Kisan Vikas Patra (KVP) is an underrated yet powerful investment tool. Adopted by a small electrical shop owner, Pradeep, in 1988. Pradeep used to buy a Kisan Vikas Patra worth Rs 500 each day from 1991 to 1999. During those times, Kisan Vikas Patra would double the investment every 5 years. Hence, after 5 years, Pradeep began receiving Rs 1000 each day as his return. Upon maturity, he began receiving Rs 2000 per day. Thus, translating to an earning of Rs 60,000 per month. Over time, he was able to buy 17 plots of land with this money. He even constructed buildings on these plots and eventually sold all plots on a profit. Thus, Kisan Vikas Patra is a great source of generating wealth. Hence, in this article, we discuss all Kisan Vikas Patra 2020 details which will help you to get your own KVP certificate.

Table of Contents

What is Kisan Vikas Patra?

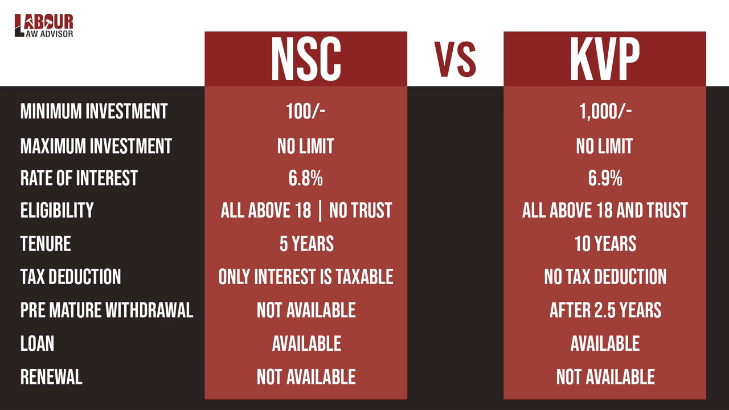

Kisan Vikas Patra is a small saving certificate scheme. It was launched by the Indian Post in 1988. It works by doubling a one-time investment in a given duration. Thus, it encourages long-term financial investment discipline. The minimum investment is Rs 1000 with no maximum investment limit. It was initially meant only for Indian farmers but is now available to all. So anyone above the age of 18 years is eligible for Kisan Vikas Patra. One can even buy KVP in the name of their trust. Only HUF (Hindu Undivided Family) and NRIs are ineligible for KVP. It serves as a low-risk savings platform where one can keep their money for a certain duration. One can get KVP at any post office or national bank.

What is the interest?

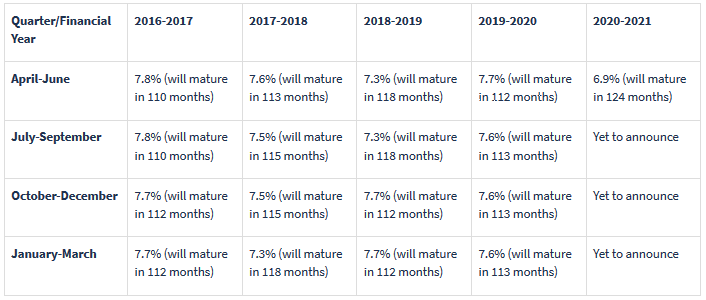

The aim of Kisan Vikas Patra is to double your investment before return. The time taken to double the investment depends on the interest. Hence, if the interest is high the time taken is less and vice-versa. Moreover, the interest is not fixed. The KVP interest is decided upon for each quarter. Currently, the KVP interest rate for Q2 of 2020 is 6.9%. For Q1 of 2020, the interest rate was 7.7%. As seen in the image below, historically the KVP interest lies between 7.6% to 7.8%. But due to the ongoing COVID-19 economic crisis, this interest rate has fallen to 6.9%.

What is the tenure?

Once a KVP is bought at a certain interest rate, that rate becomes fixed for it. Any further revised interest rate will be applicable only on the new KVP bought later. The effective interest rate for Kisan Vikas Patra varies depending on the number of years invested in KVP at the time of purchase. The tenure for Kisan Vikas Patra is 124 months while the lock-in period is 30 months. The maturity proceeds of KVP will continue to accrue interest until one withdraws the amount.

The minimum investment is Rs 1000 for KVP. While investments can only be made in denominations of Rs 1000, Rs 5,000, Rs 10,000 and Rs 50,000. Thus, for investing Rs 68000, one will have to buy one KVP certificate each for Rs 50,000, Rs 10,000 and Rs 5000, plus 3 KVP certificates of Rs 1000.

What are the documents required?

- For investments above Rs 50,000, a PAN card and Aadhaar details are mandatory.

- For investments above Rs 10 lakh, a PAN card, Aadhaar details and income proof such as salary slip, bank statement or ITR document are mandatory.

What are the modes of payments?

Payment for Kisan Vikas Patra can be made via cash, cheque or even demand draft. This is to ease the process of KVP investment. If payment is done through cash, the KVP Certificate is issued on the spot. However, for Cheque, Demand Draft or Money Order, you will have to wait till the amount is cleared to the post office.

What are the types of KVP certificates?

One can buy any of the following types of Kisan Vikas Patra certificate:

- Single Holder Type Certificate: This kind of certificate is issued to an adult for self or on behalf of a minor or to a minor. Once the minor turns into a major, the holding can shift to his name.

- Joint ‘A’ Type Certificate: This type of certificate is issued jointly to three adults, payable to all the holders jointly or to the survivor upon maturity.

- Joint ‘B’ Type Certificate: This type of certificate is issued jointly to three adults, payable to either of the holders or to the survivor upon maturity.

Is KVP taxable?

Kisan Vikas Patra doesn’t come under the 80C deductions. Hence, both the investment amount and the returns are completely taxable. However, Tax Deducted at Source (TDS) is exempt from withdrawals after the maturity period.

How to encash the KVP certificate?

To encash a KVP certificate, one has to encash it from the same post office or bank from where it was issued. All physical KVP certificates have to be kept carefully as well.

What are premature withdrawal terms?

The investment needs to be in a lock-in period of 30 months. Afterwards, one can withdraw the amount after 124 months. One will receive whatever the interest amounts to at the time of withdrawal. Encashing the scheme early is not allowed, unless in the account holder’s demise or court order. Refer to the below table to know the amount for premature withdrawal for different terms.

How to transfer a KVP certificate?

If one wants to transfer the name of the holder on a KVP certificate, then it is allowed under the following circumstances:

- If the Kisan Vikas Patra certificate holder expires, then the name can be transferred to his next of kin or nominee.

- The holder name can also be transferred to a court upon the court’s order.

- A single holder type certificate can be transferred to a joint A or B type certificate.

- A joint type certificate can be transferred to other holders as well.

- Alternately, a joint type certificate can be transferred to a single holder type certificate.

Loan against KVP certificate?

One can use their Kisan Vikas Patra certificate as collateral or security to avail secured loans. The interest rate for this is comparatively lower for such loans. The loan amount will depend upon the period of certificate held as well as the total amount of certificates held. The maturity of the loan will be lower than the maturity of the KVP certificate.

National Savings Certificate (NSC) Vs Kisan Vikas Patra (KVP)

KVP form filling procedure

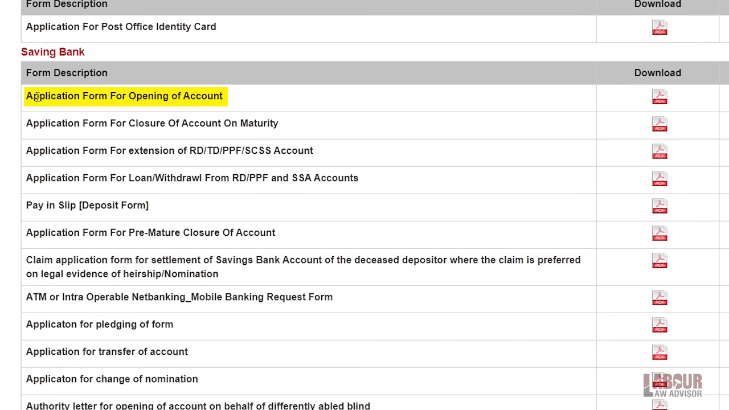

- Visit the India Post website.

- Scroll down the page to download the Application Form For Opening Of Account. Along with the Pay In Slip (Deposit Form).

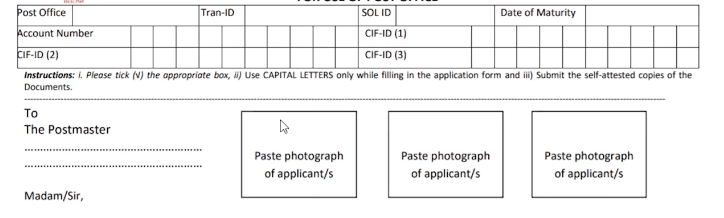

Application form for opening of account

Page 1

- For the top table, it is advised to visit the Post Office and fill in the details as received there.

- If this will be a single type holder then attach one photograph else three for a joint type holder certificate.

- Next fill in account holder’s name. In case of multiple holders, put all names with a comma.

- For the account savings type blank, choose KVP option.

- For Account holder Type, choose between Self, Minor through Guardian or Person of unsound mind through guardian, whichever is applicable.

- Pick between single, Joint B or Joint A, for Account Type.

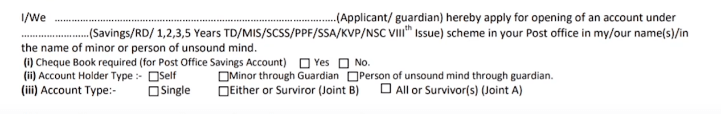

- If one is buying the KVP certificate on behalf of a minor or unsound minded person, then the below table needs to be filled. Put in the name of the account holder, their date of birth, gender and name of guardian along with the relationship.

- One also has to give details of any document as proof of birth of the account holder.

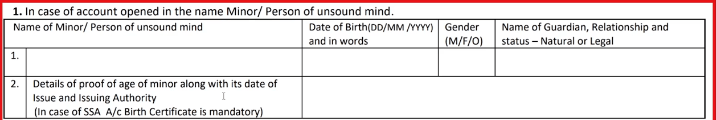

- Under the next sentence fill in the amount for the KVP certificate in numbers and in words. If payment is being done through DD or cheque then put in the number and date for it.

- For the next table, fill in all details of all account holders, whether single or joint account. Leave CIF ID row blank since that does not apply to new KVP accounts.

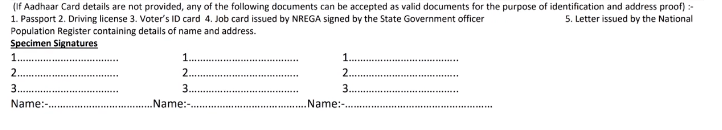

- One also has to furnish an ID proof and address proof. Any of the following documents are acceptable for this purpose – Aadhaar card, passport, driving license, voter’s ID card, job card issued by NREGA signed by the State Government officer or letter issued by the National Population Register containing details of name and address.

- Next is Specimen Signatures. Each applicant has to put his signature under one column thrice along with their name. So Applicant A would sign thrice under column A, and so on.

Page 2

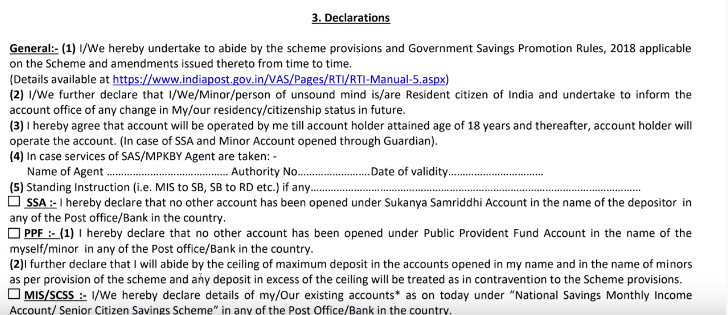

- For Declarations, one can just tick the ones which are applicable to them. The rest can be left blank unless asked by officials to fill in whilst submitting.

- Give the Signature or thumb impression of applicant(s)/guardian in the assigned space. Mention the date also.

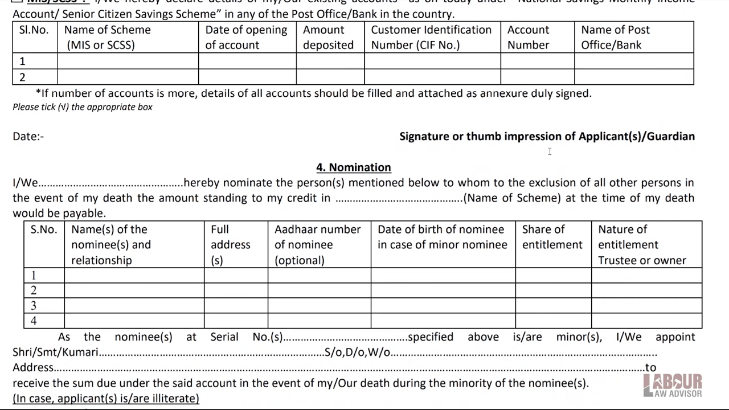

- Under Nomination, put applicant name in the first blank and KVP as scheme name in the second blank.

- There is provision for filling four nominees. In the table, fill in details of all the nominees such as 0 name and relationship, full address, Aadhaar number, date of birth, share of entitlement and nature of entitlement.

- In the next paragraph put details of the person who will receive a minor nominee’s share in case of death of the KVP account holder. This is only applicable for minor nominees.

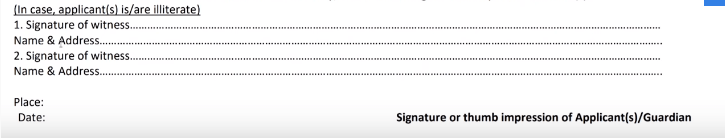

- For Signature of Witness, one needs to get signatures of two witnesses along with their name and address.

- Put name of your city or location in Place.

- Put the date of the day of submission of form in Date.

- Give one’s signature in the assigned place on right.

- Leave the part for Post Office Use blank.

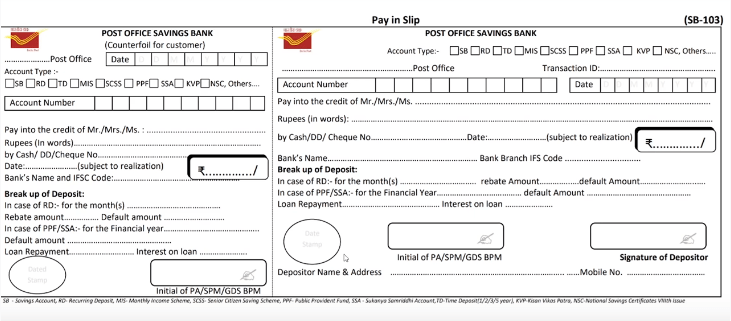

Pay in slip (deposit form)

- Similar to a bank deposit form, fill in the details on the pay in slip form.

Deposit forms

- Submit both the duly filled forms to the post office or bank.

- The Know Your Customer (KYC) process is mandatory and you need to submit the ID and address proof copy (PAN, Aadhaar, Voter’s ID, Driver’s License, or Passport).

- Once the documents are verified, you must make the deposit. The payment can be made by cash, locally executed cheque, pay order, demand draft drawn in the favour of the postmaster.

- You will get the KVP in the shape of a passbook in which the amount will be updated immediately unless you make payment by cheque, pay order, or demand draft. Keep this safe as you will need to submit this at the time of maturity.

For a detail step-by-step Kisan Vikas Patra application tutorial watch the video below.

Also read, Senior Citizens Savings Scheme (SCSS) Investment.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!