Employee’s Provident Fund (EPF) is a savings scheme maintained by the Employee Provident Fund Organization in India. Under this scheme, employees have to invest a certain fraction of their monthly wage which can later be obtained upon retirement. This is mandatory for people earning up to Rs. 6500 per month, while others can take part in it voluntarily. The employer contributes 12% of the employee’s basic salary to his EPF form 20, while the employee himself contributes 3.67% to his EPF and 8.33% to his pension scheme. This EPF money can be withdrawn upon the employee’s retirement, resignation or death. In this article, we discuss the PF withdrawal online procedure along with the criteria to be met for it and PF claim for a deceased member.

Table of Contents

When is PF withdrawal allowed?

Many employees usually face queries regarding their PF account. These queries are usually about when and how can they withdraw funds from their PF account. Since PF accounts are usually for saving money for your post-retirement life, there are certain restrictions to when and how you can withdraw these funds.

As per the attached pdf above, you can see that there are certain purposes where you are allowed PF withdrawal. Thus, PF withdrawal is allowed in the following cases:

- Purchase of house/flat, construction of house including the acquisition of site – if you are buying a new house or buying a new piece of land to build a house

- Repayment of loans in special cases – if you need to pay back a loan you have taken

- Grant of advances in special cases – in special cases such as the closure of your factory, or any natural disaster

- For illness in certain cases – if you or your family member has taken ill and need urgent medical treatment or surgery

- Marriages or post-matriculation education of children – if you or your kids are getting married or for your kid’s education purposes

- Physical handicap – if you require special equipment to aid your handicap

- Withdrawal within one year before retirement – if you are going to retire within one year, then partial PF withdrawal is allowed

PF withdrawal criteria fulfilment

For the above-given circumstances where PF withdrawal is allowed, you need to also fulfil certain criteria in each case to be eligible for PF withdrawal. These criteria fall under the following categories –

- Membership/period required – your minimum PF contribution for a certain number of years. This is usually 5 years of contribution except in special cases or illness

Number of instalments – the number of instalments in which you can withdraw your funds. This is usually one, except in cases of house acquisitionNumber of times withdrawal forsame purpose allowed – you cannot withdraw funds for the same reason multiple times. There is usually a limit of one for your total PF contribution period.- Payment will be made to –

usually the transfer is made to your bank account and this generally does not require a lot of documents as proof.

PF withdrawal online procedure

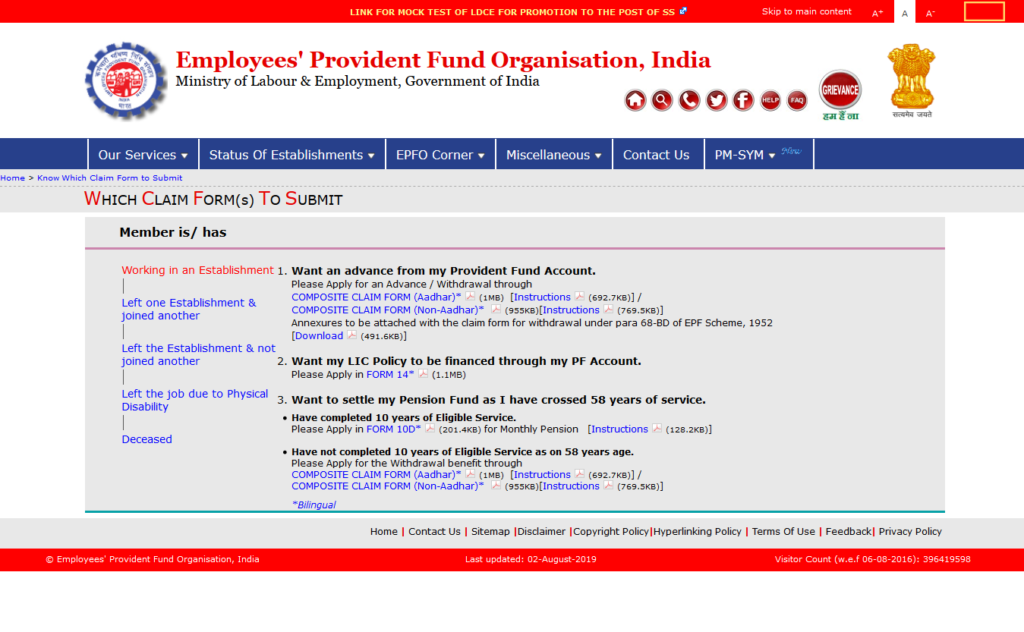

- Login to the EPFO website and search for Claim Form to open the following page

- There are two claim form options available here – Composite Claim Form (Aadhaar) and Composite Claim Form (Non-Aadhaar). The composite claim form (Aadhaar) does not require your employer’s signature but can be availed only when your KYC is approved on the PF portal. The Composite Claim Form (Non-Aadhaar) is used when your KYC is not done and it needs your employer’s signature. Both these forms are used for PF withdrawal, pension withdrawal and advance funds withdrawal.

- If you do not submit your PAN card details to your PF account then your TDS will be deducted from the PF withdrawal, if your service is less than 5 years. This deduction will be 34.608% of your PF withdrawal. If you have submitted your PAN details then 10% will be deducted which you can get back by filing for TDS return.

- Attach your PAN card with the form submission.

Procedure For Composite Claim Form (Aadhaar)

Mention the following details correctly:

- Claim applied for – tick on PF Part Withdrawal in this case

- Your name

- UAN details

- Your Aadhaar number

- The date of joining the establishment

- Purpose of PF part withdrawal – tick on the reason where applicable. Check in the PDF attached above to see if you fulfil the criteria for this withdrawal.

- Date of leaving service – can be left out since you are applying for partial PF withdrawal

- Discontinuation of service cause – also can be left out

- Full postal address – necessary to fill in this detail

- Member’s signature – your own signature

Procedure For Composite Claim Form (Non-Aadhaar)

Mention the following details correctly:

- Claim applied for – tick on PF Part Withdrawal in this case

- Your name

- UAN details

- Your Aadhaar number

- The date of joining the establishment

- Purpose of PF part withdrawal – tick on the reason where applicable. Check in the PDF attached above to see if you fulfil the criteria for this withdrawal.

- Date of leaving service – can be left out since you are applying for partial PF withdrawal

- Discontinuation of service cause – also can be left out

- Full postal address – necessary to fill in this detail

- Member’s signature – your own signature

- Employer’s signature – your employer’s signature with company seal

Here is a detail video tutorial on this whole process.

Procedure For PF Withdrawal Online

In the earlier days, the Pension Fund (PF) or Employee Provident Fund (EPF) withdrawal proved to be a big hassle which required some running about and arm-twisting. But with the latest changes in PF withdrawal, thanks to the ease of UAN and Aadhaar, the online PF withdrawal process has become a piece of cake.

Online PF Withdrawal Process Steps

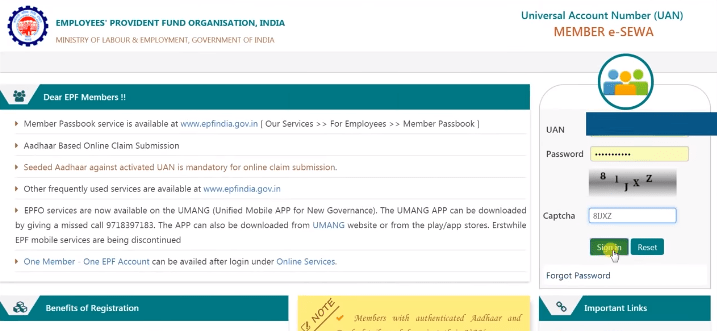

- Firstly, visit the UAN portal.

- Login via your UAN and password, then enter the CAPTCHA given. If you don’t have your UAN then visit the following link to learn how to get one – All Details For UAN | Generate, Activate, Link Aadhaar & More. We recommend you to keep your password safely written somewhere or changing it to something which is easy for you to remember.

- Next click on MANAGE to open a drop-down and proceed to click on KYC.

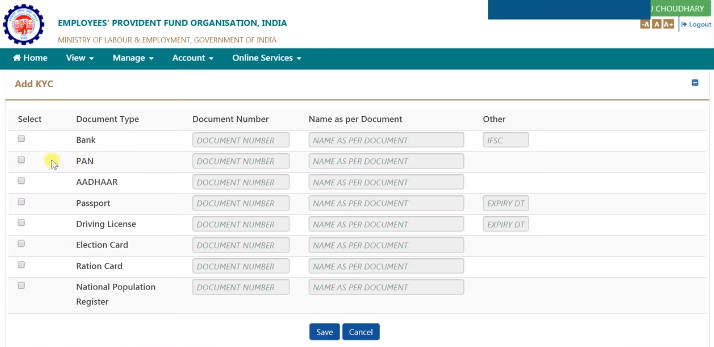

- Once you click on KYC, a screen appears to your bank details, PAN and Aadhaar card details. It is necessary to have your PAN and Aadhaar details verified for online PF withdrawal process. Make sure that your Name and Date of Birth given on your PAN and Aadhaar are the same. Any mismatch between these will fail your EPF withdrawal.

- If there is a mistake in your Name or Date of Birth, on either PAN or Aadhaar, you can correct it by submitting a Joint Declaration Form.

KYC Details

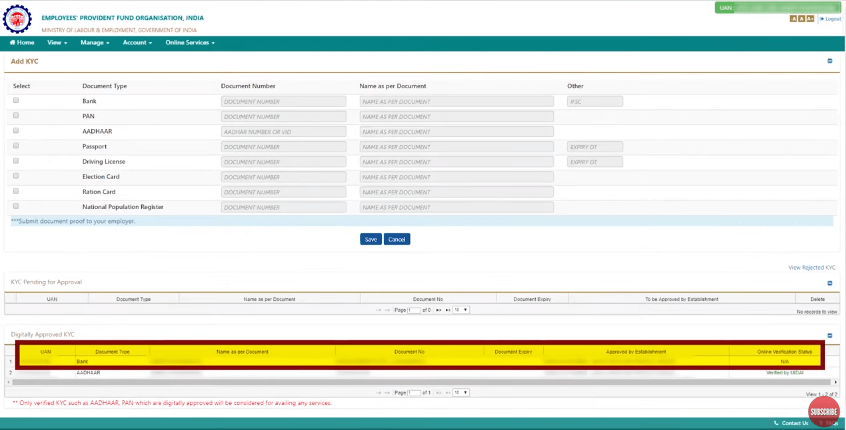

- Before continuing to the next step, check that your given Bank Account and IFSC Code are correct. If there is a mistake here, then resubmit your bank KYC details. Ask your previous or current employer to verify this KYC online with their Digital Signature.

- The bank KYC appearing top-most will be considered by the EPFO. Also, the Online Verification Status, might appear as “N/A”. This does not mean that your bank KYC is unverified by your employer. So you can proceed to the next step.

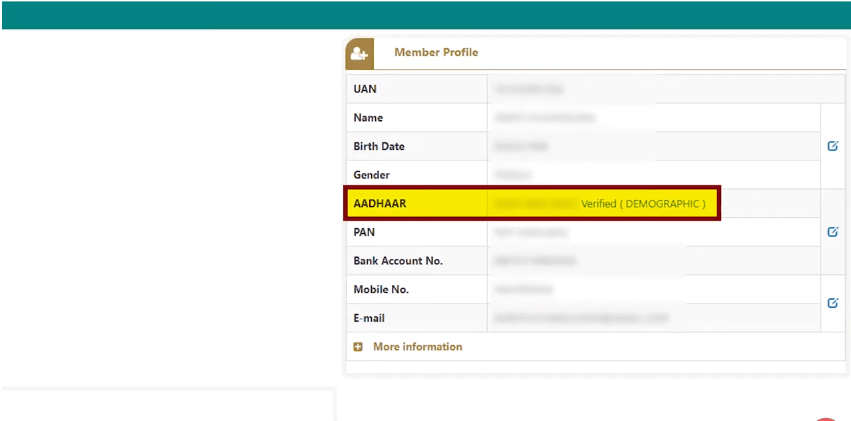

- On the home screen check that your Aadhaar detail appears as “Verified (Demographic)”. Else you will not be able to have a successful online PF withdrawal. Furthermore, make sure that your active mobile number is linked to your Aadhaar and that mobile number is available to you. This is because you will receive an OTP for the EPF withdrawal process. In case you don’t have the registered mobile number in use, go to your nearest Aadhaar centre and get your active number linked.

- It is extremely important to have your PAN KYC done in case your service period is less than five years or your EPF balance is over Rs 50,000. Else you will receive a TDS deduction of 33% on your EPF withdrawal. You will also be unable to get a TDS refund for it. Additionally, your online PF withdrawal request will be rejected.

Transfer Details

- Many times, members forget to transfer their old EPF funds to their new EPF account, before the online PF withdrawal. Thus, their latest EPF account’s money gets withdrawn, but the old EPF account money is left behind. This leads to many problems in the future.

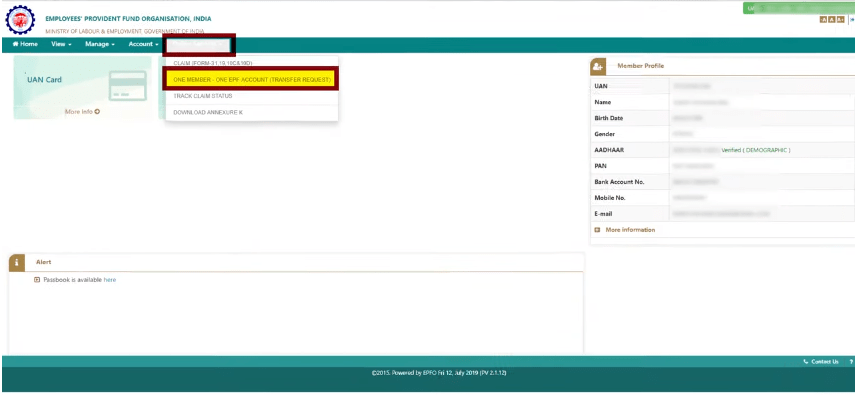

- To avoid this go to Online Services and click on One Member One EPF Account (Transfer Request). Now transfer all your old EPF account balance to your current EPF account. Once your current EPF passbook reflects this total transfer, then only initiate the withdraw of EPF. Your pension funds will not be shown in this passbook, but that is nothing unusual, so do not worry.

Withdrawal Details

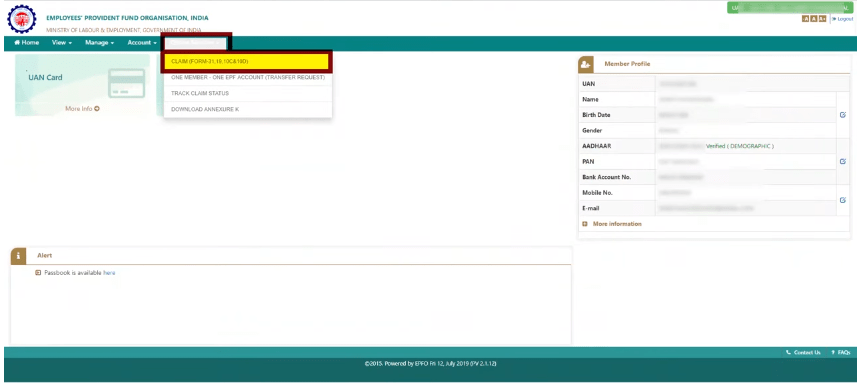

- Once your details are verified click on Online Services to open another drop-down menu and click on Claim (Form-31, 19, 10C & 10D).

- Go below and check if your Date of Exit is mentioned. If it is not, then either you are still in active service or your employer has not updated your exit date. This has to be updated, else your claim will get rejected. It should also be past 2 months your exit date to be eligible for withdrawal.

- Once you have checked everything, then put in your bank account’s last four digits and Verify. This is another security check.

- There is also the option to fill a new Form-15G. This is valid if your service period is under 5 years, your PF amount is above Rs 50,000 and you want to save TDS deduction. But for this, you should fall below the taxable limit.

- Check that your correct address is given, so you can receive the EPF correspondence.

- Fill Form 19 to withdraw EPF and Form 10C to withdraw pension.

- Pension withdrawal is available if your service period is a minimum of 6 months and maximum of 9.5 years. This is not available if you fall under the PMRPY scheme.

- Once your details are verified click on ONLINE SERVICES to open another drop-down menu and click on CLAIM FORM.

- Next screen appears to show all your details. Once you have checked everything, click on PROCEED FOR ONLINE CLAIM to submit your form.

- In the tab, I WANT TO APPLY FOR, select the claims you would like. The following options are available only if the individual is eligible for it: Form 31 – For partial withdrawal of PF

Form 19 – For complete withdrawal of PF

Form 10C- For withdrawal of EPF - If the employee has less than 6 months of work experience at their current job or is still employed at their current job, only Form 31 will be available for them.

- An OTP is sent on the mobile number which is linked to your Aadhaar. Enter the OTP number and click on SUBMIT.

- After you have submitted the form successfully, you will receive a confirmation copy with a reference number, which you can then use to check your claim status.

Important points to note

- You can get the EPF balance amount only in the registered bank account.

- Your registered bank account should be active. If it is closed then change your bank account number before you submit the withdrawal application. You can change your bank account number through your employer.

- The mobile number which you have registered with your Aadhaar should be active since authentication is done through that number.

- Your EPF database details should match with your Aadhaar database, otherwise, the online EPF withdrawal would not succeed.

Find two videos below to guide you through the PF withdrawal online process.

EPF Form 20 Death Claim Procedure

So how does one claim the EPF account money after the death of an employee? The process actually begins partly when the person is still alive and well. As a subscriber to EPF form 20, it is necessary that the employee fills an EPF Nomination Form to make sure that his money is transferred easily to his family as well as a Pension Scheme Certificate whenever he switches jobs so that the correct pension amount is calculated. These two documents are necessary for submission during the EPF form 20 death claim process. If you want to know how to fill the EPF nomination form, then click on our related video here, and to know how to fill the pension scheme click here.

The next important step is for the employers wherein they need to mark “Death” as the reason for the employee leaving his job on the EPF Employers’ Portal. This ensures that the employee’s family does not get into unnecessary hassles during the EPF death claim.

Documents you need to submit for EPF death claim

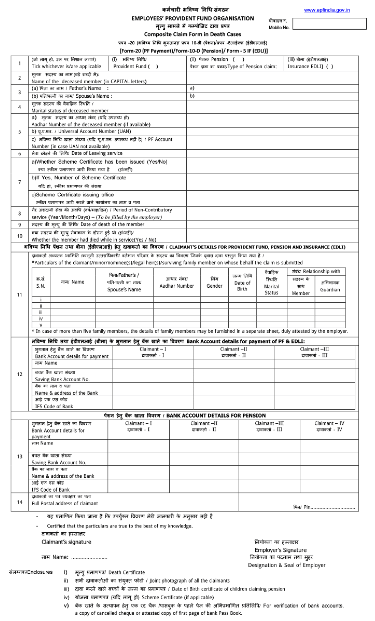

1. EPF Composite Form – is the main document to fill to claim the EPF amount. You can download the form from here.

- In the case of death, for the first row, you can tick on PROVIDENT FUND, PENSION CLAIM and INSURANCE EDLI.

- Next fill in the NAME OF THE DECEASED MEMBER, their FATHER’S NAME, SPOUSE’S NAME, MARITAL STATUS, AADHAAR NUMBER, UAN, PF ACCOUNT NUMBER, DATE OF LEAVING SERVICE.

- Now tick YES or NO for ISSUE OF SCHEME CERTIFICATE.

- If YES, next mention the NUMBER OF SCHEME CERTIFICATES and SCHEME CERTIFICATE ISSUING OFFICE.

- Then fill in the PERIOD OF NON-CONTRIBUTORY SERVICE in the format of year/month/days.

- Tick YES or NO for WHETHER THE MEMBER DIES WHILE IN SERVICE.

- Next, give up to 5 claimant details and all the relevant bank accounts where the money would be transferred. For receiving Pension you can fill in up to 4 claimant bank accounts. Fill in claimant’s name, signature. Get the signature and company seal of the employer.

2. Death Certificate – of the employee who passed away.

3. Birth certificate – of the children or people who are claiming for the EPF amount.

4. One Joint Photograph – of all the claimants together in the frame to avoid fraud.

5. Copy of a cancelled cheque or attested copy of the first page of bank passbook – as a proof of all the accounts mentioned on the composite form where money will be transferred.

6. Pension Scheme Certificate – with all details of claimants receiving the deceased employee’s pension.

Document Submission

Now take all these documents to the employer, who first needs to check all submitted documents, then sign and seal the composite form. Next, take all these original documents as well as a copy of each of them to the PF Department who shall receive and put a seal on the document copies to prove the submission of them. After submitting all documents to the PF Department, it should take under 30 days for the EPF money to get successfully transferred to the claimants.

Check out our video on EPF claim process after death below.

If you still have difficulty in your PF withdrawal then check out – All PF Rejection Reasons Solved | How to Withdraw EPF Online 2020.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and then search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!