Many of you have a common question in your mind regarding PF’s employee pension scheme certificate and how to acquire the same and what all are the benefits it holds?

However, the accumulated pension amount can be withdrawn using Form 10C after 180 days of continuous service and before completion of 10 years of the service period.

To start with this let us breakdown the Provident Fund into two categories:

The first one is an Employee’s Provident Fund which is like a pension scheme for the ones who are not in a job or retired. Easy to say it is the funds saved for your retirement life.

The second one is the Employee’s Pension Scheme, for the ones who are pretty responsible with their hard earned savings. Few of them do not withdraw the entire pension fund just after retiring. Moreover, if required they go to refund back their provident fund but do not touch their pension fund. Hence, they

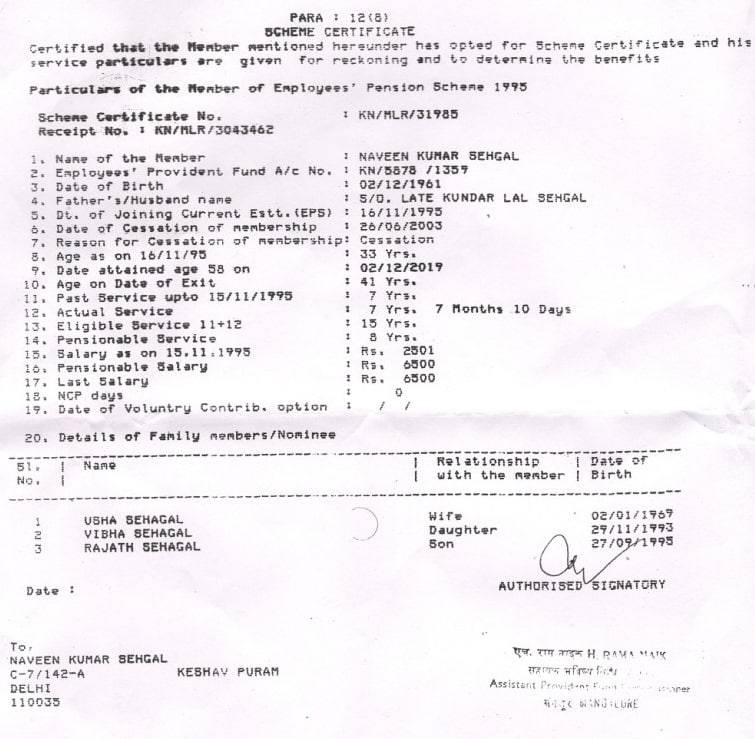

When your total service period is more than ten years, you directly become eligible for pension scheme certificate. Whenever you turn 50 or 58 years of age, you become likely to get your pension scheme started. Read on to know more about the pension scheme certificate, how to apply and acquire it and why will you need it in the first place?

Table of Contents

What is Provident Fund’s Employee Pension Scheme Certificate?

Let us assume that you have the basic idea about PF and employee pension scheme. A pension scheme is tailored to provide you with earnings after your retirement. Generation of Interest is not in the scenario, however, depending on formula this is an assured way to secure your savings and seek financial help from it once your work life comes to an end.

Now after retirement when you go to withdraw your provident fund, you are provided with the option of two forms. Form 19 and Form 10C, wherein filling the Form 19 will refund your provident fund and F

Few of the responsible citizens who are well aware and concerned about their retirement, withdraw the provident fund but leave out on the pension fund.

Assuming you have not worked for the same organisation for ten straight years, but the Provident Fund department is not aware of this change of yours. For this case, you have to apply for your pension scheme certificate. You can apply for your pension scheme certificate even if your work experience is less than six months.

You have to accumulate all the supporting documents along with the pension scheme certificate and submit to the PF department at the age of 58 years to start earning your pension under the same scheme.

Always keep in mind that the scheme certificate is only available to you on an offline basis.

How to apply for the Employee Pension Scheme Certificate?

To apply for the above-said scheme, you have to fill in the Form 10C for claiming withdrawal benefit/scheme.

A brief idea about the Form 10C:

The form starts with the name of the member and the name of claimant. If both are going to be the same, then fill the same details for both the cases. Job details for the company you have last worked for, including date of joining and service leaving date. Also, you have to fill in other details like regional code, account number, and family details. You have to attach birth certificate and copies of Aadhar card of yours and for all the family members you mention in the form.

If you have taken a break from your job due to unavoidable circumstances, then do not forget to attach that certificate as well. However, once you have thoroughly finished filling the form, send it to the PF office and wait for your pension scheme certificate. For the ones who have joined a new organization to continue their work life, they need to fill Form 11 and mention the scheme certificate no in the 9 (C) section. Once you are leaving the organization, you have to once again apply for a new pension scheme certificate. Furthermore, accumulate all these scheme certificates once you turn 58 or after retiring to enjoy the earning benefits from the pension scheme.

You can also check out our blog on the EPF Act and amendments.

To read more such important articles, check out our blog page.

To easily understand the application procedure for Employee Pension Scheme Certificate, check this video of ours:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!