Indian as a country has many labour laws for establishments to follow. Companies need to maintain a payroll sheet to keep track of all their employee payments. Companies also have a large number of workers and employees for whom they have to comply with several labour laws. The labour laws itself keep updating quite frequently too. In such cases, it is common for the company or the HR in charge to miss out on some compliances and make some mistakes in the payroll & salary calculation. In this article, we discuss eight such common payroll & salary calculation errors which occur often in establishments.

Table of Contents

8 Payroll & Salary Calculation Errors

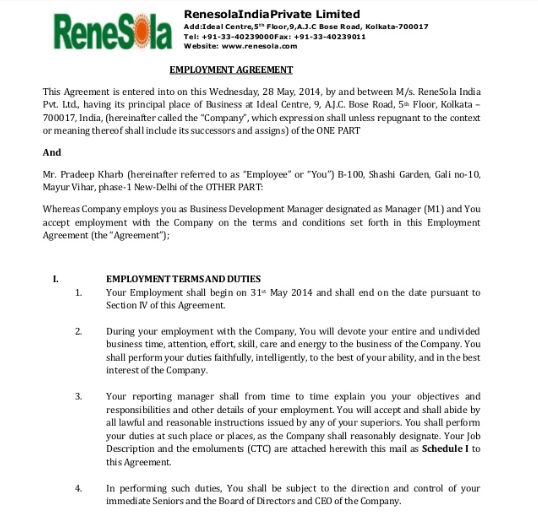

1. CTC based contracts

When a new employee joins an establishment, a good practice is to make him sign an employment contract. This employment contract is a bind between the employer and employee and states the various clauses of employment. Most important clause is the monetary compensation for the employees. Nowadays, establishments offer a CTC based contract to employees. But CTCs do not show the actual truth, they are rather an inflated version of what the employee is receiving. To know how CTC is different from gross salary and in-hand salary, read CTC Vs Gross Vs In-Hand Salary | Understanding The Hierarchy.

CTC includes the employer’s contributions towards employee’s labour law compliances, such as PF, ESI, gratuity, etc. Moreover, these labour law contributions change with the passage of time. So along with the changes in their contributions, the total CTC of employee also changes. Thus, if CTC falls below the amount given in the employment contract, then it will be seen as a breach of contract. Therefore, employer will have to revise the rate and redo all employee’s contracts. Hence, to make payroll and salary calculation easier the best practice is to make rate based contracts rather than CTC based. Employer must never promise an in-hand amount to employee. Rather tell them the rate of work and the compliance contributions with an approximate salary amount.

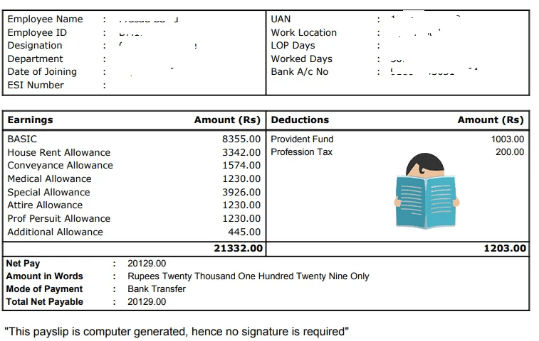

2. Too many allowances

In many instances, it is seen that companies add several allowances as part of employee’s salary. Additionally, companies may put different allowances in fixed proportions and follow the same for all employees. This is a big mistake when making payroll and salary calculations.

Even the Supreme Court of India made a ruling in the Surya Roshni Ltd Vs EPFO case, that including several allowances in salary calculation just for the sake of reducing labour law contributions and saving taxes is a malpractice and should not be followed. This made many companies revise their salary structures. The government is also planning to implement the Code on Wages. This will again reiterate that total allowances cannot exceed 50% of basic in salary calculation.

Thus, employers must only include the necessary allowances in employee’s salary which will actually benefit them. It is not a good practice to include many allowances just to make salary look extravagant. So, make the salary structure as simple as possible.

3. Monthly bonus and gratuity

Bonus means giving a part of the annual profits of the company to the employees. This can range from 8.33% to 20% maximum. But companies make the mistake of giving all employees a monthly 8.33% statutory bonus. This is wrong on multiple levels. Firstly, bonus can only be taken on the company’s profits and cannot exceed 20%. Secondly, monthly bonus attracts PF, ESI and other compliance deductions. Although annual bonus payments are exempt from it.

Thus, it is better to label this monthly bonus as advance bonus. Then company can calculate the total bonus at the end of the fiscal year and deduct the advance bonus from it. But giving statutory bonus for every month for payroll and salary calculation is extremely wrong.

4. Not knowing applicable acts

Depending on the Indian state of location, different labour law compliances are applicable. So, it is the employer’s responsibility to know which labour laws are applicable to their firm. PF, Pension, ESI, Bonus, Gratuity, Professional Tax, Labour Welfare Fund, TDS, etc are all different labour laws that vary from state to state. The employer or HR must know all the labour law compliances applicable to them. They must also keep track of the number of employees in the company. Thus, adding more labour laws as per the strength of the company increases.

Not following these compliances can be harmful to the company. Upon the company audit, all the backlogs get revealed and employer will have to pay the full backlog of compliances plus penalties for them. This can incur a huge sum of amount as a loss.

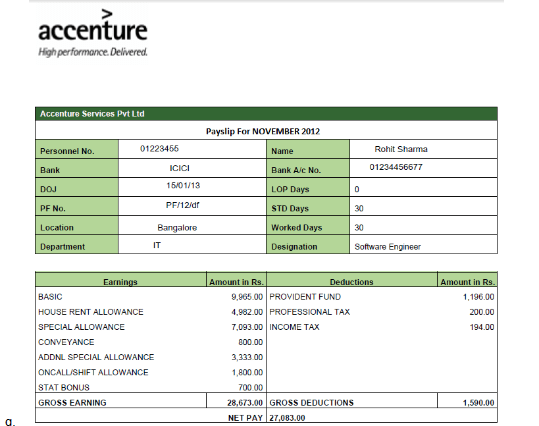

5. Not knowing calculation and rules

It is important to know the basic payroll and salary calculation rules. These are usually – working day rule, total day rule, daily wage rule, fixed day rule, piece rate calculation, among others. Even labour laws have different calculation rules. Example, if an employee joins EPF after 1st September 2014 and earns over Rs 15,000/month, then he must not pay pension contribution. Similarly, employer’s contribution of ESI has to be calculated on the overall sum of ESI contribution of employees. So employers and HRs have to be aware of the correct payroll & salary calculation rules. Moreover, they should not depend on salary calculation software for the same.

6. Delay in filing

Delay of even a single day in payment of compliances can lead to big penalty and damages payments. In some cases, it can even lead to severe punishments and imprisonments. Thus, it is a good practice to create a compliance calendar for your establishment. this must have the deadlines for all compliance filings. In the long-term, it will save money from payment of damages and penalties.

7. Relying on softwares only

There is availability of many softwares in the market for payroll and salary calculation. But they should not be used as a BlackBox. Most softwares leave a lot of customization open to the user. For example, which compliances to deduct, how much to deduct, may not always be input into the software. Some softwares may even be outdated with previous contribution amounts or lacking the newer labour law contributions. Therefore, it is not advisable to trust these payroll calculation softwares blindly. Rather use them as an aid to your understanding.

8. Proper record keeping

It is extremely important to have a proper record-keeping in place. Employers must keep up-to-date records of muster roll, payroll, adult register, PF, ESI and Professional Tax statements, to name a few. The record-keeping will help you in correct payroll and salary calculation. It will also help you for sudden company audits, where you don’t have to scramble in a hurry to get your records in place.

Watch the video on payroll & salary calculation mistakes below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!