Employee State Insurance Corporation has a lot of benefits for you. ESI contribution, filing and checking are as easy as pouring a glass of water from the jug today. In the era of online functionality, you can do almost everything online. By using the ESIC online portal you can update, check and keep all your records safe. If you want to know how to update your Aadhaar card, your family’s Aadhar details and check what medical benefits you have unlocked then continue reading.

Table of Contents

Steps to check ESI contribution, Benefits and Aadhaar Card Update

First, you need to go to the ESI member portal and provide your employee login credentials. There is no password but fill the captcha and provide the correct IP number. After that, you can check your details on page 1. Your employer must update the dispensary number and the Aadhaar number. These two are the most essential information that will entitle you to receive all the benefits.

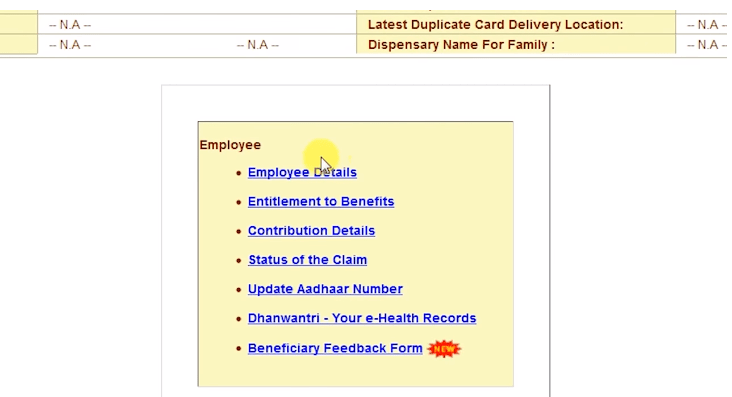

Apart from that, you can check the details about ESIC E-pehchaan card. If your department is not issuing any identity card then, you can yourself make your E-pehchaan card. An employer can give you the details by downloading the card. Let us have a detailed view on how you can proceed for checking your ESIC contributions and benefits step by step. The following are the name of the links that will lead you to the detail section.

Part 1 – Employee Details

In this section, you can fill the credentials of your family member as a nominee or beneficiary so that they can enjoy the benefits. You can update nominee Aadhaar number by clicking on the Update Nominee Aadhar Number and further update their information. Your employer can update the details about your family members Aadhaar card by seeding the number.

Part 2 – Entitlement to Benefits

After you have checked the details and credentials for you and your family members, you can click on the link Entitlement to Benefits. Upon clicking on this link, the page consisting of all your employee details is viewable. You can easily check what are the benefits that you can access and what are the levels that you have already unlocked. For example, there is a section for Super Speciality for IP which covers the cost of diseases like cancer, its operations and all other additional costs. The contribution for 2 years will entitle you to unlock this benefit and if you succeed then cost related to the operation, medicine, OPD and food will be covered under ESIC.

Part 3 – Contribution Details

On the ESI contribution page, you can check all your contribution details. All your payments are recorded here. There is a drop down menu which will enable you to choose the month so that you can further take notice of your monthly contributions. On the right side of the page, you can find the drop down year menu, where you can check the contribution history. Moreover, the details regarding your wage during that period and what were your earlier contributions are all stacked here at the ESIC portal.

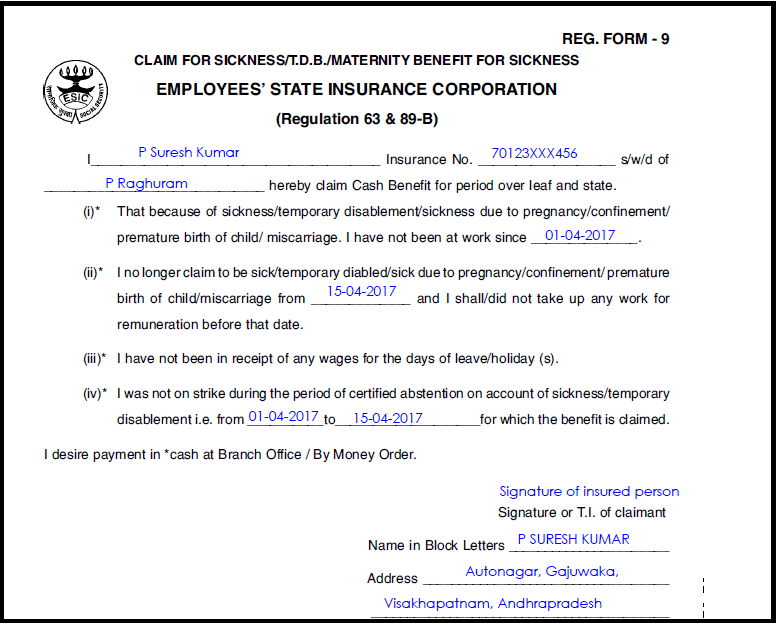

Part 4 – Status of the Claim

If you have claimed for any benefit then you can check its details regarding date, time and reason all under this link.

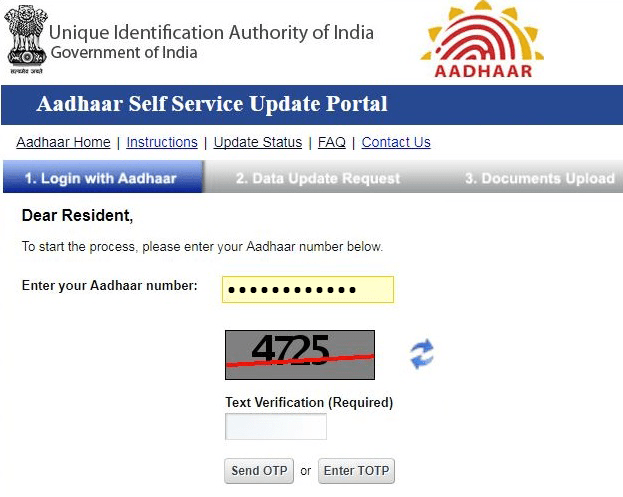

Part 5 – Update Aadhaar Number

This is a very essential section for the ones who have requested for an E-pehchaan card. Simply seed in your Aadhaar card number on the ESIC portal and link it with your profile.

Part 6 – Dhanwantari – Your e-Health Records

A very helpful initiative by the government is that you can save your health records. This includes all the OPD prescriptions in a PDF format. You can download and keep it with yourself. The online portal will help to reduce the wrongdoings among the departments too.

So, this was the complete guide on how can you check your ESI contribution, benefits and update your Aadhaar details. Keep checking your ESI member portal to update yourself with the relevant information, know when your employer has updated your details and what is the information that you have missed. If you switch from one company then make sure you provide your IP details to your new employer so that your contributions keep on adding and you can unlock other benefits.

For more information on ESI calculation read our blog to get valuable insights.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!