Table of Contents

What are Mutual Funds?

Mutual Funds raise money from investors and invests that money on their behalf. A small fee is applicable for managing the investor’s money. Mutual Funds are an excellent investment option for the common man who does not have many ideas about investing. The investors have the options to choose a mutual fund scheme on the basis of their financial goals and can invest to achieve those goals. Additionally, one does not require a demat account to invest in these funds. You can easily use a mobile app to begin investing.

Types of Mutual Funds available in India:

- Equity mutual funds – which invest directly in the stock market.

- Debt mutual funds – which invest in debt security.

- Hybrid mutual funds – which invest in a combination of equity and debt, where the investor has to pick one as per the risk he is willing to take.

- Solution-oriented mutual funds – which are specific to certain goals like retirement or education, along with a compulsory lock-in period of five years.

Methods of investing – SIP & Lump sum:

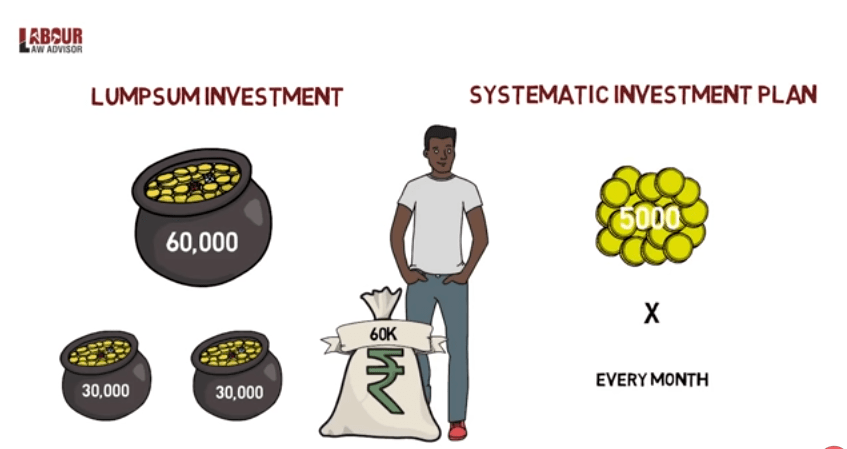

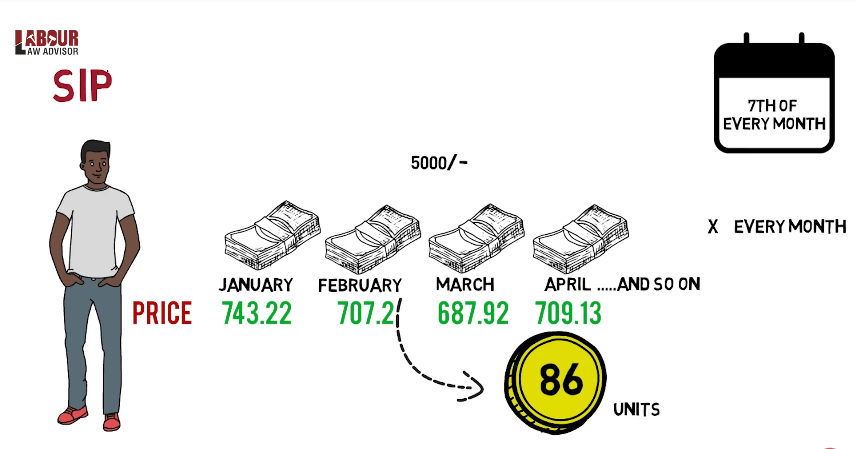

There are two ways in which you can start investing in mutual funds – SIP and Lump Sum. To understand how they both work, let’s look at an example. Suppose a person called Ramesh wants to invest Rs 60,000 in mutual funds. If Ramesh invests the full Rs 60,000 in one mutual fund at a single go or he invests Rs 30,000 each in two mutual funds at one go, then this is known as Lump Sum investment. Thus, Lump Sum means investment all your money at a single opportunity. On the other hand, if Ramesh invests Rs 5,000 every month for 12 months, in any fund, then this is known as Systematic Investment Plan or SIP. Thus, SIP means a monthly investment.

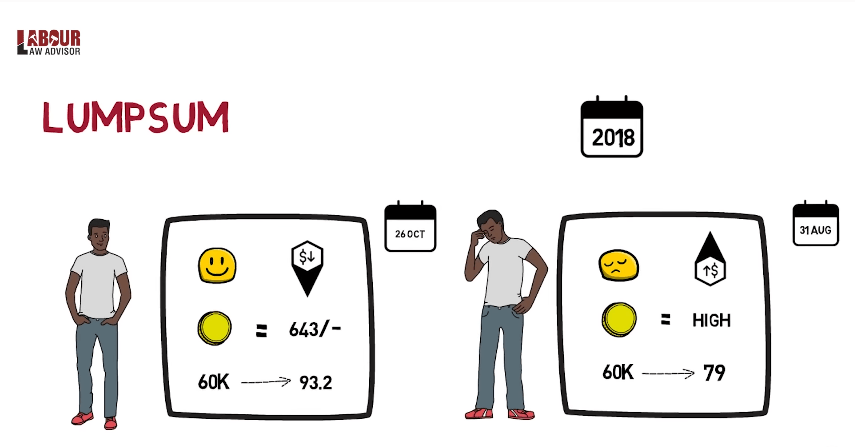

Similar to the stock market, where each share is allotted, in mutual funds, there are units allotted to investors. As each share has a price, each mutual fund unit also has a price. The price of a unit is known as Net Asset Value (NAV). As the price of shares varies in the stock market, likewise the NAV of units also vary.

So, Ramesh decides to invest in Birla Sun Life Mutual Funds in 2018. If he invests Rs 60,000, lump sum, on a day when the NAV of one unit of the fund was lowest at Rs 643, he receives 92.3 units of the fund. But is invests on a day when the NAV of one unit of the fund was highest, then he receives only 79 units. Hence, if the market is not timed correctly, then there could be a loss of 17% in one’s investment.

Smart Stock Tip:

It can be concluded now, that timing the market correctly plays a big part in higher profits in investments. But luck plays an equally important part here. So, what can one do to ensure that they avoid a big loss risk and get a higher profit? The answer is SIP! So, if Ramesh invests via SIP, by investing Rs 5000 per month for a year, he ends up with 86 units of the fund. This is much better than the 79 units in lump sum investment. He can thus avoid the high market pricing and win over the market dynamics.

Benefits of SIP:

- SIP avoids the highs and lows of the market, by getting you the best average pricing of units. One can easily save 5-6% of minimum returns by this method of investment.

- If one does not have a large sum of money for a one-time investment, but there is a regular income source, some of which one can be set aside for investing every month, then SIP is a better choice.

- Unlike Lump Sum investment, which requires thorough study of the mutual fund market to understand which is the best option and has higher risk, SIP is more risk free and less uncertain.

Key features of the Kuvera App:

- One can easily use this app to start investing in mutual funds.

- Firstly, this app is completely free to use.

- Secondly, one has the option to add goals for their savings on this app.

- Next, on the basis of one’s income and expenditure, the app suggests which funds are perfect for them to invest in.

- Furthermore, it also gives how long it would take for one to achieve their financial goals and considers the market to give realistic feedback.

- You can easily download the Kuvera App from here. Additionally, you can use the code LLAYT on the app and receive 100 points for free which you can use later for your in-app purchases.

- One can set a monthly date where the money for investment is directly deducted from their bank account.

- Even if there is no money in your bank accoutn, for automatic monthly deduction, you wll not be charged a penalty.

Do watch our tutorial on this below for a detailed study.

Learn some more financial tips through our following blogs:

Income Tax Return Filing For Salaried Persons | Online Process

How To Become Rich Without Hard Work | Financial Advice By Finnovationz.com

Make Money in Share Market | Financial Advice by Finnovationz.com

Franchise Business | Low Investment High-Profit Business Idea

Income Sources | Financial Advice To Earn More Money

EasyPlan – Investment Solutions

Meesho App – Earn Money Online Without Any Investment

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!