The EPFO released a circular in May 2021 which stated that PF members who do not have their Aadhaar linked to their UAN will not be able to get their challan filed. This new rule will come into effect from 1st June 2021. Until now, PF members without their Aadhaar linked to UAN would still be able to have their challans filed, add their contributions and see their PF balance on the PF passbook. But it would cause issue with their PF withdrawal sometimes. But henceforth, employers will not be able to make and file such employee’s challan only. This new rule has come into effect under Section 142 of the Code on Social Security 2020.

Table of Contents

What is Code on Social Security 2020, Section 142?

Code on Social Security 2020 has been in the works by the government for a long time. As of now, the law has been passed however all its rules and regulations have not been released except for Section 142. Section 142 of the Code states that:

(1) An employee or unorganised worker or any other person, as the case may be, for –

(a) registration as member or beneficiary; or

(b) seeking benefit whether in kind, cash or medical sickness benefit or pension, gratuity or maternity benefit or any other benefit or for withdrawal of fund; or

(c) availing services of career centre; or

(d) receiving any payment or medical attendance as Insured Person himself or for his dependants,

under this Code or rules, regulations or schemes made or framed thereunder, shall establish his identity or, as the case may be, the identity of his family members or dependants through Aadhaar number and for such purpose the expression “Aadhaar” shall have the meaning as defined in clause (a) of section 2 of the Aadhaar (The Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016.

Therefore, without having an Aadhaar card, a worker cannot be added a member to PF scheme. Even the beneficiaries of PF members without an Aadhaar cannot avail any benefits under PF. Moreover, such employees without an Aadhaar will not be able to receive any benefits for sickness, cash, maternity, medical or withdrawal of PF funds.

Impact of EPFO Circular on your PF

Any employee who does not have their Aadhaar linked to their UAN will not be able to pay their PF contribution from 1st June 2021. This will probably affect lakhs of employees who do not have their KYC completed. It may be due to an error in some legal document or a missing document. Even the employer will end up suffering in this. Reason being that doing UAN KYC takes a considerable amount of time. The employee needs to submit the UAN KYC from his end, which then needs to be approved by the employer and then it goes to the PF Department for approval.

This process can take months. Even if the employer is able to submit your pending contributions later then he will have to pay the late penalty and damages for it. Thus, it is important to know all Aadhaar related errors and how to resolve them.

Aadhaar errors and corrections

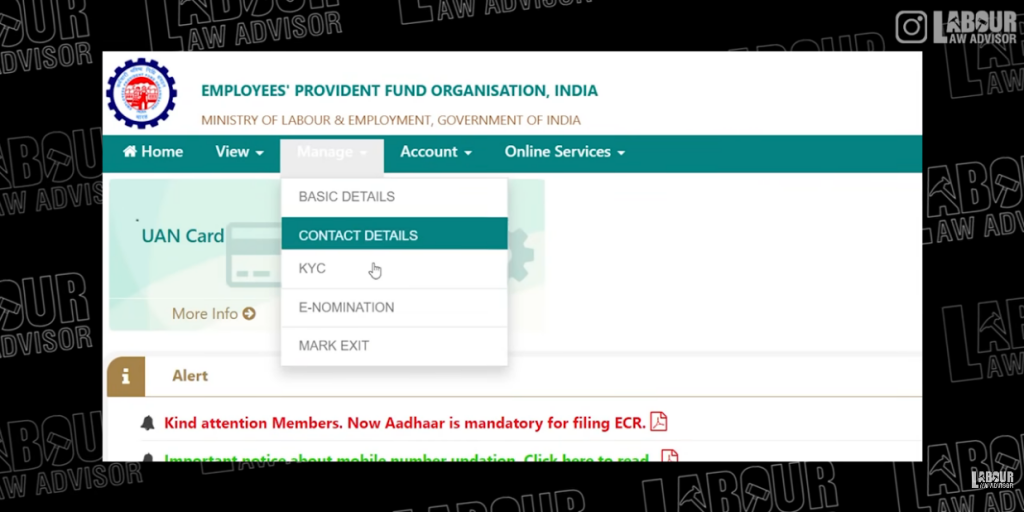

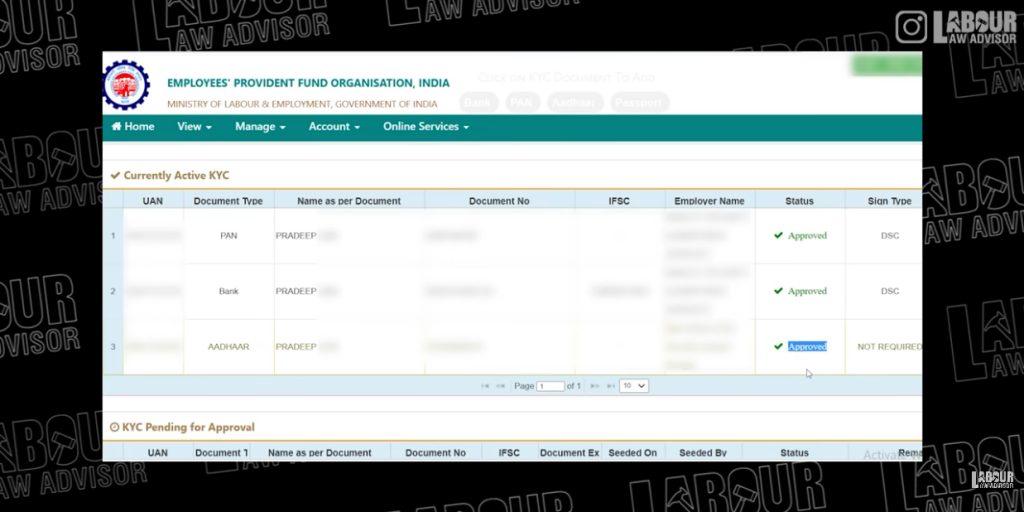

Process to check if Aadhaar is seeded

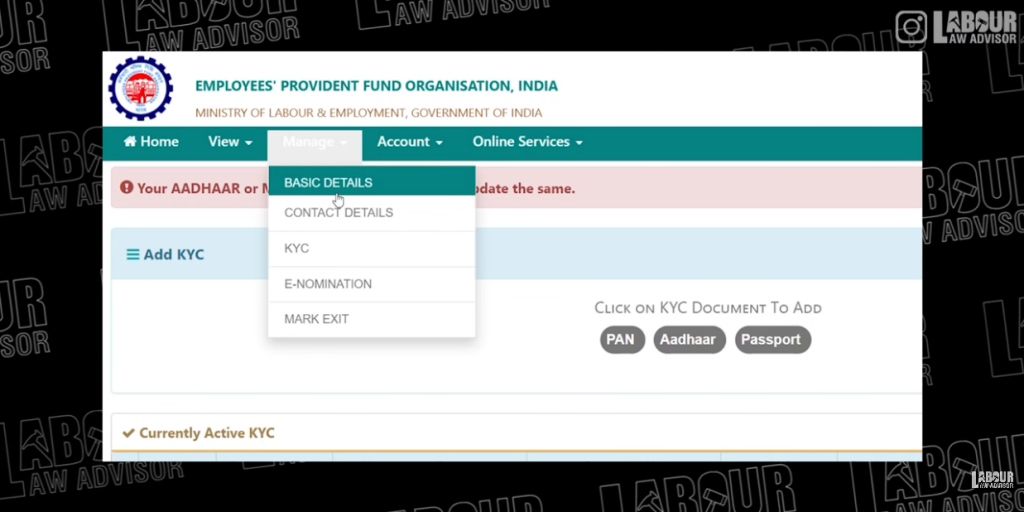

- Log into the PF member portal.

- Go to Manage on the top menu and select KYC from the drop-down menu.

- On the new page, if the Aadhaar document type shows as Approved under Status, then there is no issue at all. Your PF contribution will continue as always.

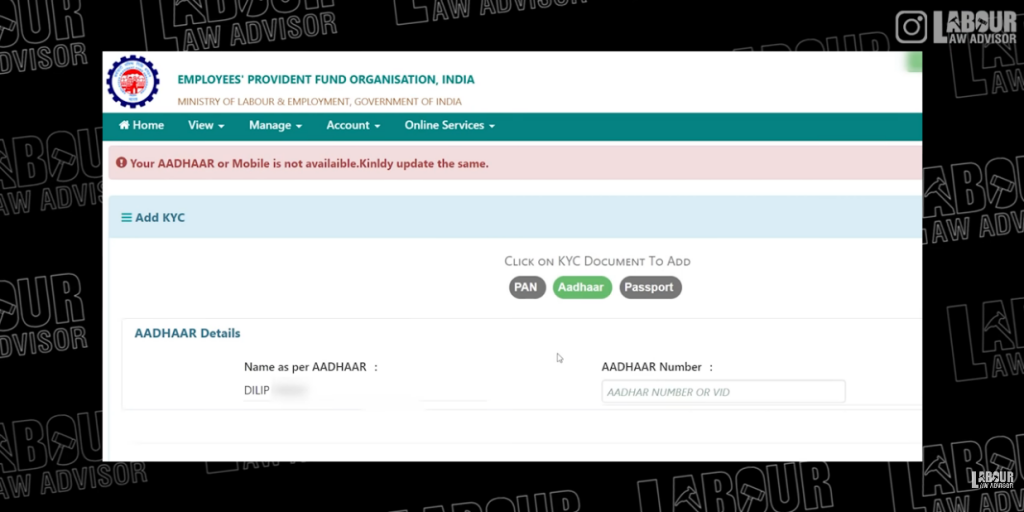

Process to check if Aadhaar is not seeded

If the Aadhaar is not seeded but

Name, DOB and Gender is correct and match with the Aadhaar details, then

- Go to Manage and select KYC option from drop-down list

- Enter your Aadhaar number and click on Submit

- If all details on Aadhaar match correctly with your Name, Date of Birth and Gender, then this will move to Verification Pending by Employer section.

- Next, your employer has to verify this through his digital signature. Thus, your KYC verification process will be complete.

If employee is not presently working at any company

Then the verification approval can go to the last employer. Here, the last employer can also complete KYC verification.

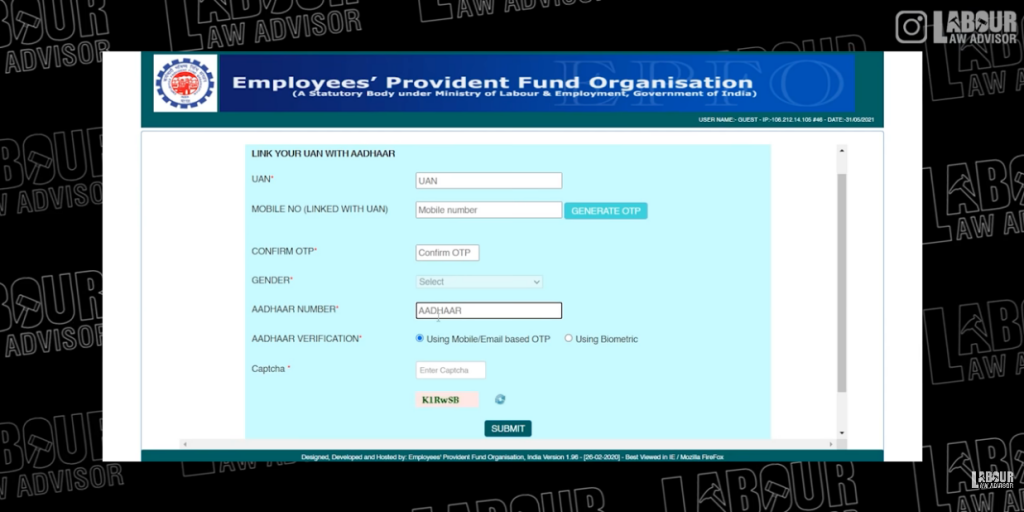

If employer not available but UAN is active & registered mobile number is active

- Visit https://iwu.epfindia.gov.in/eKYC/LinkUanAadhaar

- Fill up all the details on the page

- You will receive an OTP on your registered mobile number

- Input OTP and click on Submit. Your Aadhaar KYC will be completed within a day

If employer not available, UAN not active & registered mobile number is inactive

In such cases, there is no easy solution. You will need to visit the PF Department to fix this issue.

Name, DOB and Gender is incorrect and don’t match with the Aadhaar details

Either one or multiple details from name, date of birth or gender are incorrect and don’t match with Aadhaar, then

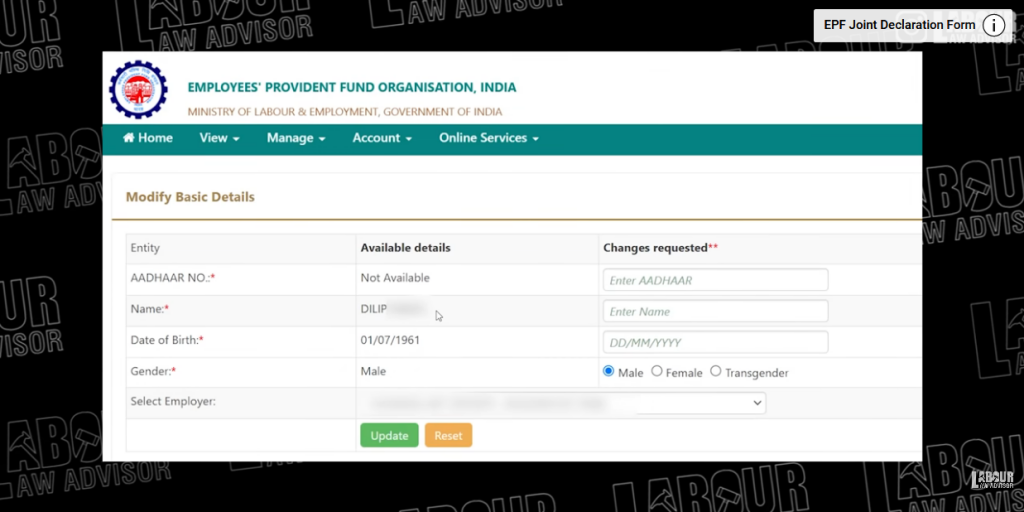

- Login to the PF member portal

- Go to Manage then Basic Details from drop-down list

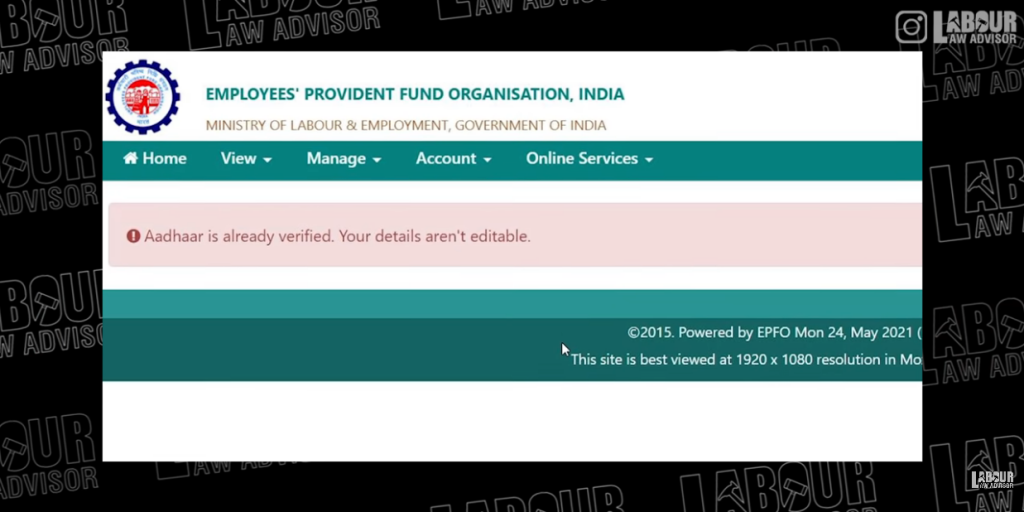

- If all your details were correct and linked with your Aadhaar then you will receive the below message box. You will not be able to make any further edits in this case.

- But if there were any mismatch between your Aadhaar and details submitted then you can see the below window. Here you have the option to edit your Name, date of birth and gender.

Case 1 – Name is incorrect

- If the name correction is minor, then check the table below for the process to follow:

| Correction Type | Correction From | Corrected to | Remark | Document Required |

| Expanding Name | R. Kumar | Ramesh Kumar | Minor – Online | Only AADHAAR |

| Spelling Change | Sunita | Sunitha | Minor – Online | Only AADHAAR |

| Addition or Removal of Middle Father/Husband Name | Sunita Kumar | Sunita Ramesh Kumar | Minor – Online | Only AADHAAR |

| Change of Surname for Married Female | Sunita Kumar | Sunita Sharma | Minor – Online | Only AADHAAR |

- The name correction is considered major when the full name has to change. For example, Ramesh Kumar will change to Suresh Kumar. Then there is no procedure to do this online. You will need to submit a Joint Declaration Form with the employer’s seal and signature, along with some documents for proof to the PF Department. The PF Department may even ask for some original documents for proof. This process will require some follow-up trips and rigorous patience from your end!

Case 2 – Date of Birth is incorrect

- If the correction is for less than 3 years, then it is a minor date of birth correction. The correction can be done online with your Aadhaar only.

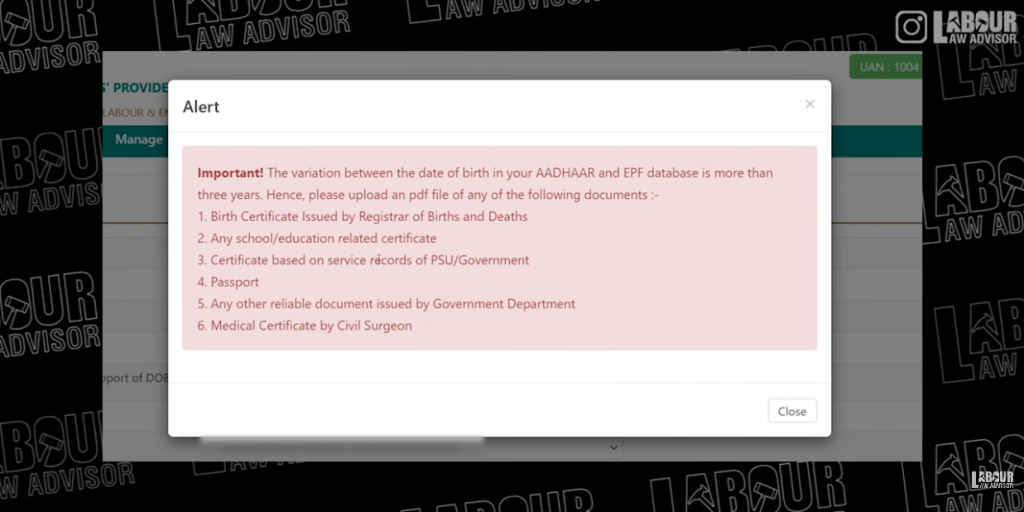

- But if the date of birth change is for over 3 years then it is a major correction. In this case, you can do the edit online, but you will get the below alert message. You need to submit the mentioned documents as PDF and the process will be complete.

Case 3 – Gender or Father’s Name or any other detail is incorrect

- For Gender/Father’s Name correction – Submit a Joint Declaration Form offline. There is no online solution.

Where to complaint about any delay?

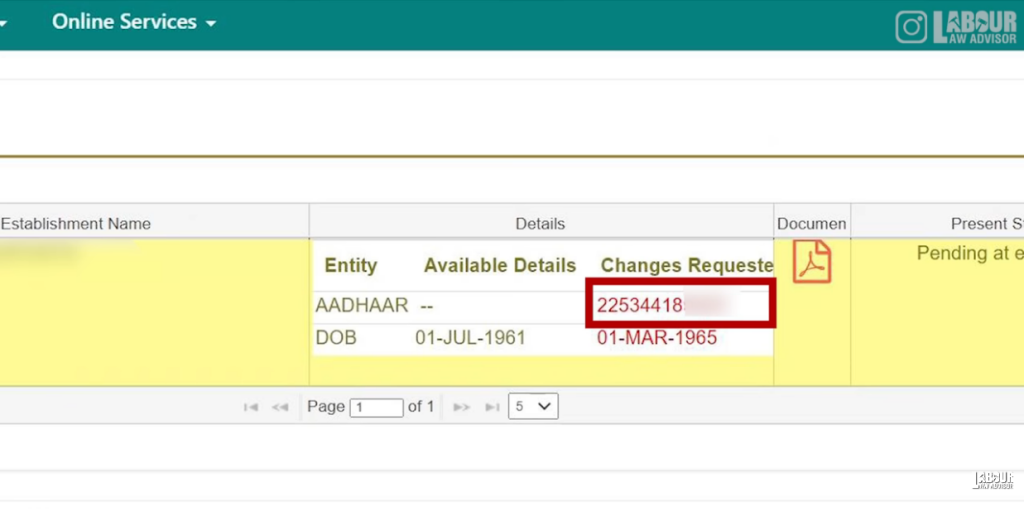

Suppose the corrections have been made from your end and verified by your employer. But the appeal is pending with the PF office for more than 15 days or is rejected without a valid reason. Then you can take any of the following steps:

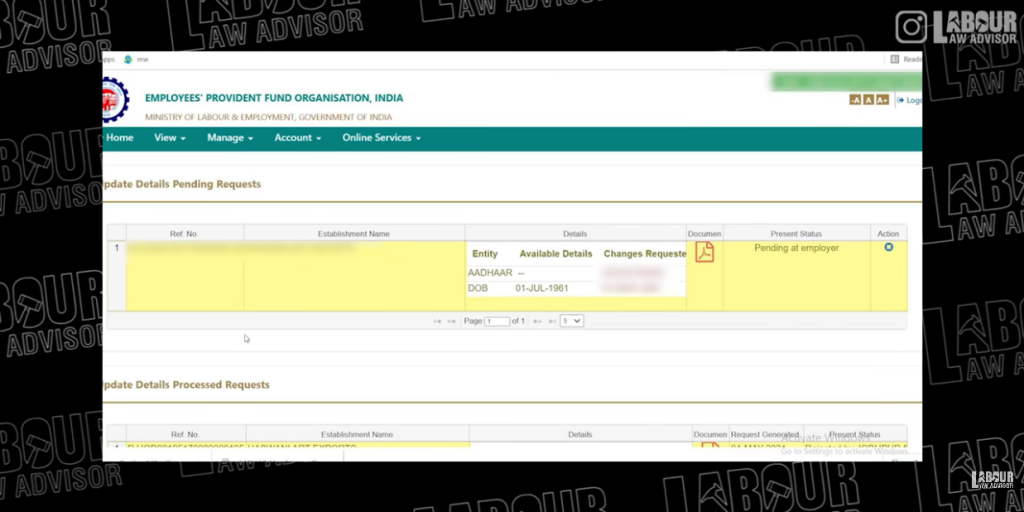

- Reapply for the correction and note the Application Number, which is the number highlighted below.

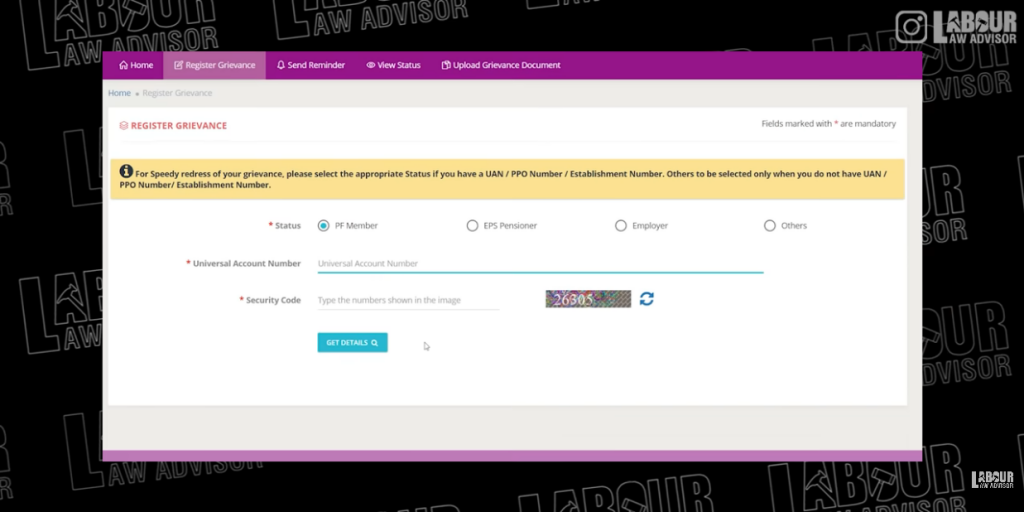

- File a grievance on the PF Grievance Portal. Mention the reason for your grievance and the steps you have taken thus far.

- If your issue is still not resolved then complain on CPGRAMS. Lodge your complaint under PF Department on the portal.

- The last resort will be to file an RTI and track your application status and know where and why it is stuck.

If the employee’s establishment has now closed and it is impossible to get the employer’s seal/signature then he can get his documents signed by a Gazetted Officer.

For all the Employers

Employers can get a list of all pending KYC at their end and inform those employees. To do this:

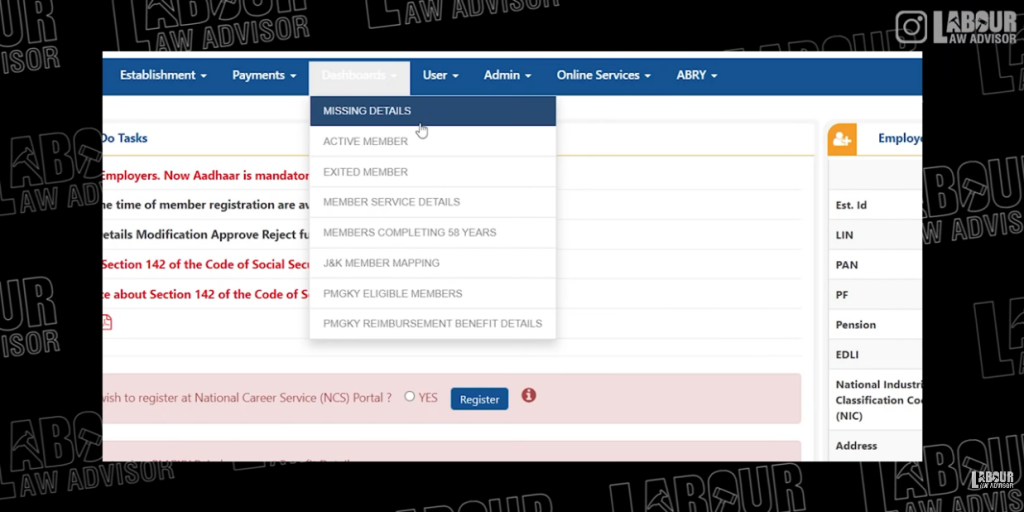

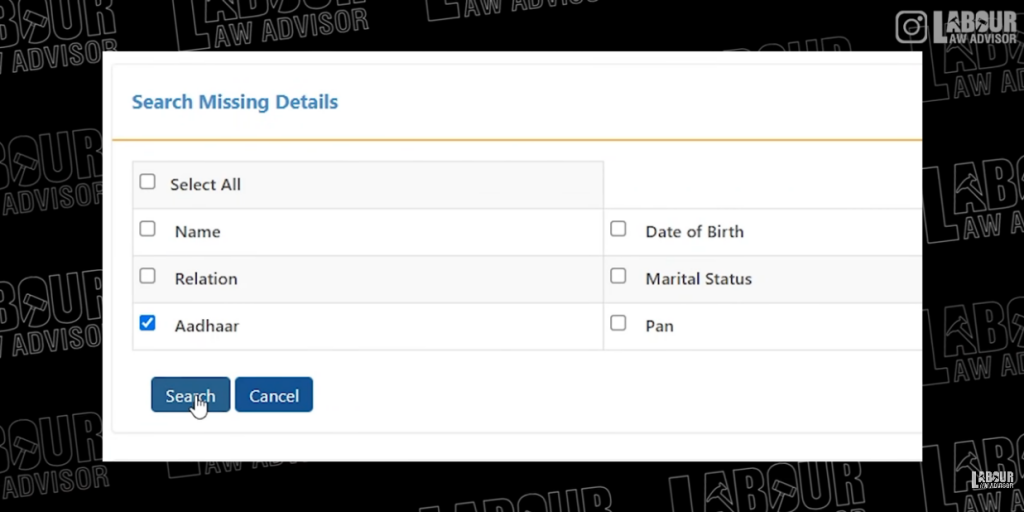

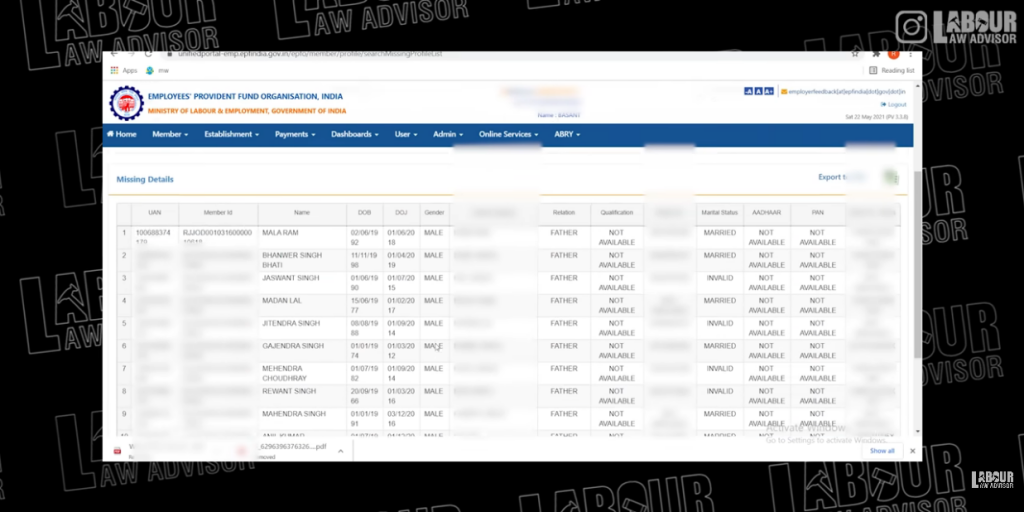

- Log into the PF employer portal

- Go to Dashboard and Missing Details

- Select Filter for Aadhaar to get a list of all employees without their Aadhaar details on PF portal. Inform the same to all of them.

Watch all details in the video below.

Update on status of Aadhaar seeding

The EPFO, with prior approval from the Central Government, had extended the date of Aadhaar seeding for all employees to 1st September 2021, due to the challenges of the second wave of Covid-19. It is now seen that overall around 94% of EPF members have seeded their UAN with Aadhaar. However, it is still low in the North-East region of India. Therefore,

- Mandatory seeding of Aadhaar for North-East India, comprising of Assam, Arunachal Pradesh, Manipur, Mizoram, Meghalaya, Tripura and Nagaland, has been extended to 31st December 2021.

- Similarly, mandatory seeding of Aadhaar for industries involved in beedi making, building and construction, and plantation is extended to 31st December 2021.

- For areas and industries apart from above mentioned, delay in filing of challans for August and September 2021 due to non-seeding of Aadhaar will not be taken as the employer’s fault and no penalty will be charged.

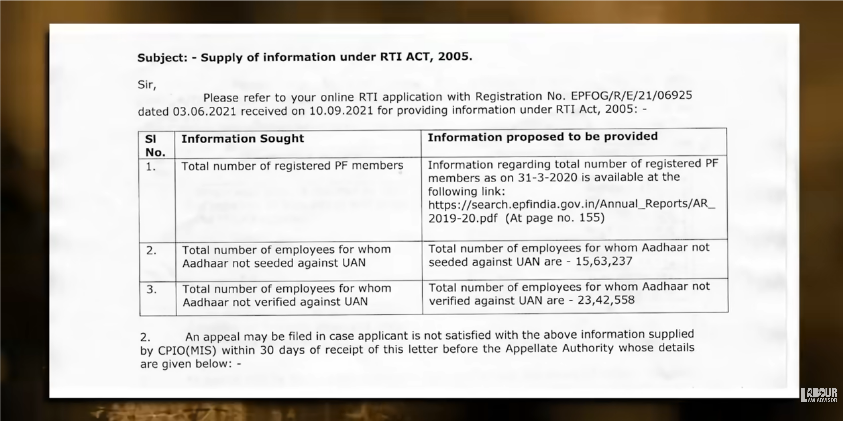

RTI filed to EPFO

Total number of PF registered members – 24,76,64,359

Number of members without PF Aadhaar seeding – 15,63,237

Number of PF members without Aadhaar verification – 23,42,558

Thus, 15,63,237 + 23,42,558 = 39,05,795 PF members will be affected by this update.

For more information on this update, watch the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!