While looking at your salary payslip, you might notice a small deduction as “Professional Tax”, along with other components. So what is this Professional Tax (or P. tax)? It is a tax levied by State Governments on all the people who are working and earn an income in India. Professional tax calculation is different for each state of the country. But the upper limit for it is Rs 2500 per year. In this article, we discuss the professional tax rate for every state in the country, along with its applicability, registration process, calculation and more. Furthermore, we introduce a new online course covering Professional Tax in Maharashtra. Read on to find out more.

Table of Contents

Applicability

Professional tax is applicable as per Article 276 of the Constitution of India, for the following:

- Salaried individuals earning a certain salary and above

- Professional practitioners such as Chartered Accountant, Doctor, Lawyer, etc.

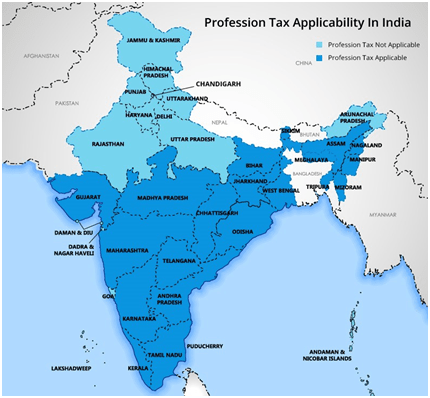

The tax varies from one state to another. Although, every state or union territory does not levy the tax. The list of states impose the tax, as on March 2019:

Professional Tax Calculation

Professional tax calculation is collected on basis of a slab and it depends on various factors for each state, such as:

- Gross income of individuals – Example, Karnataka charges Rs 200 as Professional Tax calculation on employees who make above Rs 15000 of basic salary and DA.

- The number of employees – Example, in Gujarat, companies with 5 employees on average in a year are covered under the tax.

- Gross turnover of business – Example, West Bengal levies the tax on factory owners if their turnover for the previous year was over Rs 5 lakh. For companies, Rs 2500 per year is mandatory as the tax regardless of their turnover.

The maximum amount which can be levied on any individual as Professional tax is Rs 2500 per financial year. Example, Maharashtra charges Rs 200 as P. tax for 11 months and Rs 300 for the 12th month. Some states charge Rs 208 as P. tax per month.

Calculate your P.tax according to your income here.

Registration

It is the employer’s duty to apply for P. tax Registration Certificate from the State Department within 30 to 60 days of employees’ hiring. If the workplace is spread out over many states then multiple Registration Certificates have to be applied to each individual jurisdiction’s authority. In some cases, a state may not have a central registration platform and thus different municipal corporations take over.

Example, in Karnataka the employer has to go to e-Prerana website for P. tax registration.

A penalty amount varying from Rs 5 to Rs 20 per day is levied for any delay in registration.

The Responsibility for Deduction & Submission

It is the employer’s responsibility to deduct P. tax from the employee’s salary and submit that to the concerned department. The employer also has to provide a return to the Tax Department in the prescribed form, within the due date. If an employer has over 20 employees, he has to pay P. tax within 15th of a month. But if an employer has below 20 employees, he can pay P. tax on a quarterly basis, which means by the 15th of the next month from the end of a quarter.

The penalty for late P. tax payment differs from state to state. Example, Maharashtra applies a 10% penalty. Furthermore, interest on late payment can also be charged. This can be up to 1.25% per month.

Returns

If the employer has more than 20 employees then he has to file a monthly return in Form No. 5 by the 15th of the next month. If the employer has less than 20 employees, then he has to file an annual return in Form No. 5AA.

In the matter of late filing of returns, a penalty of Rs 1000 per return is imposed, if the filing was done one month past the due date. After that, a penalty of Rs 2000 is imposable.

Income Tax Benefit

As per Section 16(III) of the Income Tax Act 1961, the Professional Tax paid by an employee is allowable as a deduction from his gross salary income.

Our following video covers this topic in detail:

Also, don’t forget to check out our last blog on Employee Pension Scheme Certificate.

Professional Tax Rates for FY 2019-20

Professional Tax rate in Andhra Pradesh & Telangana

The Professional tax in Andhra Pradesh and Telangana is levied under the Andhra Pradesh Tax on Professions, Trades, Callings and Employment Act 1987. The slab rates in Andhra Pradesh on salary/wage-earners are as follows:

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.15000 | Nil |

| Rs.15001 to Rs.20000 | Rs.150 per month |

| Rs.20000 and above | Rs.200 per month |

Professional Tax rate in Assam

The Assam Professions, Trades, Callings And Employments Taxation Act, 1947 states that every person who carries on trade either by himself or by an agent or representative or who follows a profession or calling or who is in employment, either wholly or in part within the State shall be liable to pay for each financial year, a tax in respect of such profession, trade calling or employment if otherwise not exempted by a notification from payment of such tax under this Act.

| Monthly Salary | Amount payable |

|---|---|

| Upto Rs. 10,000 | Nil |

| Rs. 10,001 to Rs. 15,000 | Rs. 150 per month |

| Rs. 15001 to Rs. 24,999 | Rs. 180 per month |

| Rs. 25,000 and above | Rs. 208 per month |

Professional Tax rate in Bihar

The Commercial Taxes Department regulated under the Bihar Government is responsible for the collection of professional tax dues from professionals in the state. As per the provisions of Bihar Professional Tax Act, 2011, individuals engaged in a business or profession are levied a Profession Tax.

| Monthly Salary | Amount payable |

|---|---|

| Upto Rs. 25,000 | Nil |

| Rs. 25,001 to Rs. 41,666 | Rs. 83.33 per month |

| Rs. 41,667 to Rs. 83,333 | Rs. 166.67 per month |

| Rs. 83,334 and above | Rs. 208.33 per month |

Professional Tax rate in New Delhi

In December 2004, the Municipal Corporation of Delhi tried to enforce a professional tax on those residing and working in New Delhi. This proposal was rejected by the Standing Committee of Municipal Corporation of Delhi. Hence, this tax is not levied in New Delhi.

Professional Tax rate in Goa

Professional tax rate applicable in Goa is as follows:

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.15,000 | Nil |

| Rs.15,001 to Rs.25,000 | Rs.150 per month |

| Rs.25001 and above | Rs.200 per month |

Professional Tax rate in Gujarat

Professional Tax in Gujarat is governed by the Gujarat Panchayats, Municipalities, Municipal corporations and State Tax on Professions, Trades, Callings and Employment Act 1976. The Professional tax slab rates in Gujarat on Salary/Wage-earners are as follows:

| Monthly Salary | Amount payable |

|---|---|

| Less than Rs.5999 | Nil |

| Rs.6000 to Rs.8999 | Rs.80 per month |

| Rs.9000 to Rs.11999 | Rs.150 per month |

| Rs.12000 & above | Rs.200 per month |

Professional Tax rate in Jharkhand

The person or the employee himself indulged in any employment, profession, calling and trade is responsible for paying the tax from the salary or wages. Salary and wages under the Jharkhand Tax on Professions, Trades, Callings and Employments Act, 1979 are described below.

| Monthly Salary | Amount payable |

|---|---|

| Upto Rs. 25,000 | Nil |

| Rs. 25,000 to Rs.41,666 | Rs.100 per month |

| Rs.41,667 to Rs. 66,666 | Rs.150 per month |

| Rs. 66,666 to Rs. 83,333 | Rs.175 per month |

| Rs. 83,333 and above | Rs.208 per month |

Professional Tax rate in Karnataka

Professional Tax in Karnataka is levied under the Karnataka Tax on Professions, Trades, Callings and Employment Act 1976. Different slab rates in Karnataka are for a different class of individuals and the below slab rates are only for salary/wage earners. For late payment of Professional Tax in Karnataka, interest at1.25% pm would be levied. Also, a maximum penalty of 50% of the total amount due may be levied by the Karnataka authority.

| Monthly Salary | Amount payable |

|---|---|

| Less than Rs.15000 | Nil |

| Rs.15000 and above | Rs.200 per month |

Professional Tax rate in Kerala

Professional Tax in Kerala is payable half-yearly. Below given are the professional tax slabs for Kerala paid half-yearly or semi-annually.

| Half Yearly Salary | Amount payable (Half yearly) |

|---|---|

| Up to Rs.11999 | Nil |

| Rs.12000 to Rs. 17999 | Rs.120 |

| Rs.18000 to 29999 | Rs.180 |

| Rs.30000 and Rs. 44999 | Rs.300 |

| Rs.45000 to Rs.59,999 | Rs.450 |

| Rs.60,000 to Rs. 74,999 | Rs.600 |

| Rs.75000 to Rs.99999 | Rs.750 |

| Rs.100000 to Rs. 124999 | Rs.1000 |

| Rs. 125000 and above | Rs.1250 |

Professional Tax rate in Madhya Pradesh

Professional Tax in Madhya Pradesh is levied by the Madhya Pradesh Vritti Kar Adhiniyam, 1955. Madhya Pradesh levies the Professional tax at Rs. 208 for 11 months and Rs. 212 for the last month. Tax Slab rates in Madhya Pradesh on Salary/Wage-earners are as follows:

| Monthly Salary | Amount payable |

|---|---|

| Less than Rs. 18750 | Nil |

| Rs.18750 to Rs.25000 | Rs.125 per month |

| Rs.25000 to Rs. 33333 | Rs. 167 per month |

| Rs. 33333 & above | Rs. 208 & 212 per month |

Professional Tax rate in Maharashtra

Professional Tax in Maharashtra is governed by the Maharashtra State Tax on professions, Trades, Callings and Employment Act 1975 which came into effect from 1st April 1975.

The Professional tax slab rates in Maharashtra for Females are as follows:

| Monthly Salary | Amount payable |

|---|---|

| Less than Rs.10,000 | Nil |

| Rs.10001 and above | Rs.200 per month except for the month of Feb Rs.300 for the month of Feb |

The Professional tax slab rates in Maharashtra for MAles are as follows:

| Monthly Gross Salary | Amount payable |

| Upto Rs. 7,500 (Male) | Nil |

| Rs 7,500 to Rs.10,000 | Rs.175 Per Month |

| More than Rs. 10,000 | Rs. 2500 Per Annum |

Professional Tax rate in Manipur

Manipur levies the Professional tax at Rs. 208 for 11 months and Rs. 212 for the last month.

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs. 4250 | Nil |

| Rs. 4251 to Rs.6250 | Rs.100 per month |

| Rs.6251 to Rs.8333 | Rs. 167 per month |

| Rs.8334 to Rs. 10416 | Rs.200 per month |

| Rs.10417 & above | Rs.208 & 212 per month |

Professional Tax rate in Meghalaya

Professional tax in the State of Meghalaya is governed by the Meghalaya Professions, Trades, Callings and Employments Taxation Act, 1947. Like most of the states, professional tax rates in Meghalaya is determined by the monthly salary or income received by an assessee.

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.4166 | Nil |

| Rs.4167 to Rs.6250 | Rs.16.50 per month |

| Rs.6251 to Rs.8333 | Rs. 25 per month |

| Rs.8333 to Rs.12500 | Rs. 41.50 per month |

| Rs.12501 to Rs. 16666 | Rs. 62.50 per month |

| Rs.16667 to Rs. 20833 | Rs. 83.33 per month |

| Rs.20834 to Rs. 25000 | Rs.104.16 per month |

| Rs.25001 to Rs. 29166 | Rs.125 per month |

| Rs.29,167 to Rs. 33,333 | Rs.150 per month |

| Rs.33334 to Rs. 37500 | Rs.175 per month |

| Rs.37501 to Rs. 41666 | Rs. 200 per month |

| Above 41667 | Rs. 208 per month |

Professional Tax rate in Odisha

The Commercial Taxes Department regulated under the Odisha Government is responsible to collect Professional Tax from various professionals in the state. As per the provisions of the Odisha Professional Tax Act, 2000, an individual is levied to pay a Professional Tax with a minimum of Rs.125 and a maximum of Rs. 300 per month.

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.13304 | Nil |

| Rs.13305 to Rs.25000 | Rs.125 per month |

| Rs. 25001 and above | Rs.200 per month except for the month of FebRs.300 for the month of Feb |

Professional Tax rate in Punjab

The State of Punjab follows the professional tax laws dictated in The Punjab State Development Tax Act, 2018, which was bought into play on the 19th of April, 2018.

| Class of person | Amount payable |

|---|---|

| All such persons who are assessable under the Head Income from Salaries and/or Wages as per the Income Tax Act, 1961. i.e., if the income of the individual is more than 2.5 Lakhs per year. | Rs. 200/- per month |

| All such persons who are assessable under the Head Income from Business and/or Profession as per the Income Tax Act, 1961. i.e., if the income of the individual is more than 2.5 Lakhs per year. | Rs. 200/- per month |

Professional Tax rate in Puducherry

The Puducherry Municipalities (Amendment) Act, 2017 governs the levy of the tax to the whole territory of Puducherry.

| Half-yearly Salary | Amount payable (Half yearly) |

|---|---|

| Up to 99,999 | Nil |

| Rs. 1,00,000 To Rs. 2,00,000 | Rs.250 |

| Rs. 2,00,001 To Rs. 3,00,000 | Rs.500 |

| Rs.3,00,001 To Rs. 4,00,000 | Rs.750 |

| Rs. 4,00,001 To 5,00,000 | Rs.1000 |

| 5,00,001 and above | Rs.1250 |

Professional Tax rate in Sikkim

The state of Sikkim follows the professional tax laws dictated under the Sikkim Tax On Professions, Trades, Callings And Employments Act, 2006 as follows.

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.20000 | Nil |

| Rs.20001 to Rs.30000 | Rs.125 per month |

| Rs.30001 to Rs.40000 | Rs.150 per month |

| Rs.40000 & above | Rs.200 per month |

Professional Tax rate in Tamil Nadu

Professional Tax in Tamil Nadu is levied under the Town Panchayats, Municipalities and Municipal Corporations Rules 1988.

| Half-yearly Salary | Amount payable (half-yearly) |

|---|---|

| Upto Rs. 21000 | Nil |

| Rs 21001 to Rs.30000 | Rs.135 |

| Rs.30001 to Rs.45000 | Rs.315 |

| Rs.45001 to Rs.60000 | Rs.690 |

| Rs.60001 to Rs. 75000 | Rs.1025 |

| Rs. 75001 and above | Rs.1250 |

Professional Tax rate in Tripura

Professional Tax in Tripura was revised on 25th July 2018. The revised tax slab rates in Tripura on Salary/Wage earners are as follows:

| Monthly salary | Amount payabl |

|---|---|

| Up to Rs.7500 | Nil |

| Rs.7500 and above and up to Rs. 15,000 | Rs.1800/-(Rs.150/- per month) |

| Rs.15001 and above | Rs.2496/-(Rs. 208/- per month) |

Professional Tax rate in West Bengal

Professional Tax in West Bengal is levied under the West Bengal State Tax on professions, Trades, Callings and Employment Act 1979. In case of any delay in depositing this tax in West Bengal Government, interest at 1% pm would be levied. A penalty of 50% of the total amount due may also be levied by the West Bengal government.

| Monthly Salary | Amount payable |

|---|---|

| Up to Rs.10000 | Nil |

| Rs.10001 to Rs.15000 | Rs.110 per month |

| Rs.15001 to Rs.25000 | Rs.130 per month |

| Rs.25001 to Rs.40000 | Rs.150 per month |

| Rs.40000 & above | Rs.200 per month |

Maharashtra Professional Tax Online Course

Taxes in India is complex. Which is why having a proper understanding of every factor is important. Since even a minor error can lead to penalties and fines. This is why we have incorporated an online course on Professional Tax in Maharashtra. This course is ideal for HR, Accounting students, consultants. With this course, you can create a base for starting your payroll consultancy. The course will be of around 30 lectures and it will cover the following topics:

- Introduction to Professional Tax Maharashtra

- Applicability

- Registration

- PTCR Registration Process

- Calculation

- Excel Format

- Payment Process

- Return

- Form 3B

- PTCR Return Process

- Penalty, Interest, Tax Exemption

- PTEC

- Audit

- Common Mistakes & Q&A

- Practical Demonstrations

Enrol in the Maharashtra Professional Tax Course today!

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!