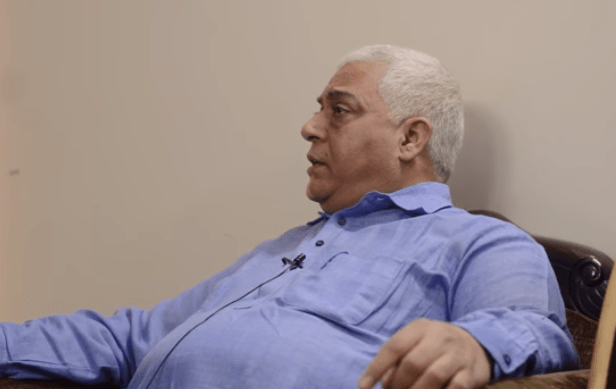

Mr Praveen Kohli won a Supreme Court case that allowed him to get a 1200% raise in his pension. This Haryana Tourism Corporation’s retired general manager got an increase in his pension from Rs 2372 to Rs 30,592 per month. Mr Kohli was able to get a revision on his EPS pension under the Employee Pension Scheme (EPS), by pointing out the 1996 Amendment in the EPS Act to the EPFO. According to the 1996 amendment, PF members could increase their EPS contribution to 8.33% of their total basic salary (Basic + Dearness Allowance), without any upper limit. This would result in PF higher pension every month. This was the result declared by the Supreme Court in October 2016 at the end of a prolonged legal battle.

Table of Contents

How to hike EPS Pension contribution?

- According to the standard EPF guidelines, an employer has to contribute 12% of the employee’s basic salary to his EPF account. Out of this, 8.33% is transferred to the employee’s EPS account.

- Currently, an employee can receive a maximum amount of Rs 15,000 a month as EPF. Hence, the maximum EPS contribution for an employee can be Rs 1250 per month.

- The 1996 Amendment of the EPS Act gave a loophole to employees wherein they had the choice of raising their EPS contribution to 8.33% of the total salary (i.e., basic + dearness allowance).

- To avail this hike, the employee has to give an application to EPFO and a consent letter from his employer.

- The October 2016 ruling of the Supreme Court made it compulsory for EPFO to allow higher EPS contribution by employees. This was also valid for retired professionals.

- Post a couple of years though, the EPFO stopped entertaining such requests for higher EPS contributions.

- Since tools of spreading awareness on such matters were low during that period, not many employees opted for this.

Who is eligible for higher EPS contribution?

All employees who became EPFO members before 1st September 2014 can raise their EPS contribution to their full salary. They need to submit an application to their employer and the EPFO, asking to get upto half of their last average monthly salary as pension. Employees who joined the EPFO after 1st September 2014, with a monthly salary of over Rs 15,000 are not eligible for this hike. This is because the EPFO put a maximum salary cap of Rs 15,000 on September 1, 2014.

The 1st September 2014 Amendment has brought a change to EPS calculation method. The average of the past five year’s salary would be accounted for, instead of the past one year. Some members try getting a higher pension by getting a higher basic salary in the final year of employment, before retirement. This amendment ensures that there is no sudden big payout to the member.

Exempt organizations left out

The EPFO was reluctant to give pension on full salary to employees of exempt organizations. These organizations manage their PF independent of the EPFO. Around 80 lakh of EPS’ approx 5 crore members are employees in exempt organizations.

According to the EPFO, allowing the higher pension to exempt organization employees has many procedural hurdles. If EPS contribution is increased with retrospective effect to giving pension on full salary then a corresponding amount of money has to be transferred from the member’s EPF account to his EPS account. Furthermore, the interest earned by that amount of money for the period it remained under EPF also has to transfer to EPS.

But the EPFO is of the opinion that this transfer of funds is possible only when both EPF and EPS accounts are under the EPFO trust. Since exempt organizations handle EPF of their employees on their own, this would not work out. Read more about Exempted Trusts in How To Withdraw PF Or Transfer PF From Exempted Trust?

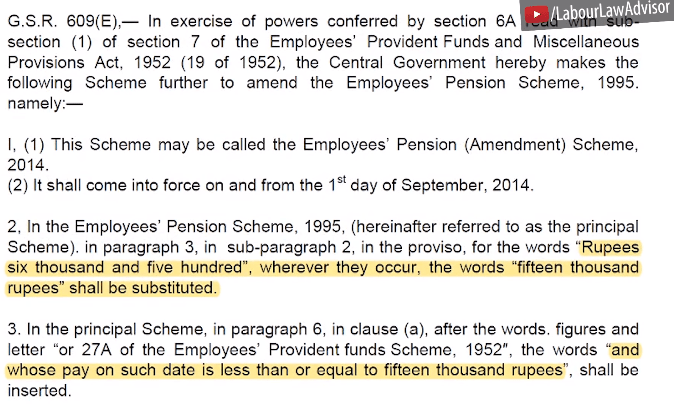

1996 Clause no longer available

In August 2014, the government made an amendment to the EPS Act of 1995 and deleted the provision of higher EPS contribution by employees. This amendment also raises the cap on the salary from Rs 6500 to Rs 15000 per month. Thus, any member who joined EPF post 1st September 2014, with a basic salary of over Rs 15000, is not eligible for EPS.

EPFO circular on pension increase update

On 8th June 2018, EPFO released a circular which stated that 3570 members were already receiving hiked pension. The average pension increase was Rs 7700, up from Rs 1930. As earlier stated, Mr Praveen Kohli was the person who began this domino effect. Read our one-on-one interview with Mr Kohli in In Conversation With Praveen Kohli | Higher Pension Case Details for more details on what we went through to achieve this milestone. After Mr Kohli’s case, other members also began trying to hike their pension. Therefore, EPFO released this circular to outline the details on pension increase.

Important points from the EPFO circular

- As per circular dated 23rd March 2018, all PF officers have to give hiked pension to eligible members. This is in accordance with Supreme Court’s order of 4th October 2016, which voids the six month arbitrary deadline given by EPFO for pension increase.

- All members who joined EPF before November 2014 and made contributions higher than ceiling wages are eligible for higher pension.

- 3570 members have received higher pension.

- Trivandrum and Kozhikode have most of these members.

- Very few members from North India have got higher pension.

- The total pension of these 3570 people increased from Rs 68 lakh to Rs 2.5 crore.

- Additionally, Rs 113 crore worth of arrears has also been cleared by the EPFO for these members.

- All PF offices have to comply with this order from the Supreme Court.

- All PF offices have been provided with the software to help calculate the higher pension of eligible members.

- PF offices cannot reject any request for higher pension without proper reasoning.

- PF officials need to be aware of all the guidelines regarding higher pension.

- If any Regional PF Office is forwarding higher pension requests to the Head PF Office, without the knowledge of their Regional PF Commissioner, then the PF Commissioner will be held responsible for this delay.

- All local PF offices are warned to comply with higher pension requests quickly and not delay them.

Watch the video below for this update.

The Issue with PF Pension Scheme

The EPFO made a new amendment to the PF Pension Act on 1st September 2014. According to this, the contribution was now increased to 8.33% of a maximum of Rs 15000 (i.e. Rs 1250). This amendment also specified that those employees who availed pension benefits on their full salary would have their pensionable salary calculated as the average of last five year’s monthly salaries. This was different from the earlier pattern of pensionable salary calculated on the average of last one year’s salary. Thus, PF pension was reduced for many employees. The employees also had to submit fresh options by April 1st 2015 to be considered valid for exercising this right.

Even after the Supreme Court’s judgement, the EPFO declined to receive the contributions of employees from exempt organizations, whose EPFs were operated by trust funds. This, despite them being ready to contribute the amount due. The EPFs of most large PSUs such as Indian Oil, ONGC and others, as well as large private sector companies, are controlled by trusts according to the EPFO rules.

Some of the High Courts of India from Kerala, Rajasthan, Tamil Nadu and Andhra Pradesh, along with others, passed a judgement in favour of the employees. They asked the EPFO to let them contribute. The latest judgement by the Supreme Court of India is expected to resolve this matter. Even employees who started working post 1st September 2014 would be able to get the benefits of pension of their full salary.

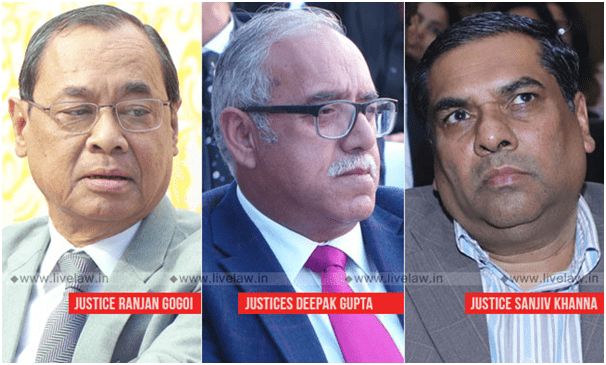

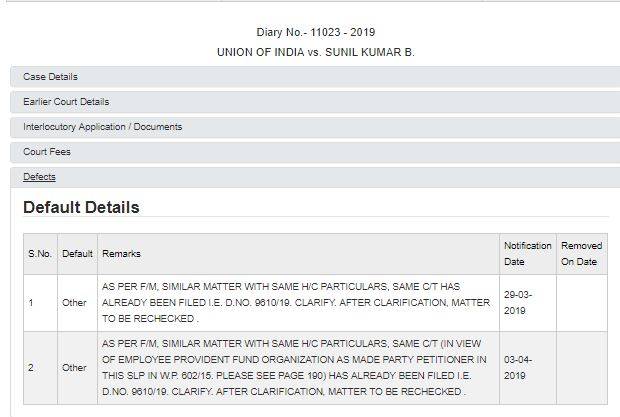

The Current Decision: Special Leave Petition

A Special Leave Petition is an important tool on the Indian Judiciary. It gives special permission to the troubled individual, to appear before an Apex Court to appeal against any judgement passed by any Tribunal or Court in India. The bench consisting of eminent judges – Chief Justice of India Ranjan Gogoi, Justice Sanjiv Khanna and Justice Deepak Gupta, dismissed EPFO’s Special Leave Petition, on the basis that it did not have any merit. This ruling was over the GSR 609(E) amendment of the EPFO. GSR stands for General Statutory Rules, which are issued by the Ministries of the Indian Government.

Kerala High Court’s Decision

- The EPFO’s Amendment Act of 2014, GSR 609(E), was to be set aside.

- All important orders and proceedings issued by the EPFO based on GSR 609(E) were also to be set aside.

- The proceedings issued by the EPFO declining to grant opportunities to petitioners to exercise a joint option along with other employees to remit contributions to the EPS on the basis of the actual salaries drawn by them are set aside.

- The employees shall be entitled to exercise the option stipulated by paragraph 26 of the EPF scheme without being restricted in doing so by the insistence of a date.

- There will be no order as to costs.

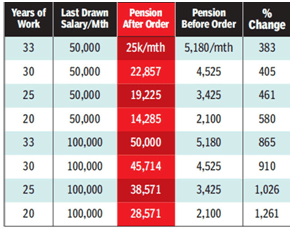

Impact on Pension

Pension Calculation

For more details on PF Pension calculation, check out our video.

Whose Pension Will Be Increased?

Only for those employees, who have given contribution on their full wages as well as whose full wages were more than Rs 6500 and later more than Rs 15000.

How Will Pension Be Increased?

Both the employer and the employee have to give a fresh option. There is no standard form for filling this out. Hence, different PF offices have their own formats for this form. Employees need to visit their local PF office and talk to their Account Officer. He will provide a format for the fresh option and the relevant documents needed to be submitted. You need to submit all these documents with the company seal to the PF department.

The Roadblocks – Celebrating Too Soon?

Mr KK Jalan, ex-EPFO Commissioner, stated that this judgement would yield a negative effect on the PF Pension fund. The PF Pension fund would not be viable to give out the total increased funds to the employees because that extra amount was not deducted from the employee’s salary during his work tenure, in the first place. Hence, the Indian Government will have to provide for these increased PF pension funds.

Similarly, Mr Brijesh Upadhyay, a current trustee of EPFO, stated that this decision will have negative repercussions on the PF pension fund. The Government has to provide sufficient budgets for the increased pension supply. Else, future pensioners will be in trouble.

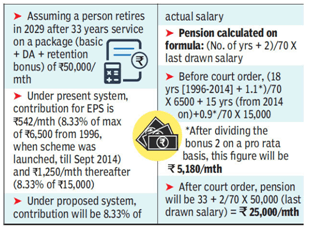

EPFO also filled a Special Leave Petition (SLP) in the Supreme Court on 13.3.2019 (verified on 27.3.2019) vide Diary No. 9610 of 2019 against the Judgment of Kerala High Court dated 12.10.2018 in the WPC No. 13120 of 2015. This SLP was dismissed on 1.4.2019, and the decision for it has been shared earlier.

Another SLP was filed by the Union of India, Through Secretary, Department of Labour and Employment on 26.3.2019 vide Diary No. 11023 of 2019 against the same Judgment of Kerala High Court dated 12.10.2018 in the WPC No. 13120 of 2015. This SLP is still under Defect List.

The EPFO is still trying its level best to get the orders modified, may be due to the other SLP on the same matter pending.

Learn more details on this topic in the below video:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!