The Employees’ Pension Scheme (EPS) was launched in 1995. It is a social security scheme by the Employees’ Provident Fund Organization (EPFO). This scheme provides financial assistance to employees who have been working in an organized sector post their retirement at 58 years of age. But the scheme is only eligible for those employees who have been in service for a minimum of 10 years. This service may not be a continuous one though. In this article, we talk about the different facets of EPFO Pension Withdrawal as well as the calculation for pension. Along with the process for submitting pension related grievances.

Table of Contents

EPS contribution in EPF

Under PF scheme, there are 3 contributions as follows:

- EPF (Employee Provident Fund Scheme): 15.67% of basics + DA.

- EPS (Employee Pension Scheme): 8.33% of basics + DA.

- EDLI (Employee Deposit Life Insurence): 0.5% of basics + DA.

Maximum pension limit in EPS

As of September 2014, the maximum contribution limit of EPS was Rs 15000 (of Basic+DA). Thus, you can add 8.33% + DA which amounts to Rs 1250. Prior to September 2014, the upper limit was Rs 6000, wherein you can add Rs 542.

What if Service Period is less than 9 years 6 months?

When is Pension Withdrawal Possible?

If your total service duration is more than 6 months but less than 9 years 6 months, then Pension Withdrawal is certainly possible. If your service duration is more than 9 years 6 months then you are eligible for a pension but you cannot withdraw your pension money. Also, if your service is less than 6 months then you cannot withdraw your pension.

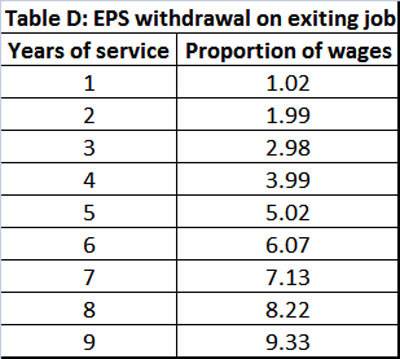

How much Pension money can you Withdraw?

You will not receive the full funds in your EPS account. The pension withdrawal calculation amount is different. This calculation is explained in Table D by the EPFO as follows –

Hence if your service is less than 1 year, then your pension withdrawal calculation amount will be 1.02 times of your basic salary. This equals to 1.02 times your average basic salary for one year. For example, if your basic salary was Rs 10,000 then the EPFO will pay you Rs 10,200 as a pension. Similarly, if your service is under 2 years, then your pension withdrawal amount will be 1.99 times of your basic salary and so on.

Point to note here is that the EPFO adjusts your service duration by 6 months. So, anything above 1 year 6 months is considered as 2 years. Similarly, anything below 1 year 6 months is considered as 1 year.

How to proceed with EPFO Withdraw Pension Amount?

You will need to fill out FORM 10C. There is a UAN based and a non-UAN based version of this FORM 10C. You can withdraw your pension funds via it. For more details watch this video.

What if You Do Not Withdraw Pension Amount?

The best solution, in this case, would be to attain a Scheme Certificate. A scheme certificate is a record of your service duration in all your past organizations. This will help you to show proof of your 10 years service, to make you eligible for a Pension. This is also attainable via filling up FORM 10C. Get the full details of this here.

Does pension attract Interest?

No, you do not get any interest on your contribution to EPS. But it is possible that during the pension withdrawal process you withdraw more amount than the amount of money you have contributed to the EPS. But you will only get interest upon the Provident Fund part which is 15.67% of your Basic+DA.

When do you start receiving pension?

Once you attain the age of 58 years, you begin receiving your pension even if you are working in a job. After that, all your pension starts to add to your Provident Fund account rather than your pension amount. There is also a concept of early pension. The main criteria of early pension is that you must be less than 50 years and unemployed. Although, if you start an early pension then you have a loss of 4% on your pension amount annually.

What are the minimum and maximum limits of Pension

The Modi government has increased the minimum limit of pension to Rs 1000 while the maximum limit is Rs 7500.

Pension Calculation Formula

Member’s Monthly Pension Amount = (Average Pensionable Salary X Pensionable Service) / 70

Average Pensionable Salary OR Average Basic Salary

The average pensionable salary, also known as average basic salary, is equal to the average monthly (basic+DA) salary of the member’s last 5 years. For example, your basic salary was Rs 10,000 for 3 years and then Rs 12,000 for 2 years. Then your average monthly salary will equal to Rs 10,800 {(3×10000)+(2×12000)/5}.

But there is a vital point to note here. After September 2014, the maximum average monthly salary that will be considered is Rs 15,000. Thus, even if your basic salary is Rs 50,000, then also Rs 15,000 will be taken as your average monthly basic salary for your pension calculation. Likewise, for pension calculation before September 2014, Rs 6,500 would be the cap on the average basic salary for pension calculation. Hence, if a person wants to know his pension on 1st September 2018 and his average basic salary is more than Rs 15,000, then his average basic salary for pension calculation formula would equal to {(15000×4)+(6500×1) / 5}.

Thus, the maximum pensionable income for the last 5 years can be up to Rs 15000 only.

Since the employer contributes 8.33% of this salary in the employee’s EPS account, the amount deposited in the EPS account of the employee every month is Rs {15000x(8.33/100)} = Rs 1250.

Pensionable Service

The actual service period of the member is his pensionable service. The service duration under each different employer is added to get the actual pensionable service period. The employee needs to get an EPS Scheme Certificate issue for himself and submit it to his new employer each time while changing jobs.

To be eligible for a pension, an employee must have a service duration of 10 years (or, 9 years 6 months). If an employee has less than 10 years service then he is not eligible to get a lifelong pension. He can only withdraw his accumulated EPS amount. The maximum pensionable service duration allowed is 35 years for pension calculation formula. If the employee completes service of 20 years, then he is eligible for a bonus of 2 years in his pension calculation formula. So including the bonus years also, the pensionable service period cannot exceed 35 years.

Pension Calculation Formula Example:

Maximum average pensionable salary can be Rs 15000.

The maximum pensionable service period can be 35 years.

Thus, the maximum monthly pension amount can be (15000×35)/70 = Rs 7500.

The minimum monthly pension amount can be Rs 1000. This is set to increase soon.

But, there is a person who has been able to increase his monthly pension to Rs 30,500. He is Mr Praveen Kohli who was able to increase his pension amount from Rs 2372 to Rs 30592. Catch his story on pension calculation here.

To know more about pension withdrawal and calculation, watch the following videos:

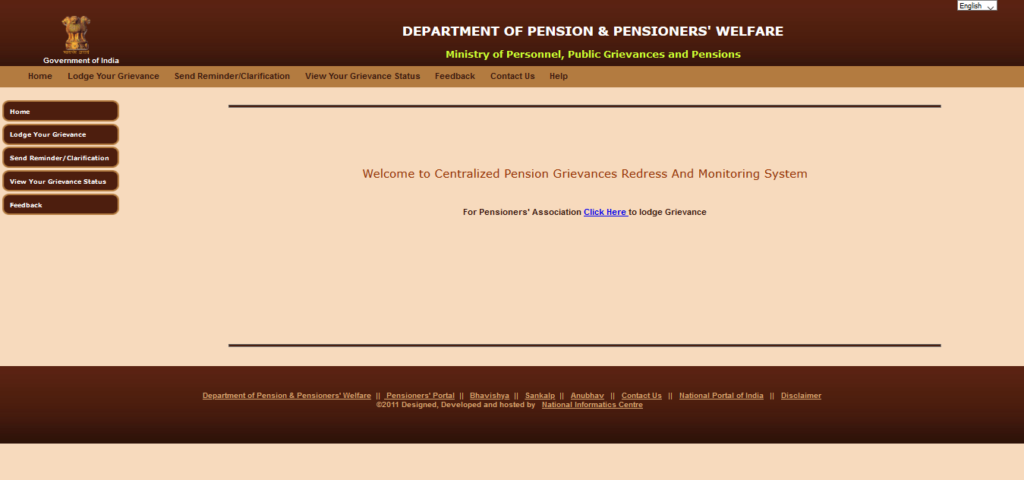

Pension Grievance System – Solution to every pension problem

The Department of Pension and Pensioners’ Welfare runs the Centralized Pension Grievances Redress And Monitoring System. This online redressal platform provides solutions to all retired pensioners’ grievances. This is particularly helpful for retired government employees. If one has been running around various government offices to address an issue with their pension account, but to no avail, then this place helps them with immediate effect.

Steps for pension grievance complaint registration

- Visit the website, Centralized Pension Grievances Redress And Monitoring System.

- One does not need to log in or register anywhere on this website. Simply click on Lodge Your Grievance on the left of the page.

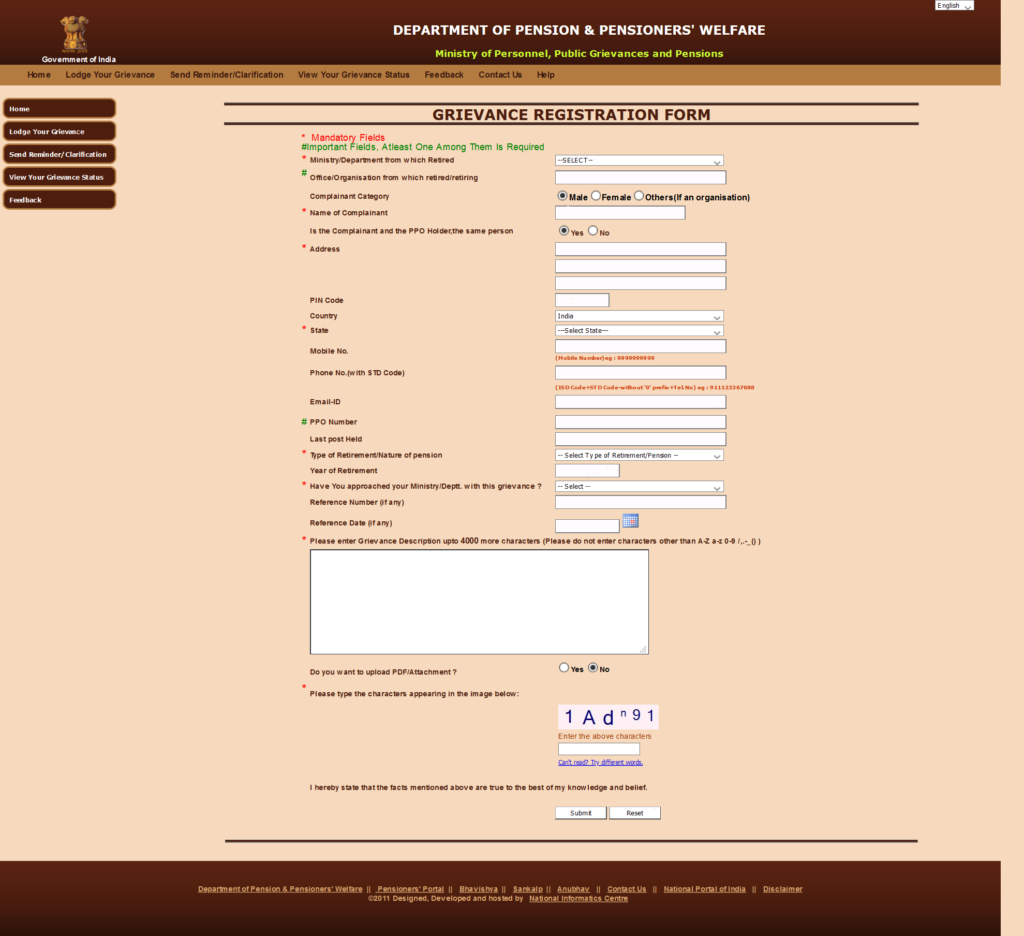

- This will open a new form for submission. In the form, select your Department from the drop-down list, mention your Office, your pension details, KYC details and more.

- It is important to note here that if you provide your correct email id and phone number then you will receive timely updates of your grievance status on these.

- Under the point, “Please enter Grievance Description upto 4000 more characters”, give the details of your pension-related problem.

- There is also the option to attach a PDF as proof.

- Lastly, enter the captcha and click on Submit. You can also submit this complaint on behalf of another pensioner.

- Next, you will receive a complaint number on your email id or phone number. Ensure to keep this complaint number safely for future reference of the complaint status and redressal.

- You will get updates regarding your complaint on your email id to which you can further reply.

- You can also check your complaint status on the same website under the tab, View Your Grievance Status.

- If some considerable amount of time has passed with no response to your complaint, then click on Send Reminder/Clarification for an update.

Steps for complaint status check

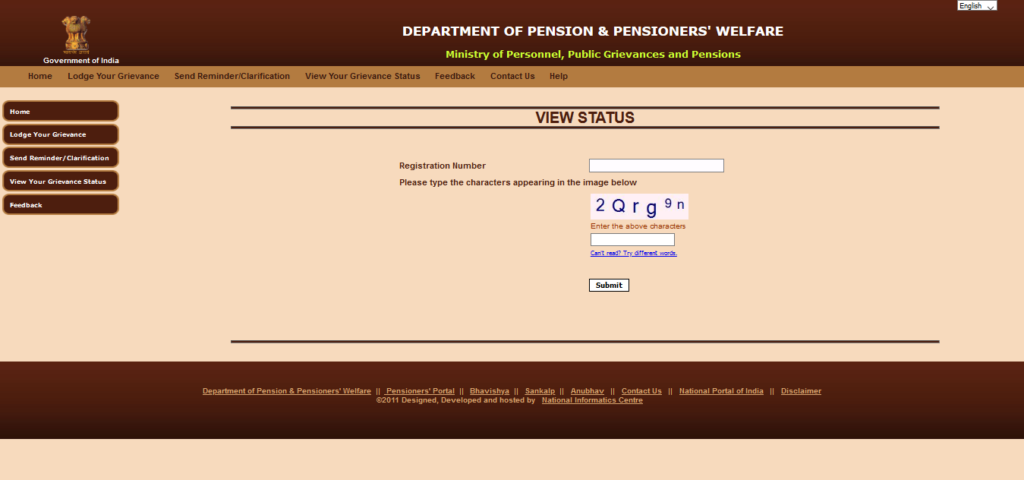

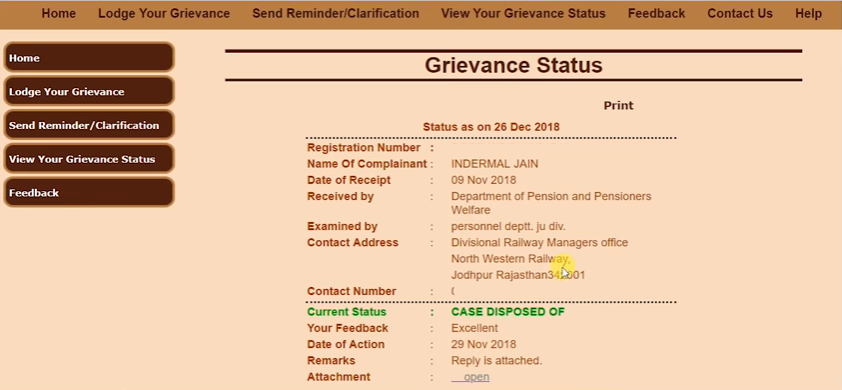

- Go to the website Centralized Pension Grievances Redress And Monitoring System.

- Click on View Your Grievance Status.

- Input your Grievance Registration Number and Captcha and click on submit.

- This will reveal a full description of your complaint, the status of it and all other details of the process. Any other documents send by either party will also be visible here.

Watch the full process of pension grievance redressal system below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!