These days leaving a job from time to time is a common phenomenon in this dynamic job scenario. But, there are certain formalities like EPF that you need to carry out before leaving a particular job. This distinct piece of writing throws light on the conventionalities that you should keep in mind before quitting a job so that you do not face any problem in the long run. and reason for leaving job.

While joining a job, there are certain formalities that we all go through, and if you make sure to carry out those formalities during joining, then leaving a job won’t be a problem for you at all. Here, we are going to divide the etiquette of leaving a job into four sections and let us get started with the first point.

Table of Contents

Basic Compliance/reason for leaving job:

When it comes to basic compliances, you need to keep two things in mind. The first is the experience letter and the second one is the recommendation letter. An experience letter is proof of your work experience which you are likely to produce in the next company. While a recommendation letter is a letter from your employer which designates the authority of your job and how well you have worked in your previous company. If you are leaving your job on good terms, you will not face any difficulty while getting these two letters. Make sure to collect these two letters on the first hand before reason for leaving your job.

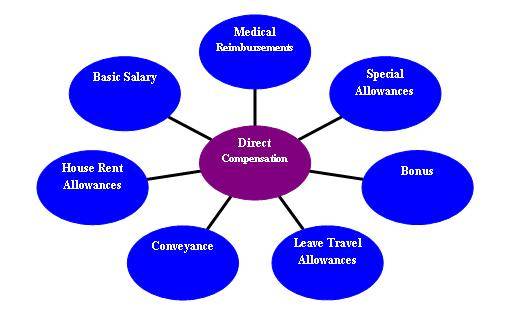

Allowance/Benefits:

Each employee is eligible to get certain benefits while leaving the job. The first among those benefits is your final settlement. If you are leaving the job after properly serving the notice period then you are likely to receive the final settlement at the time of quitting your job. The next point is your paid leaves. If you have not taken any or some of your paid leaves then you are likely to receive the money generated from the paid leaves while leaving the job. and reason for leaving job.

Apart from these two points, there are other two points for which you can be eligible if you are serving the company for a long period. In case you are serving the company for more than five years, you are eligible for bonus and gratuity. So, make sure you collect your bonus payment before leaving the job. If you are two or three months away from receiving the bonus, it is advisable to delay your joining at the new company and complete your bonus term in the existing company. Therefore, make sure to collect these documents before you quit.

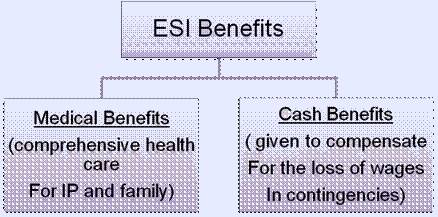

ESI Formalities:

When it comes to ESI, there are certain points you need to look for like the Exit Date, IP Number and Eligibility. Make sure to get your proper exit date marked on the EPFO portal from your employer so that you do not face any problem in the long run. Furthermore, do not forget to collect your IP number. If you have already done it during your joining process, well and good. In case, you have not taken it, make sure to take it while leaving the job. Another thing that you should keep in mind is the eligibility criteria. Make sure to check your member portal now and then to check how many leaves you have pending and other such details.

EPF Formalities:

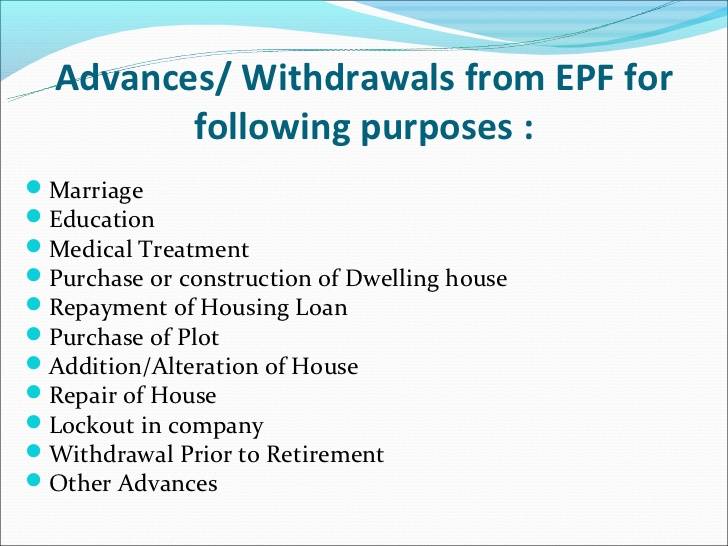

This is the most important point among all the other points described so far. Make sure to know your UAN/EPF number before leaving the job if you have not at the time of joining. The next thing that you should keep in mind is marking the exit date. If your employer doesn’t mark the exit date on your EPF portal, you cannot get a refund of your money online.

Another thing that you must check is the KYC approval. It is extremely important for when you have to withdraw or transfer your money online. If you have not done it during joining, make sure to do it while leaving. Apart from all the other things explained so far, make sure to check your basic details approval, collect your claim and transfer form.

We’ve also created an informative video on this topic, so check that out below:

Join LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link for free.