The Employees’ State Insurance (ESI) Act 1948 provides financial security for medical reasons like maternity, disability, etc., to employees of a factory and their dependents. This ESI calculation applies to non-seasonal factories using power, who employ 10 or more employees and non-power using factories who employ 20 or more employees. Both the employers and the employees contribute towards the ESI Act 1948. The Employees’ State Insurance Corporation (ESIC) is a statutory corporate body under the ESI Act 1948. It is responsible for the administration of the ESI Scheme.

Table of Contents

What is the ESI Act 1948?

According to the government, the ESI Act states “The promulgation of Employees State Insurance Act, 1948 envisaged an integrated need based social insurance scheme that would protect the interest of workers in contingencies such as sickness, maternity, temporary or permanent physical disablement, death due to employment injury resulting in loss of wages or earning capacity. The Act also guarantees reasonably good medical care to workers and their immediate dependants.”

Don’t worry, it’s not as complicated as it seems. The ESI Act is basically an insurance scheme for employees, with many benefits for them and their families. It ensures employees against a wide range of issues. So far, the ESI Act has reached out to over 2 crore employees and their families. Over 150 multi-speciality hospitals and 15,000 dispensaries are covered by the ESI Act 1948.

When is ESI registration applicable?

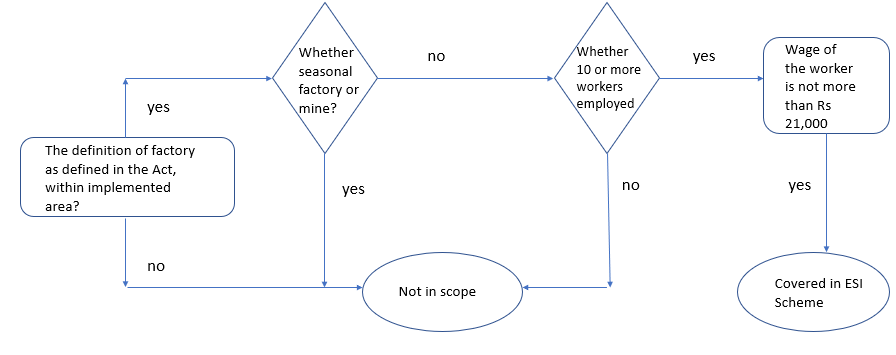

ESI Act 1948 is applicable for all companies with 10 or more employees, with the employee earning a monthly wage of Rs 21,000 or less. The ESI calculation includes employees working in restaurants, motor road transports, newspaper establishments and undertakings, movies and purview theatres, hotels, shops, etc. Following flow chart diagram demonstrates the applicability of this scheme:

Benefits of the ESI Act 1948

- Medical Benefit: All medical expenses of the employee are taken care of. This is applicable for the employee from the first day of his employment.

- Disability Benefit: An employee is paid his monthly salary for the full duration of his injury if it is temporary disablement. A permanent disablement ensures salary for his entire lifetime.

- Maternity Benefit: A total of 100% of the average daily wage is paid to the employee for a duration of 26 weeks from the time of labour. In case of a miscarriage, it is paid for 6 weeks, while in case of adoption it is paid for 12 weeks. Learn more on this in Maternity Benefit Details.

- Sickness Benefit: If an employee is on medical leave, then he receives 70% of the average daily wage for a maximum duration of 91 days, in 2 consecutive periods.

- Unemployment Allowance: In the case of involuntary employment loss or permanent invalid state arising from a non-employment injury, the employee receives a monthly payment for a maximum duration of 24 days.

- Dependent’s Benefit: If the employee loses his life while at work then his family members receive monthly cash payments.

Other benefits applicable to the ESI Act 1948 are:

- Confinement Expenses

- Funeral Expenses

- Physical Rehabilitation

- Vocational Training

- Skill Upgradation Training under Rajiv Gandhi Shramik Kalyan Yojana (RGSKY)

ESI Act 1948 contribution rates

All employees earning under Rs. 21,000 per month contribute 0.75% of their salary while their employer contributes 3.25%, as of July 2019 revisions. This makes the total ESI contribution of 4%. The employer can apply for an ESI scheme registration within 15 days from the moment the ESI act is applicable for his company.

Here’s an example to explain to you the scheme. If an employee earns Rs 10,000 per month then he contributes Rs 75 while his employer contributes Rs 325 towards his ESI scheme. Thus, the employee’s total ESI for that month will be Rs 400 (=75+325); he will receive Rs 9,925 (=10,000-75) in hand. His CTC (Cost To Company) for that month will be Rs 10,325 (=10,000+325), assuming no other act is applicable such as PF, bonus, etc.

A video guide for the article in Hindi.

ESI contribution late payment interest/damages

ESI contribution has to be made every month. The last date of ESI contribution payment for any month is the 15th of the succeeding month. This means that you need to pay the ESI challan for the month of April before the 15th of May. If you miss your payment deadline before the 15th of the month, then you are susceptible to additional interest and damages on your total ESI due amount. The employer incurs a late payment interest of 12% per annum. On the other hand, the damages incurred are on the basis of slab division. These damage slab categories are as follows:

- 0 to 2 months delay – 5% pa.

- 2 to 4 months delay – 10% pa.

- 4 to 6 months delay – 15% pa.

- Over 6 months delay – 25% pa.

These are the rates of the additional damages that you need to pay in the case of delay of ESI payment. But the total damages amount cannot exceed 100% of the total due amount. Even the total interest cannot exceed the total due amount. Let us understand this in simple terms in the following example.

Example

- Suppose your total due amount is Rs 1 lakh and you have delayed it for 1 year.

- In this case, your calculation for the first two months will be on 5% interest which is equal to 100000*(5/100)*(2/12). Thus, Rs 833.33.

- If you delay it for a further 2 months which can now equal to a total of 4 months, then your interest rate will be doubled. But, the calculation will be the same as per the previous formula which is equal to 100000*(10/100)*(2/12). Thus, Rs 1666.66.

- Similarly, if you further delay it for another 2 months which is now equivalent to a total of 6 months, then you will be entitled to pay 15% interest. This will be equal to 100000*(15/100)*(2/12). Thus, Rs 2500.

- Following the same process for another 6 months, your calculation will be 100000*(25/100)*(6/12). Thus, Rs 12,500.

- Now, if want to calculate the total damage for 1 year, simply calculate the sum of the last four calculations and that will be equal to your total damage. Thus, total damages = Rs 17,499.99.

Furthermore, the interest of 12% per year will have to be paid. This is equivalent to 1% per month.

What should you do?

We recommend not to take this issue lightly and let your damages and interest amount accumulate. Instead, it will be a wise decision to make the ESI payment before the due date. The ESI department may not send you any immediate notice when your payment is delayed. This might happen due to delay in their procedures but you will receive the notice later nonetheless. In various companies, the ESI department has even sent the notice after 5 years. So, make sure to make your payment on time to avoid any penalty.

Types of ESI Act 1948 late payment notices

There are mainly three types of ESI notices as follows:

- C-18(I) (INTEREST). This notice has the total interest amount which you need to pay. It is possible to defend this notice by appearing before the ESI department and putting forward your case. If you are deemed not guilty, then this interest amount will be cancelled.

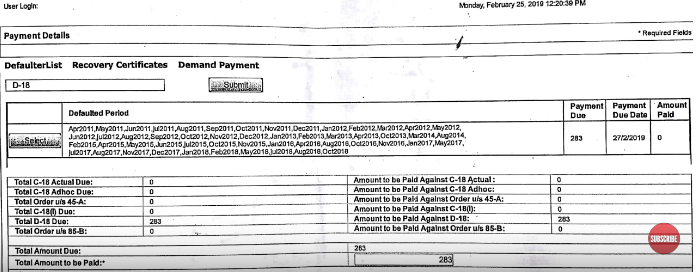

- D-18 (DAMAGES). This notice has the total damages which you need to pay. It is possible to defend this as well in the similar manner to the above notice.

- C-18 (ADHOC). This means that the amount given in notice is not final. Let us understand this notice better with the help of an example.

Example to support C-18 (ADHOC) Notice

Suppose there is a firm in Jaipur under which 100 employees work together. Eventually, the firm shifts from Jaipur to Jodhpur. So the ESI number that was there for the employees in Jaipur is no more existent. It is shifted to Jodhpur now. But the employer has not submitted the closure letter of the Jaipur branch of the firm. Hence, the sudden closure of contribution charges for a long period of time can make the ESI authorities believe that you are saving your money. Furthermore, they will also believe that 100 employees are still working in your Jaipur firm. In this case, if more than 10 months have passed and you still have not submitted the ESI contribution amount, then the ESI department will assume the above fact and will send you a notice regarding the same that your amount is due.

Additionally, they will also charge you with extra damages and interest. If you are thinking that the ESI department will not come to know about your due charges, remember that through inspections they can always find out how many month’s payments is due from your side.

What does ADHOC mean in this case?

ADHOC here means the amount charged as due is not final. You will be given 15-20 days time span to present your case and fight the amount mentioned. Suppose after presenting your case you notice that the due amount has reduced or turned to zero, then, in this case, a new notice will be issued against you which is named as C-18 (ACTUAL). This new notice will have the final settled amount which you will have to pay.

If you choose not to fight against such notices, then the ESI authorities assume that the entire fault was yours. Furthermore, they will also state that the amount is correct and you are entitled to pay that particular amount. Also, whatever will be the final amount, you need to pay it through the ESI employer portal.

What happens if you don’t fight/pay the penalty after the issue of notice?

When you neither fight back nor pay your due ESI amount and your 15-20 days time span lapses, then the ESI department will send you a show-cause notice under Section 45(A). The show cause notice will clearly depict that it is your final warning. The final warning will state “either pay the amount or fight it”. If you decide to fight after getting the show cause notice, then you cannot go forward with it unless you pay 50% of the due amount. After you pay 50% amount, you have to present your case in front of the regional EPF commissioner and the final words of the RPFC will be the final decision. But, in case, you are not satisfied with the decision of RPFC, you can also take the case further to the court.

What happens if you don’t pay even after all the notices?

If you still choose to not pay the amount after all the previous notices, then under section 45(H) you will be given another show-cause notice. It will be stating “If you do not pay the amount now, you will be arrested”. After that, an arrest warrant will be issued, and you will actually be arrested.

A detailed video on these notices is given below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!