People are often on the lookout for investments which are not linked to the stock market yet give high returns. The instability of the stock market is the reason many people refrain from investing their money into it, despite having better margins of investment. One such investment option which is not linked to the stock market, yet gives 11-12% interest within a short-term is called Invoice Discounting. This article takes an in-depth look at this investment scheme and how it works.

Table of Contents

What is Invoice Discounting?

To explain invoice discounting we take the example of a small bottle manufacturing business called Gupta Bottles. Gupta Bottles gets an order from Coca Cola to manufacture 1 lakh bottles but with a credit period of 90 days. In order to not lose out on a big order with a big brand, Gupta Bottles takes the assignment. But it also has to sustain its employee salaries and other expenditures for these 90 days.

Hence Gupta Bottles has two options to get a loan either go to a bank or a third-party. Banks usually have set criteria for approving loans and MSMEs don’t fall within the purview of credit ratings. Thus, Gupta Bottles goes to a third-party and requests them to purchase the Coca Cola invoice worth Rs 10 lakh at a discount of Rs 9 lakh. It promises the third-party that when Coca Cola pays up their bill within 90 days then the third-party can have the full Rs 10 lakh. Therefore, making a profit of Rs 1 lakh in return for the third-party,

This is known as Invoice Discounting where one literally sells their invoice at a discount to a third-party. It is one of the prevalent ways MSMEs in the country use to raise capital.

Where to invest for invoice discounting?

There are several online portals where MSMEs and investors can find each other. One such portal is TradeCred. Continuing with the previous example, how TradeCred works is that it would purchase the Coca Cola invoice from Gupta Bottles worth Rs 10 lakh for Rs 8 lakh at 20% discount. This invoice will then be sold to a third-party at Rs 8 lakh. When Coca Cola finally pays the Rs 10 lakh, the Rs 2 lakh profit will be shared between TradeCred and the third-party investor at an interest division of usually 11.5-12% for investor and 8-8.5% for TradeCred.

Risks involved with invoice discounting

As with any investment scheme, there are some risks involved with invoice discounting as well. The biggest being credit risk, which can be further diversified into the following categories:

1. Brand matters

In the earlier example, since the invoice was for Coca Cola, a big brand name with a known history, it was easier to get capital on its invoice. On the other hand, if it was a small scale random company which was new to the market, then it would be difficult to get capital against their invoice. Trust on the brand name and their credibility will be more secure and hence easier to sell via invoice discounting.

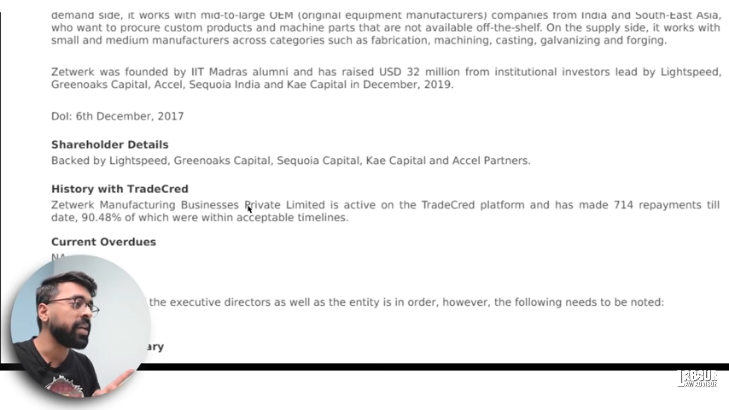

Next point to check is how long the company has been with the online portal, TradeCred in this case, and check their company history of invoice payments and delays. Generally, the average delay for MNCs is very low thus providing less risk for the third-party investor.

2. Insolvency

To understand this we take another example. Say, with the onset of lockdown people started working from home and many of them placed orders for tables and chairs on online furniture portal, Furlenco. Now, Furlenco places these orders to his vendor but is unable to pay his vendor currently because his customers will be paying him over the next couple of months in instalments. So Furlenco will ask his vendor for a credit period of 5 months.

The vendor will now go to TradeCred to sell his invoice from Furlenco for invoice discounting to raise capital. In this case, the third-party investor will check whether Furlenco, being a start-up, will be able to honour their invoice and complete the payment in the future, depending on if their business model will be successful or not. This risk is known as insolvency.

3. Dishonourable invoice

Sometimes it may happen that a company comes on a portal to sell their invoice having the knowledge that it will not get cleared by the other company. Still, they sell the investor a bogus invoice and raise capital via it. This is then called a dishonourable invoice.

4. Disputed invoice

Another situation that may occur is that the big company which had placed its order with the MSME may later find faults and issues with their order quality. This may lead to a dispute between the two wherein the bigger company may either pay less than the invoice or nothing at all. Thus, the investor may run a loss if the bigger brand does not pay up.

To sort this problem, investors must look at the methodology of the portal which brings these invoices onto their platform. Some portals run a thorough background check with both the parties involved to make sure that the invoice is legitimate and will be honoured and only then bring the invoice to the investors. This lowers the risk of dispute invoicing.

Why is it still a good option?

Despite the credit risks, online platform TradeCred is a preferred option for invoice discounting. This is because TradeCred has another subsidiary on the platform called Orowealth. Orowealth verifies every invoice and provides a guarantee against them to the investor.

- Orowealth provides the investor with instant liquidity up to Rs 5 lakhs of the investment with some additional charges. If an investor wants their funds back before the period of credit is over, then Orowealth returns their investment up to Rs 5 lakh with a 1-1.5% deduction on the interest rate. Hence, this Rs 5 lakh is guaranteed by Orowealth regardless of the invoice being honoured or not.

- Secondly, if the company fails to pay their invoice then Orowealth does not let the investor deal with the full loss of this situation. Rather, Orowealth checks all their losses over all the invoices and until that hits 8%, it won’t let the investor suffer the loss. In the last 8-10 years, this overall loss has been between 1-2%.

How to invest in invoice discounting?

- Visit TradeCred website and make your account on it.

- Go to the header tab and click on Investor and log in.

- Put in your PAN details and you will get an OTP on your registered mobile number to login to your account.

- From the left of the page click on Current Deals to view all available invoice discounting offers.

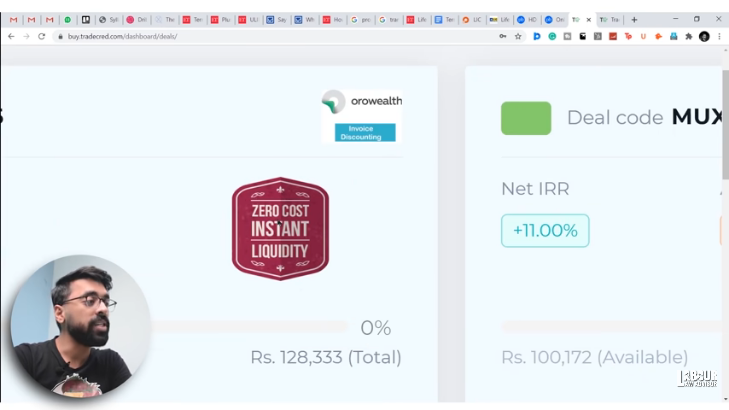

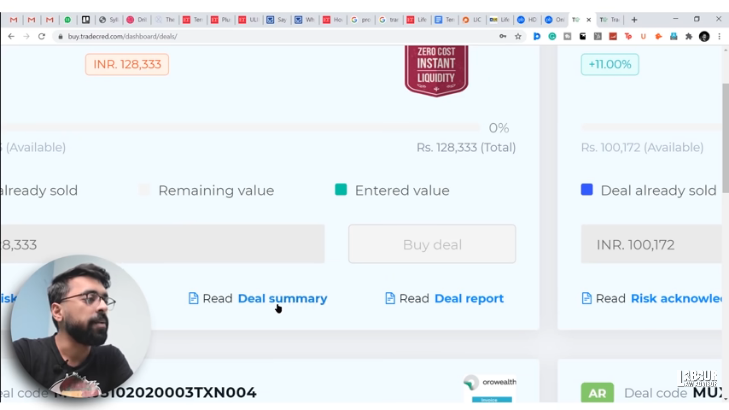

- On each deal check for Orowealth logo and Zero Cost Instant Liquidity badge. This means that this invoice is guaranteed by Orowealth and secure up to Rs 5 lakhs.

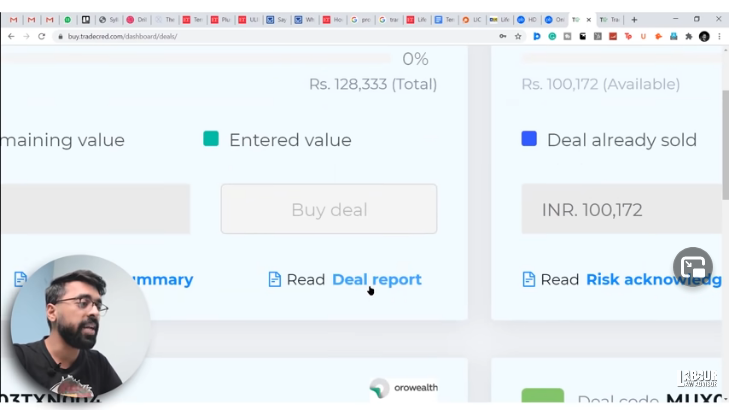

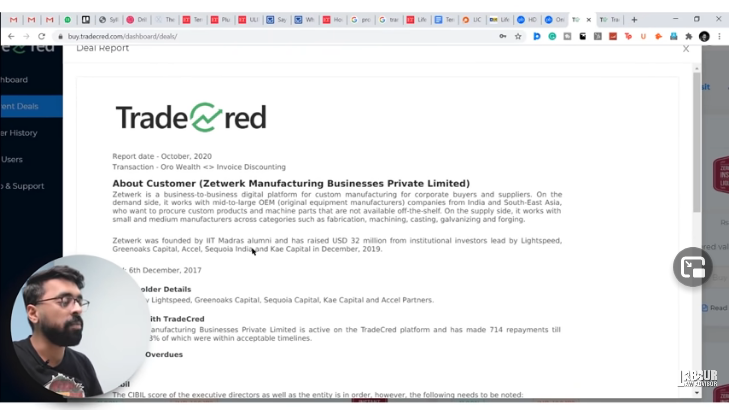

- Next, you can click on Deal Report to know details about the company who is responsible to pay for the invoice. It details their payment history on TradeCred and their general company history. It also details the vendor who has sold his invoice on this platform.

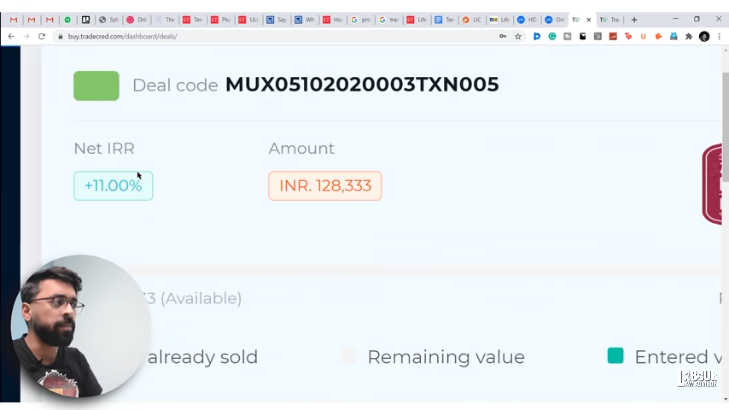

- The deals also display the Net IRR (Internal Rate of Return) which is the annual interest return rate on the deal.

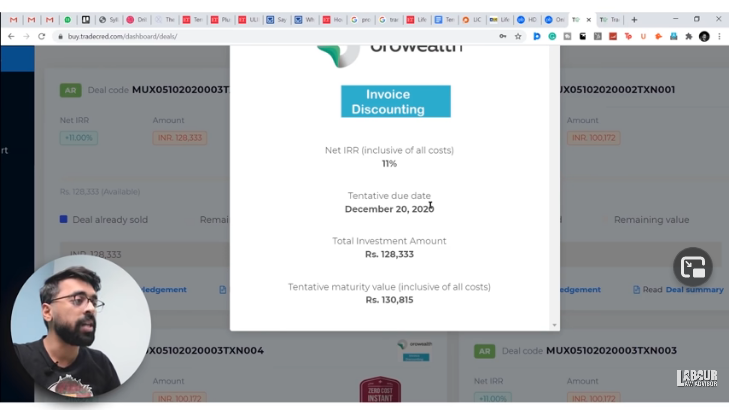

- You can click on Deal Summary to view the total investment amount of the invoice, its Net IRR, the tentative due date for the invoice, and the maturity value.

- Additionally, there are some deals which come directly on TradeCred without the middle vendor and these have the company logo on top of them.

- Then add funds to your wallet by clicking on Deposit and purchase any invoice you want.

Advantages of invoice discounting

- It’s a short-term investment scheme where you don’t need to lock-in your investment for several years and the returns are high as well.

- You can manage your risk level by taking low-risk deals with Orowealth guarantee or going for big brands. But you can also go for high-risk deals if interested by going for lesser-known brands with higher returns.

- It provides the opportunity for portfolio diversification which is completely unrelated to the stock market.

Disadvantages of invoice discounting

- The minimum investment for deals is quite high, you cannot start with as little as Rs 500 in equity investment. The minimum investment required here is Rs 50,000.

Watch more details on invoice discounting in the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!