Indians have always loved possessing gold. It signifies a sort of economical status as well as works well as a future investment. Since mutual fund investment is sometimes risky to invest in, gold can be the better more stable option. But in today’s day and age one is not limited to possessing gold in the physical sense. One now also has the option to buy gold digitally. So what is digital gold investment and how does the procedure work? This article covers all important facets of digital gold investment.

Table of Contents

Why is gold investment a good option?

Whenever the stock market goes through tumultuous times, the value of gold always rises. When the stock market crashed recently due to the global pandemic, your equity investments would have seen a loss. At that time, having gold investment would have been a saving grace. Since gold prices rise even if the stock market crashes and are highly liquid. Therefore, we suggest having atleast 10% of your total investment in gold. This will provide a safety net if your equity funds run a loss and you need to withdraw cash urgently.

What is digital gold?

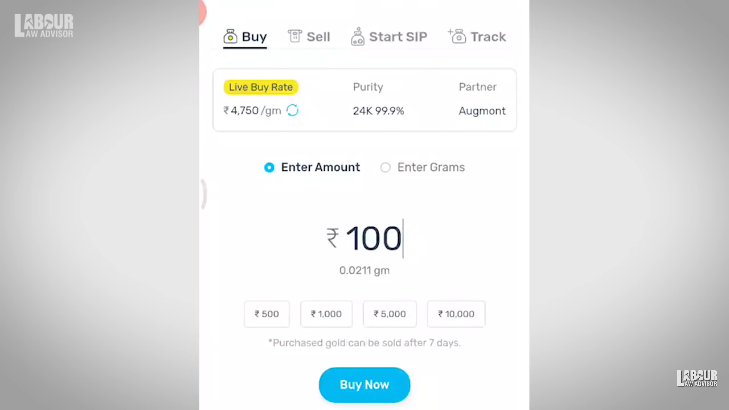

Digital gold gives you the opportunity to purchase 24-carat gold digitally which is also 99.9% pure. You have the option of investing a minimum of Rs 100 in digital gold. This is similar to buying gold physically except you will not possess it physically. This is also an advantage since you do not have to worry about making charges, purity, storage and liquidity issues. Digital gold investment provides a transparent means to buy and sell gold digitally.

Digital gold is issued by the state-owned MMTC (Metals and Minerals Trading Corporation of India), which is associated with PAMP (Produits Artistiques Métaux Précieux), Switzerland, who is a global leader in branding bullion. You can buy digital gold via an app online. The allotted gold in your name will be stored separately. You have the option to sell this gold using the same app. Additionally, you also get the option to get the digital gold delivered to you, upon request.

Cons of buying physical gold

- When buying gold physically from a store, you have to pay more than the actual gold price. The extra payments is the jewellery making charges for the jeweller. Thus, making the whole purchase a little more expensive.

- There is always also a question on the purity of the gold you are purchasing from a physical store. There is no way to find out if the gold sold is what the jeweller says and you just have to take his word for it.

- Keeping gold at home is also risky business, as it is prone to theft or even being misplaced due to carelessness.

- Moreover, gold require polishing after a couple of years to keep it looking shiny and new. The design of the gold jewellery may also go out of fashion and require additional making charges to update it.

All these reasons make physical gold not the best option for investment or purchase. Since the amount initially invested in purchasing the gold does not give the same return.

Advantages of digital gold investment

- This investment is highly liquid. You have the option to sell it, convert it into cash, or have it physically delivered with no lock-in period.

- It has the ultimate ease of buying with the touch of a button on your smartphone. All you have to do is download an app for it. No need to physically go somewhere or check for the authenticity of the product.

- Similar to mutual funds where stocks are registered under your name when purchasing them, regardless of which app or dealer you use, digital gold investment is also registered under your name and stays so even if the app used to buy it ceases to exist.

Disadvantages of digital gold investment

- You do not get any interest on the digital gold investment you make. This is true for physical gold purchase as well.

- Like you pay GST when purchasing physical gold, you also have to pay GST when purchasing digital gold.

Who sells digital gold online?

MMTC (Metals and Minerals Trading Corporation of India), SafeGold and Augmont are some of the companies selling digital gold in India. You buy your digital gold from one of these companies via a mediator which is the app. The app makes the entire process of purchase super easy. It in no way makes the app handle your gold purchase physically, so your purchase stays safe with the original company.

Tax on digital gold investment

If you purchase and sell a digital gold within a period of three years then it becomes a Short-Term Capital Gain (STCG). This incurs a tax as per the income tax slab rate. If you purchase and hold digital gold for longer than three years then it becomes a Long-Term Capital Gian (LTCG). This incurs 20% tax plus 4% cess. But you also get the benefit of indexation with it. Indexation takes note of the inflation rate and compares the price of your gold purchase accordingly to help you save tax on your profit.

Things to remember before buying digital gold

- Before using any app to purchase digital gold you must check a few things. Primarily you need to check the minimum delivery quantity which the app allows. So that if our digital gold purchase is lower the the delivery quantity, the app does not refuse to deliver it to you later.

- Each app has a minimum and maximum limit for purchasing digital gold without your KYC details. For instance, Google Pay allows purchase up to Rs 50,000 without KYC. Thereafter, it becomes mandatory to do your KYC on the app else it blocks any future digital gold purchases.

- Some apps may not allow you to hold digital gold indefinitely for an unlimited duration. Once the duration is over you can either sell it for cash or have it physically delivered. So you need to check the maximum duration the app allows to hold digital gold.

Steps for digital gold investment

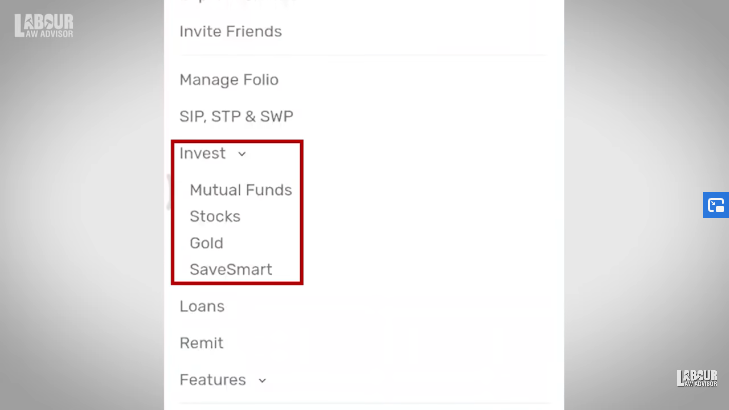

- Download the Kuvera app and use code LLAYT for a discount.

- Open the Kuvera app and click on the top-left menu icon.

- Scroll down and click on Gold option under Invest.

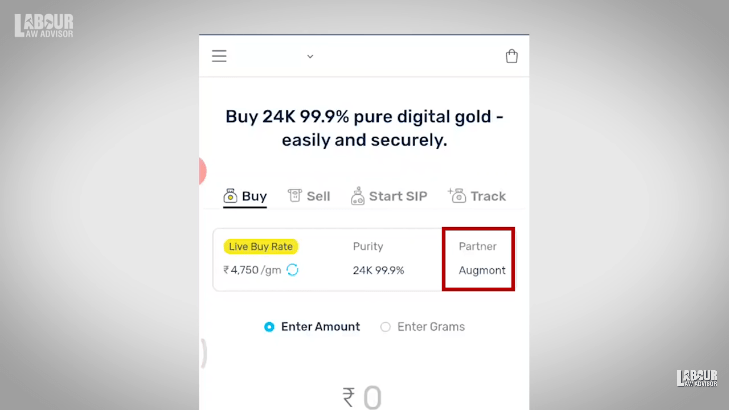

- The next page will display information regarding the digital gold being sold – its purity, purchase rate and purchase company which is Augmont in this case. Hence, Kuvera is purchasing digital gold from Augmont under your name, on your behalf.

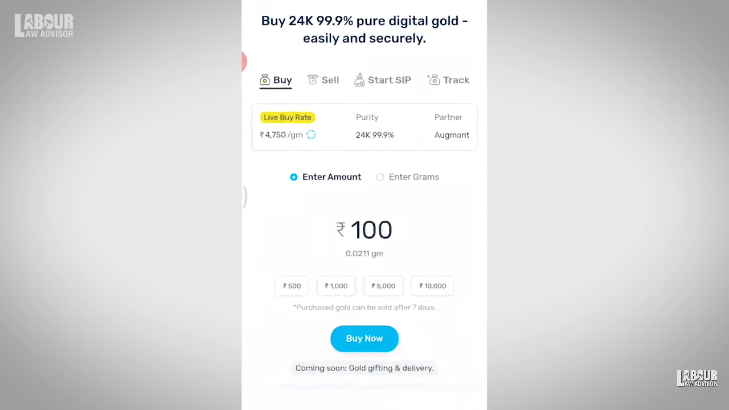

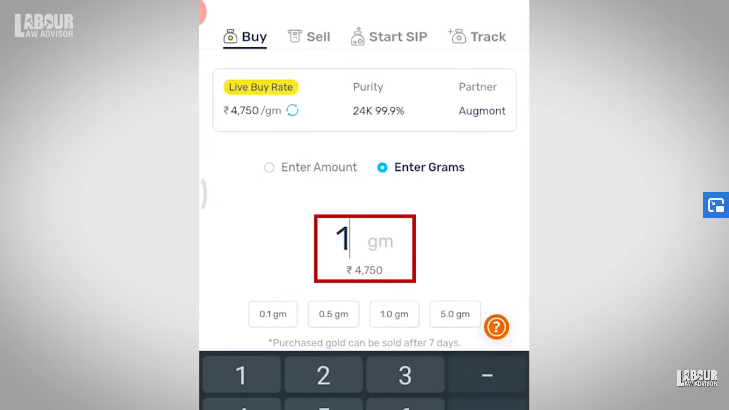

- There are three methods of purchasing digital gold. Firstly, you can purchase by entering the amount you want to invest by choosing Enter Amount. This will reveal the amount of digital gold against the purchase amount you enter.

- Secondly, you can enter the amount of gold you want to purchase and it will reveal the amount of gold it will convert to physically. For this, you can select the option for Enter Grams.

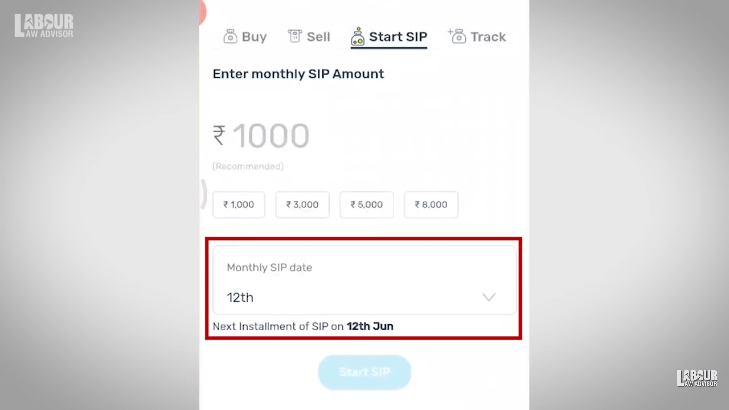

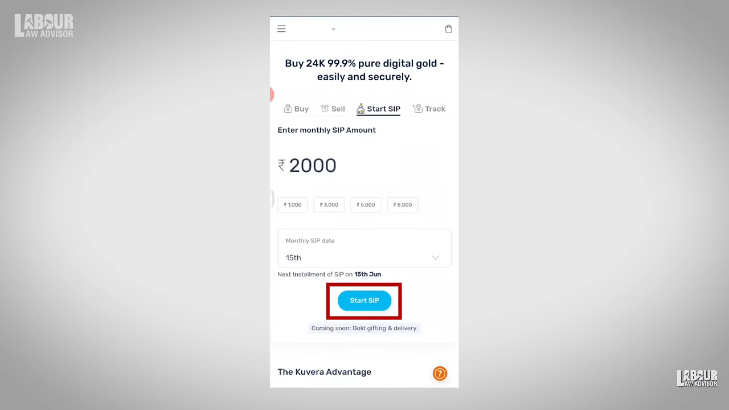

- Thirdly, you can select the option of Start SIP. This can begin with a minimum investment of Rs 1000. You can also set a specific date every month when your digital gold is automatically purchased. Once the amount and date are entered, click on Start SIP to begin.

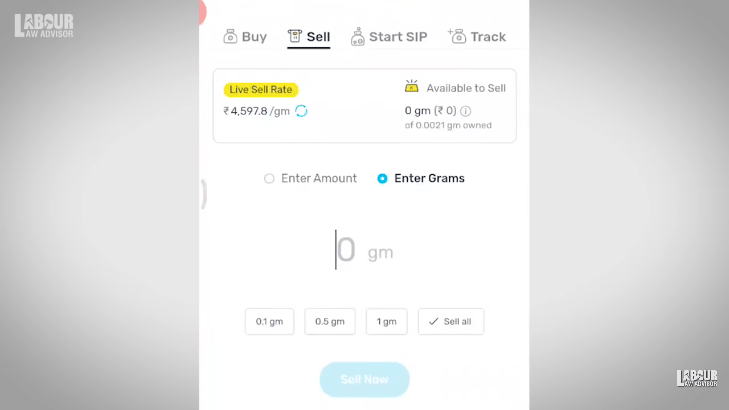

- Similar to buying digital gold, you can also sell it by selecting between the options of Enter Amount or Enter Grams.

- To buy, select the Buy tab and enter the amount or grams. Then click on Buy Now.

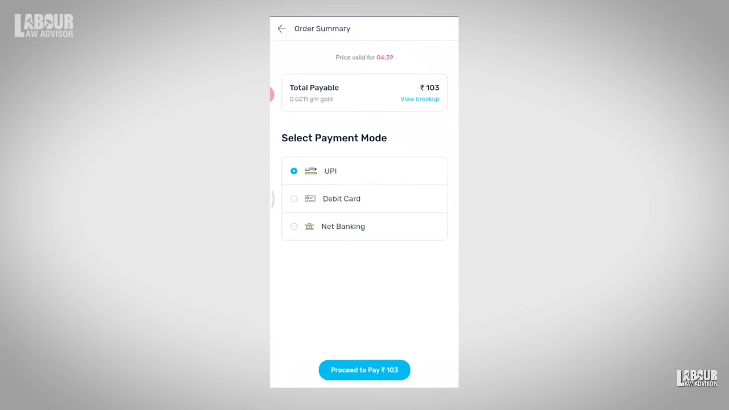

- The payment page will open next and give you the option to pay via UPI, debit card or netbanking. You can also click on View Breakup to view the amount distribution towards actual gold purchase and GST.

- Select your payment mode and click on Proceed to pay.

- Next, you get the option to choose the UPI app you want to use for payment and complete the payment. Once you receive the payment notification on your UPI app, go ahead and complete the payment.

- Once complete, you will receive a message congratulating you for the digital gold purchase. Click on Continue.

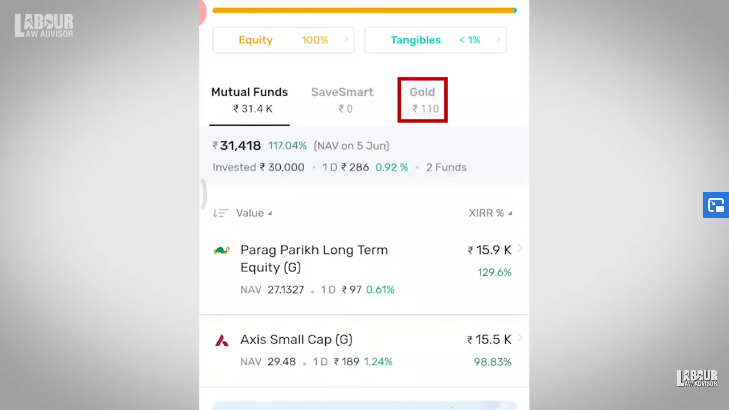

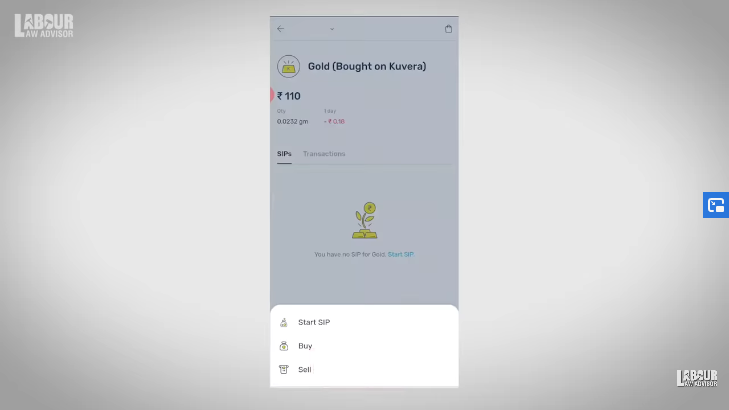

- Next open the Kuvera app again and go to Portfolio option from the Dashboard. This will display all your investments, with Gold tab showing digital gold investments.

- You can select the gold and click on Buy|Sell|Manage to choose between Start SIP, Buy or Sell.

Watch the full process in the video below.

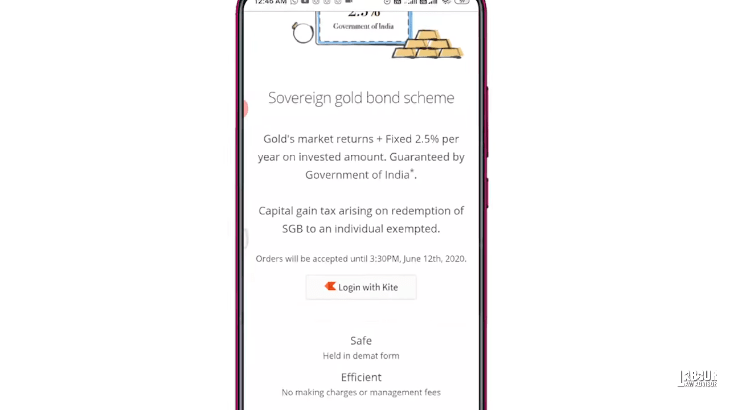

What is sovereign gold bond?

Sovereign Gold Bonds or SGBs are government securities denominated in grams of gold. These are great substitutes to purchase instead of buying physical gold. Investors have to purchase SGB via cash and can redeem the bonds for cash upon maturity. SGB is issued by the Reserve Bank of India (RBI) on behalf of the Government of India five times in a year. For the year 2020, the dates of issue are as follows:

| TRANCHE | DATE OF SUBSCRIPTION | DATE OF ISSUANCE |

| SGB 2020-21 Series I | April 20th – 24th, 2020 | April 28th, 2020 |

| SGB 2020-21 Series II | May 11th – 15th, 2020 | May 19th, 2020 |

| SGB 2020-21 Series III | June 8th – 12th, 2020 | June 16th, 2020 |

| SGB 2020-21 Series IV | July 6th – 10th, 2020 | July 14th, 2020 |

| SGB 2020-21 Series V | August 3rd -7th, 2020 | August 11th, 2020 |

| SGB 2020-21 Series VI | August 31st – September 4th, 2020 | September 8th, 2020 |

The maturity period for SGB is 8 years. Thus, you can buy SGB from RBI at the current gold rate and sell it back to RBI at the gold rate prevalent then. This will be a profitable investment. You also get a physical certificate as a proof of purchase for buying SGB. Additionally, you can avail premature withdrawal after 5 years if necessary. You can also get early redemption every 6 months, after holding the bond for 5 years. You can even extend your maturity for 3 more years after completion of 8 years. Whenever you redeem your SGB through RBI, it will be completely tax free.

Read RBI’s notification on SGB and FAQs.

Advantages of SGB

- Since it is issued by the RBI it can be deemed secure and safe.

- You receive an interest of 2.5% per annum on your SGB investment which is credited to your bank account every 6 months. Although this is calculated always on your initial investment amount and does not compound as the years progress.

- Unlike the purchase of physical gold or digital gold, you do not have to pay GST for purchasing SGB.

- Upon reaching maturity when you resell the SGB back to RBI, you do not have to pay any tax on your profit accumulated. Hence, it is LTCG exempt.

- You can apply for SGB both offline via banks and post offices and online.

- Moreover, you get a discount of Rs 50/gram if you select online application.

- If you mention your Demat account’s DP id on your application then you can view SGB under your holdings. This enables you to sell this SGB before 5 years, similar to stock trading. It is also important to note that ultimately RBI will buy back the SGB from the investor, and the gold prices that time may not be favourable or profitable. So, it is better to have your SGB under your Demat account for an extra tradeable option.

- You also have the option to use your SGB as collateral for bank loans.

- You can get SGB as a joint holding with another individual.

- There is also the option of filing a nominee for your SGB since it is an investment after all.

- You also have the option of partial redemption in multiples of one gram instead of selling your entire holding at one go.

- There are no making charges involved.

How is SGB price decided?

The purchase amount of SGB is equal to the average gold price of the last three working days. Similarly, when selling, the SGB price is calculated by taking average of gold price of last three days.

Tax on SGB investment

Upon reaching maturity of 8 years, the capital gain you receive from the SGB is completely tax free. In case of premature withdrawal after 5 years, the capital gain is still completely tax free. Similarly, after extension of maturity till 11 years, the capital gain will be completely free.

But if you trade your SGB via your Demat account in the stock market then you will have to pay taxes as per slab rate of gold. For STCG of under 3 years, the capital gain will be added to your income and taxed likewise. For LTCG after 3 years you will have to pay 20% tax plus cess with indexation benefit.

Things to remember before buying SGB

- SGB purchase is only possible during the issue window which occurs only 5 times in a year.

- You can purchase SGB from a commercial bank, post office, stock exchange or your Demat account.

- A minimum investment of 1 gram per person per year and a maximum investment of 4 kg per person per year is allowable under this scheme.

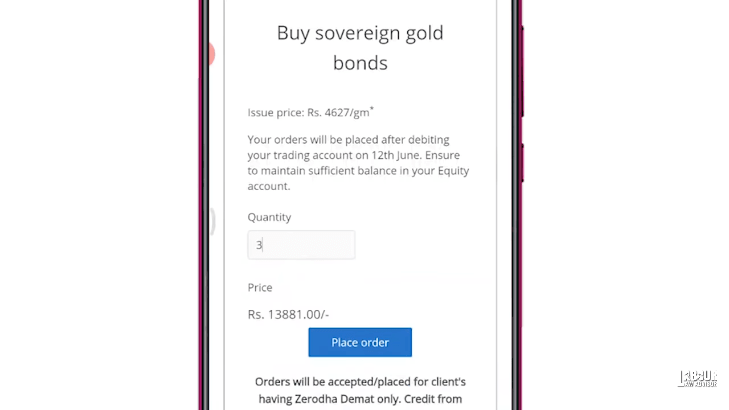

Steps to apply for SGB

- Open Zerodha account. Learn how to open Zerodha Demat & Trading Account and how to use the Kite app.

- Open Google Chrome and search for Zerodha.com/gold to open SGB scheme page.

- Click on Login With Kite and enter your login details.

- To place your order, type in the grams you want to purchase. The total payment amount will be reflected below. Then click on Place Order.

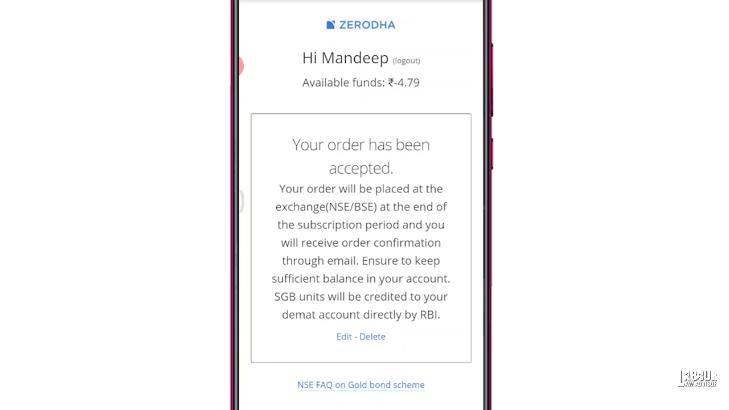

- You will get a confirmation message that your order has been accepted and will be placed at the end of the subscription period. You must ensure you have available funds in your account.

- If you click on Edit, you can go back and edit your order quantity.

- You can also place a fresh order by logging in to Zerodha again. Placing a new order will automatically cancel your previous one.

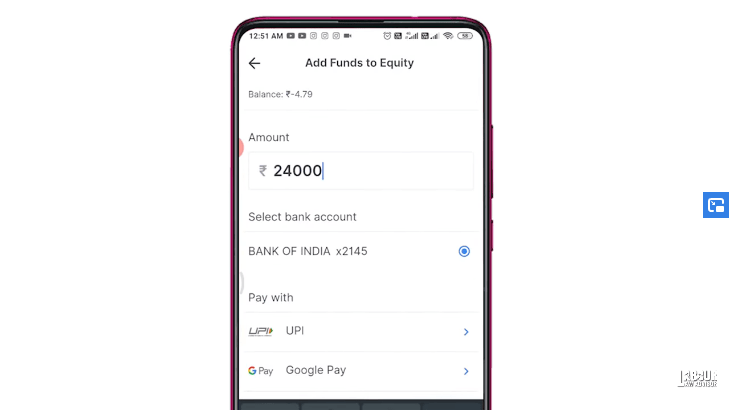

- To add funds to your Zerodha account, open your Kite App and go to Profile.

- Then go to Funds and click on Add Fund under Equity tab. Complete the payment to add the amount in your Zerodha account.

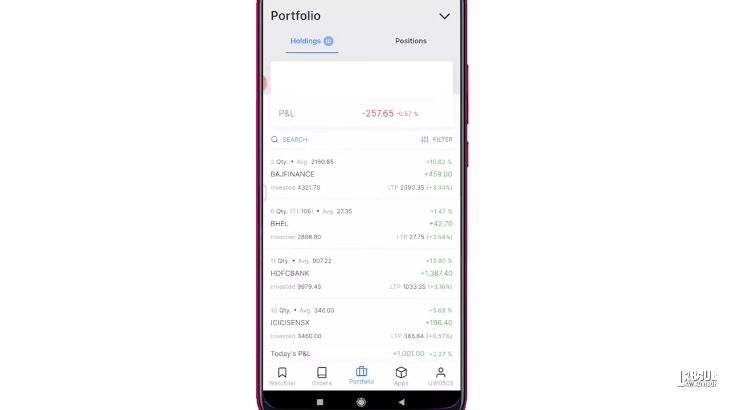

- Once your SGB is issued it will be viewable in your Zerodha Kite app under Portfolio, Holdings tab.

Bonus tip

You can always go to Zerodha Kite app and search for SGBs being sold. Here, you will find SGB at lower rates than RBI and you will not even have to wait for the issue window from RBI for purchase of SGB.

Watch complete video on SGB below.

What are ETFs?

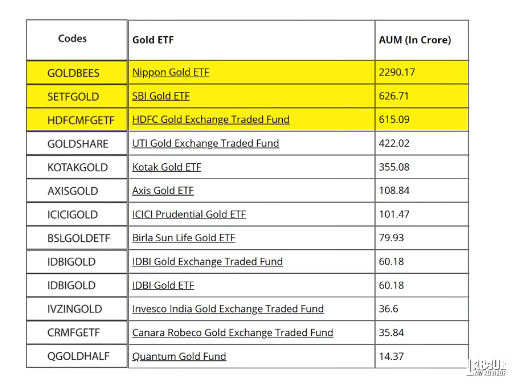

ETF or Exchange Traded Fund are of various types such as Sensex ETF, Nifty ETF, GOLDBEES – Nippon, SETFGOLD – SBI, HDFCMFGETF – HDFC, GOLDSHARE – UTI, KOTAKGOLD – KOTAK. In the case of Sensex ETF, your investment will be proportionately investment in the top 30 performing companies of Sensex. Sensex ETF will then perform directly proportional to Sensex. ETF is bought as individual units. The price of each ETF unit is NAV, similar to mutual funds. You can purchase ETF similar to purchasing stocks, using a Demat account.

What are Gold ETFs?

Gold ETF will invest your money in 99.5% pure gold. The investment is not limited to physical gold and can be broadened to RBI’s gold monetization scheme, gold company stocks, mining company stocks and likewise further gold related companies. So as per the rise and fall of gold prices your gold ETF investment will also rise and fall.

Gold ETF is managed by an Asset Management Company since the investment occurs over various companies. The Asset Management Company charges an expense ratio. The whole concept of gold ETF is similar to mutual funds.

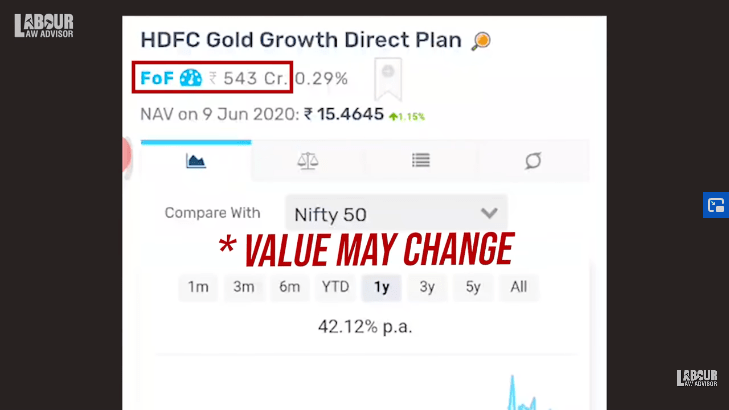

What are gold mutual funds?

Gold funds are a type of mutual funds but they cannot be accessed via demat account. You can access gold funds through a mutual funds app. Money invested in gold fund goes into gold ETF directly. So, you can either invest in gold ETF directly through your Demat account or invest into golf funds through your mutual funds app, which ultimately invests in gold ETF.

Gold ETF Vs Gold Mutual Funds

| Category | Gold ETF | Gold Mutual Funds |

| Purchase method | Via demat account | Via mutual funds app |

| SIP option | Unavailable | Available |

| Minimum investment | High, NAV of 1 gold ETF can be as much as price of 1 gram gold | Low, can start as much as Rs 500 |

| Liquidity | Highly liquid | Higher liquidity than ETF |

| Exit load | None. Can exit whenever you want | 1%-2% if exiting before one year duration |

| Expense ratio | Up to 1% | Up to 1.5% |

| Brokerage | As per broker | None |

| Tax | STCG before 3 years (as per tax slab) / LTCG after 3 years (20% + 4% cess) with indexation | STCG before 3 years (as per tax slab) / LTCG after 3 years (20% + 4% cess) with indexation |

| Physical delivery option | Available for minimum of 1 kg gold | None |

| Loan collateral | Unavailable | Unavailable |

Overall, Gold ETF has no exit load and a lower expense ratio than Gold Funds. But Gold ETF also does not have SIP option and the minimum investment can be on the higher side.

Why are gold ETFs/mutual funds better than digital gold investment?

Purchase of digital gold incurs 3% GST charges. Selling of digital gold incurs 3% spread. In total it means loss of 6% in digital gold investment. Whereas, gold ETF/gold funds incur additional costs of under 1.5% as the expense ratio. Hence, they are a better investment option over digital gold.

Important things to remember

- You must check the Asset Under Management (AUM) of any golf ETF before investing. This means that any ETF which does not have a lot of investment may not be very liquid and hinder you trying to sell it in the future.

- So only invest in gold ETFs with a high Asset Under Management (AUM) value. Some of the best gold ETFs with AUM are given in the image below.

- For checking the AUM for gold mutual funds, open your mutual funds’ app and search for any gold fund. The AUM will be given as the total investment at the top.

How to invest in gold ETF?

For gold ETF investment, you can use Zerodha app to open your Demat account. Learn the full process in How to open Zerodha Demat & Trading Account. For gold funds investment, you can use the Kuvera app. Use code LLAYT for a discount. Learn the full process in How To Invest In Mutual Funds Online.

Watch the full video on Gold ETF and Gold Funds below.

Reality of Physical Gold

The first step is to realize the reason for purchasing physical gold. If it is solely to wear it as jewellery then the return on this investment is negligible. However, if you want to buy physical gold for investment purpose then there is the option to purchase it as just pure 24-carat gold which is not as a coin or jewellery. Then there will be no GST or making charges involved. Otherwise, purchasing gold as jewellery to wear or as a coin will incur GST and making charges. Furthermore, we discuss the best option of purchasing gold as an investment.

Advantages of Digital Gold

- When purchasing digital gold, the company reserves your purchase and you do not need to physically store it anywhere. Hence, there is no issue of security concerns.

- There are no making charges involved hence lowering the price of digital gold. Although, there will be 3% GST charges applicable on it.

- The option to get physical delivery for digital gold is also available. But there may be additional making charges payment added then.

- There is no minimum investment requirement. You can buy digital gold for as little as Rs 1.

Disadvantages of Digital Gold

- Purchasing digital gold on any digital platform will incur GST charges of 3%.

- When reselling digital gold on the digital platform, you will not be able to sell it at the rate you bought it. The selling rate will be 3%-6% lower than the purchase rate. This rate difference is called Spread, which has multiple costs associated with it such as storage, insurance which the company will undertake on behalf of your purchase. There may also be some profit margin for the company involved.

Challenges of Digital Gold

- You cannot hold digital gold on the app indefinitely. At some point, you will have to either sell it or take physical delivery for it.

- If you choose to sell it then you will have to pay Capital Gain tax on it forcefully, when you just wanted to hold it.

- All three companies handling digital gold operations in India – MMTC, SafeGold, and Augmont, are unregulated. There is no authority keeping a watch on it like RBI or SEBI, which may have implications in the future.

Sovereign Gold Bond – Best gold investment option

As previously stated in this blog, the best way to invest in gold is through Sovereign Gold Bond (SGB). This trumps purchasing gold as physical gold or even digital gold. These bonds are issued by the RBI at certain intervals in the year. There are many advantages to opting for SGB as mentioned earlier. The process of applying for it is also pretty easy through an app. The issue dates for SGB for the year 2021 are as follows:

| TRANCHE | DATE OF SUBSCRIPTION | DATE OF ISSUANCE |

| SGB 2021-22 Series I | May 17th-21st, 2021 | May 25th, 2021 |

| SGB 2021-22 Series II | May 24th-28th, 2021 | June 1st, 2021 |

| SGB 2021-22 Series III | May 21st-June 4th, 2021 | June 8th, 2021 |

| SGB 2021-22 Series IV | July 12th-16th, 2021 | July 20th, 2021 |

| SGB 2021-22 Series V | August 9th-13th, 2021 | August 17th, 2021 |

| SGB 2021-22 Series VI | August 30th – September 3rd, 2021 | September 7th, 2021 |

Trick to get higher returns on SGB

Some people are able to sell their SGB at 5%-20% profit while others are able to buy SGB at discount rates. This trick lies at the stock exchange trading. When placing order on the stock exchange if you choose Limit Order option then you pick a price at which you want to sell/buy as asset. So the asset will sell/buy automatically when it hits that rate, else it wont. Alternatively, if you choose Market Order then you signal the stock market that you want to buy/sell the asset at whatever price it is available in the market at that moment.

The stock market will match Limit Order and Market Order and pick whichever option is applicable for you. This may result in loss for someone who chooses at buy at market price while profit for someone who chooses to sell at limit order price. Thus, it is recommended to never put Market Order for purchasing SGB. Rather choose Limit Order and select a price closer to market gold pricing.

Comparing Gold Investment Returns

Assuming that a specific amount has been invested in six gold investment instruments – physical gold as coin, physical gold as earring, physical gold as piece, digital gold, SGB and Nippon gold fund, as on 20th July 2016. We compare the returns on all these instruments on this excel sheet.

Pre-tax XIRR for all comes to:

| 6.84 – coin | 2.80 – earring | 9.02 – piece | 8.34 – digital gold | 11.6 – SGB | 8.99 – gold fund |

Post-tax XIRR for all comes to:

| 5.7 – coin | 1.7 – earring | 7.7 – piece | 7.1 – digital gold | 11.6 – SGB | 7.8 – gold fund |

Comparing all the values, SGB is giving the highest investment returns.

Conversion to physical gold

SGB cannot be converted to physical gold since you do not reserve any physical gold for it in the first place. Digital gold can be converted to physical gold albeit with a few extra charges. Gold ETF can be converted to physical gold only if you are holding minimum 1 kg of gold, else it cannot. The process involved for it is also quite tedious, hence not recommended. Gold mutual funds cannot be converted to physical gold.

Watch the video below for more information on return on gold investments.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!