The insurance market is full of unlimited health insurance options. As such, consumers become confused about how to go about selecting the best health insurance policy for them. It is never a good choice to select a health insurance policy according to one’s peers. Hence, this article details the different health insurance policy options available in the market and how to select the best one for yourself.

Table of Contents

Who needs health insurance?

Every individual who does not have spare cash must invest in a health insurance policy. This is because diseases do not come with a warning. More often than not people fall ill suddenly and medical bills can run up high. In such cases, if one does not have the spare cash for paying medical bills then the last resort is breaking into their long-term investments. Thus, eating into one’s retirement money or other goal’s savings. Hence, to protect one’s present and future, having health insurance policy is necessary.

But the point to note here is that just because one has health insurance, it does not necessarily mean that the insurance company will cover all the medical expenses. The aim of the insurance company will be to negate one’s claim or pay as little as possible. Hence, the truly best way to guard oneself against such uncertainties is to build one’s wealth. Doing proper investments and creating wealth will help one in not fretting about expenses that may occur suddenly.

What is the ideal health insurance cover?

The ideal health insurance cover depends on certain factors such as one’s lifestyle and job safety level. If the lifestyle is unhealthy or the job falls under hazardous category then their health insurance cover should be high. Usually, a healthy child’s cover for about Rs 3 lakh and a healthy adult’s cover for about Rs 5 lakh is considered safe.

Health insurance can again be of two kinds – Floater or Individual. Individual, as the word says, means insurance for a single person. While Floater means taking a combo health insurance as part of multiple family members. The advantage of a floater plan is that it includes multiple family members and only one premium has to be paid for it. But the disadvantage is that all the family members have to share the total medical claim between them. If the total insurance cover gets used up for one family member in a year, then the rest of the members do not get any insurance cover. Also, if there are elder members with comorbid diseases, then the entire family’s premium charges increase.

The fine print of health insurance

Some fine print details or clauses that one must pay attention to when taking a health insurance policy are as follows:

Room rent

Many health insurance policies have a room rent clause attached to them. This means that the rent of the room one takes in a hospital cannot exceed 1% of the total insurance cover. Thus, if the total insurance cover is Rs 5 lakh then the room rent cannot exceed Rs 5000.

If the room rent exceeds the percentage given in the clause, then all other claims attached to the health insurance also get deducted by said percentage. For example, if insurance cover is Rs 5 lakh then room rent cannot exceed Rs 5000. But if room rent was Rs 10000, then one will get only 50% of it reimbursed. Consequentially, all other hospital charges will also be only 50% reimbursed. All charges are linked to the room rent.

Alternately, if one wants a higher room rent in their insurance cover then they need to opt for a higher insurance cover and thus pay a higher premium charge.

Hence, when taking a health insurance plan ensure that either there is no room rent limitation or all other charges are not linked to the room rent.

Disease sub limit

Some policies have a limit on insurance cover as per the disease. Even though the total insurance cover may be Rs 5 lakh, it could cover only up to Rs 2 lakh for say cancer. Ideally, one should avoid such health insurance policies.

Co-pay

Some insurance policies have a co-pay clause where the company pays some of the medical bill amount and the policy taker pays the rest. But one takes health insurance to get all medical bill reimbursed. Hence, one should try not to opt for a co-pay clause in their health insurance.

Zonal Vs pan India

Some policies have the same premium payment pan India. Meanwhile, other policies have varying premium payments depending on the zone of the city. Here, premium charges are higher in tier 1 cities compared to tier 2 cities. Similarly, tier 2 premium charges are higher than tier 3 cities. In such cases, it is important to take premium according to the residential address.

For example, one may take tier 3 city premium to save money but if they get admitted in a tier 1 hospital then they will not get 100% medical claim. Conversely, if one resides in tier 1 city but they are taking health insurance for family members living in tier 3 cities then they have to ensure that they take separate health insurances. So that they don’t end up paying higher premium for members who will not actually use the medical services in bigger cities.

Reasonable and customary clause

In some insurance policies, it may happen that the company will check the cost of medical expenses in the area that one was hospitalized. If they find that another hospital in the same area charges a lower amount for the same medical procedure that the policy taker had at a hospital that charged a higher amount then they will refuse to give 100% claim settlement. This is known as reasonable and customary clause.

This usually occurs in group policy plans provided by employers. It is not generally seen in individual plans but one must always check for it.

Additionally, when one wants to exit a job where they have a group health insurance policy it is suggested to convert that into an individual policy rather than opting out of it. This saves them from taking new health insurance which may have a higher premium, going through medical examination again and waiting period again.

Top-up Vs super top-up

Top-up and super top-up cover medical expenses beyond the base health insurance sum. For example, one has a base insurance policy of Rs 5 lakh and top-up or super top-up of Rs 5 lakh. Hence, total insurance cover is of Rs 10 lakh and it will cover all expenses up to that amount.

But these two are standalone policies. They are not additional riders that one has to take with their existing policy. It is possible to take the base policy from one company and top-up or super top-up policy from another company. But it is not recommended to do this since in that case one has to first pay the medical expense themselves and then have it reimbursed by the company.

Top-up and super top-up plans work only when the medical expenses cross the base insurance policy threshold. One needs to opt for them only if they feel that their medical expenses may go beyond their base insurance plan cover. The expense limit at which top-up and super top-up get activated is called deductible.

How does top-up work?

Suppose one has a base insurance cover of Rs 5 lakh and a top-up of Rs 5 lakh. If they have a medical expense of Rs 7 lakh then 5 lakhs will be deducted from the base cover and 2 lakhs from the top-up cover. Since top-up plan only gets activated at a deductible price, it is important for the amount to cross that limit to avail the top-up claim. Now if there was another medical expense of Rs 2 lakh in the same year then one will have to pay it himself. That is because the base insurance cover is already used up and the top-up plan will only be activated if the deductible limit is reached.

How does super top-up work?

Suppose one has a base insurance cover of Rs 5 lakh and a top-up of Rs 5 lakh. If they have a medical expense of Rs 7 lakh then 5 lakhs will be deducted from the base cover and 2 lakhs from the top-up cover. Super top-up plan also gets activated at a deductible price. But the difference here is that if there was another medical expense of Rs 2 lakh in the same year then that would get covered by the super top-up. Hence, nothing will have to be paid separately by the policy taker.

Therefore, super top-up plans are activated even if the deductible is crossed once in a year. One does not need to cross deductible limit each time to avail super top-up cover. So, super top-up is a better option than top-up plan and can be opted for.

Pre and post hospitalization

It is important to check the number of pre and post hospitalization days that are covered in the health insurance policy. This includes any therapy, examinations, medicines that one has to take for a period before or after their hospital procedure. Nowadays, most companies provide these clauses. They usually include 60 days of pre-hospitalization and 180 days of post-hospitalization medical expenses cover.

Daycare coverage

In some situations, one may not have to stay overnight at the hospital. The medical procedure or treatment may be complete in the daytime itself. It is important to know if the health insurance policy will cover this. It is known as daycare coverage.

Extended coverage

If one requires cosmetic treatment or Ayush treatment then it falls under extended coverage. Hence, it is important to check if health insurance policy covers it.

Waiting period

It is not possible to take a health insurance policy and start using it from the next day itself. All insurance policies come with a waiting period. Health insurance policy usually has a 30 day waiting period. However, Covid-19 related health policies have a waiting period of 15 days. One can apply for medical claim only after the waiting period is over.

Waiting period for pre-existing diseases

If one has pre-existing medical condition at the time of taking a health insurance policy, then they cannot ask for medical claim for the same condition for upto3-4 years of taking the policy. The waiting period depends on the company. However, if one visits hospital for any new disease developed after taking the health insurance policy or some other reason, then they can ask for medical claim.

Waiting period for slow growing diseases

The IRDAI has instructed all insurance companies to list approx 20 diseases which the policy taker may not have at the time of taking the policy but may develop later. These slow-growing diseases have a set waiting period of up to 2 years. Any medical claim resulting due to them will not be valid.

No claim bonus

If the policy taker has been paying the premium for a year and not made any medical claims for the same then the insurance company may reward them. Either the base cover increases a little or the premium decreases a little. This is a good clause to look for while selecting the best health insurance policy.

Ambulance charges

One needs to check the the policy cover ambulance charges or not.

Cashless hospitals

The company whose health insurance one is opting for must have a good network of hospital tie-ups in their city. Since such hospitals allow cashless payments. That is, one does not have to first pay upfront to the hospital to start the treatment. The hospital allows the treatment to happen first and later the medical claim settlement happens with the insurance company. If this facility is not there, then the hospital will ask for cash upfront first before beginning any treatment. Hence, the policy taker will need the money to pay himself first.

Free health checkup

Most insurance policies provide atleast one yearly free health checkup. This includes a full body medical examination, at the time and convenience of the policy taker. This also helps people in maintaining their health records. These are usable later to prove the timeline of any diseases and get term insurance claim.

How to make a list?

One needs to make a list of all pointers to check before taking a health insurance plan, as follows:

- Floater or individual plan

- Private or government insurance company

- Amount of base cover needed + super top-up

- Room rent with cap or not

- Sub-limit on diseases

- Co-pay limitation or not

- Zonal or pan-India policy

- Pre and post-hospitalization period

- Daycare coverage available or not

- Cosmetic or Ayush treatment availability

- Waiting period, where is it minimum

- No claim bonus availability

- Cashless hospitals network

- Ambulance charges covered or not

- Free health checkup availability

How to search for best health insurance policy?

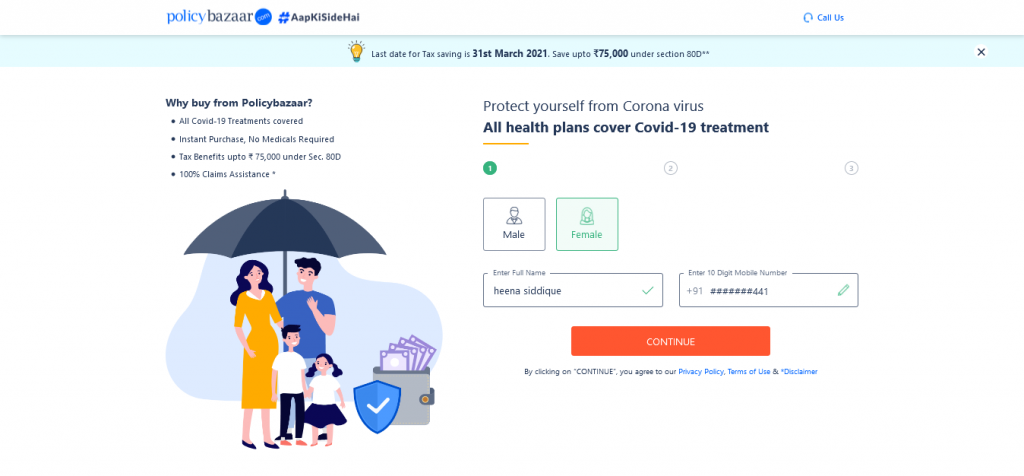

The easiest way to check for various health insurance policies is to go to policybazaar.com. Enter one’s name, gender, phone number, number of people to insure and continue. This will list all available policies as per your specifications. One can even get on call with an executive and has out the details further.

Another benefit of using policybazaar.com is that the insurance agents from the company visit the policy taker in the hospital and take care of all procedures for the medical claim. One also gets a representative for them. So they don’t need to search around contacting customer care for help.

Additionally, as soon as one shows their claim card from policybazaar.com the company gets an alert and itself starts the process for medical claim. So the policy holder does not have to separately call the insurance company to let them know.

Moreover, depending on the personal and health information given, policybazaar.com will keep some insurance cover pre-approved and ready for use instantly if needed.

Lastly, policybazaar.com gives the guarantee of policy holder not having to wait at the hospital upon discharge to settle the medical claim. They will take care of it with the hospital.

Other option is to get in touch with an insurance agent and buy insurance from them.

Watch the full video on getting the best health insurance policy below.

Navi Health Insurance

Navi Health Insurance is a platform providing simple, affordable and accessible health insurance policies to people. Founder and former Chairman of Flipkart, Sachin Bansal is the Co-Founder of Navi.

Problems faced by customers

Some common problems faced by customers during health insurance claims and how does Navi health insurance overcome them:

Case 1: Before taking health insurance policy, customer’s medical checkup was fine. But after some years, customer develops a heart condition and has to undergo surgery. Doctor writes a statement of “Customer had checkup X years back” and company rejects policy.

If customer develops a heart condition years after taking a health policy wherein doctor mentions that customer had undergone a health checkup few years back but does not mention that the checkup result was fine, then the company in most cases takes that statement as a reason for rejecting claims for insurance for heart surgery.

In case of Navi, the investigation with customer before taking a policy is recorded and then transcripted. The transcript is sent to the customer along with the policy to avoid any discrepancies. If the results of all tests pre-policy were normal then Navi does not reject the claim. Additionally, a recent law has been passed where a claim cannot be rejected unless there is a strong correlation found between the claim and the disease for which one is requesting claim. Rejecting claims just on the basis of risk factor is not valid.

Case 2: Company rejects policy on basis of customer not submitting initial doctor prescription detailing the health issue to company immediately upon hospital admission.

As per regulations, an insurance company cannot reject insurer’s claim for delay in submission of any documents. Every policy details a mandatory period within which insurer has to submit hospital documents or atleast intimate the insurance company about it. Insurance company may ask reason for delay in document submission but they cannot reject claim due to it.

Meanwhile, in case of Navi, documents need to be submitted within 15 days for reimbursements. If there is a delay, then insurer needs to submit an application with reasoning for the delay. This is only due to the regulations and not a Navi policy.

Case 3: Insurance company gives regular claim to insurer inspite of knwoing he is diabetic. But rejects claim later saying that diabetic plans are different.

If insurer has disclosed his medical conditions before taking a policy then company cannot reject the policy on basis of pre-existing medical condition. That is the rule and regulation.

Case 4: Company rejects claim saying that insurer underwent a heart surgery caused by the BP pills he was taking. Even though doctor had claimed that the disease was rare and not related to BP pills at all.

This case is quite absurd since medically it is not possible for BP pills to cause a heart condition. Moreover, companies cannot reject claims citing diabetes and BP as cause of other heart conditions as per regulations. The insurer must go ahead and file a complaint with the Grievance Officer of the insurance company. The name and contact details of every Grievance Officer is mentioned on all important insurance documents for insurer.

If insurer is still not satisfied with result of Grievance Officer then he can send a mail to Insurance Goodsman. Additionally, he can file a complaint on IRDAI website. Since no company can neglect IRDAI intimation, they have to thoroughly investigate the case further. Lastly, insurer can file a complaint in the Consumer Court.

Other doubts as a consumer

Unlimited restoration

Whenever insurer requests a claim which is less than his total insurance sum assured, then the original sum gets restored for his next claim. Thus, this means that claim amount is restored unlimited times in a year as long as the total claim amount is less than the sum assured.

However, unlimited restoration is not valid in case of any one illness which recurs within 45 days of a previous claim for same illness. Even if the treatment for same illness is done in different places, it will be rejected if occurring under 45 days. But if same illness recurs after 45 days, then claim is not rejected.

Importance of super top-up

If there is a facility for unlimited restoration then why does one need super top-up? Super top-up comes handy in certain conditions as follows:

If the claim amount is larger than the claim sum assured then super top-up pays for it instead of insurer paying for it from their own savings. Hence, insurer can take super top-up instead of taking a bigger premium policy option. Thus, super top-up is a standalone policy that assures to pay for any extra claim amount beyond the sum assured. Super top-up ensures to provide claim above a certain deductible amount. The deductible could be either the sum assured or something else as well.

30 minute claim settelment

Navi assures claim settlement within 30 minutes of proposal in most cases. However, it is not applicable in cases where it takes insurance company longer to determine if the illness was predisposed. This also depends on how long it takes insurer to provide medical history records which in turn the hospital can review to answer insurance company queries.

Features of Navi Health Insurance

- Waiting period for pre-existing diseases is just one year for under 40 years and three years for above 40 years of age.

- There is no cap for hospital room rent.

- There is unlimited restoration for under 40 years of age.

- One free annual health checkup is included every year.

- Free online OPD is available in some cases where doctor is consulted digitally and not physically.

- 25% claim bonus applicable for every year which goes claim free, untill 100% is achieved.

- A dedicated Relationship Manager is alotted for easy followup.

- Monthly premium payments is available as well.

- Covid-19 hospitalization coverage available

- Pre and post hospitalization expenses coverage is also available.

- Daycare treatment expenses are available.

Navi health insurance plans

- Plan 1 – By default Plan 1 is given to everyone above 40 years which can be changed later after speaking to Navi representative. This plan does not have unlimited restoration but only once in a year. The waiting period for pre-existing diseases is 3 years. Moreover, the specific illness waiting period is 2 years.

- Plan 2 – No maternity expenses or newborn benefits.

- Plan 3 – No maternity expenses or newborn benefits.

- Plan 4 – Has maternity expenses and newborn benefits. 30 days pre-hospitalization benefit and 90 days post-hospitalization benefit.

- Plan 5 – Has maternity expenses and newborn benefits. Additionally, prolonged hospitalization benfits and air ambulance benefits are available. 90 days pre-hospitalization benefit and 180 days post-hospitalization benefit.

Watch full video on Navi Health Insurance below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and then search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!