The Public Provident Fund or PPF scheme was introduced by the Government of India in 1968. PPF scheme is a long duration investment scheme which is free of risk and has a lucrative interest rate. Owing to its flexible nature, it is quite a popular investment option for investors. It is a means of retirement security for individuals.

Table of Contents

Types of PPF Scheme Forms

- Form A – For opening a PPF scheme account

- Form B – For making deposits in your PPF account and repaying loans taken against your PPF account

- C Form – For making partial withdrawals from your PPF account

- Form D – For requesting for a loan against your PPF account

- Form E – For adding a nominee to the PPF account

- F Form – For making changes to PPF account nomination information

- Form G – For claiming of funds in a PPF account by the nominee or the legal heir

- Form H – For extending the maturity of the PPF account (1 or 5 years)

Interest Rate of a PPF Scheme

The interest rate for the PPF scheme is compounded yearly and usually announced by the central government every year during budget revisions. The rate of interest for 2018-2019 is 8% p.a.

The interest on your PPF account is calculated on the minimum balance in your account between the 5th and the last day of every month. Also, the interest is a credit on the 31st of March every year.

Tenure & Maturity

The tenure for a PPF scheme account is 15 years. The PPF account matures after a period of 15 years from the end of the year in which the account was open. i.e., 16 years in total for maturity. Upon maturity, you can extend the tenure of your account as many times as you want, but each extension is limited to five years. The extensions are allowed either with or without making any deposits. Extension of PPF account must also be done within 12 months from its date of maturity.

Investment & Deposits

A PPF scheme account can open with an initial investment of Rs. 100. Also, a minimum of Rs 500 needs to be deposited every financial year in the PPF account while a maximum of Rs 1.5 lakhs can be deposited per year.

A deposit is necessary for each year of the tenure of 16 years to keep the PPF account active. Failing to do so renders the account as inactive. Deposits to the PPF account are available either through cash, cheque, PO, DD or online money transfer. These deposits made all at once or in separate instalments of which 12 are allowed in a financial year.

Withdrawals & Loans

Partial withdrawals are available every year from the end of the seventh year of your tenure. Furthermore, you can withdraw up to 50% of the balance of your account.

You can also take a loan against your PPF account. This allows for the third financial year until you complete six years of investment. Additionally, the interest rate for the loan is 2% over the current interest rate on your PPF account. The loan can be repaid either in a lump sum or in two or more installments, within a duration of 36 months. Also, after repaying the principal loan amount, the interest amount needs to be repaid within a maximum of two monthly installments.

Tax Implications

The interest received for the PPF scheme is tax-free while the deposits are eligible for tax exemption under Section 80C of the Income Tax Act. The withdrawals taken against the PPF account are also exempt from wealth tax.

Other Key Features

- A nomination for the PPF account is possible right after opening the account or later.

- The PPF account fund is not transferrable between people but transferrable between bank branches or post offices for free.

- No opportunity to open joint accounts under the PPF scheme.

Inactivation & Reactivation

Upon the failure of depositing a minimum of Rs. 500 in the PPF account each financial year, the account is deemed inactive. During this inactive period, you cannot take out a loan against your PPF account. To reactivate the PPF account you have to pay Rs. 50 for each year of inactivation and the minimum amount cumulative for each inactive year as well.

For example, if a PPF account was inactive from year 4 to year 7 then to reactivate the account in year 8, a penalty of Rs 50 each year for 4 years has to be paid = Rs 200 (=Rs 50 x 4 years).

Plus, deposit amount = Rs 500 * 4 years = Rs 2000 needs to be deposited as well along with the penalty of Rs 200.

Eligibility to open a PPF account

- Only an Indian resident can open a PPF account.

- One person can open only one PPF account.

- NRIs who had opened a PPF account while they were resident Indians can operate the account until 15 years with no option for extension.

- Minors can open a PPF account based on a legal age proof.

- HUFs cannot open PPFs after 13th May 2005. All PPF accounts prior to this date can be operated until the maturity period of 15 years with no extensions.

Steps to open a PPF account

- A PPF scheme account is allowable in designated bank branches of SBI and its subsidiaries, ICICI Bank and Axis Bank. Other banks where you can open a PPF account include HDFC Bank, Central Bank of India, Bank of India (BOI), IDBI, Central Bank of India, Punjab National Bank, Indian Overseas Bank and few others.

- Otherwise, a PPF account can be opened at a post office.

Following are the documents require to open a PPF account:

- PPF Account opening form, available at the bank branch or the Indian Post portal.

- ID proof that includes any of the following:

- PAN card

- Driving license

- Voter ID card

- Passport

- Aadhaar Proof

3. For online applications, there are separate procedures for all the banks but the basic documentation and submission of application remains the same as follows:

- PPF account opening form

- ID proof

- Address proof, from any one of the following:

- Telephone bill

- Electricity bill

- Ration card

- Aadhaar Card

- Two current passport size photographs

- Pay-in-slip at the bank branch to transfer the amount to your PPF account, or a signed cheque in favour of your PPF account.

- For a minor, a birth certificate may also require as an age proof

Please note that all documents submitted need to be self-attested and the originals have to be taken along while opening the account.

Benefits of opening a PPF account

- Get an attractive interest rate of 8% with a scheme from the Central Government.

- The interest rate on PPF is compound annually. Your interest is payable on the 31st of March, every year.

- Get deductions of up to Rs 1.5 lakhs on investments in the PPF account, under Section 80C.

- Good long-term investment of 15 years.

- Loans are available between the 3rd and the 6th financial year.

- The PPF deposit amount ranges from a minimum of Rs.500 to a maximum Rs.1,50,000 in one financial year.

- A PPF account can get an extension in a block period of 5 years after maturity.

- Partial withdrawal facility is available from the 7th financial year onwards.

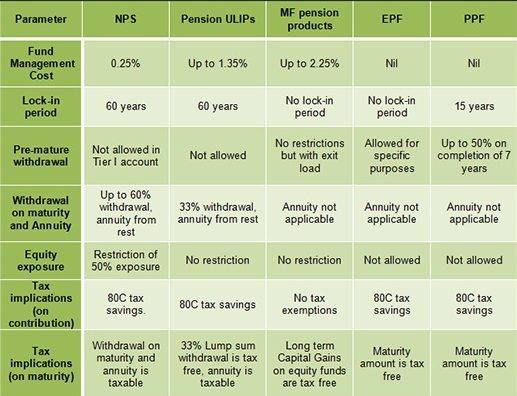

To know how the PPF scheme compares among other saving schemes, check out our video below:

PPF is one of the safest investments which not only offers a return of more than 8% but also provides tax benefits under section 80C of the Income Tax Act. Then why is it that you could lose your money in a PPF account? This can happen if you do not fully understand how PPF works, and how all the financial advisor institutions are intelligently saving their money. Hence, this is our financial advisor to help you save money, while you still can. Your PPF will mature after 15 years, and at that point, it might hit you that you have been making a lot of mistakes during these last 15 years. This can result in you earning way less money than you should have.

How to Save Money on PPF account with the help of a financial advisor

- Only when you deposit premium into your PPF account before 5th of any month, will you get the interest for that month. Making deposits on the 6th onwards will not get you any interest on your PPF. Hence, if you have been depositing money into your PPF after the 5th of any month, then after 15 years you lose out on the interest of 15 months which you could have received.

- PPF interest is credited on the 31st of March every year. So make sure to deposit your premium for March before the 5th every year. Else you will not get the March premium for that year. Furthermore, if this happens for the full term of 15 years, then you lose interest for 15 months.

- Do not rely on Cheque or DD for depositing money into your PPF. This is because the cheque/DD might take a few days to get clear and deposited. If this results in surpassing the 5th of any month, then you lose the interest of that month. Hence, it is much better to either transfer money online or make a direct cash payment to your PPF.

Case Study

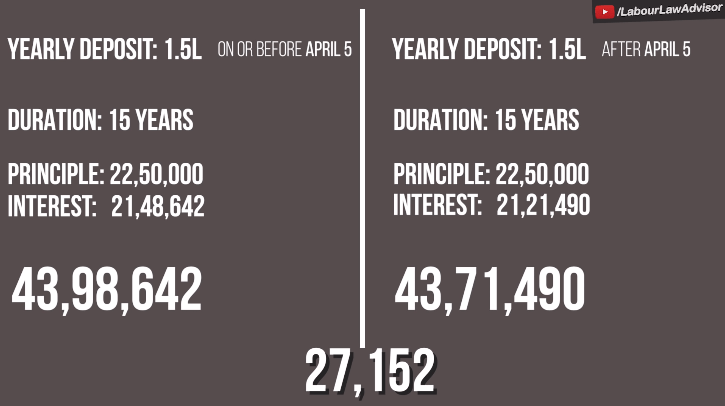

CASE 1 – You deposit Rs 1.5 lakh into your PPF every year for 15 years, before April 5th of any year. Here, your principal amount will be Rs 22,50,000. Your interest accrued on it at the end of 15 years will be Rs 21,48,642. Thus, at the end of 15 years you will be able to withdraw, Rs 43,98,642 from your PPF account.

CASE 2 – You deposit Rs 1.5 lakh into your PPF every year for 15 years but after April 5th of any year. Here, your principal amount will be Rs 22,50,000. Your interest accrued on it at the end of 15 years will be Rs 21,21,490. Thus, at the end of 15 years, you will be able to withdraw, Rs 43,71,490 from your PPF account.

The difference between Case 1 and Case 2 comes down to Rs 27,152.

Thus, the more months you deposit money for after the 5th, the more interest you lose out on.

CASE 3 – You deposit your entire year’s Rs 1.5 lakh premium after the 5th of March every year, for 15 years. In this case, you will receive zero-interest for the entire year. Furthermore, you receive zero interest for 15 years. This is the worst-case scenario.

Watch our detailed video on PPF account savings below:

Another scheme which you can check out is the Ayushman Bharat Yojana.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!