The Pradhan Mantri Shram Yogi Maandhan (PMSYM) yojana is a new pension scheme announced by the Central Government in the Financial Interim Budget 2019. The PMSYM yojana was finally launched by PM Narendra Modi on 5th March 2019. It will also be a part of the Unorganized Workers’ Social Security Act.

This scheme was a result of the strike held on 8th and 9th January 2019 by 20,000 labourers of the unorganized sector. There are around 42 crore workers in the unorganized sector of the country who do not receive the benefits of workers in the organized sector such as gratuity, EPF, EPS, etc. These unorganized sector workers demanded a minimum wage of Rs 18,000 and a pension of Rs 3000 per month. The PMSYM yojana was thus a result of this demand, to safeguard their life post-retirement

Table of Contents

PMSYM Yojana Key Features:

- The person will get a minimum pension of Rs 3000 per month upon retirement. The retirement age is 60 years.

- The government will also make an equal contribution to the member’s contribution, towards the scheme.

- Furthermore, only workers of the unorganized sector are eligible for this scheme. These thus include landless labourers, washermen, home workers, brick kiln workers, cobblers, auto drivers, plumbers, electricians, etc. Also, only those workers are eligible who earn less than or equal to Rs 15,000 per month.

- The PMSYM yojana will hence run alongside the Atal Pension Yojana scheme. Learn more about that here.

Who is eligible for PMSYM yojana?

- One has to belong to the unorganized sector of workers in the country. This can be a home-based worker, street vendor, mid-day meal worker, head loader, brick kiln worker, cobbler, ragpicker, domestic worker, washerman, a rickshaw puller, landless labourer own account worker, agricultural worker, construction worker, beedi worker, handloom worker, leatherworker, audio-visual worker and similar other occupations.

- The person cannot be a part of any other social security scheme, especially, EPF, ESI and NPS.

- He is not eligible to file for income taxes.

- The person should fall between the ages of 18 to 40 years.

- His monthly income should be Rs 15,000 or less.

How to prove that you are eligible for PMSYM yojana?

If one has an issue proving that they are not a part of any other social security scheme or their monthly income is under Rs 15,000 then they may raise their case to the Joint Secretary and Director General Labour Welfare, Government of India in the Ministry of Labour and Employment, New Delhi. Their decision will be taken as the final word. In case of any difficulty in the implementation of the decision, the matter will be forwarded to the Central Government. Their judgement on it will be conclusive of the matter.

What is the contribution rate in PMSYM yojana?

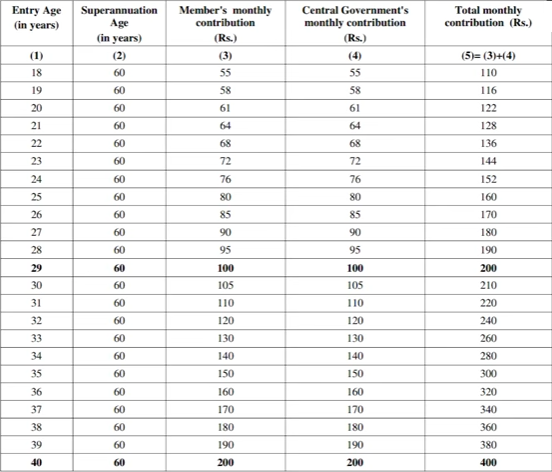

The younger you enroll in this scheme, the less contribution you need to give, and vice-versa. Although, the minimum contribution is Rs 55 and maximum is Rs 200. The government is equal whatever your contribution is to the scheme. The full contribution rate in the scheme is as given in the image below:

What happens in case of death of the member?

In case the yojana member passes away before the age of 60 years, then his surviving spouse will be given the option to continue making monthly contributions to the PMSYM yojana until they turn 60 years. Later, they may withdraw the pension once they reach 60 years of age. But if the member passes away after 60 years of age then his surviving spouse be continue receiving 50% of the pension.

What will be the framework of this scheme?

The PMSYM yojana will be fully automated scheme. It will have an app which will be accessible to all members via their mobile phones. Members will be able to check their contribution on the app. They will also be able to enable an auto-debit functionality from their bank where their monthly contribution will get automatically deducted from their bank accounts.

What happens in case of payment default?

In case one does not have the auto-debit functionality and forgets to make their monthly contribution on time, then they have to pay a penalty fine and interest. They will be allowed to regularize their contribution by paying the full outstanding due along with interest of the rate as determined by the Government in the Ministry of Labour and Employment from time to time. This interest will be let known as and when needed by the member.

How to open a PMSYM yojana account?

- You need to contact a LIC agent or visit a LIC office. Since the full scheme falls under the management of LIC and they will be making the pension payments.

- Other options will be to visit your nearest EPF office, ESIC office or District Labour office.

- All the places will have a help desk where you have to fill up all the forms and complete all formalities.

- Then submit your bank account and Aadhaar details.

- You also have to get a consent form signed and submitted in your bank for enabling the auto-debit functionality.

What are the benefits of closing this account?

- If a member exits the PMSYM yojana before ten years then his full contribution until then will transfer to his bank account. This only includes his contribution and not the government’s contribution though. He will also receive interest on the contribution as per a savings bank account.

- Otherwise, if a member exits the PMSYM yojana after ten years but before his age of sixty years, then also only his contribution will transfer to his bank account. It will not include the government’s contribution. Although, he will receive an interest on it either as per the Pension Fund scheme or savings bank account, whichever is higher.

Disablement cases

What happens if a PMSYM yojana member suffers permanent or partial disablement later on in life? In such cases, their spouses can continue making monthly contributions and get pension once they turn 60 years of age. Else they may close their account as well. Upon closing their account, the clauses applicable remain the same the two given above.

Watch our two detailed videos on the PMSYM yojana scheme below:

Find more such informative articles on our blog and our YouTube channel.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!