The worldwide pandemic of COVID-19 has had many negative impacts in the past months. Among them, unemployment has been a big crisis. With industries and factories shutting down, many workers have been left without any jobs. The government observed that the rise in unemployment was affecting compliances of labour laws by employees. Since majority of them have been exiting schemes which had them paying a monthly contribution of their salary. Therefore, the ESIC Board has come up with an unemployment allowance under the Atal Beemit Vyakti Kalyan Yojana (ABYKY). This article details the ESIC unemployment allowance scheme and how to avail it.

Nearly 80 lakh workers are estimated to have existed the ESIC scheme in the past few months due to the pandemic’s impact on businesses. “The initial calculation based on certain rules shows that around 40 lakh will be eligible to get the benefit from ESIC board decision. This will cost the government to the tune of Rs.6700 crore,” V. Radhakrishnan, another board member of the ESIC said.

Table of Contents

What is Atal Beemit Vyakti Kalyan Yojana?

Atal Beemit Vyakti Kalyan Yojana (ABVKY) was announced in the 175th ESIC meeting and launched on 1st July 2018. It was initially supposed to run on a pilot basis from 1st July 2018 to 30th June 2020. But this will now get an extension for another year until 30th June 2021. Between 24th March 2020 and 31st December 2020, the eligibility criteria of the scheme will be relaxed. There will also be additional benefits given in this period. Depending on a review after December 2020, the scheme may get another extension.

Benefits of ESIC unemployment scheme

ABVKY scheme will have different set of benefits in the long-term and for the pandemic period. Both of these are listed below.

| REGULAR PERIOD BENEFITS (1st July 2018 – 31st June 2021) | COVID BENEFITS (24th March 2020 – 31st December 2020) |

| Member will receive a cash unemployment allowance for up to 90 days if he loses his job. This is only available once in a lifetime. | |

| The unemployment allowance will be 25% of the average earning per day or ESIC wages. Eg, if the salary is Rs 20,000, then member will get Rs 5000/month as ESIC unemployment allowance. | The unemployment allowance will be increased to 50% of the average earning per day or ESIC wages. Eg, if the salary is Rs 20,000, then member will get Rs 10,000/month as ESIC unemployment allowance. |

| Earlier, the ESIC unemployment allowance could be claimed after 90 days of unemployment. That too it was subject to eligibility. | But now, the ESIC unemployment allowance can be claimed after one month of unemployment only. |

Eligibility criteria for ESIC unemployment scheme

Here again, there are different set of eligibility criteria under regular conditions and under COVID-19. These are as follows:

| REGULAR PERIOD BENEFITS (1st July 2018 – 31st June 2021) | COVID BENEFITS (24th March 2020 – 31st December 2020) |

| The Insured Person should have been rendered unemployed during the period the relief is claimed. In case the IP is working for more than one employer: and is covered under the ESIC scheme, he will be considered unemployed only in case he is rendered unemployed with all employers. | |

| The Insured Person should have been in insurable employment for a minimum period of two years immediately before his/her unemployment. | |

| The Insured Person should have contributed not less than 78 days during each of the preceding four contribution periods. Thus, April – September is Contribution Period 1 and October – March is Contribution Period 2. Similarly, between July 2018 and June 2021, there will be four contribution periods. | The Insured Person should have contributed for not less than 78 days in the contribution period immediately preceding to unemployment and minimum 78 days in one of the remaining 3 contribution periods in 2 years prior to unemployment. But there should not be zero contribution in any periods. |

| The contribution in respect of him/her should have been paid or payable by the employer. | |

| The contingency of the unemployment should not have been as a result of any punishment for misconduct or superannuation or voluntary retirement. | |

| Aadhaar and Bank Account of the Insured Person should be linked with the insured person database. If not done then refer to Page 5 K(2) of the scheme document attached above as proof to avail benefits. | |

| Application (Form AB-1) to be forwarded by Insured Person with employer cover letter (Form AB-2). | The Insured Person can submit the claim directly to the ESIC branch office instead of the claim being forwarded by the last employer. |

| As specified in Section 65 of the Act, an IP shall not be entitled to any other cash compensation and the relief under ABVKY simultaneously for the same period. However, periodical payments of PDB (Permanent Disability Benefit) and Medical Benefit under ESI Act and Regulations shall continue. |

How to check eligibility for ABVKY?

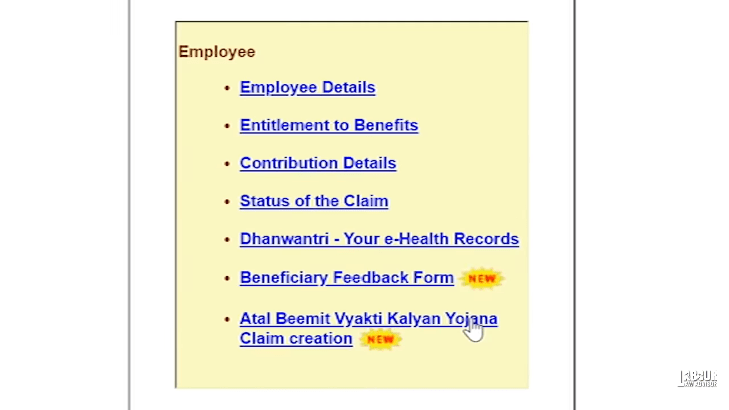

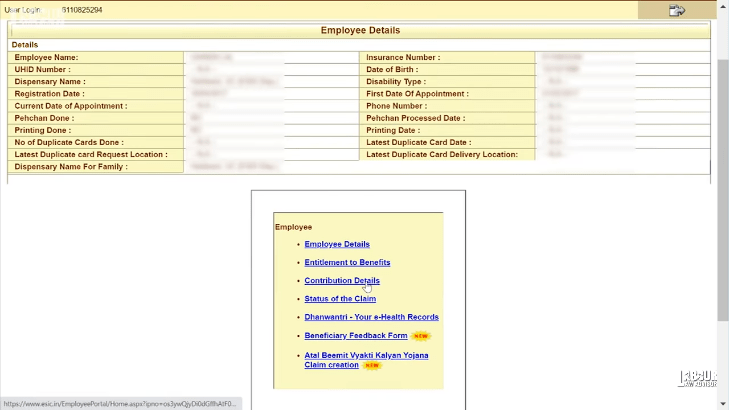

- Visit the ESIC member portal.

- Login with your Username and Captcha.

- A new window will appear with all your ESIC member details. There will be a flashing topic – Atal Beemit Vyakti Kalyan Yojana Claim Creation. Click on it.

- In the next page if you get the option to fill in the details from parameters “From Date” and “To Date”, then you are eligible for the unemployment allowance scheme.

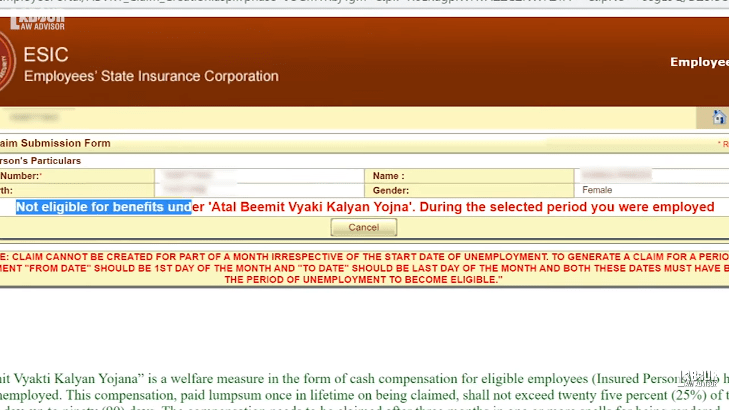

- If on the other hand, you get the message “Not eligible for benefits under Atal Beemit Vyakti Kalyan Yojana. During the selected period you were employed” then you are ineligible for this scheme.

Disqualifications reasons from ESIC unemployment scheme

- If IP has voluntary resignation from employment or voluntary retirement or premature retirement.

- IP is unemployed on attaining the age of superannuation.

- If IP was convicted (i.e. punished for false statement) under the provisions of Section 84 of the ESI Act read with Rule 62 of the ESI (Central) Rule.

- On being re-employed elsewhere during the period he/she is in receipt of Relief under ABVKY.

- Dismissal/termination under disciplinary action.

- On the death of IP.

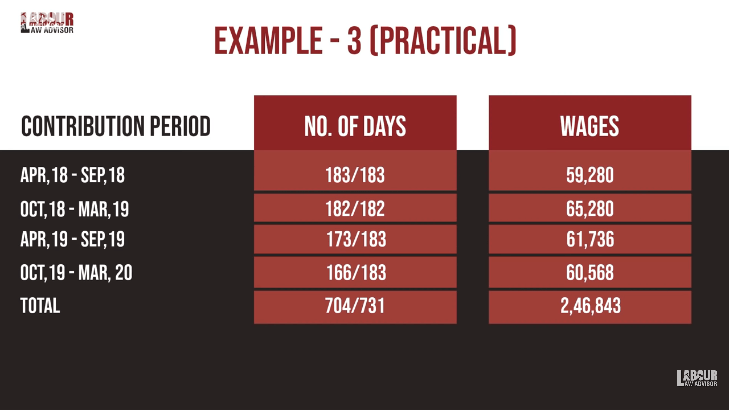

ESIC unemployment allowance calculation

It is important to note here that member can claim the ESIC unemployment allowance benefit only once in their lifetime. This benefit will only be equal to 90 working days. Members can either take the full 90 days benefit in one go or break it up into minimum 30 days benefit. It is not possible to claim benefit for less than 30 days. Furthermore, it is only possible to claim benefit from the first to the last date of a month. Also, it is not possible to claim benefit for only some days in a month.

Following are some ESIC unemployment allowance calculation examples.

Example 1 – Benefit under regular conditions

| CONTRIBUTION PERIOD | NO. OF DAYS | WAGES (Rs.) |

| Oct ’18 – Mar ’19 | 182 | 60,000 |

| Apr ’18 – Sept ’18 | 183 | 60,000 |

| Oct ’17 – Mar ’18 | 182 | 60,000 |

| Apr ’17 – Sept ’17 | 183 | 60,000 |

| TOTAL | 730 | 2,40,000 |

AVERAGE DAILY SALARY = (2,40,000/730) = Rs 328.76

AMOUNT OF RELIEF/ BENEFIT AVAILABLE FOR 90 DAYS = 328.76 x (25/100) x 90 = Rs. 7397

Example 2 – Benefit under regular conditions

| CONTRIBUTION PERIOD | NO. OF DAYS | WAGES (Rs.) |

| Apr ’18 – Sept ’18 | 80 | 26,667 |

| Oct ’17 – Mar ’18 | 183 | 60,000 |

| Apr ’17 – Sept ’17 | 78 | 26,000 |

| Oct ’16 – Mar ’17 | 78 | 26,000 |

| TOTAL | 419 | 1,38,667 |

AVERAGE DAILY SALARY = (1,38,667/419) = Rs. 330.94

AMOUNT OF RELIEF/ BENEFIT AVAILABLE FOR 90 DAYS = 330.94 x (25/100) x 90 = Rs. 4274

Steps to check your ESIC unemployment allowance amount

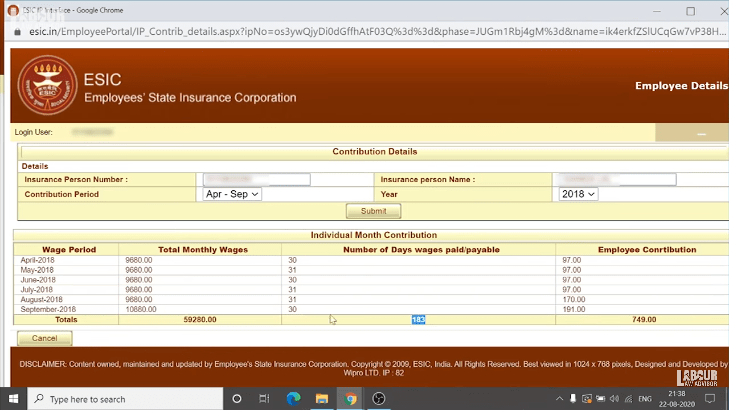

- Visit ESIC member portal and login to your account.

- Click on Contribution Details.

- On the next page, select the Contribution Period as Apr-Sep and Year as 2018. This will thus display the total monthly wages, total no. of working days, and employee contribution for the employee.

- Similarly, we can find the parameters for all the Contribution Periods in all the years of employment.

- Then calculate the total no. of working days and total wages for the entire employment period.

- Lastly, calculate the Relief Amount for COVID period with the formula = (total wages/total no. of working days) X 0.50 X 90

How to claim ESIC unemployment allowance benefit?

- Visit the ESIC member portal.

- Login with your Username and Captcha.

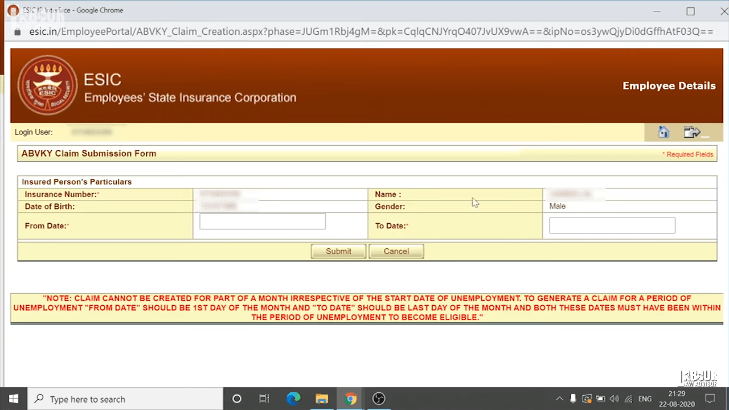

- A new window will appear with all your ESIC member details. There will be a flashing topic – Atal Beemit Vyakti Kalyan Yojana Claim Creation. Click on it.

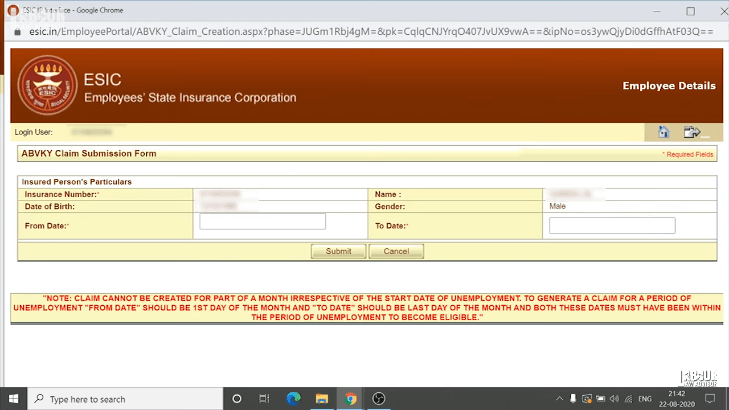

- In the next page if you get the option to fill in the details from parameters “From Date” and “To Date”, then you are eligible for the unemployment allowance scheme.

- The “From Date” can only be a date after your date of exit from job. Then the “To Date” cannot be a date in the future, but a date which has already passed or the current day. Moreover, both the dates can only be the first and last dates of any month, and not from the middle of any month.

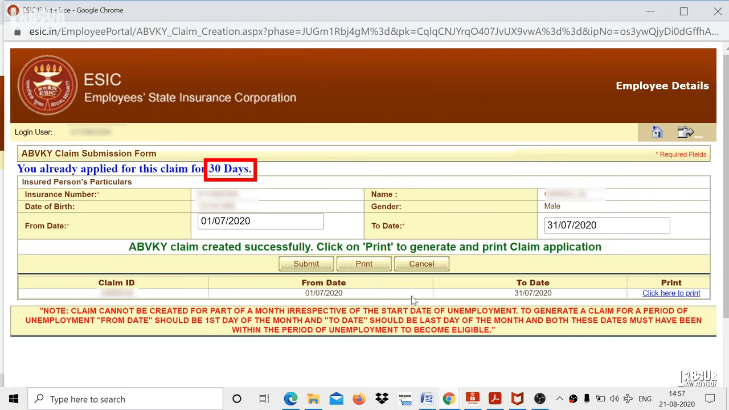

- Once you submit this claim there is no option to delete or edit it.

- Even if the month contains more or less than 30 days, it will still count the month as 30.

- Enter the Insurance Number, Name, Date of Birth, Gender, From Date and To Date and click on Submit.

- A message for successful claim filing will appear.

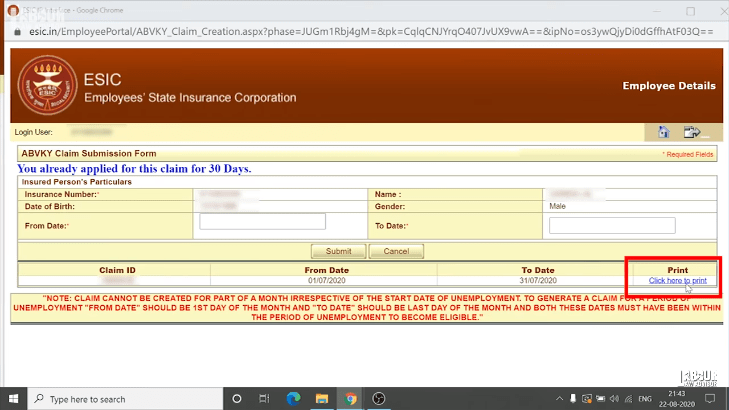

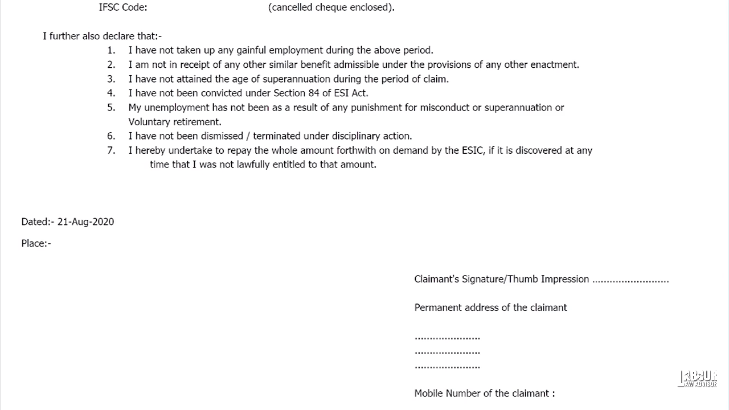

- Now, click on Click Here To Print and download the document.

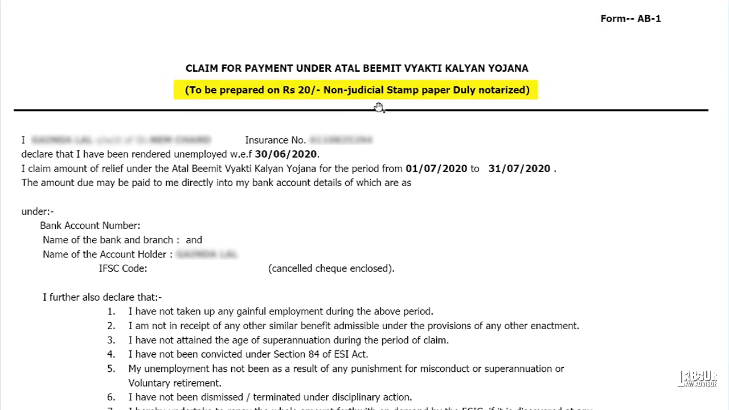

- Furthermore, print this document on a Rs 20 worth of non-judicial stamp paper which will also have to be get notarize.

- Next, attach a cancelled cheque with the document as well as write your bank account details on it.

- Finally, at the end of the document write your location, signature, permanent address and mobile number.

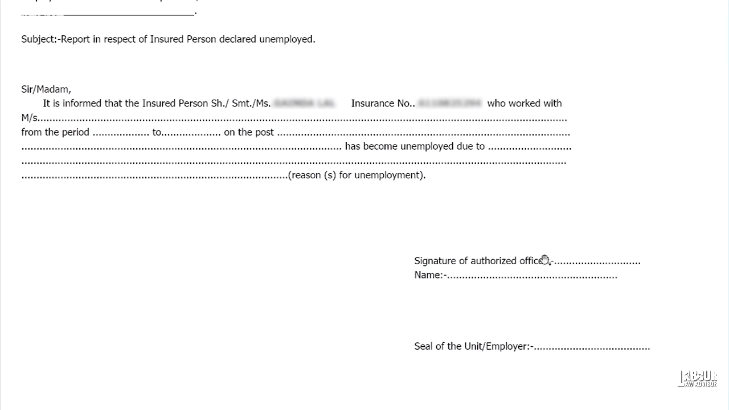

- Duly note the consecutive second part of the document which is Form AB-2. You do not require to fill this during the ongoing pandemic period but can do so after when applying for the claim.

- So Form AB-2 requires you to write your location, employer’s details, employment details, employer’s signature, name, as well as employer’s seal.

- Simultaneously attach your ID proof as Aadhaar card or PAN card while submitting your claim form.

- Lastly, submit one copy of this claim form at the ESIC copy and get a stamp with the receiving date as proof of your submission on a second copy, from the ESIC office.

Watch full video below for further details on ABVKY ESIC unemployment allowance scheme.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!