For ages, man has expressed his joys through celebration and celebration invites gifts followed by income tax. In this article, we shall discuss a few basics of taxation of gift, cases where the taxation of gift is not applicable, rules when the gift received is money, movable property with, without, or inadequate consideration, and immovable property with, without, or inadequate consideration. Furthermore, we shall discuss the calculation of taxation of gift in case of inadequate consideration through an example.

Table of Contents

Basics of taxation of gift

The gift is taxed under the head Other Sources of the Income Tax Act. It is based on the concept of taxability of notional income and is governed by Section 56(2) which decides its taxability and computation thereon. Earlier this section dealt only with individuals and HUF. However, in order to avoid tax evasion, it has been amended to include companies, firms, and other persons also.

Gifts which are not taxable

In the following cases, Section 56(2)(x) is not applicable and hence the money/property received as a gift by the receiver is not taxable as per Income Tax Act.

- On the occasion of marriage

- From any relative*

- Through will or inheritance

- From any trust registered u/s 12AA

- From any medical institution or hospital

- By any educational institution or university

- From any Local Authority defined u/s 10(20)

- From an individual by a trust created solely for the benefit of the individual

- By a transaction not regarded as transfer under section 47.

- Car, Phone, TV, furniture, watch, etc are not taxable even if the amount exceeds Rs. 50000/- as they are not covered under section 56(2)(x).

*Definition of relative

In case of Individual:

As we say in simple terms, a relative includes the spouse, brother/sister of the person, spouse, lineal ascendant, and descendant of the person and the spouse.

In case of HUF:

Any member of HUF.

Gifts which are taxable

Money as gift

If the aggregate value of the amount received exceeds Rs 50000 then the entire amount of money shall be taxable under the head of other sources.

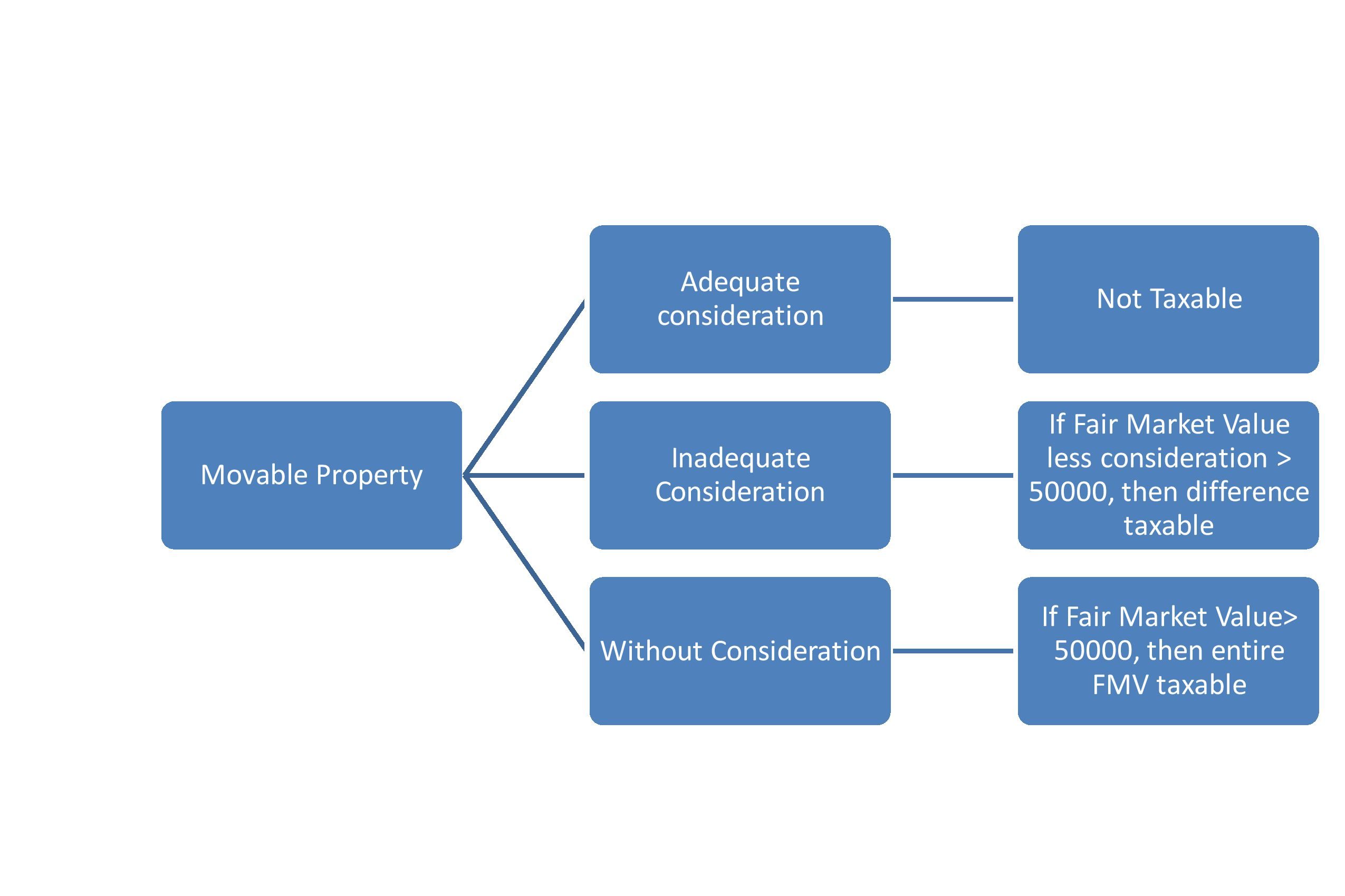

Movable property

The movable property includes shares & securities, jewellery, drawing, painting, archaeological collection, sculptures, bullion, or any other work of art. Taxability of movable property received as a gift is as follows:

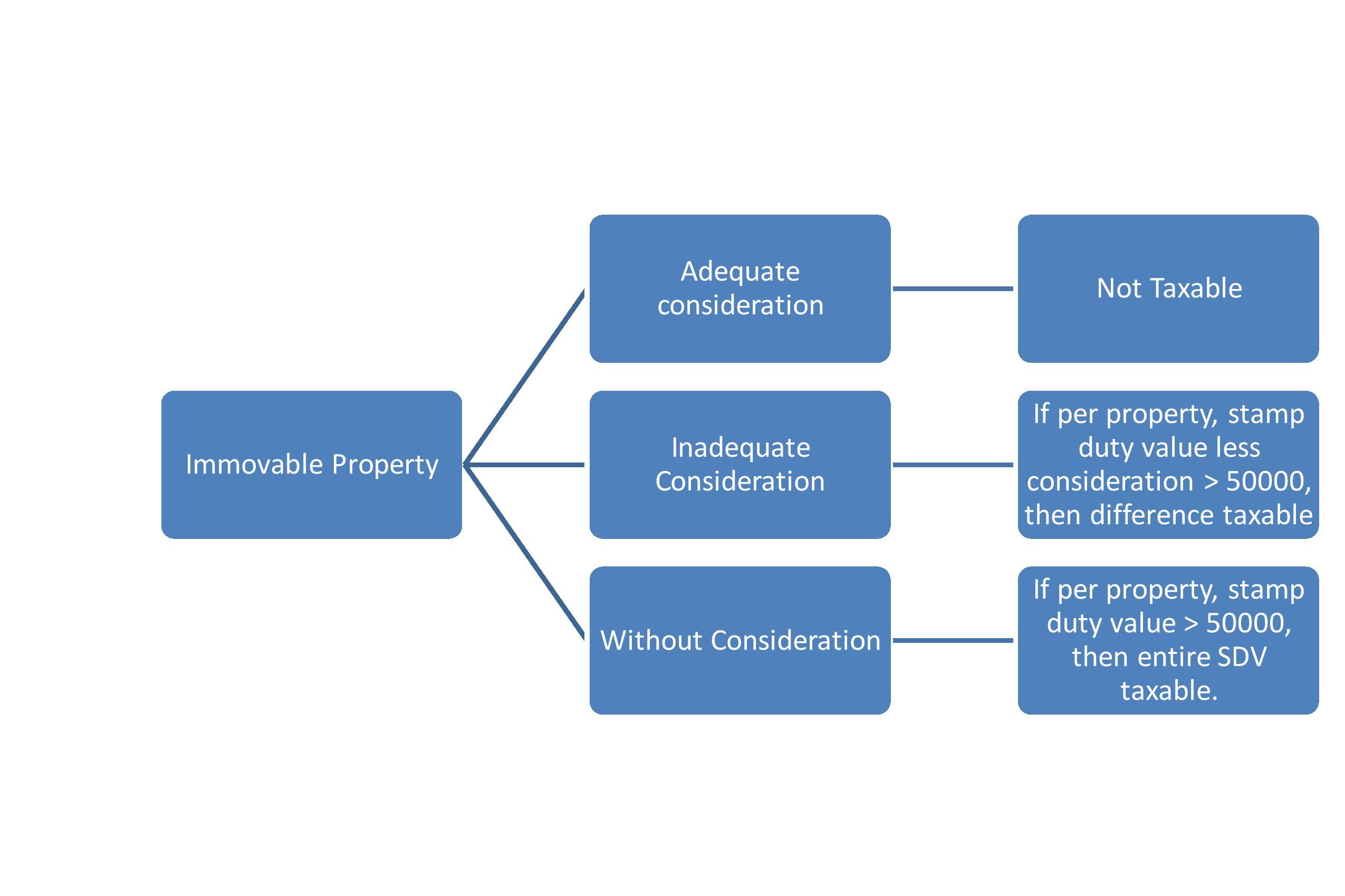

Immovable Property

Immovable property includes land, building or both. Taxability of immovable property is as follows:

Points to be cautious about:

- 5% variation in stamp duty value is allowed.

- If the assessee is not satisfied with the stamp duty value, then he may refer the case to the valuation officer.

- Section 56(2)(x) is applicable only if the property is in the nature of the capital asset.

Tax calculation – inadequate consideration

If a person receives property as a gift for inadequate consideration, then he shall be taxable a) under other sources u/s 56(2) in the previous year when the gift is received and (b) capital gains in the previous year at the time of transfer of asset. However, for the purpose of calculating capital gain, following should be considered:

- Period of Holding: from the date when the gift is received, that is, the period of holding of the previous owner shall not be considered.

- Cost of Asset: It shall be considered as the Fair Market Value or the Stamp Duty Value that was considered at the time when the gift was received.

Let us better understand this through an illustration:

Suppose Mr A acquires a house property for Rs 500000 on 01/04/2001. He gifts such property to Mr B for no consideration on 24/09/2019. SDV of the property as of 24/09/2019 is Rs 3000000. Furthermore, Mr B sells this property to Mr C for 6000000 on 02/05/2021.

Case I – A and B are friends

In hands of Mr A – Capital Gain is not applicable as gift is not considered as transfer.

In hands of Mr B

At the time when the gift is received

In hands of Mr B – Since SDV of the immovable property received without consideration > 50000, it is taxable under other sources in the previous year 2019-2020.

At the time of transfer

| Particulars | Amount |

| Sales Consideration | 6000000 |

| (-) Expense on transfer | – |

| (-) Cost of Acquisition (SDV as on date when gift is received) | 3000000 |

| Short Term Capital Gain (POH – 24/09/2019 to 02/05/2021) | 3000000 |

Case II – A and B are brothers

In hands of Mr A – Capital Gain not applicable as gift is not considered as transfer.

In hands of Mr B

At the time when gift is received – Not taxable as gift is received from the relative.

At the time of transfer

| Particulars | Amount |

| Sales Consideration | 6000000 |

| (-) Expense on transfer | – |

| (-) Cost of Acquisition (500000*301/100) | 1505000 |

| Long Term Capital Gain (POH – 01/04/2001 to 02/05/2021) | 4495000 |

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!