It is common practice to fill out bank cheques. But are you aware of all the ways you could be making errors which could be leaving you vulnerable to bank frauds? Read our article for more details.

Table of Contents

What are some common cheque frauds?

- When giving a cancelled cheque, do not put your signature on it as this is not mandatory. This is the first rule to fill cheque correctly.

- Secondly, always carry and use your own pen when signing or to fill cheque correctly. There have been numerous instances where people borrowed a pen to sign a cheque and it turned out to be erasable ink. In such cases, it is very easy for the receiver to erase the amount written to the cheque and change it to something else. Thus, your account could be withdrawn of a sum much higher than you intended to.

Tips to fill cheque correctly

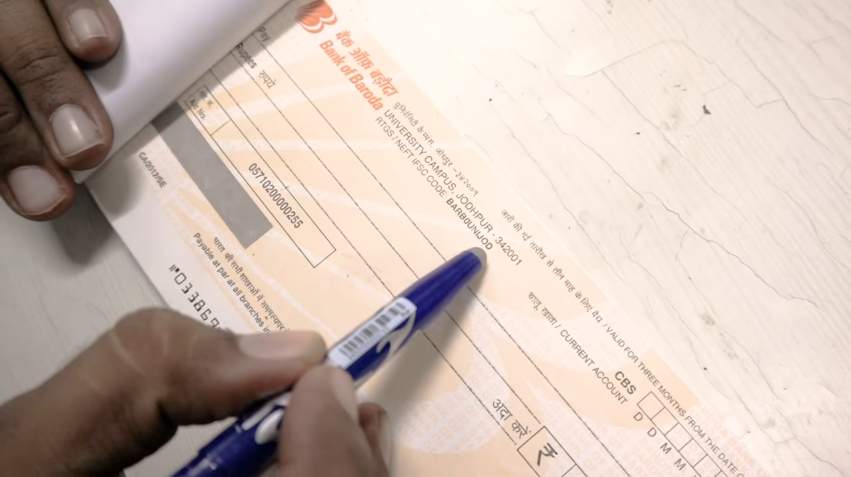

A cheque typically has the following things which one has to pay attention to:

- The top of the cheque has the name of the bank along with its IFSC code and sometimes the bank branch’s address.

- The top-right of the cheque has the date of issuing the cheque. A cheque is only valid up to three months from the date written on it.

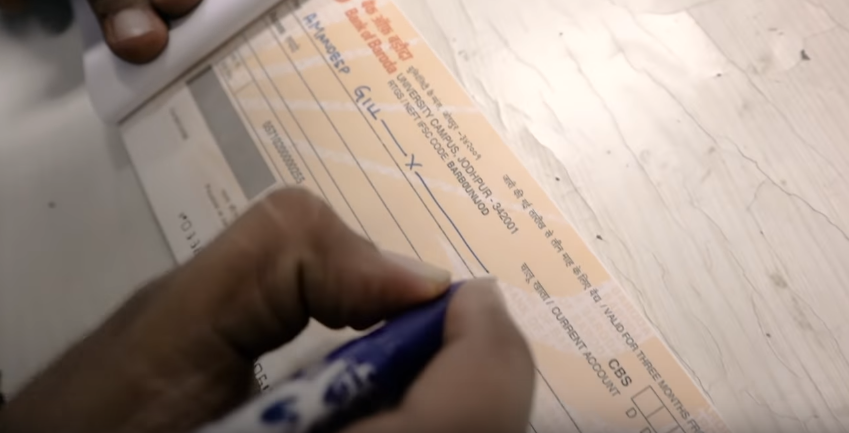

- On the Pay section, you have to write the name of the person/organization, you are paying the amount to. Do not leave any space before the name or after the name of the entity. Since it is possible to add more names there.

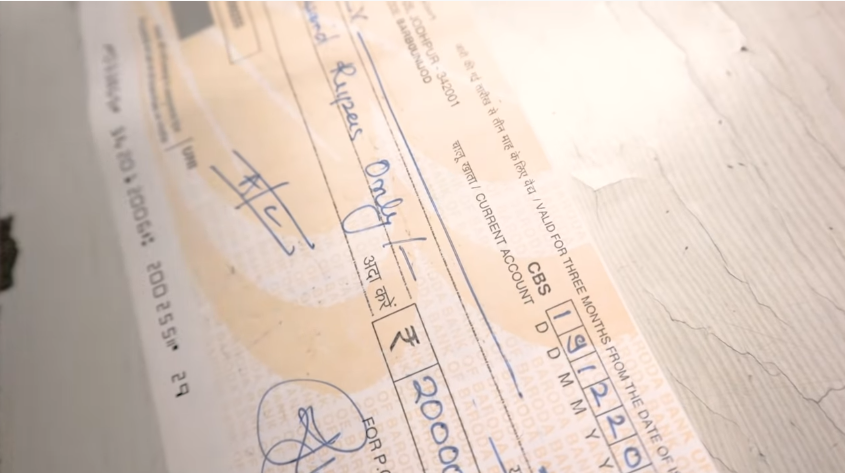

- Next, in the Rupees section, you have to write the amount you are paying in words. Pay attention here as well to not leave any extra space before writing the amount as it is possible to add extra words. After the amount, you should write “only/-” as well to avoid anyone from adding anything extra. Similarly, in the box where you write the amount in numerical, start the first digit from the edge of the box and add “only/-” after the last digit.

- Under Authority Signature you can give more than one signatures if you feel the first one is incorrect.

- The bottom of the cheque has two important numbers – the cheque number and the MICR number.

- On the backside of the cheque, you can additionally mention the account number and account holder’s name to whom you are making the payment, for extra security.

- Under the Payee section, if you only want the Payee to collect the cheque amount then you can cross out the term “or bearer” from it.

- If you want the cheque to only be deposited in the bank and not be personally withdrawn then you can write “A/C” on the cheque as well.

- If you want to withdraw money for yourself then under Payee write “Self” and give two signatures on the back of the cheque.

- The beginning of every cheque book has a slip. Use this to fill out details for every cheque you issue.

Bonus tips for filling cheque correctly

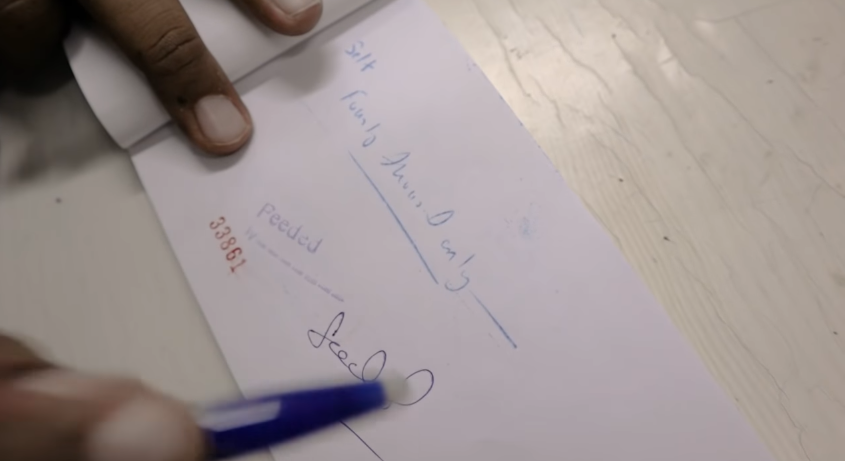

- If your business generally requires many cheque deliveries then it is advisable to have 3-4 cheque books issued from your bank. You can then have them all bound together. Furthermore, after each cheque, have a white paper inserted. When filling out cheques, keep a carbon paper between both sheets to keep track of all your issues. you can also have the Voucher Number printed on each white sheet. This reduces the work of maintaining a separate voucher book as well. When entering each cheque in your accounting, put a “Feeded” mark on each to maintain a tally. On the top of the chequebook have your Serial Number given. Also, have your company’s bank account number, address and IFSC code given. This will reduce any chances of mismatching the cheque and the company.

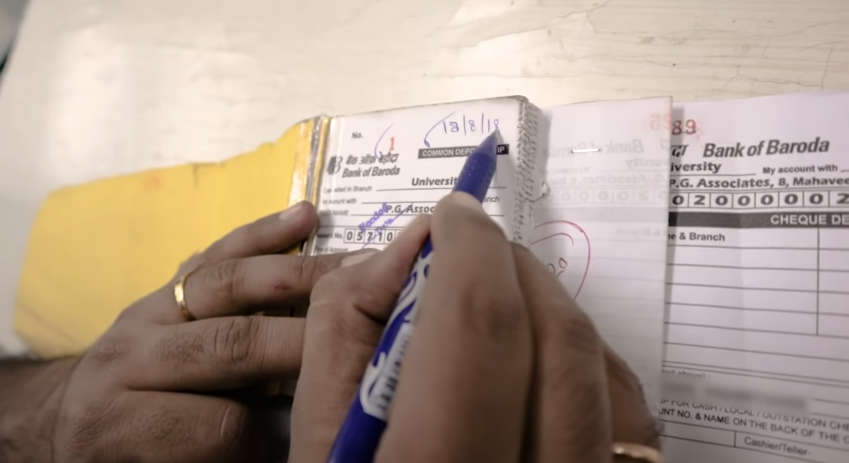

- Another important tip in cheque book maintenance is handling the slips you receive when depositing any cheque. Have a big slip book bound together, with all details of your account number, account holder name, date of issue, etc. This bound slip book can also have serial numbers given on each page. This will help in cross-checking with your accounting. Additionally, you can ask the binder to write the account name, account number and branch name on each page. This also helps reduce time in filling cheque. Also, make a habit of writing the name of the party behind each cheque you receive.

Learn these tips on how to fill cheque correctly below.

While on the topic of bank frauds, you can also learn about cyber frauds from Tips To Safeguard From Cyber Crime Fraud Case.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!