Table of Contents

What is House Rent Allowance?

House Rent Allowance or HRA is a kind of allowance given to employees for paying their house rent. This HRA is given by the employers to the employees. This allowance is on the basis that the employee is renting a place for accommodation for his work purpose. The amount of HRA given depends on the employer. Salaried employees can claim HRA to reduce their tax payments either fully or partially.

How much HRA can be claimed?

How much House Rent Allowance one can claim is different as per different laws.

- According to the Income Tax Act, the exemption limit for HRA is 50% of one’s basic salary plus dearness allowance, for employees living in metro cities. Thus, this is valid for employees living in cities like Mumbai, Delhi, Kolkata, Chennai. For employees living in other 2-tier and 3-tier cities, the exemption limit is 40% of their basic salary plus dearness allowance. This IT Act only explains the exemption limit for HRA and does not give any restrictions.

- According to the Code on Wages Act, the HRA is an excluded allowance and cannot be termed as a part of “Wages”. Although, this Act provides a cap on the total allowances given. It states that the total allowances, including HRA, cannot exceed 50% of the “Wages”. Any amount above will be taken as a part of Wages. You can get more details on the Code on Wages Act here.

- According to the Provident Fund Act, HRA is not a part of “Wages”. But this Act also does not specify the permissible percentage of salary which can be given as HRA. The new EPF amendment bill borrows the definition of Wages from the Code on Wages Act. Hence, the

total allowance cannot exceed 50% of the salary as per this Act.

- Lastly, as per the ESI Act, HRA is a part of the ESI wages. The ESI deduction is possible till a capped limit but no specific percentage for HRA is mentioned.

What are the conditions for HRA exemption?

- Only salaried employees can get HRA exemption. It is not a benefit available to self-employed individuals.

- The employee has to be renting out his accommodation and not living in his own house.

- The employee’s house rent should exceed at least 10% of his salary.

- HRA is a part of the employee’s salary and should have a separate division for it.

- Rent payment to a

spouse is not acceptable.

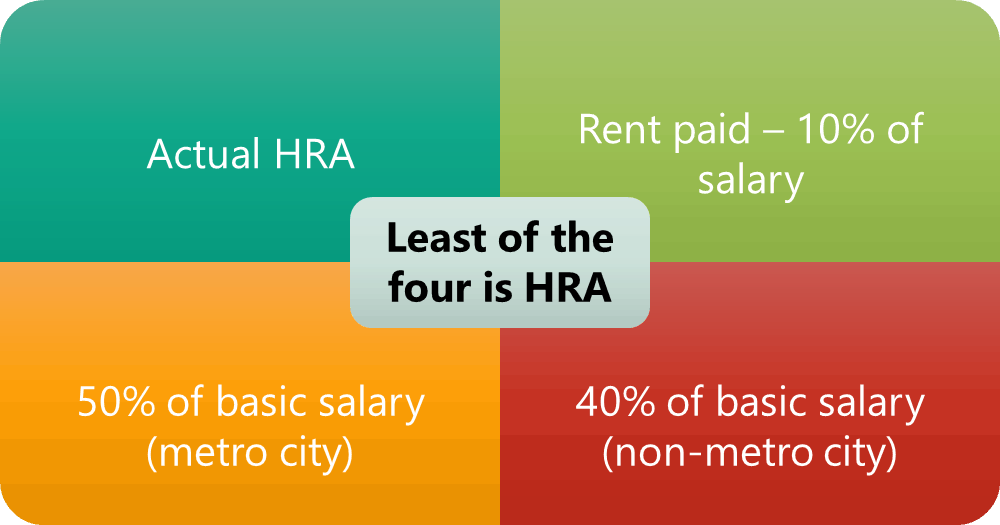

How much HRA tax exemption is possible?

The HRA tax exemption is available on whichever is the least of the following amounts:

- Condition 1 – Your exemption cannot exceed the actual HRA amount received.

- Condition 2 – Residents of metro cities cannot get over 50% of their basic salary plus dearness allowance. Meanwhile, non-metro city residents cannot get over 40% of their basic salary plus dearness allowance.

- Condition 3 – HRA claim cannot exceed your actual house rent minus 10% of the basic salary plus dearness allowance.

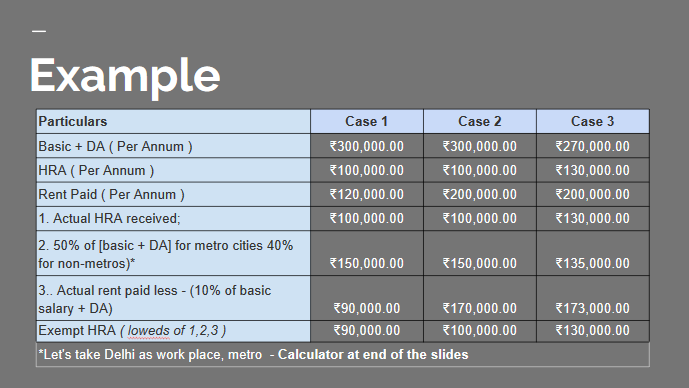

HRA exemption example:

Case 1:

The basic salary + Dearness allowance = Rs 3,00,000.

HRA = Rs 1,00,000.

Actual rent paid = Rs 1,20,000.

Hence, HRA exemption as per

Condition 1 – Rs 1,00,000

Condition 2 – Rs. 1,50,000

Condition 3 – Rs 90,000

Thus, actual HRA exemption = lowest amount of conditions 1, 2 and 3 = Rs 90,000.

Case 2:

The basic salary + Dearness allowance = Rs 3,00,000.

HRA = Rs 1,00,000.

Actual rent paid = Rs 2,00,000.

Hence, HRA exemption as per

Condition 1 – Rs 1,00,000

Condition 2 – Rs. 1,50,000

Condition 3 – Rs 1,70,000

Thus, actual HRA exemption = lowest amount of conditions 1, 2 and 3 = Rs 1,00,000.

Case 3:

The basic salary + Dearness allowance = Rs 2,70,000.

HRA = Rs 1,30,000.

Actual rent paid = Rs 2,00,000.

Hence, as per

Condition 1 – Rs 1,30,000

Condition 2 – Rs. 1,35,000

Condition 3 – Rs 1,73,000

Thus, actual HRA exemption = lowest amount of conditions 1, 2 and 3 = Rs 1,30,000.

Things to remember when paying rent

- If the employee’s annual house rent exceeds Rs 1,00,000 then he has to provide his landlord’s PAN details to claim his TDS benefit.

- If the landlord does not have a PAN card then he can provide a self-declaration, as per Circular No. 8/2013 – 10 Oct 2013. It can state that he will provide PAN details when he gets them.

- The individuals of HUFs who pay a monthly house rent of over Rs 50,000 can deduct TDS at 5% under Section 194-IB.

- If the employee’s landlord is a non-residential Indian, then he is liable for 30% TDS deduction on the house rent.

Can self-employed individuals claim HRA exemption?

Under Section 80GG, some self-employed individuals can also claim the

- If they are self-employed or salaried individuals

- If they do not get House Rent Allowance as being self-employed or do not have salary bifurcation as a salaried individual.

- Neither you nor your spouse nor your child can have residential accommodation under their name, at your current city of residence.

Furthermore, the House Rent Allowance exemption available under Section 80GG will be the least out of the following conditions:

- The total rent paid minus 10% of the adjusted income. The adjusted total income is the annual income minus the long-term and short-term gains.

- The maximum amount possible is Rs 60,000 per year or Rs 5,000 per month.

- 25% of the adjusted gross total income.

Can individuals living with parents get HRA exemption?

It is possible to be living with your parents as well as claim House Rent Allowance exemption if you follow these conditions:

- If you form a rent agreement with your parents.

- You pay the house rent to your parents and thus claim the HRA benefit.

- But this cannot be just a verbal agreement. You have to actually transfer the house rent amount to your parent’s bank account.

- Additionally, the parents have to show the house rent as rental income and show it in their tax filing. If the parents are retired or not earning then this process can help the family a lot of money in taxes.

Additional notes

- Both the House Rent Allowance and Home Loan Exemption can be claimed separately.

- If you have more than one rented apartments in a city, then you can claim House Rent allowance for only one of them.

- If your monthly house rent is over Rs 5,000 then you need to submit a house rent receipt. This is not needed if you are transferring the rent via NEFT.

- The House Rent Allowance provides exemption on only the actual house rent and not on electricity or other maintenance charges.

- Form 16B has your employer states all the allowances given to you explicitly. Hence, it is not possible to cheat the system into getting more HRA exemption.

- You can calculate your House Rent Allowance here.

Watch our detailed video explaining this topic below.

Also read, Leave Travel Allowance (LTA) | How To Claim Income Tax Deduction?

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!