EPF (Employee Provident Fund) is a monthly savings scheme for an employee to provide financial stability during his retirement. Both employee and employer contribute towards this scheme. EPF is mandatory for all companies having above 20 employees. In the following blog, we will view the EPF interest and damages incurred upon the late payment of EPF challan.

Table of Contents

EPF Payment Deadline:

The deadline for submitting the EPF of your employee for one month is the 15th of the next month. Hence, if you have to deposit EPF for your employee for January 2019 then it has to reflect in their EPF account by the 15th of February 2019. Otherwise, the EPF payment is considered as late.

EPF Return Deadline:

According to the new ECR, EPF filling and payment can both occur simultaneously. Thus, the EPF return deadline is the same as the EPF payment deadline, that is on or before the 15th of each month.

| TYPE | DEADLINE |

| EPF payment | On or before 15th of every month |

| ECR filing | On or before 15th of every month |

EPF Late Payment Penalties:

Upon late payment of EPF challan, two arrears ensue on the employer as follows:

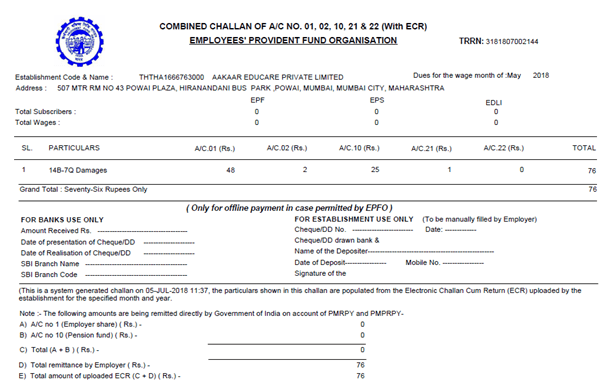

1. EPF Interest for Late Payment under Section 7Q

When an employer fails to deposit the EPF contribution before its deadline, then he is liable to pay an EPF interest of 12% p.a. for every single day that there is a delay in EPF payment.

2. Penal Damages for Late Payment under Section 14B:

Depay in EPF contribution by the employer incurs penal charges, as follows:

| NO. OF MONTHS DELAYED | PENALTY RATE APPLICABLE |

| Delay for up to 2 months | 5% per annum |

| Delay ranging from 2 months to 4 months | 10% per annum |

| Delay ranging from 4 months to 6 months | 15% per annum |

| Delay exceeding 6 months | 25% per annum (which may correspondingly go up to 100%) |

These penalties keep accumulating and are informed to the employer via official notices from the EPFO. These penalties can also be contested in the future, but there is little chance that the employer would get a waiver if the EPF payments have actually been delayed.

How to pay PF Damages Challan?

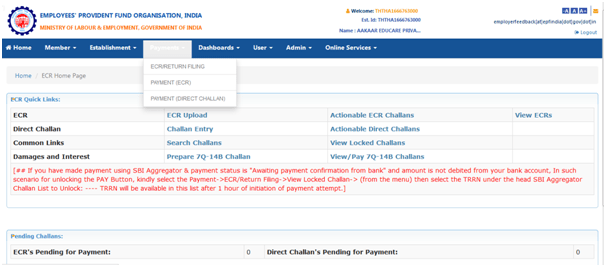

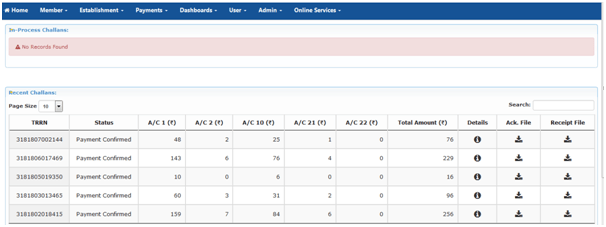

To pay the EPF interest and penal damages for late payment of challan go to the EPFO website. Under the drop down tab PAYMENTS, click on DAMAGES AND INTEREST. The total penalty amount will be automatically calculated for you.

Formal Proceedings for Non-Payment Of EPF Penalties:

Even after all the served notices if the employer does not pay his due penalties and EPF interest, then the following proceedings happen:

How to Determine the Amount Due from Employer?

PF Commissioners are authorised to pass an order on this, under Section 7A of the EPF Act.

This could be the Central PF Commissioner, or any Additional Central PF Commissioner, or any Deputy PF Commissioner, or any Regional PF Commissioner or any Assistant PF Commissioner.

The order applied:

- If there’s a disagreement over whether the EPF Act applies to a particular establishment or not.

- In this case, the PF Commissioner can decide the issue and determine the amount owed by the employer under any EPF, Pension Scheme or Insurance Scheme.

- They can also conduct any necessary inquiries for any of the aforementioned reasons.

The officer in charge of conducting the inquiry will possess the same powers as that of civil court in terms of following topics:

- enforcing the attendance of any person or examining him under oath

- requiring the discovery and procedure of documents

- receiving evidence on affidavit

- issuing commissions for the examination of witnesses

Furthermore, the employer must be given reasonable opportunity to represent his case.

If the concerned employer/employee fails to attend the inquiry without a valid reason or fails to procure valid documents or returns, then the officer in charge has the authority to pass an order against that person determining the amount he has to pay, etc. All of this will be done based on the evidence acquired during the inquiry.If order passes ex parte, employer may set it aside within 3 months either by showing that the notice was not duly served upon him or by showing that, due to some sufficient cause he was prevented from appearing in the inquiry. However, such a request will not be accepted if it appears to the officer that the employer had sufficient time to appear before the officer.

Do I Have Remedy Other Than Appealing Such Orders Passed By PF Commissioners?

The employer aggrieved by an order made under Section 7A, even with filing an appeal, can apply for a review if they discover new and important matter or evidence that was not within their knowledge or could not be produced at the time.

The officer who issued the order will carry out the review, but he must be satisfied that there is a valid reason for the request; otherwise, the application will be rejected.

An application for review has to be filed in the form prescribed in the Scheme but will not be granted:

- Without prior notice to all the parties

- On the ground of discovery of new matter or evidence which applicant asserts was not within his knowledge

An appeal can be filed against the order of review.

Employer to Receive Notice for Recovery of Final Amount

Section 7C states that once the order of amount due has been determined under Sections 7A and 7B and the officer has reason to believe that the employer has not disclosed all of the material facts necessary to correctly determine the amount or that the amount has been incorrectly determined, the officer may reopen the case, pass appropriate orders, and re-determine the amount due from the employer within 5 years from the date of communication of the order passed under Section 7A or Section 7B.

In this case, however, the employer must be given a reasonable opportunity to be heard.

How to Appeal to the EPFAT?

The employer can appeal to a higher court against the order passed if he feels that it is not fair.

We hope you found this article helpful. For any more queries, watch our video below:

Also please check out more such important topics covered in our blog – Labour Law Advisor.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!