On 26th March, the Finance Minister of India, Nirmala Sitharaman, had a press briefing. In this briefing, the Finance Minister’s EPF announcement brought relief to the working class, already suffering from a lockdown and coronavirus scare. What were these important EPF announcements and how will they help you? Read on find out.

Table of Contents

1. Government will pay EPF contribution for 3 months

Due to the government’s 21 day lockdown in the country, the corporate sector has come to a standstill. Employees are unable to go to work and have to resolve to work from home only. This was a reason for employers to worry about how they were going to be able to pay any wages, especially the monthly EPF contribution since work was on a pause. Thankfully, the Finance Minister’s EPF announcement was a silver lining in this situation. This EPF announcement was as follows:

- The government will pay EPF contribution for employees for 3 months. This will include both employer’s share (12%) as well as the employee’s share (12%). The actual months have not been stated yet. But it is safe to assume that this will be liable for the months of March, April and May 2020. The admin charges might still fall on the employer though. It is yet to be confirmed. But there are two conditions to be eligible for this benefit as follows:

- This benefit is only eligible for companies who have less than 100 employees.

- Along with that, this benefit is eligible for companies where 90% of the employees have a salary of less than Rs 15,000.

Hence, this EPF announcement is set to benefit small companies such as manufacturing units, small businesses, handicrafts, construction, and the likes. Since the government is making this payment, there are no chances of getting any interest, damages or penalty on it. But it is important to note that this benefit is not eligible for all companies.

Watch the video below for more details on the Finance Minister’s EPF announcements.

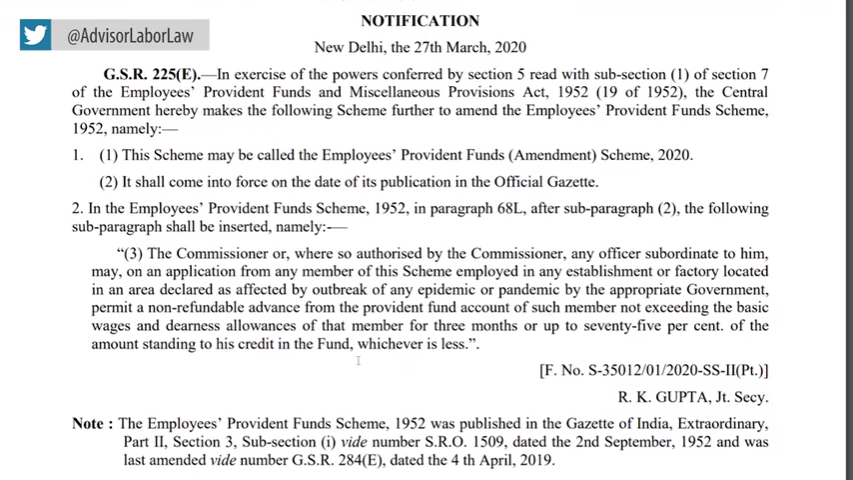

2. EPF advance withdrawal reforms

Currently, there are set rules for EPF advance withdrawal. Advance withdrawal is only allowed for certain conditions. But the Finance Minister’s EPF announcement included mention of reform in the EPF advance withdrawal rules. Due to the ongoing coronavirus lockdown, all employees will be able to withdraw EPF in advance. Employees have the option to take either 75% of their EPF balance amount or 3 months of wages, whichever is less. The wages will include basic salary plus DA. The IT framework setup for this may take some time though.

For instance, if your monthly basic + DA calculates to Rs 15,000, then you are eligible to receive Rs 45,000. But if your EPF account balance itself is Rs 45,000, then you will receive 75% of it, i.e., Rs 33,750. So tallying both the cases, your final EPF withdrawal will be the lesser of the two, which is Rs 33,750. To be eligible for this EPF withdrawal, your KYC must be complete on the PF portal.

EPF advance withdrawal steps

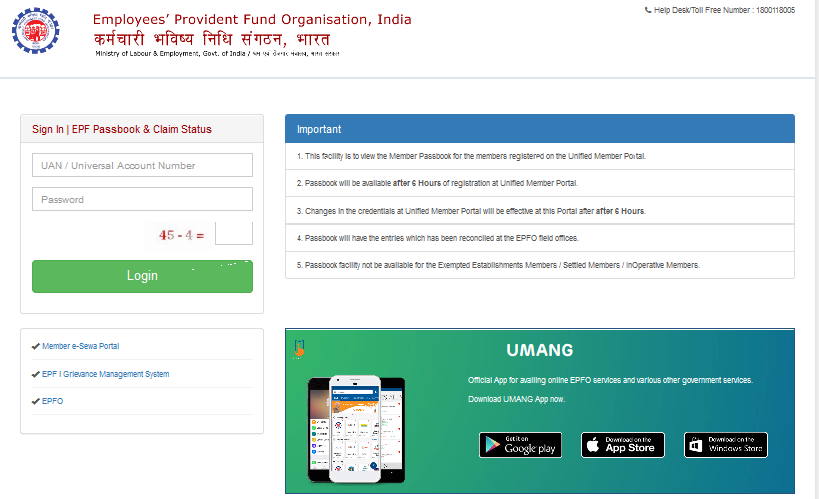

- Visit the EPF passbook website.

- Input your UAN and password to login to your account.

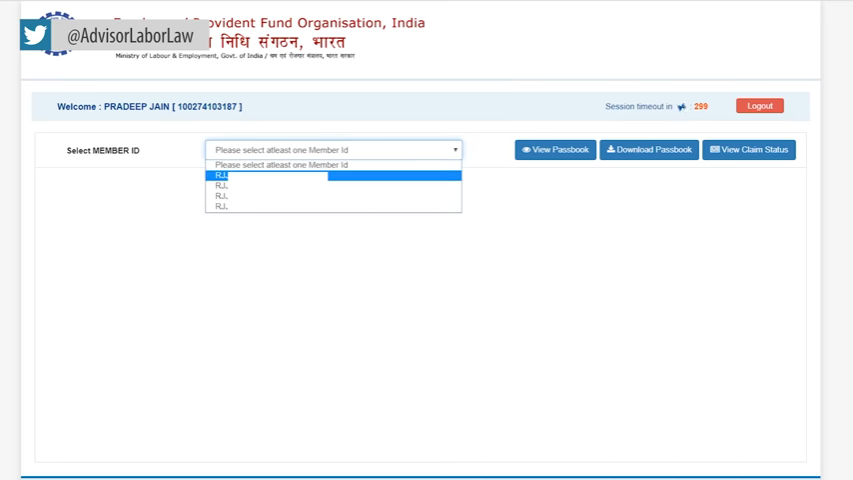

- On the next page, click on the drop-down list for Select Member ID. Then click on View Passbook.

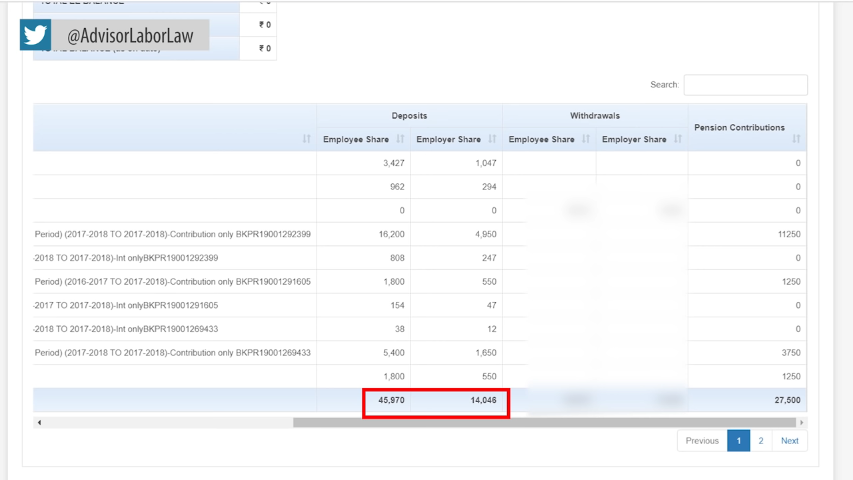

- This will display your EPF passbook. If you scroll to the right corner of the page, you can view your EPF and EPS deposits. EPS withdrawal is not applicable for this case. Only 75% of the sum of employee and employer’s shares are applicable. Which in this case amounts to 45,970+14,046= Rs 60,016. Either this or 3 months of basic wages + DA is applicable for withdrawal.

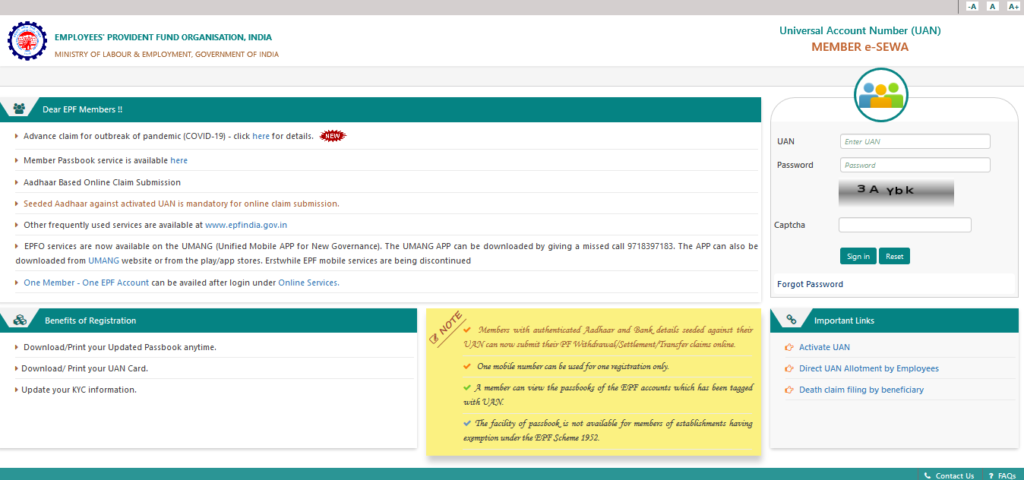

- On a new tab, visit the EPF member portal website.

- Type in your UAN and password to login to your EPF account.

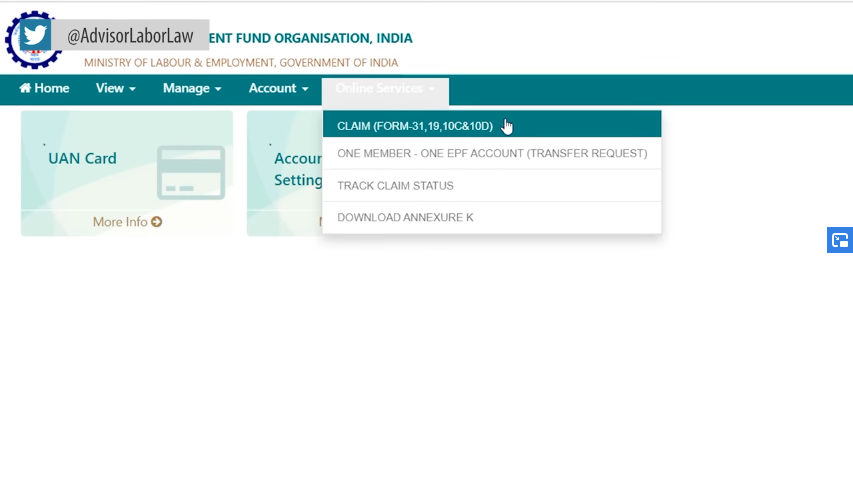

- On the next page, under Online Services option, click on (CLAIM FORM-31, 19, 10C & 10D)

- Fill in the last four digits of your bank account on the next page. Click on Verify and then click on Yes to agree to the terms and conditions.

- Then click on Proceed For Online Claim.

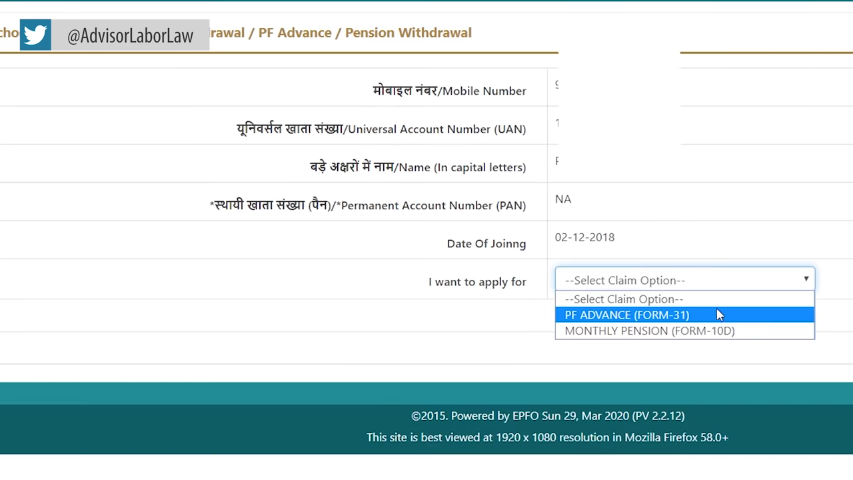

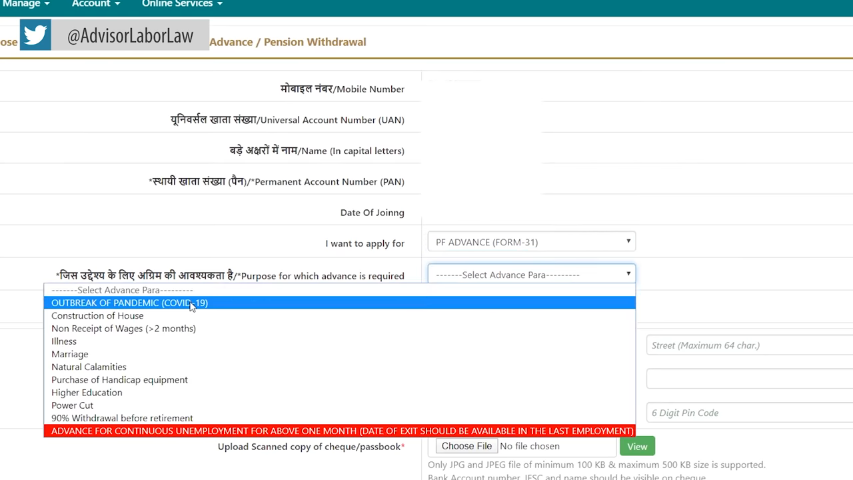

- On the next page, for “I want to apply for”, click on PF Advance (Form-31).

- The new page will open. It will ask for “Purpose for which advance is required”. Here you have to select “Outbreak of Pandemic (COVID-19) as your answer.

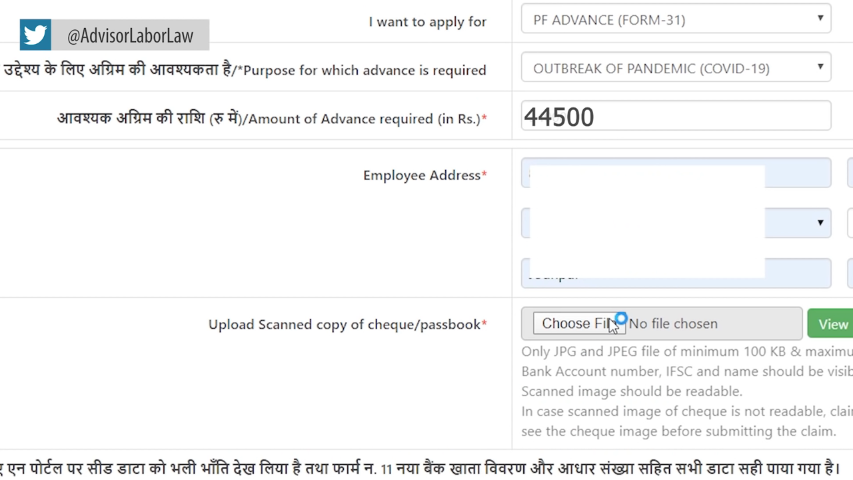

- Under “Amount of advance required (in Rs)” we need to put the withdrawal amount. In this example, we put Rs 44,500 to be safe. Since we are not sure of the sum of basic salary + DA for 3 months. But we know our EPF balance amount from the EPF passbook. So, we input 75% of that EPF balance amount. Similarly, you have to calculate your basic salary + DA for 3 months and EPF balance amount. Then input the lesser value of the two for your EPF withdrawal amount.

- To be on the safer side, input Rs 500 less, to avoid claim rejection for any reason.

- Next, input your address and upload a scanned copy of your passbook or a cancelled cheque.

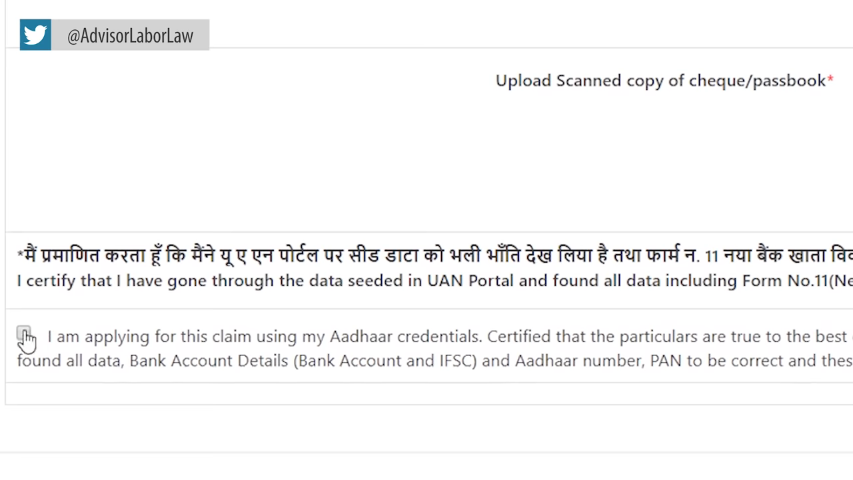

- Then scroll down to the bottom to tick on the declaration checkbox.

- Click on Get Aadhaar OTP.

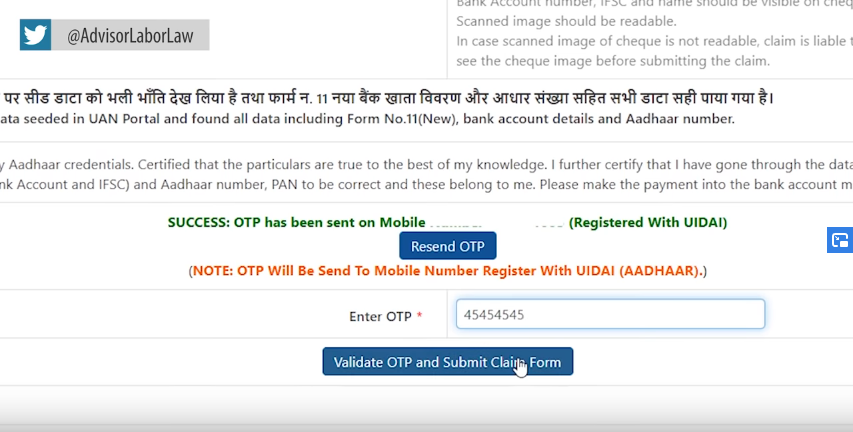

- You will receive an OTP on your Aadhaar registered mobile number. Input the OTP under Enter OTP.

- Then click on Validate OTP and Submit Claim Form.

- Your EPF advance withdrawal submission is complete. Your withdrawal should reflect in your bank account within three days.

Watch the full tutorial for EPF advance withdrawal under this EPF announcement below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!