The Securities and Exchange Board of India (SEBI) brought about the Direct mutual fund plans back in January 2013. This made it mandatory for all Asset Management Companies (AMCs) to give an option to their customers for direct vs regular investing in mutual funds. But what is the difference between direct vs regular mutual fund investment and which one is the more profitable option? Read on to learn!

Table of Contents

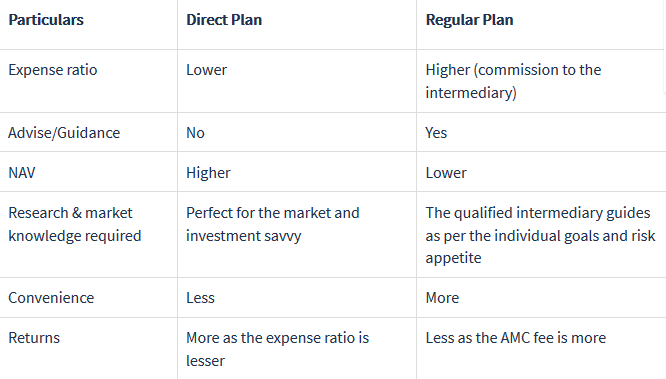

Direct Vs Regular Mutual Funds – The Difference:

Direct and Regular are two options for buying the same mutual fund scheme. This scheme may be run by the same fund manager and have investments in the same stocks and bonds. The only parameter differing between direct vs regular scheme is that in regular schemes the AMC has to pay a distributor’s commission to the broker. Meanwhile, in the

Rather, in the direct scheme, the commission is added to one’s investment balance. Thus it reduces the expense ratio of the whole mutual fund scheme and increases returns over the long term.

Case Study:

For example, Mr X and Mr Y invest in three mutual fund schemes. These investments occur via a monthly SIP of Rs 5000 for each scheme on April 1st 2014. Mr X chose the option of Regular scheme while Mr Y chose direct scheme. After 5 years, the value of their investments are as follows:

Difference in investments after 5 years:

| Particulars/Schemes | Mutual Fund A | Mutual Fund B | Mutual Fund C |

| Mr. X (Regular plan) | Rs. 4,00,335 | Rs. 3,63,967 | Rs. 4,05,544 |

| Mr. Y (Direct plan) | Rs. 4,10,115 | Rs. 3,64,837 | Rs. 4,14,396 |

| Difference | Rs. 9,780 | Rs. 870 | Rs. 8,852 |

Here’s a comparative analysis of the average expense ratio and average returns of the direct and regular plans of mutual funds across different fund categories.

Average Expense Ratio of Regular and Direct Mutual Fund plans:

| Fund Category | Regular Plan | Direct Plan | Difference |

| Equity | 2.02% | 1.22% | 0.80% |

| Debt | 0.90% | 0.42% | 0.48% |

| Hybrid | 1.96% | 0.98% | 0.98% |

Source: Value Research, Data as on March 31, 2019.

As the table above shows, on average, a person earns 0.50%-1% more per annum by investing in a direct plan rather than the regular plan for the same mutual fund scheme.

Why Is Direct Plan Better Than Regular Plan?

- Direct plans have a lower expense ratio.

- Direct plans also have a higher return due to reinvestment and compounding of the

amount which gets paid as commission in regular mutual fund plans.

Why Invest in a Direct Plan of a Mutual Fund?

Direct plans are a good option for those people who wish to invest in mutual funds schemes directly dealing with the fund without any intermediary. Fund Managers can generate better returns by reducing their expense ratio. The commission when removed increases the

In the case of direct mutual fund plan, investors are advised to do their own market research and select top-performing mutual fund schemes. The investors can do the analysis by reaching out to mutual fund websites and blogs to know more about the suitable mutual fund schemes.

Direct plans work best for those who want to increase their returns by investing directly through the fund and can manage all the documentation on their own. While the process may look a little complex in the initial stage, it should be comfortable while investing in further schemes.

Watch our video on this topic below.

Another interesting read: Mutual Funds – SIP Vs Lump-Sum

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!