Are you looking to make the most out of your savings? Fixed Deposits might be the answer! Let’s dive deep into understanding them. A large portion of the country’s population has a Fixed Deposit (FD) to their name. Thus, it is essential for everyone’s financial health. But are we all aware of how a fixed deposit account works? This article details the different facets of fixed deposit accounts and how to navigate them.

Table of Contents

What is a Fixed Deposit (FD) account?

A fixed deposit account is a type of loan given to the bank where the bank pays you a return for exchange. Each fixed deposit account has a fixed tenure, which can range from 7 days to 10 years. Upon putting your money in an FD you lock in the amount for a fixed duration with the bank. Then the bank pays you interest on the principal sum of the amount. The interest is added to the principal amount after every specific interval of time. Since there are flexible tenures for FD you can have multiple FD accounts of different tenures, at the same time. Thus, you can earn more through investing in multiple FDs.

Comparing Banking Instruments:

- Current Account: Designed for frequent transactions, this account holds your money without offering any interest. The bank doesn’t invest these funds elsewhere due to the high liquidity requirement.

- Savings Account: Typically used by individuals, this account requires a minimum balance. The bank can lend a portion of these funds, offering account holders a modest interest in return.

- Fixed Deposit: With a tenure that can span from 7 days to 10 years, FDs provide banks with more lending freedom. In return, you earn a portion of the interest from the bank’s lending activities. Generally, longer FD tenures attract higher interest rates.

7 Key Terms Every FD Investor Should Know:

- Principal Amount: Think of this as the starting pot of money you put into an FD. For instance, if you start with ₹1,00,000, that’s your principal amount.

- Tenure of FD: This is how long you’re letting the bank borrow your money. It could be as short as 7 days or as long as 10 years.

- Interest Rate: This is the rate at which the bank promises to grow your money. Let’s say you lock in an FD at a 9% rate today. Even if the bank drops its rates to 8% tomorrow, you’ll still earn your promised 9%. Right now, many experts believe we’re seeing some of the highest rates banks have offered in a while. But remember, rates might drop in the future. And hey, if you’re over 60, you’re in luck! Most banks offer a bonus interest rate, usually an extra 0.5%-1%.

An observation: Many people stick with their current bank for FDs, even if another bank offers a slightly better rate. But how much difference does a small percentage like 0.5% or 1% make? See for yourself and understand as you go on reading this blog. - Compounding: This is where the magic happens in FDs. There are two main types:

- Non-cumulative: The bank pays you interest at regular intervals (like monthly, quarterly or yearly), but it’s always based on your original principal amount.

- Cumulative: Your interest gets added back to your principal. So, over time, you earn “interest on interest.”

- Cumulative Frequency: This is all about how often your interest gets added back to your principal. The more frequently this happens, the more you earn. For instance, if it’s done annually, your money grows once a year. If it’s monthly, your money grows every month. Most banks in India, following RBI guidelines, compound quarterly. But if you’re looking at non-banking financial companies (NBFCs), make sure to check their rules.

- Maturity Amount: This is your final payday! It’s the total amount you get when your FD ends, including your original money and all the interest you’ve earned. The best part? You’ll know this amount right when you start the FD.

- Pre-mature Withdrawal Penalty: Life’s unpredictable. If you need to break your FD before its time, the bank might charge you a small penalty, usually between 0.5%-2% of your interest rate.

Types of Fixed Deposit accounts

There are various types of FDs one can open. These are as follows:

- Regular Fixed Deposit – The most common type of FD, this is for anyone below the age of 60 years. You deposit money for a fixed tenure which can lie between 7 days to 10 years. Hence, you get regular interest on the FD which is usually higher than savings account returns.

- Flexi Fixed Deposit – This type of FD is linked to your savings account. Whenever a savings account reaches a threshold, the extra amount is transferred to the FD. Alternatively, when the savings account fund decreases, the FD amount is transferred back. This gives a better interest rate on the principal amount.

- Tax Saving Fixed Deposit – This gives you a tax exemption of up to Rs 1.5 lakh on the principal amount, in a calendar year. This is as per Section 80C of the Income Tax Act. But there is a lock-in period of 5 years, during which you cannot withdraw any amount from the FD.

- Senior Citizens’ Fixed Deposit – This is available for citizens above 60 years of age. The tenures are flexible and the interest rate is approximately 0.5% – 1% higher than a regular FD account.

- Shareholders’ Fixed Deposit – This is not available at banks. This can be accessed through corporates, NBFC, and HFC. Although this is only accessible to individuals who hold shares in that particular establishment. Here also you get a 0.5% – 1% extra interest rate on the FD than regular FD.

Maximizing your financial knowledge is key to leveraging your FDs and other banking products effectively. Our Ultimate Banking Masterclass uncovers 50 things banks don’t often tell you, equipping you with insider knowledge to navigate the banking world with confidence. From understanding the fine print to optimizing your banking experience, this masterclass sheds light on crucial insights that can make a significant difference in managing your finances.

How to Choose the Right FD?

When it comes to booking your FDs, you have a few options: Scheduled commercial banks, cooperative banks, and non-banking financial corporations (NBFCs). But how do you pick the right one?

Enter DICGC (Deposit Insurance and Credit Guarantee Corporation). Whether you’re leaning towards Scheduled commercial banks or cooperative banks, DICGC ensures that both your principal amount and interest (up to 5 lakhs) are protected.

For instance, if you have two FDs in two different banks, each with a principal amount of 4 lakhs, and you earn interest of 50,000 on one and 70,000 on the other, both amounts are safe. Why? Because the combined principal and interest for each FD is under 5 lakhs. This means even in the worst-case scenario where something happens to the banks, the RBI has got your back. However, Please remember! this assurance doesn’t extend to NBFCs.

Calculation of Fixed Deposit

Basically, for opening an FD you pay a principal amount. Then you receive an interest on the principal amount after every specific interval. But there are two ways to calculate the interest you receive after every interval. This differs as follows:

As you manage your FDs and consider the tax implications, staying updated with the latest tax filing systems is essential. The New Income Tax Portal brings a slew of features designed to simplify your tax filing process. From faster processing of returns to a user-friendly interface that auto-fills dividend, salary, and interest income, this portal is a game-changer for taxpayers. It also offers a diverse range of payment options and a comprehensive dashboard for all your tax-related actions.

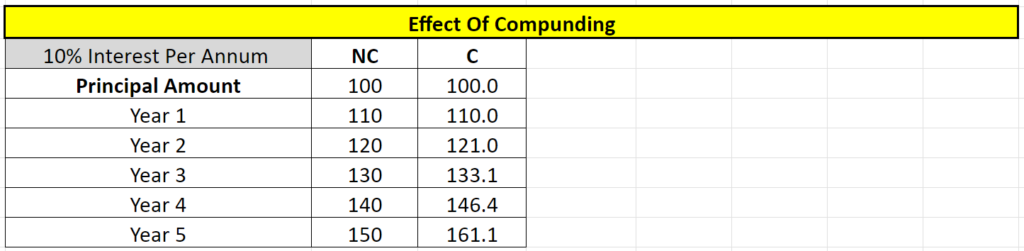

Non-Cumulative Fixed Deposit

Under non-cumulative FD, the interest rate is calculated via a simple interest method. Therefore, the interest gets calculated on the same initial principal deposit every interval. For example, as you can see in the image above, if your principal amount is Rs 100 and the interest rate is 10%, then the interest earned would be Rs 10 making it Rs 110 in the first year and so on. Thus, after 5 years, your total earnings will be Rs 150.

Also, the interest is paid out either monthly, quarterly, half-yearly or annually, as per your choice. You can withdraw the interest after every interval. Thus, overall this is a better option for pensioners looking for a regular source of income without too much risk.

Cumulative Fixed Deposit

On the other hand, cumulative FD calculates the interest via the compound interest method. Therefore, the principal amount plus interest amount of 1 year becomes the principal amount of the consecutive year. For example, as you can see in the image above, if your principal amount is Rs 100 and the interest rate is 10%, then the interest earned would be Rs 10 making it Rs 110 in the first year and then Rs 110 will become the principal amount for the second year, and similarly the interest earned on it at 10% will be Rs 11 making it Rs 121. Now, Rs 121 will be the principal for the third year. Similarly, total earnings after 5 years will be Rs 161.

You can use this FD calculator to figure out the earnings for your FD. Moreover, in cumulative FD the interest is compounded every quarter or year and paid at the time of maturity. So you cannot withdraw the interest after every year. This method also helps to substantially grow your savings.

Frequency of cumulation

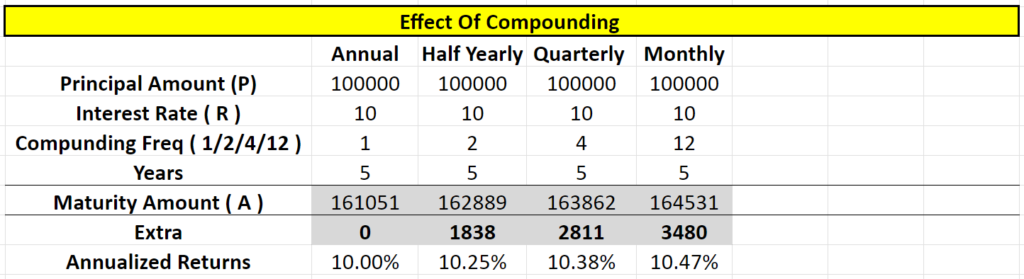

Generally, banks calculate quarterly interest on FDs, which is calculating interest four times in a year. Then they take the sum of all interest and principal as the principal for the consecutive year. But frequency of cumulation can also vary as half-yearly which is twice a year, monthly which is twelve times a year or yearly which is once a year.

As you can see in the image above, the principal amount, interest rate and tenure are all the same. But the compounding frequency changes between once a year, twice a year, four times a year and twelve times a year. Thus, as the compounding frequency increases the final maturity amount also increases. Hence, the higher the compounding frequency for Fixed Deposit accounts, the more interest you will earn.

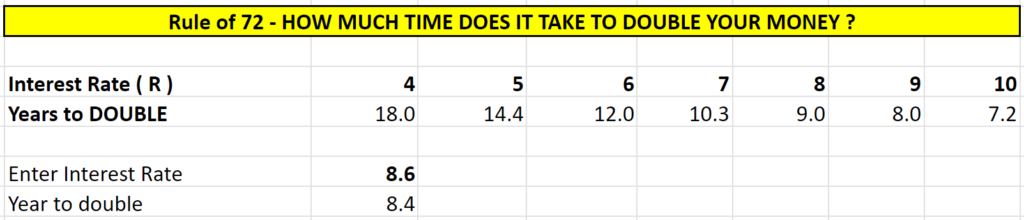

Rule of 72

A simple method to calculate the time it will take your FD to double in amount is to follow the Rule of 72. This rule entails 72 by the interest rate. Thus, as seen in the image below dividing 72 by 4 will take you 18 years to double your investment in FD. Similarly, dividing 72 by 5 will take you approximately 14.4 years to double your FD amount.

Effect of interest rate

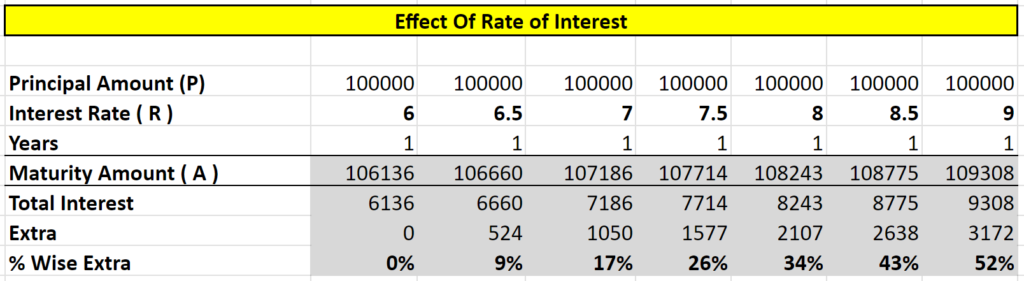

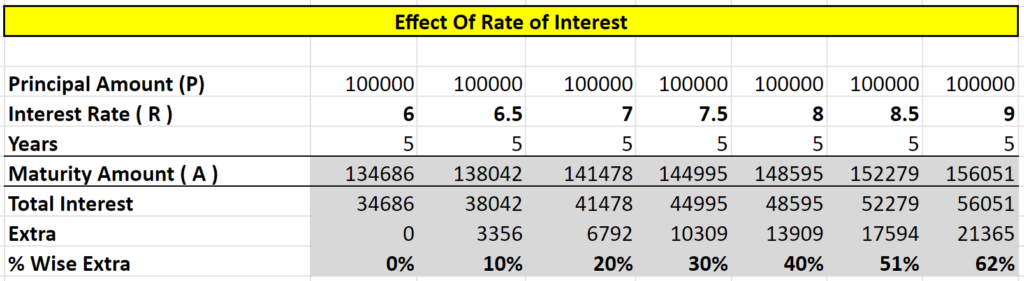

Among the different banks and corporates, the difference between two FDs may seem insignificant, but even a 0.5% or 1% variation can lead to a big difference in results. To understand how different interest rates affect FDs, view the image below.

Here, in the above image, the principal amount is the same for all the FDs, the interest rate varies from 6% to 9% and the tenure is 1 year. As you can see the difference between 6% and 6.5% interest rate is just 0.5%, but the difference in the return is of 9% (9% – 0% = 9%). Similarly, in the image below, you can see that if we increase the tenure to 5 years and consider 8% and 8.5% interest rate the difference in the return becomes even larger i.e. 11% (51% – 40% = 11%), which is a LOT!

Therefore, over the long-term, even a half per cent difference in interest rate will result in major profit or loss in net amount earned. You can calculate your interest rate variations in this calculator.

Auto-renewal of FD

You can set your Fixed Deposit account on auto-renewal, thus not wasting even a single day on filing paperwork for the same. Thus, whenever your FD tenure ends, it will automatically renew itself for the same period as the original deposit. This is a good option for someone who does not intend to withdraw their FD balance soon.

However, under the auto-renewal option, the time deposit receipt is in the bank’s custody and a Memorandum of Deposit (MOD) is issued in lieu of a fixed deposit receipt to the account holder.

Loan against Fixed Deposit

It is also possible to take a loan against your FD in banks. The process is quite simple too. Generally, you can get a loan at an interest rate that is 1%-2% higher than your FD interest rate. You have to pay back the loan within the tenure of the fixed deposit though. Although the loan amount is 75%-90% of the FD amount and the FD is taken as collateral by the bank.

Is Fixed Deposit taxable?

The tax you pay on your FD interest is added to your “income from other sources” and is already populated in the Annual Income Statement (AIS). This means you’ll pay tax on this interest based on your tax slab, whether you’re under the new tax regime or the old one.

If, in any financial year, your interest earnings exceed Rs 40,000, the bank will deduct 10% of it as TDS. Earlier this limit was Rs 10,000, but after the recent budget the limit has been extended to Rs 40,000 by the Income Tax Department (Page 4).

It is said that no tax is required to be deducted if aggregate amount of interest credited or paid to the payee in respect of time deposit during the financial year doesn’t exceed the following limit:

| Payer | Senior Citizen | Others |

| Banking Co. | 50,000 | 40,000 |

| Co-operative Society engaged in banking business | 50,000 | 40,000 |

| Post Office | 50,000 | 40,000 |

| In any other case | 5,000 | 5,000 |

Income Tax Vs TDS

Income tax is the tax applicable on your annual income depending on your earnings bracket. Read more about it in Income Tax Calculation, Slab Rates & Important Details For Beginners.

TDS on the other hand is Tax Deducted at Source, which is tax deducted from your payment before the actual payment. Now after your actual ITR filing, you get to know your actual tax liability for the year. So if your TDS deducted is more than your tax liability, you can get a TDS refund. But if the TDS deducted is less than your tax liability, then you have to pay the surplus amount.

Learn more about TDS in How To Calculate TDS And Reduce TDS On Salary and TDS Refund Filing Online Procedure. Learn about ITR filing in Income Tax Return Filing For Salaried Persons | Online Process.

How to avoid TDS deduction on FD account (non-taxable income)?

If you fall under the non-taxable income bracket then you must fill Form 15G and Form 15H. This will help you in savings TDS on FD account. It is always preferable to stop TDS deduction before it occurs when you are not liable for any tax paying. Since getting TDS refund is a tedious process and will take some time. If your age is below 60 years then you must fill and submit Form 15G. But if you are above 60 years then you must fill and submit Form 15H at your bank or corporate. Once you submit them, bank/corporate will not deduct your TDS.

How to avoid TDS deduction on FD account (taxable income)?

If you fall under the taxable income bracket then you cannot submit Forms 15G and 15H. In this case you need to make multiple small Fixed Deposit accounts such that the interest earned on any account does not cross Rs 40,000 for banks.

Moreover, if you have multiple FDs in the same bank and interest on all amount to over Rs 40,000, then also you will get TDS deduction. So it is advisable to open multiple FDs across different banks. Although all interest earnings will get added to your income and you will have to pay tax on it.

Formalities after TDS deduction

If the bank deducts TDS on your FD then it will provide you with Form 16A. This document will detail the date and amount of TDS deduction by the bank. This TDS amount will reflect in your annual ITR filing under Form 26AS. If there is a mismatch between these two documents then you must contact your bank or IT Department.

Watch our latest video for more details on FD, its tax and TDS implications.