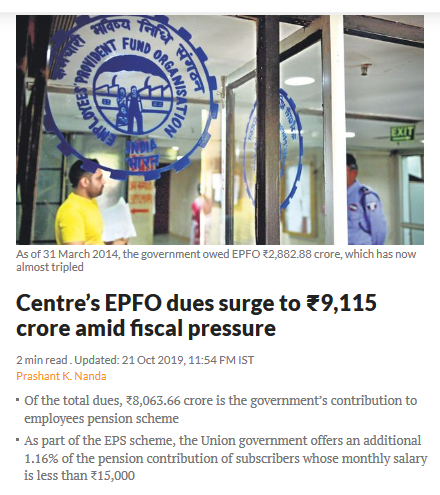

As we have previously stated in our other articles, 2019 has been a low year for the EPFO. Its investment of around Rs 7000 crore in the IL&FS is expected to lead to a major loss. Furthermore, the investment EPFO made in DHFL has also not resulted in acquiring any dividend, interests, etc. The board of trustees have even initiated the process of exiting from DHFL funds. The latest update in the situation says that the Central Government is yet to pay approx Rs 9115 crore to the EPFO. These funds from the Central Government are highly important in the financial schemes for the PF members. This delay is also the reason behind the delay in higher pension under EPS for all PF members. Let us discuss the scenario and its outcomes in detail in this article.

Table of Contents

Funding process in EPFO

In the case of Provident Fund (PF), 12% comes from the employee’s share and 3.67% comes from the employer’s share. Additionally, some part of it comes from the Central Government in the form of interests and dividends from investments. This PF money gets used up in full and final settlements for PF members when they withdraw their PF. Or when PF members withdraw their PF in advance. And some part of it is invested to get returns which can be further given as interests to PF members. Thus, it is important for the PF to always have a surplus.

Meanwhile, in the case of Pension Funds, the majority 8.33% share comes from employers. The other 1.16% comes from the Central Government for employers with a monthly salary of less than Rs 15,000. The Central Government also pays the arrears needed to maintain the minimum pension of Rs 1000 for all members. Lastly, interests and dividends from various investments make up the Pension Funds. These Pension Funds exit as the monthly pension of members and the additional payment to make up the minimum pension of Rs 1000 for some members.

Hence, the Central Government’s share is mainly the 1.16% of pension funds and the extra amount it pays to make up the arrears for minimum pension payment.

Central Government’s Delay in EPFO Dues – Reason for delay in higher pension under EPS?

Of the Rs 9115 crore which the Central Government owes to the EPFO, Rs 8063 crore is for Pension Funds. This constitutes the 1.16% share which the government pays for member pension. The rest Rs 1050 crore constitutes the arrears which the government pays for fulfilling minimum pension. Since these calculation are only taken till March 2019, there is a high possibility that the dues have increased furthers.

The delay in government dues is also the reason for the delay in higher pension under EPS. The minimum pension was slated to increase from Rs 1000 to Rs 2000. But the delay in dues worries the PF officials of being able to complete the higher pension under EPS.

Escalation of dues after the Central Government regime change

An important observation here is that the Central Government owed the EPFO Rs 2882 crore before 2014-2015. But post the new government coming to power at the Centre, this amount tripled to where it stands now at Rs 9115 crore. Supposedly, not a single penny of the 1.16% pension fund share has been paid by the government to the EPFO since 2014-2015. Currently, officials state that the pension outflow is less than the inflow, hence the dues have been manageable. But with the increase in monthly pension and members, it is possible that the funds may run out soon.

What steps is the government taking?

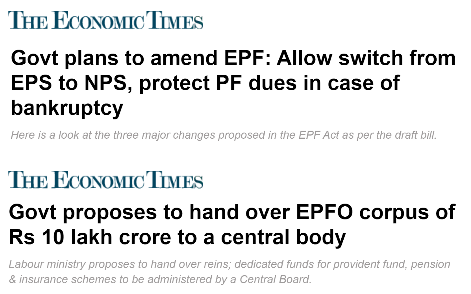

- The government has brought the EPF amendment bill which is currently in a draft code and open to suggestions. The bill states that the Rs 10 lakh crore fund of the EPFO should be handed over to a central body with a central government-appointed chairman. This fund is currently under the EPFO board of trustees who manage it. Unlike the current situation, the Labour Minister will not be the Chairman of this central body. This clause will do more harm than good since it will be even more difficult to know the status of accounts. Hence, we should object to it vehemently.

- There is also a proposal for people to shift from EPS to NPS. The reason behind this step, although not clear, might be the large sum of pension dues.

Financial steps to ensure the future safety

- Invest 20% of your monthly savings in equity. You can do this via Upstox or Zerodha.

- Invest 80% of your monthly savings in debt and mutual funds. You can do this via Kuvera.

Watch our video on why the delay in higher pension under EPS below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!