accrual method of accounting, one calculates taxable income on basis of the total Received/Receivable and Paid/Payable.

Cash Method

In Cash method of accounting, one calculates taxable income only on basis of the amount Received and Paid. Pending payments are not taken into consideration, unlike the accrual method.

Moreover, if one is paying GST then they need to maintain their – invoices, cash vouchers and bank statement.

Methods of tax planning

Presumptive Tax Scheme (Section 44AD)

Every Resident Individual, Resident HUF, and Resident Firm whose turnover does not exceed Rs 2 Crore can offer tax on a presumptive basis i.e Gross Receipts/Turnover * 8%, if Gross Receipts/Turnover is routed directly through the bank then T/O * 6%. No requirement to maintain books of accounts and audits.

To illustrate, suppose a small trader having a turnover of Rs 80 lakh was opting for a presumptive scheme, then his tax is calculated as follows:

| Turnover | 80,00,000 |

| 8% of the above | 6,40,000 |

| Deduction u/s 80 C | 1,50,000 |

| Total Taxable Income | 4,90,000 |

| Tax to be paid | Nil |

Points to be cautious:

- Not applicable on 44AE Business, Agency business, Commission & Brokerage business.

- The assessee cannot claim a deduction of expenses separately.

- If the assessee does not claim the benefit of Section 44AD in one A.Y. and gets his books of accounts audited, then he is not eligible to opt presumptive tax scheme for the next 5 consecutive assessment years.

Let us better understand this through an example.

Consider this for Mr. A, Resident Individual, carrying out the business of purchase and sale of tires.

| Particulars | A.Y. 21-22 | A.Y. 22-23 | A.Y. 23-24 |

| Turnover | 1,60,00,000 | 1,70,00,000 | 1,80,00,000 |

| Income to be taxed | 12,80,000 | 13,60,000 | 9,00,000 |

| % of Gross Receipts | 8 | 8 | 5 |

| 44AD | Y | Y | N |

Thus, Mr. A cannot claim the benefit of Section 44AD for the next five assessment years i.e. A.Y. 24-25 to A.Y. 28-29.

Eligibility for 44AD

Professionals eligible:

- Proprietorship firm

- HUF

- Partnership firm

Professionals not eligible:

- Transportation business

- Commission/brokerage business

- Interior design

- Architecture

- Technical consultant

- Accounting

- Legal consultancy

- Medical practitioner

- Actors

- IT professionals

Presumptive Tax Scheme (Section 44ADA)

This special provision for professionals says that if an individual has gross professional receipt of under Rs 50 lakh in a year then the taxable income is assumed as 50% of his gross. The government will accept the return without any questions or documents.

Professions eligible for 44ADA

- Interior design

- Architecture

- Technical consultant

- Accounting

- Legal consultancy

- Medical practitioner

- Actors

- IT professionals

Income from foreign sources

If an individual has income from foreign sources then also it will be added to their total income and taxed as per slab rates. In some cases though, it may be exempt from GST as per the relevant clause. This happens if the services are being used in a foreign country.

Payment of advance tax

If the tax liability exceeds Rs 10,000 for a financial year, then tax for that year is to be paid in the same year itself. It is based on the concept of ‘PAY AS YOU EARN’. In practical scenarios, many small businessmen fail to pay advance tax and attract a significant amount of penalty and interest under Section 234A, 234B, 234C. This can easily be avoided by following the prescribed due dates:

| On or before 15 June | 15% of Assessed Tax |

| On or before 15 September | 45% of Assessed Tax |

| On or before 15 December | 75% of Assessed Tax |

| On or before 15 March | 100% of Assessed Tax |

Goods and Services Tax

GST registration is mandatory if the business incurs a sale of tangible goods exceeding Rs 40 lakh or for providing services exceeding Rs 20 lakh. The limit may change for some states. But other than these cases, GST registration is not necessary. Hence, this point needs to be taken into account for tax planning as well.

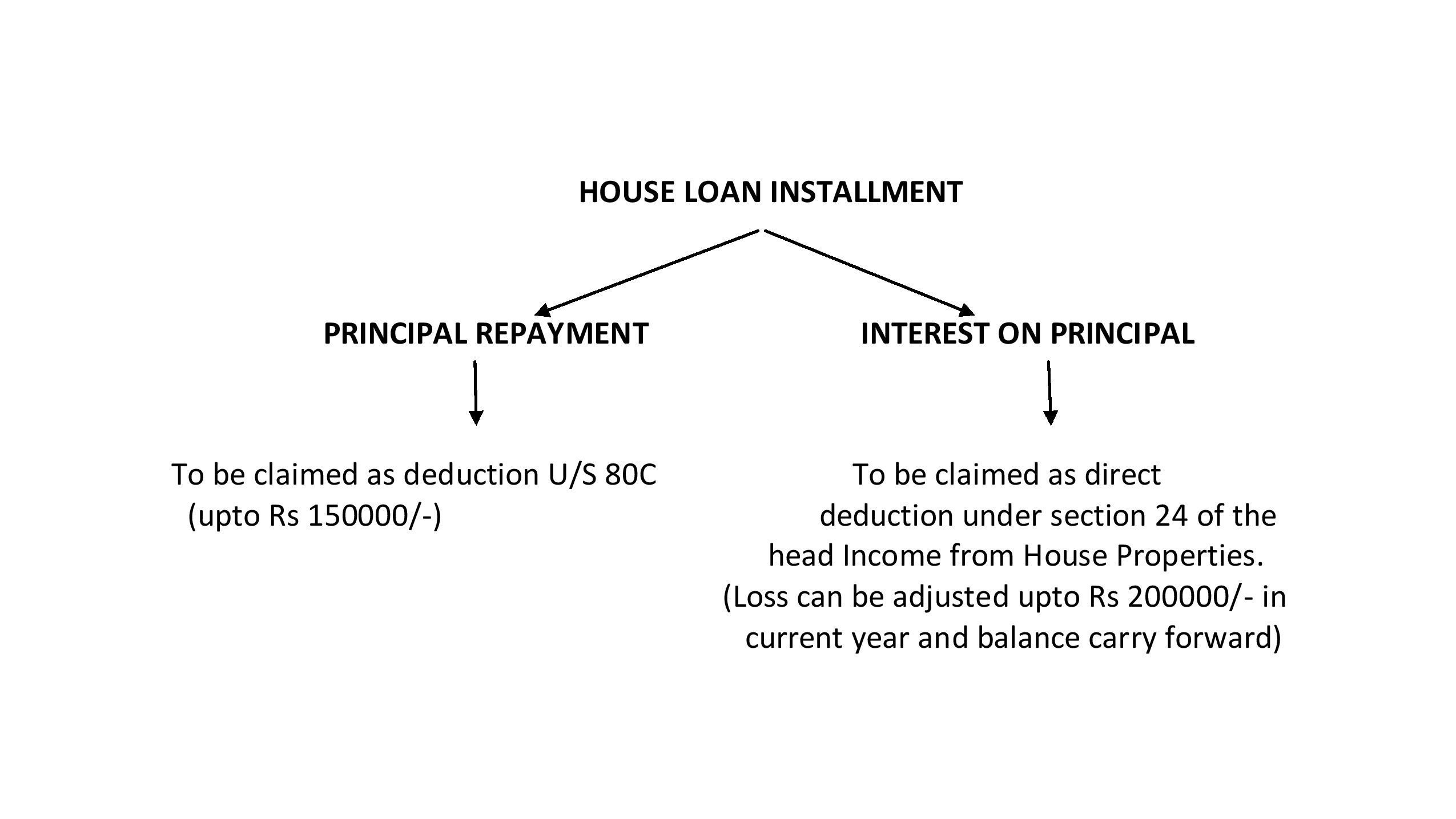

Take house loan

It is generally believed by every common man that a person should be free of any loan or financial liability. However, this is a myth. Rather it can be used as an effective tool for tax planning. Every installment comprises of two components:

It is every common man’s dream to acquire his own house. But it is rather better to pay EMI and own a house than to pay rentals every month.

Investment in various tax savings scheme

| SECTIONS | PARTICULARS | ELIGIBILITY CRITERIA | MAXIMUM LIMIT |

| Section 80C | Life Insurance Premium | Self, Spouse, Children | 1,50,000/- (Additional benefit of Rs 50000/- for Section 80CCD) |

| PPF | Self, Spouse, Children | ||

| NSC & Accrued Interest thereon | – | ||

| Principal repayment of House Loan | – | ||

| FD in scheduled bank/post office | 5 years or more | ||

| Tuition Fees | Max 2 children in India | ||

| Notified bonds of NABAD | – | ||

| Senior Citizen Savings Scheme | – | ||

| Unit Linked Insurance Plan | – | ||

| Sukanya Samriddhi Scheme | Self, daughter, girl of who, assessee is legal guardian | ||

| Section 80CCC | Pension fund of LIC /other Insurance Company | ||

| Section 80CCD | New Pension Scheme/Atal Pension Yojna | Individual only | |

| Section 80D | Medical Insurance Premium, Preventive Health Check up, Central Government Health Scheme | Self, Spouse, Dependent children, parents | Max 50000 (in case of senior citizen max limit is double) |

| Section 80 G | Donations as per category | All assessee | 50% or 100% as per category |

| Section 80GG | Rent paid of House property(HRA not received) | Individual only | Lower of 5000pm25% of AGTIActual Rent-10% of AGTI |

| Section 80GGC/80GGB | Donation to Political Parties / Electoral Trusts | All assessee | 100% of donation |

*AGTI – Adjusted Gross Total Income

Appropriate stock valuation

Most of the small businesses keep recording stock at cost only. However, the stock is to be recorded at a lower cost or net realizable value. As a result, many times the stock is over-recorded thereby increasing the profit and hence tax thereupon. For example, in the case of perishable goods, the net realizable value is generally lower than cost.

Separate business vehicle

In practical scenarios, it is observed that most businesses use personal vehicles for business purposes and ignore the expense thereupon. It is advised to maintain a separate business vehicle which is beneficial as follows:

- Petrol/diesel and day to day maintenance expense is allowed in books of account.

- Depreciation expense every year

- Capital gain/loss in the year of sale.

Deduction for new startups (Section 80IAC)

Assessee is a company or LLP engaged in the business of innovation, development & improvement of product, process or service who has the high potential to generate employment or wealth and holds a certificate from Inter Ministerial Board of Certification.

Moreover, they can claim a deduction of 100% of profit derived from the startup for any 3 consecutive years out of 10 years from the year in which the startup was incorporated.

Points to be cautious:

- The Year of Incorporation should be after 01/04/2016.

- Turnover should be up to 100Cr in the previous year in which deduction is claimed.

- It should be a new business and not split or reconstitution of existing business.

- At least 80% of the plant and machine should either be new or imported.

- Mandatory Audit by a Chartered Accountant.

TDS deduction on the expenses

TDS at appropriate rates under appropriate sections must be deducted as and when the expense is incurred. If TDS is not deducted, then the expense is disallowed, and hence that increases the burden of tax liability for the year.

Digitalize – as per budget 2021

In Budget 2021, the tax audit limit has been increased to Rs 10Cr thereby reducing the compliance burden on small businesses and also promoting more digitalization. However, this is applicable only if all the Gross Receipts/Turnover of the business is routed digitally through banks and cash payments/receipts do not exceed 5% of the Total Payments/Receipts.

Conclusion

To sum up, it would not be wrong to say that it is almost next to impossible for a taxpayer to abide by all the laws of the country, hence it is advisable to seek professional help whenever necessary. However, the above list for planning taxes is not conclusive and exclusive since there can be various other ways that a proprietor can adopt in his day-to-day business. However, it can truly give a brief idea about planning tax on the very first stage. As it is rightly said that ‘Penny saved is a penny earned’.

Learn more about tax planning for small businesses in the video below.

How to save maximum tax in business?

When starting a business, one aims to make the maximum profit. In India, one has the advantage of starting a business through multiple portals such as – Proprietorship, LLP, HUF, Partnership, OPC, to name a few. However, starting a business also entails a ton of taxes. Hence, this section of the article details which business entity will help one to save maximum tax in the best way possible.

Proprietorship taxation

Starting a proprietorship business is most easy as it requires no business registration or separate business PAN. However, as per Income Tax Act, 1961, there is no difference between a Proprietor and an Individual, since both have the same PAN. If one were to have an annual salaried income of Rs 15 lakh and an annual business income of Rs 15 lakh, then both would be added to the PAN and they will have to pay tax on Rs 30 lakh total. Here again one can pick between the old and new tax slabs. It is preferable to opt for the old tax slab if one has 80C deductions, home loans, or medical insurance.

Example,

Net income = Rs 30 lakh

Then, income tax as per old tax slab:

0-2.5 Lakh = Rs 0

2.5-5 Lakh @5% = Rs 12,500

5-10 Lakh @20% = Rs 1,00,000

10-30 Lakh @30% = Rs 6,00,000

Thus, total income tax = 0+12500+100000+600000 = Rs 7,12,500

Additionally, if one’s annual income is below Rs 5 lakh, then they can also claim 87A Rebate of Rs 50,000.

There are also some special income types where a flat slab rate is applicable. These include – capital gain income, casual income, lottery or winnings. Here, STCG is taxable at 15%, LTCG at 10%, and casual at 30%. Having any of these special incomes entails taxation as per that category instead of the normal slab rates.

HUF taxation

Under a HUF or Hindu Undivided Family, there isn’t much discretion in taxes against an individual. Both individuals and HUF get about the same rebates and deductions and have similar slab rates too. Hence, same example as above applies here as well where an income of Rs 30 lakh under HUF will result in a tax of Rs 7,12,5000.

Moreover, HUF can also opt to pay taxes as per the new or the old tax slab rate. Additionally, special income under HUF is also taxable as per the special income tax rate.

Partnership firm taxation

In Partnership Firms, one needs to pay 30% of net income as taxes. While this may seem a lot, it finally trickles down to being quite modest. Since the partners in the firm can take salary, bonus, commission or interest from the partnership income.

For example, there are 2 partners in a partnership firm X.

Total income of partnership firm = Rs 30 lakh

As per IT Act, partners can take upto 60% of firm income as their salary/bonus.

Thus, salary taken by each partner = (60% of 30 lakh)/2 = Rs 9 lakh

Now, income tax for each partner on Rs 9 lakh as income = Rs 92,500

Remaining net profit in firm = 40% of 30 lakh = Rs 12 lakh

Therefore, tax @30% for firm on Rs 12 lakh= Rs 3,60,000

Total tax paid = 92,500+92,500+3,60,000 = Rs 5,45,000

Remaining net profit after taxes = 12,00,000-5,45,000 = Rs 8,40,000

This remaining net profit of Rs 8.4 lakh can be distributed among its partners, without the need of paying extra taxes on it.

Additionally, to calculate income under Proprietorship, HUF and Partnership, one can use either Section 44AD or Section 44ADA as a guideline and file their income tax return accordingly.

LLP taxation

Under LLP, a flat 30% tax rate is applicable. However, one cannot claim benefit under sections 44AD or 44ADA.

Pvt Ltd or OPC taxation

Under Pvt Ltd or OPC, the tax rate is flat 22%. Unlike partnership firm, where the remaining profits after tax payment can be shared between partners and is exempt from tax, the dividend in Pvt Ltd firm once shared with all shareholders is not tax exempt. The shareholders will still have to pay taxes on the dividend received even if the Pvt Ltd firm has paid its own tax.

For example,

Net firm income = Rs 30 lakh

Tax for firm @22% = Rs 6,60,000

Profit for firm after tax payment = 30,00,000 – 6,60,000 = Rs 23,40,000

Now, if this profit was distributed between two shareholders for Rs 11,70,000 each, then it will get added to their income and they will have to pay taxes on it as well.

Conclusion

If the aim is to sell the business partly or completely in the long run while keeping maximum capital within the business and making it grow substantially, then Pvt Ltd Company is the best option. However, if the aim is to make the business profitable and run it for long then Proprietorship or Partnership Firm is the better option.

If as a proprietorship, the business is crossing the GST threshold then it is advisable to convert it into a partnership firm. It can be done by added a family member as the partner. This will avoid any GST or other compliances being linked to the owner’s PAN card, and make accounting easier.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!