TDS or Tax Deducted at Source is a type of advance tax. It is levied by the Income Tax Department. According to the Income Tax Act, a company/person making a payment has to deduct tax at source if it is above a certain amount. Tax Department prescribes the rates of TDS deductions. The company/person making the payment after deducting TDS is the deductor. The company/person receiving said payment is the deductee. The deductor has to deduct TDS and submit it to the government. Tax deducted at source is not dependable on the mode of payment. Additionally, you can be charged TDS on your PF withdrawal, which will lower the fund you receive ultimately. Thus, in this article, we will learn how to save TDS on PF withdrawal effectively.

Table of Contents

TDS on PF Withdrawal Update

Since June 2016, there was no TDS deduction on PF withdrawal from the EPFO. The government revised this in June 2016 via Section 192(A). Henceforth, early withdrawal of PF before it matures will receive a TDS deduction.

When does TDS on PF Withdrawal happen?

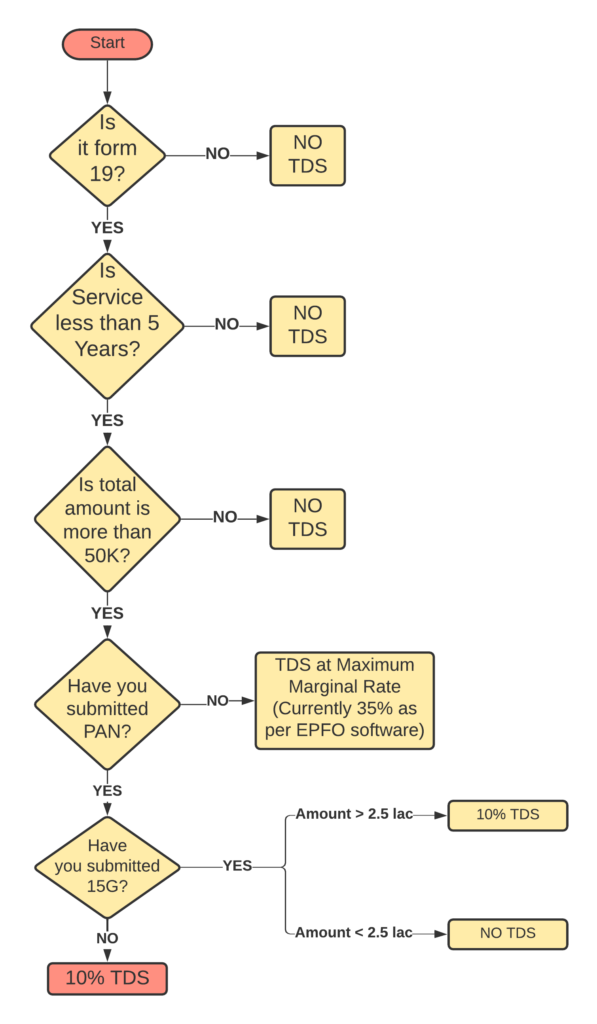

We will go step-by-step on the above given flowchart diagram to view where TDS on PF is applicable and how you can save it.

- There are three forms available for PF withdrawal – Form 31 for PF advance withdrawal, Form 19 for PF withdrawal and Form 10C for pension withdrawal. TDS is only applicable when you apply for Form 19. TDS is not applicable for withdrawal via Form 31and Form 10C.

- If your employment service period is over 5 years, then no TDS deduction occurs. You can save TDS on your PF.

- But if your service period is less than 5 years then two cases are possible as follows:

- If your PF fund is less than Rs 50,000 and you wish to withdraw it, then there is no TDS deduction on it. Earlier this fund was capped at Rs 30,000 but it has been revised to Rs 50,000 now. If your PF fund is over Rs 50, 000 then there are two cases possible as follows:

- If you do not have a PAN card linked to your PF account then a staggering 35% TDS deduction will happen on your PF fund.

- But if you have a PAN card and it is linked to your PF account then two cases are possible as follows:

- If you have submitted Forms 15G and 15H then two cases are possible as follows:

- But if your withdrawal amount is below Rs 2.5 lah then there will be no TDS deduction.

- If your withdrawal is above Rs 2.5 lakh then 10% TDS on PF will be deducted.

- If you have not submitted Forms 15G and 15H then 10% TDS deduction will occur.

- If you have submitted Forms 15G and 15H then two cases are possible as follows:

- If your PF fund is less than Rs 50,000 and you wish to withdraw it, then there is no TDS deduction on it. Earlier this fund was capped at Rs 30,000 but it has been revised to Rs 50,000 now. If your PF fund is over Rs 50, 000 then there are two cases possible as follows:

When service is below 5 years then is TDS deduction unavoidable?

No, even if the service period is less than 5 years, there are some conditions when TDS on PF will not be deducted. If the employee’s job has been terminated due to an illness, if the company itself has closed down due to unfavourable circumstances or any reason which is not under the employee’s control such as a natural calamity, will not attract TDS deduction on PF. But, the problem here arises that none of the above conditions are given as options for employee reason of exit on the PF portal. Hence, employees cannot mark the same. This creates confusion and makes it difficult to save TDS on PF.

Secondly, if an employee leaves one job before 5 years and joins a new one but does not withdraw his PF and continues to work for a few more years then no TDS deduction occurs. Thus, transferring to another company does not attract TDS deduction. The 5 years service period will also take into account multiple jobs overall.

Why is TDS deducted even after service period of 5 years?

This happens because your service period is calculated after deducting NCP days, i.e. Non Contributory Period, when you were absent from work. On NCP days your PF contribution is not submitted. NCP days are updated on your PF ECR as well.

For instance, if A has worked for 5 years and 3 months but taken leave for 180 days or 6 months, then his service period will be counted as 4 years and 9 months. This will attract TDS deduction. Hence, it is important to keep note of your NCP days.

PF fund not withdrawn even after leaving job but kept in PF account till 5 year period

If you leave a job before 5 years but continue to keep the PF money in the PF account for over 5 years and not withdraw it, it will still attract TDS deduction. This is because the circular clearly states that only continuous service periods are taken into account. So anything less than 5 years will have TDS on PF.

What to do if TDS is deduction at 10%?

If you are not in the income tax payable limit then you can file your ITR for the financial year. The TDS amount will appear under your tax credit and you can get it as a refund. You can learn ITR filing in Income Tax Return Filing For Salaried Persons.

What to do if PAN is not linked to PF account and TDS is deducted at 35%?

If you have over Rs 50,000 withdrawal amount then we highly suggest you not to withdraw it without a PAN card. As it will cause some unnecessary problems. But if you still get TDS deduction then it will not reflect in your Tax 26AS Credit because EPFO will not have the PAN details to submit it to the IT Department. Then you should immediately submit an application to the PF Regional Office to file a revised return with your PAN details. It is extremely difficult to refund the amount once it is received by the IT Department.

What will happen if you submit online PF claim without a verified PAN?

If your PAN is submitted on PF portal but not verified by employer then it is still considered as not submitted. An unverified PAN is equal to No PAN. So submit it again and ask your employer to approve i with his digital signature.

How to save TDS on PF?

Firstly, saving TDS does not mean you are saving yourself from paying taxes. Since if you fall under the taxable bracket and go ahead to file your ITR, you will end up paying the amount in your taxes. But that being said, some other legal ways in which you can save TDS on PF are as follows:

- If your withdrawal amount is below Rs 2.5 lakh then you can submit Form 15G or Form 15H and save TDS deduction on PF.

- If total PF fund amounts to close to Rs 50,000 then you can take advance withdrawal for half the amount. This will bring the total fund to under Rs 50,000 and there is 99% chance that TDS deduction will not happen on it. Only if an It officer is super diligent about it will TDS be deducted.

- Lastly, if your reason for exit is beyond your control then submit an application to the Regional PF Office with your employer’s signature, which states that your reason for exit is unavoidable. This will help in not getting TDS deducted regardless of having PAN.

Check out our detailed videos below for more clarification:

Applicability of TDS payment

On 20th May 2019, the PF Department released a new circular related to all clarifications regarding TDS on PF payment.

According to this circular, as per Rule-8 of Part-A of Fourth Schedule of the Income Tax Act, TDS is not applicable on a PF member in the following conditions:

- If the employee has worked for a duration of five years or more continuously with his employer

- If employee did not complete five years of service as he lost his employment due to

- The employee’s ill health

- Discontinuation of the employer’s business

- Any other cause which is beyond the control of the employee

- If the employee joins another employment upon termination of the previous one, or works under several employers, all of whom maintain PF contributions for their employees, and the employee’s total service period exceeds five years.

How much TDS to pay?

Paragraph 7.3 of the same circular states that as per Section 192A of the Act, if the employee does not fall under any of the exceptions given and his PF withdrawal amount exceeds Rs 50,000 as well as his service duration is less than 5 years then he is liable to 10% TDS deduction on his PF withdrawal amount. Moreover, if the employee has not submitted his PAN details to PF Department then he is liable to TDS deduction at the maximum marginal rate, i.e., 33%.

To prevent this, employee can submit his Form 15G and prevent TDS deduction of his PF payment. Otherwise, employee will have to file his ITR and wait for the filing to be processed to receive his TDS amount back.

With the amendment to the TDS portal, Form 15G can now be filled online.

Steps to fill Form 15G

- Download Form 15G and take a print out of it.

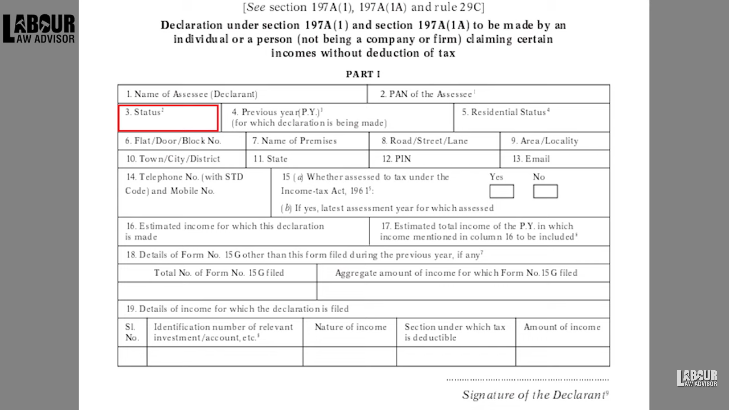

Part 1

- Enter the Name of Assessee, i.e., the PF account holder.

- Enter the PAN of the Assessee.

- For Status, it will be Individual for PF unless it is for any other purpose.

- Previous Year is the year for which the form is being filled.

- Residential Status will be Resident if member lives in India.

- Flat No. will contain the residential address details.

- Name of Premises will contain the residential address details.

- Road/Street/Lane will contain the residential address details.

- Area/Locality will contain the residential address details.

- Town/City/District will contain the residential address details.

- State will contain the residential address details.

- PIN will contain the residential address details.

- Email will input member’s email address.

- Telephone number and Mobile number will have the contact number details.

- (a)Whether assessed to tax under the Income Tax Act, 1961, tick Yes if member has filed ITR before in his lifetime.

- (b)If yes, latest assessment year for which assessed, mention the year succeeding the financial year for which income tax was filed. Hence, if financial year was 2019-2020 then assessment year will be 2020-2021.

- Estimated income for which this declaration is made, will mention the full amount which will be withdrawn from PF account.

- Estimated total income of the previous year in which income mentioned in column 16 is to be included, will mention the total income including the PF amount withdrawal for the year and this has to be under Rs 2.5 lakh. Else a person is not eligible for Form 15G.

- Details of Form 15G other than this form filled during the previous year if any, will have details of any other Form 15G which have been submitted for the same year for any other income source where TDS deduction is possible. This will have details for the total number of Form 15G filled and the aggregate amount of income from all sources for which Form 15G is filled.

- Details of income for which declaration is filed which in this case will be PF withdrawal.

- Identification number of relevant investment/account – will be PF number and UAN details

- Nature of income – will be EPF withdrawal

- Section under which tax is deductible – will be Section 192A

- Amount of income – will be the PF withdrawal amount

- Signature of the Declarant will have the member’s signature

- Declaration/ Verification

- After I/we, input member’s name

- For the previous year ending on, input the current financial year’s last date.

- Relevant to the assessment year, input the next year succeeding the above given financial year.

- Repeat the same details of the next two gaps.

- Input the city under Place and Date of filling the form.

- Input the member signature under Signature of the Declarant.

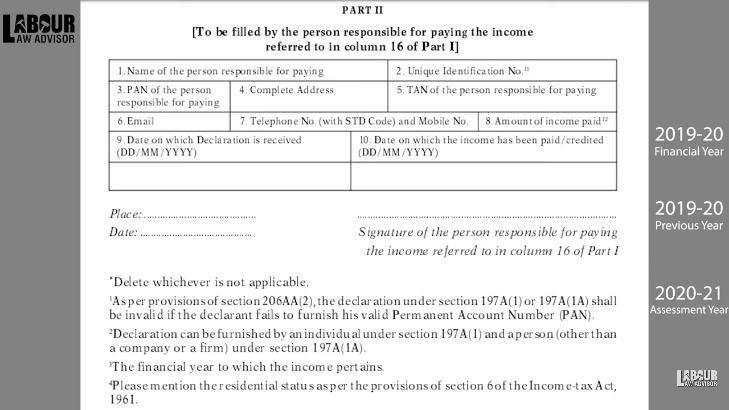

Part 2

- This will be filled by the PF Department and a copy of it will be submitted to the Income Tax Department.

- Scan the full form and save it as a PDF file.

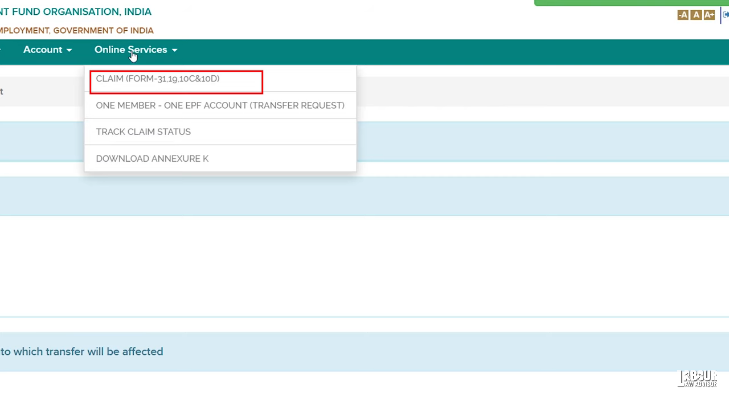

- Open the PF member portal and go to Online Services, then Claim Form 31, 19, 10C & 10D.

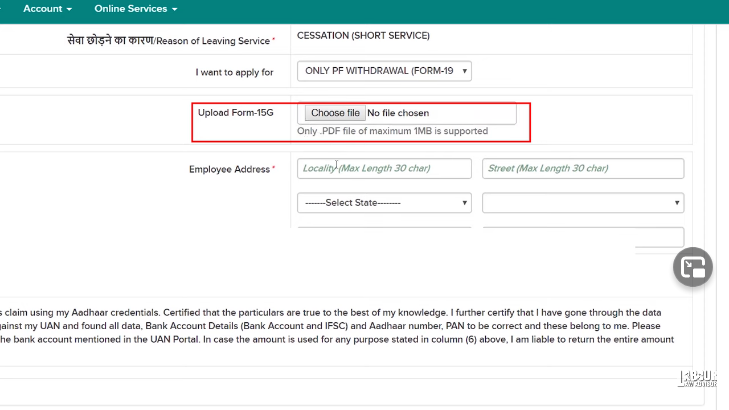

- For Upload Form 15G, select this form and upload it.

- For senior citizens, Form 15H has to be filed instead of Form 15G.

Learn the step by step process of filling Form 15G in the video below.

Learn How to calculate and reduce TDS on salary.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!