The Union Budget for financial year 2021-22 was announced on 1st February 2021. So read along to find out the updates relating to tax on PF as announced in the budget 2021.

Table of Contents

Rationalization of tax-free income on PF

Budget 2021, Annexure B, point 15 states that “in order to rationalize tax exemption for the income earned by high-income employees, it is proposed to restrict tax exemption for the interest income earned on the employees’ contribution to various provident funds to the annual contribution of Rs 2.5 lakh. This restriction shall be applicable only for the contribution made on or after 1st April 2021.”

Tax on PF interest

This new law states that if any employee contributes over Rs 2.5 lakhs towards his provident funds (applicable on both EPF and GPF) in any financial year, then he is liable to pay tax on the interest earned on contribution exceeding Rs 2.5 lakh.

This was done primarily because employees who earn high salaries and contribute a large sum of it towards their PF get tax benefit, as well as almost 8% assured interest return. According to the Finance Minister, this amount sometimes tallies to even a few crores each month. Hence, this step was taken.

Calculation Example

| Employee Number | A | B | C |

| PF Wage (Annual) | ₹ 6,00,000 | ₹ 6,00,000 | ₹ 24,00,000 |

| Contribution Rate | 12% | 50% | 12% |

| PF Employee Share | ₹ 72,000 | ₹ 3,00,000 | ₹ 2,88,000 |

| Tax Free Limit (for interest) | ₹ 72,000 | ₹ 2,50,000 | ₹ 2,50,000 |

| Taxable Limit (for interest) | ₹ 0 | ₹ 50,000 | ₹ 38,000 |

| Tax Free Interest (8.5%) (Approx) | ₹ 6,120 | ₹ 21,250 | ₹ 21,250 |

| Taxable Interest (8.5%) (Approx) | ₹ 0 | ₹ 4,250 | ₹ 3,230 |

Employee Number – A

Employee A has an annual wage of Rs 6 lakh on which he contributes 12% PF which is Rs 72,000 annually. To make calculations simple, we calculate 8.5% PF interest rate on complete Rs 72,000. Which is equal to Rs 6,120. Since this interest amount of Rs 6,120 is less than Rs 2.5 lakh, Employee A does not have to give any tax on the interest earned.

Employee Number – B

The next employee B with an annual wage of Rs 6 lakh, contributes 50% of his salary to PF. This is voluntarily acceptable on the employee’s behalf. The employer is not mandated to match the employee’s extra contribution. Thus, employee B contributes annually Rs 3 lakh towards PF. Until now all the interest earned on it would be tax-free. But with the enforcement of the new law, the interest earned above Rs 2.5 lakh will be taxable. Hence, interest earned on PF contribution of Rs 2.5 lakh, which comes to Rs 21,250 at 8.5% interest rate, is tax-free. But interest earned on the extra Rs 50,000 which comes to Rs 4,250 if taken at 8.5% interest rate, will be taxable.

Employee Number – C

The last employee C with an annual wage of Rs 24 lakh, contributes 12% of his salary to PF. Thus, employee B contributes annually Rs 2,88,000 towards PF. Until now all the interest earned on it would be tax-free. But with the enforcement of the new law, the interest earned above Rs 2.5 lakh will be taxable. Hence, interest earned on PF contribution of Rs 2.5 lakh, which comes to Rs 21,250 at 8.5% interest rate, is tax-free. But interest earned on the extra Rs 38,000 which comes to Rs 3,230 if taken at 8.5% interest rate, will be taxable.

Impact on salaried employees

The Finance Minister also mentioned in her speech that the move is aimed at taxing high-value depositors in the Employees Provident Fund. This will have a limited impact specifically on the high-income salaried individuals. Thus, only 1% of PF contributors will be impacted approximately.

Though by general calculations, we can say that any employee who earns basic wage of over Rs 20.83 lakh per year will definitely attract his or her interest on EPF contribution being taxed. Other employees earning lower than this, but contributing at higher rate to PF, will attract the interest. Else they will not.

How to check for tax on PF?

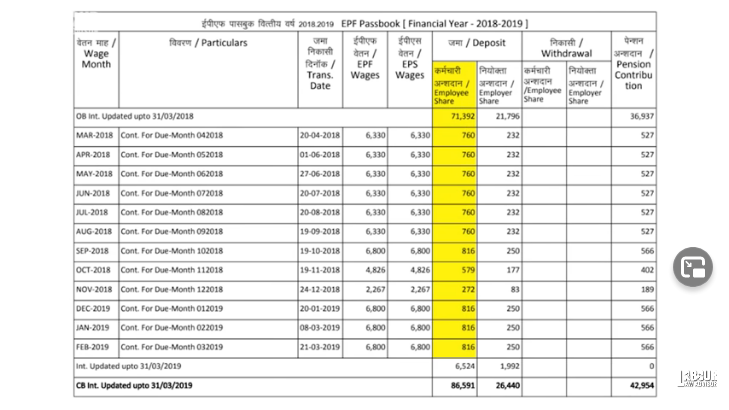

To check whether you will be charged tax on PF, visit the PF employee member portal. Next, go to the PF passbook tab which is available in a new format. In the new PF passbook, look at the column for Deposit of Employee Share. The sum of all the values under a financial year if exceeding Rs 2.5 lakh will be taxable.

Important points to note

- The actual PF contribution amount is not calculated by summing up all values for a financial year. So, it is still to be seen how the government calculates it. Learn actual PF calculation process in 5 Most Important PF Interest Rate Calculation Rules.

- Exact mechanism of how the tax will be charged is still to be worked out. Whether it will be added in income from other sources or will be deducted as TDS by EPFO directly. This is not to be confused with the 80C limit. You can claim that deduction upto 1.5 lakh only each year, in which PF is included.

- If employers henceforth pay EPF contribution after the deadline of the 15th of any month, then they will not be able to get business deduction for it. It will be taxable.

Watch the full video on tax on PF below.

Income Tax Act amendment for PF

The government has brought a new amendment in the Income Tax Act for EPF. PF members will now have to pay tax on their PF contribution, PF interest, PF withdrawal, and incoming pension as well. This change has come about due to the decision taken as part of Budget 2021-22, discussed earlier. Where high salaried employees get tax-free benefits on PF as well as assured PF interest returns. In the following part, we discuss the different taxes applicable on EPF henceforth in detail.

Income tax on PF contribution

As we already know, PF contribution comes partly from the employee’s salary and partly from the employer. The employee contributes 12% of his salary towards PF. Additionally, employee can claim up to Rs 1.5 lakh deduction under Section 80C on his PF contribution. For example, if employee’s annual income is Rs 10 lakh and PF contribution is Rs 1.5 lakh, then his taxable income will be Rs 8.5 lakh. If employee contributes Rs 2.5 lakh towards PF, then also his taxable income will be Rs 8.5 lakh only. Moreover, Section 80C encapsulates contributions to PF, PPF, NPF and many other schemes as well. Learn more about Section 80C in How To Benefit From Section 80C Income Tax Deductions?

Meanwhile, the employer contributes 8.33% towards employee’s PF and 3.67% towards employee’s pension. All of this is exempt from taxation provided that employer is not exceeding total contribution of either 12% or not exceeding Rs 7.5 lakh annually. For example, if employee’s salary is Rs 10 lakh and employer contributes Rs 1.2 lakh, then it is exempt from tax. But if employer contributes Rs 2 lakh then Rs 80,000 from that is taxable. Similarly, if employee’s salary is Rs 1 crore and employer contributes 12% i.e. Rs 12 lakh, then up to Rs 7.5 lakh is exempt. But remaining amount will be added to employee’s taxable income and taxed.

Income tax on PF interest

As per Budget 2021-22, interest accrued on PF is also now taxable, under certain conditions, as follows:

- If an employee contributes under Rs 2.5 lakh annually, then interest accrued on it is completely tax-free.

- However, if employee contributes over Rs 2.5 lakh annually, then interest accrued on the amount above Rs 2.5 lakh will be taxable.

- Similarly, if employer contribution is over Rs 7.5 lakh then the interest accrued on the excess amount is taxable.

- Additionally, if PF gives over 9.5% interest returns in any year, then interest earned up to 9.5% is tax-free and above that is taxable.

Learn exact PF interest calculation rules in 5 Most Important PF Interest Rate Calculation Rules.

Income tax on PF withdrawal

There are many withdrawals available under PF for various purposes. PF members can either take an advance part withdrawal or full withdrawal to close the account. PF withdrawal also attracts TDS which can be saved if one follows – Save TDS On PF Withdrawal | Deduction Rules, Refund, Form 15G/15H. If one’s TDS on PF has been deducted then they can download Form 26AS from the income tax website and submit it for TDS return.

If PF member withdraws PF fund after 5 years of service, then it is tax-free. However, if PF member withdraws funds before 5 years of service due to resignation of his own accord, then the fund will be taxable. But if withdrawal before 5 years due to resignation is not of his own accord, then it is not taxable.

Income tax on pension

Pension amount gets added as salary and is taxed as taxable income. Moreover, a standard deduction of Rs 50,000 is applicable on it. Since pension amount is usually low, in most cases it goes tax-free.

Learn more in the below video.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!