Debt funds play an important part in your portfolio. Often people invest in mostly stock market and equity options, leaving out debt funds. This can result in a risky investment portfolio. It is possible to earn a return of 10-12% with debt funds. Hence, neglecting them just because you do not have adequate knowledge of them for investment might be a big folly.

Table of Contents

What are Bonds?

To understand how debt funds work, first you must understand how Bonds work. Bonds are a type of loan. Any company has two methods of raising capital. It can either release its company shares in the stock market, which people can buy and call themselves shareholders of the company. The second method is by the company releasing a bond. The bond is a type of loan to the company and it will pay back the bond holder the principal amount and interest on the principal as EMI. By the end of the bond maturity period the company will have paid back the full principal amount and interest to the bondholder.

This process is similar to a customer taking a loan from a bank and paying it back in monthly instalments. There are various company’s bonds available for purchase in the financial market. Bonds can either be corporately issued or even government-issued.

What are Debt Mutual Funds?

Similar to an equity mutual fund, wherein you invest your finances in multiple shares of companies, in Debt Mutual Fund, you invest in multiple companies by purchasing their bonds. Essentially, you are giving out a loan to these companies or the government. Hence, for the government, these debt mutual funds can go towards government bonds, government securities or treasury bills. Meanwhile, for companies, these debt mutual funds can go towards corporate bonds or certificate of deposit. It is also possible to issue debt mutual funds to PSUs and small and medium enterprises.

Your debt mutual fund manager is responsible for selecting these loans for investment. So, he invests your finances in multiple debt funds and provides you with the return earned on them.

Why must you invest in debt mutual funds?

It is important to have debt funds in your portfolio simply because they are less volatile compared to equity funds. Debt fund prices are not seen fluctuating heavily as equity funds. Reason being that debt funds are essentially loans with a fixed interest rate. So you can rest assured that you will get your interest at the fixed rate as well as the principal amount upon maturity. Thus, they are not seen as too risky and are perfect for less risky investments.

As a rule of thumb, your age should be the percentage of debt funds investment you opt for. For example, if you are investing Rs 100 and your age is 25 years, then you must invest Rs 25 in debt funds and the remaining Rs 75 in equity funds. This is essential as your age increases and you need to invest in fewer high-risk investments. So even during market fluctuations when your equity fund investments may hit rock bottom, your debt fund investments will be substantially better and easier to withdraw for the liquidity of funds.

When do you need debt mutual funds?

1. Unexpected cashflow

In the case of gaining some extra wealth, where you do not want it to sit idle in a bank account and get wasted in leisure activities, or it is not possible to invest it in the stock market due to the volatility, the best option is to invest it in debt mutual funds. This serves as a stable return asset where your money can grow over time and once you are sure of how to utilize it, you can withdraw it.

2. Short term planned expense

If you have some short term planned expenses in the upcoming 1-3 years, such as purchasing an automobile or taking a vacation abroad, then it is advisable to invest your money in debt mutual funds. For such short term investments, equity is not suitable since they work best for over 5 years. So to save money for a short term goal, it is best to invest it in debt funds.

3. Rebalancing

Say you had invested in equity funds for your long term goals, which are now drawing to a close, so to keep your investment earnings stable, you can slowly start shifting the equity investments towards debt fund investment. This is known as rebalancing where you ensure that your investments stay stable after earning the extra income and yet keep growing over a short term too. Hence, identify your reason for investment before opting for a path.

Watch the above discussion in the video below for further explanation.

Risks involved with debt funds

1. Credit risk

There is a possibility that the company whose bonds you purchase under debt funds, may go bankrupt in the future. Thus, it may be unable to pay you back the remaining bond loan amount. This is known as credit risk where you cannot be 100% sure that your loan will be completely returned.

To overcome this risk, you can go through the company’s credit rating. CRISIL is one of the most trusted credit rating agencies. It rates all the instruments of investment of any company based on their ability to not default on investor’s money and to pay it fully back. These ratings range from AAA for company’s which have a very low chance of defaulting on investor money and goes down till D for high chances of defaulting. One can just check the company’s CRISIL rating to ensure the credit risk involved before investing in their debt fund.

2. Liquidity risk

This is the reason why recently Franklin Templeton shut down 6 of its debt funds in the market. Liquidity risk occurs when investors in the debt funds ask for their investment amount before the maturity of the loan. This puts the company in a difficult state as they also have to get their money from their other investments to pay you back.

In the case of Franklin Templeton, it was known as one of the country’s best debt funds hence it had many people investing in them. But during the onset of COVID-19, when people were uncertain about the financial market, they started retracting their money from mutual fund investments. With a ton of people retracting their investment, it was difficult for Franklin Templeton to conjure the money to pay back all their investors. This is because they also did not have many sources for liquidity. Else they would have had to sell their investment instruments at extremely low market rates to pay back their investors. Thus, it decided to close its debt funds and pay back the people once their mutual funds reach maturity.

3. Interest rate risk

Any company’s bonds are tradeable like shares in the stock market. Hence, if you bought a company’s bond and do not wish to hold it until maturity then you can sell it in the stock market. It’s price point will depend on the market’s current interest rate.

To understand this further, let’s take an example. Suppose you bought a Rs 1 lakh bond at 8% interest rate. After 3 months it is announced that all companies will now issue bonds only at 6%. At this moment, the value of your 8% interest bond will skyrocket because there will be many buyers in the market for it, since its interest rate is higher. This is specifically true for debt funds with over 5 years of maturity. These are usually Gilt Funds which invest in the Government which have volatile interest rates.

The opposite case can also happen where new bonds are being issued at 10%. So everyone will want to buy the higher interest bond and there will not be many buyers for your lower 8% interest bond. Thus, if you absolutely need to sell your bond, you will have to do so at a low amount and result in a loss. This was also the reason for shutting down Franklin Templeton debt funds.

Therefore, the art of a good debt fund manager is to buy bonds when their interest rate is high and hold them until interest rates fall in the market. Then they sell their higher interest bonds at an even higher price to gain 10-12% profit.

Case 1

A buys Rs 1 lakh bond at 8% interest rate for 2 years. After 1 year, the market announces that bond interest rates have fallen to 5%. So A sells his bond to B at Rs 1.2 lakh. Thus, for the 1 year period, A receives interest of Rs 8000 from the bond. Additionally, A receives Rs 2000 profit from selling the bond to B. Therefore, A’s total profit from this bond is Rs 10,000 (=8000+2000), and the return rate is 10%. Thus, buying bonds at higher interest and selling them later is quite profitable.

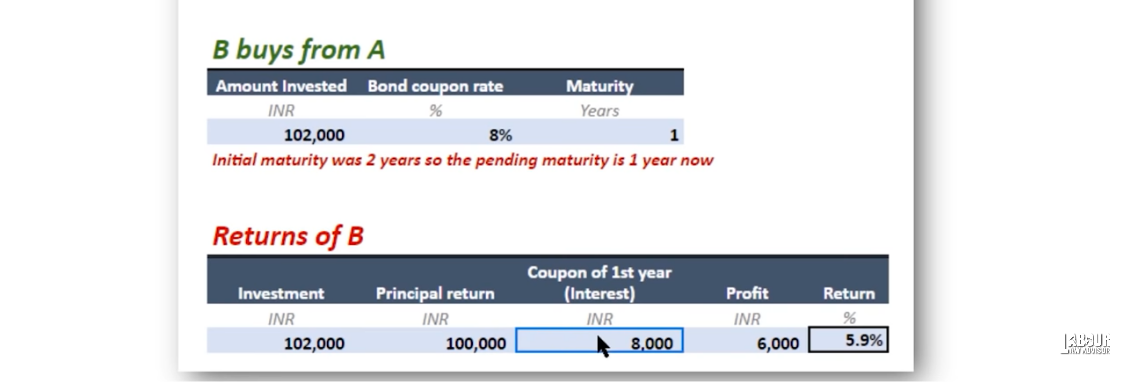

Case 2

B bought a Rs 1.2 lakh bond from A at 8%. After 1 year, B receives the principal amount of Rs 1 lakh and Rs 8000 as interest. Thus, at the end of maturity of 1 year, B received Rs 1.8 lakh. Therefore, his profit is Rs 6000 which is equivalent to 5.9% interest. This is higher than the 5% interest rate B would have received had he bought the latest bond straight from the market itself.

Types of debt funds

A. Maturity period

On the basis of maturity period, debt funds are divided into the following categories:

1. Liquid funds

Liquid funds are the lowest risk variety of debt funds. With a return rate of 7-8%, many consider putting their wealth in liquid funds instead of keeping it at a bank with 3.5-4% returns. Moreover, it is super easy to liquefy your funds and shift it to your bank account as cash.

2. Ultra-short term funds

These funds are issued for 3-6 months only.

3. Short-term funds

These funds are issued for 6-12 months.

4. Medium term funds

They are issued for 3-5 years.

5. Long term funds

These are issued for over 5 years.

B. Investment instrument

On the basis of the investment instrument, debt funds are divided into the following categories:

1. Gilt funds

Gilt funds invest in only government securities which have negligible credit risk factor. It is rated to be the most secure debt fund.

2. Credit risk funds

These funds invest in low rated debt funds for higher return opportunities. Hence, they take higher risk for higher returns.

3. Banking and PSU funds

These funds invest only in the banking and PSU sector. Thus, their credit security is quite reliable.

4. Dynamic bond funds

In this type of fund, the fund manager has the flexibility to shift investment between long term and short term funds. This is based on the prevailing interest rate in the market. But only a certain percentage of the total funds can be allocated in a certain type of maturity, according to SEBI’s guidelines.

Watch the below video for more clarifications on the risks and types of debt funds.

Goal and category for debt funds investment

To select the category of debt mutual funds to invest in, you must know your goal for that amount. That means you need to know the duration after which you want your investment back. For example, if you want to invest for 3 years then you select such a debt fund which will further invest in instruments which will mature within 3 years. If there is a mismatch between your investment goals and the maturity period, then you might get fewer returns than planned.

- For investments within 1 year, where you also don’t really have any purpose for investment, you can invest it in Liquid Mutual Funds. In pre-Covid era, these would give 7-8% returns, which were generally higher than banks. But post-Covid era, these give 3-4% returns.

- For investments within 6 months to 1 year, you can select Ultra-Short Term debt mutual funds.

- On the other hand, for investments which last only 1-3 years, you can select Banking and PSU funds or Short-Term debt mutual funds.

- But if you want your investment to last over 3 years, then you must go for Long-Term debt mutual funds. The catch though is that for long-term investments, equity mutual funds give better returns than debt mutual funds. So if you can, go for equity funds investment. But if you must stick to debt mutual funds, then you can opt for Gilt or PSU debt funds for long-term investment. These have lower credit risk and also give higher returns.

How to pick the best debt funds?

These are the six important steps which you must execute to pick the debt mutual funds for your investment.

- Check fund ratings – it is advisable to check the rating of the debt fund from multiple rating sources. We recommend using CRISIL, Value Research and Morning Star. These are trusted debt funds rating systems which give a broad idea of how trusted the debt fund is and what is the risk involved with them.

- Asset under management – next step is to check the Asset Under Management (AUM). In equity mutual funds if the AUM is high then it is not advisable to invest in them because their returns will be low. This is because the bigger the funds, the fewer opportunities to double your investment. Rather, smaller companies will give you more scope to double your investment. On the other hand, in debt mutual funds, the higher the AUM, higher the returns. This is because higher AUM in debt funds means that more people have trusted and invested in it and bigger the capacity of the fund to get big bonds from the government and otherwise.

- Past performance – check how the fund has performed in the last 1-3 years. In today’s time, it will also show which funds handled the Covid market crash successfully.

- Risk matrix – check what is the status of the credit risk and the interest rate risk for the fund. If both are high or medium or low.

- Modified duration – this stands for the remaining maturity duration of the fund. The remaining duration will decide how much the interest of the fund will fluctuate. For funds with 6 years maturity vs 2 years, the one with 6 years will have more impact of interest fluctuations rather than the one with 2 years.

- Fund manager – lastly, you need to check the history of the fund manager. The funds he has been involved in and for what duration. This is because the performance of returns on a fund depends on the methodology of buying and selling of the fund manager.

Practical example

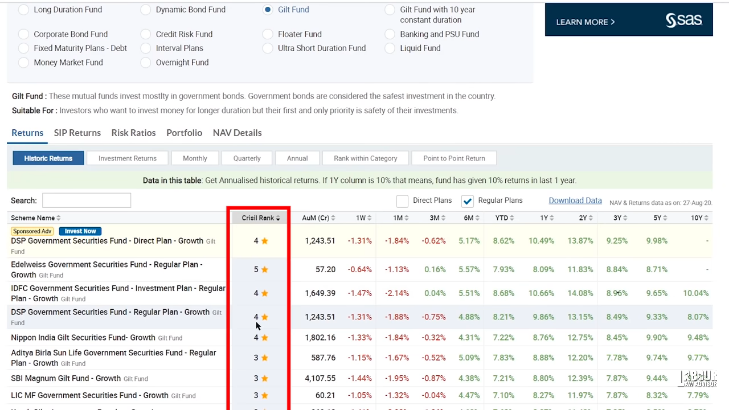

Suppose we want to invest in a GILT debt fund, then we follow the steps given below to pick the best GILT fund.

Check fund rating

- Visit valueresearchonline.com and go to the Funds tab.

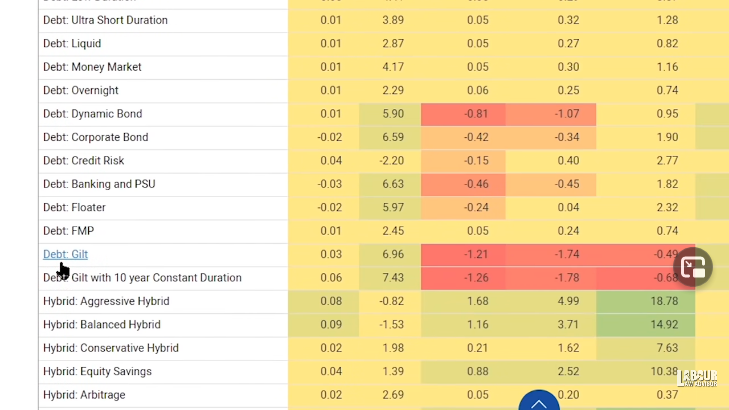

- Scroll down to view the Fund Category Returns and select Debt: Gilt Funds options.

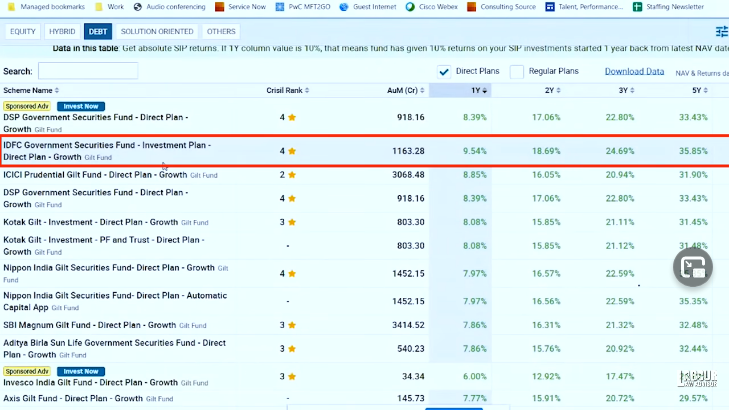

- A new page appears with all the Gilt fund listing. From the filters, check Direct Plans and Ratings of 4 and 5 Stars. This will display the best Gilt debt fund options.

- Visit moneycontrol.com and select the Mutual Funds tab.

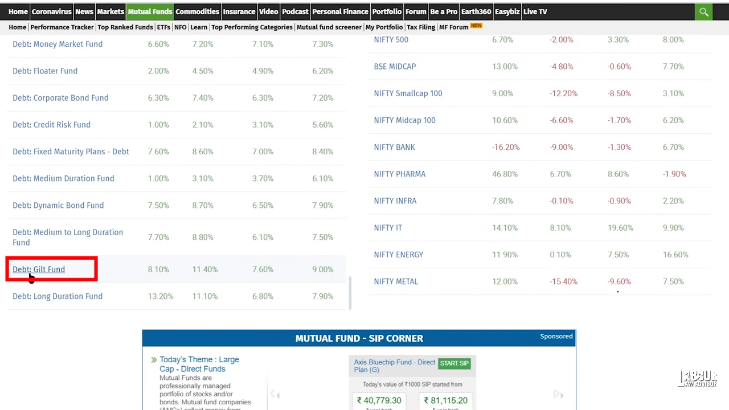

- Scroll down to view Top Performing Categories and select Debt: Gilt Funds from the list.

- This will open a new page with all debt Gilt fund options, ranked in a descending order.

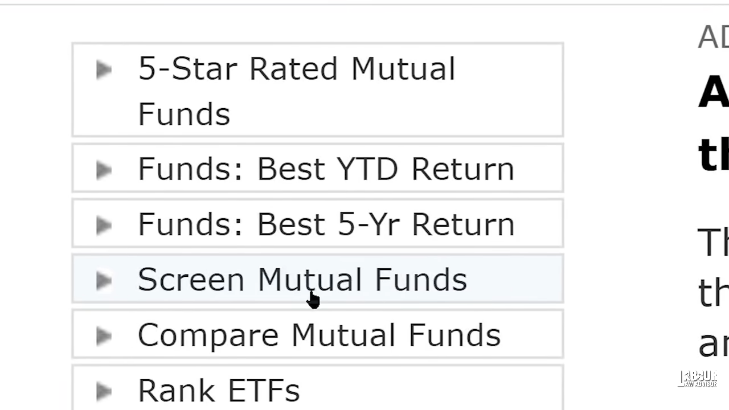

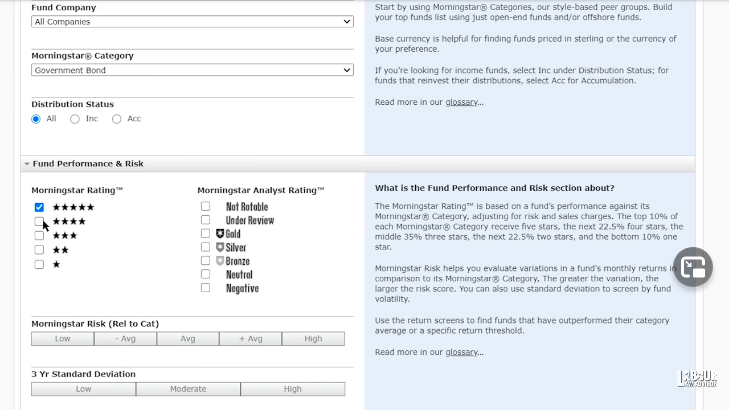

- Visit morningstar.in and go to Screen Mutual Fund options.

- On the next page, select Government Bond for Morningstar Category option and check the 5 and 4 star ratings. Then click on Search to reveal the best performing debt gilt funds.

- From these three lists, we shortlist the funds which have the best ratings on all three simultaneously.

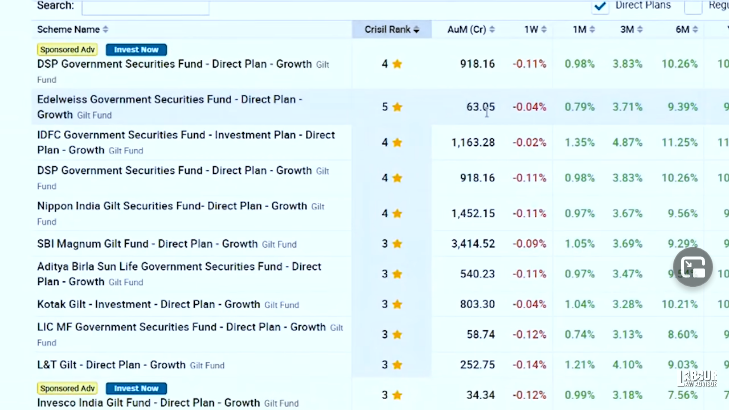

Check AUM rating

- On moneycontrol.com, visit the SIP Returns tab.

- Select the AUM column to arrange the values in decreasing order. This reveals if the AUM of your shortlisted debt funds is high or not.

Check Past performance

- On moneycontrol.com go to the SIP Returns tab.

- Select the 1 year, 2 years, 3 years and 5 years returns column and arrange them in decreasing order. This will reveal the return rate for these shortlisted debt funds over the past couple of years.

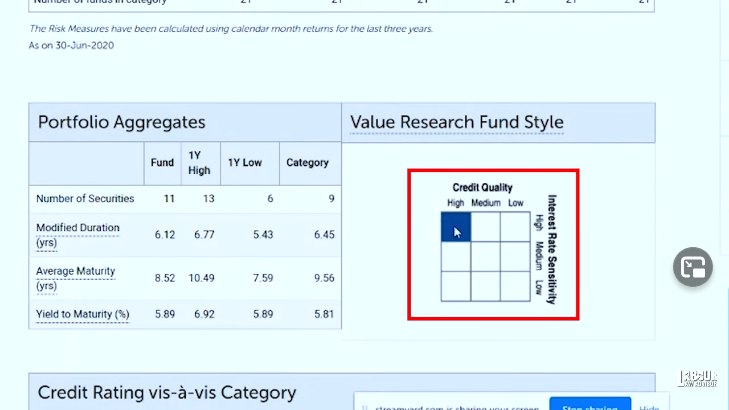

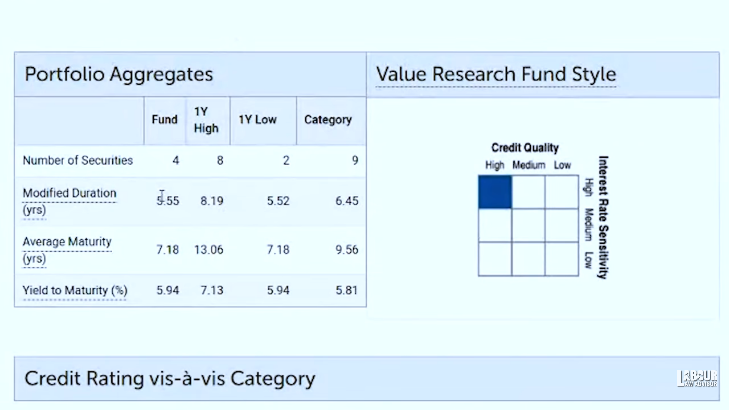

Check Risk matrix

- On valueresearchonline.com, open the page for the individual funds and scroll to the page bottom.

- See the Risk Matrix under Value Research Fund Style. This shows the Credit Quality Vs Interest Rate Sensitivity of the debt fund in question.

- We are looking for a high Credit Quality but a low Interest Rate Sensitivity ideally.

Check Modified duration

- Similarly, on valueresearchonline.com, open the page for the individual funds and scroll to the page bottom.

- See the Portfolio Aggregates of the debt fund.

- This shows the modified duration of the individual funds in years. Longer the modified duration, higher the interest rate sensitivity of the fund.

- Next, you can also see the Yield To Maturity of the debt fund. This shows the number of securities under a given debt fund and the interest rate you will keep earning on them until maturity.

Check Fund manager

- To check Fund Manager, visit valueresearchonline.com and scroll to the bottom of the individual fund page.

- This will show the current Fund Manager in charge of handling that debt fund. Ideally, we want someone who has been working on the debt fund for a long duration, and not someone who has joined over the past couple of months.

After shortlisting debt funds from all the above points, we select the final debt fund to invest in. Similarly, you can check debt funds performance for any other category of debt fund by selecting that category over all platforms. It is advisable to visit your debt funds every six months to check whether they are actually performing according to plan or not.

Tax on debt funds

Contrary to equity funds, holding investments for over a year under debt funds does not raise capital gain. Only when you hold debt funds for over 3 years do you get capital gain on it. On this capital gain, you are liable to 20% tax and indexation gain. On the other hand, if you hold debt funds for less than 3 years, then your capital gain will be added to your income and you will be charged tax according to the income tax slab rates.

For more explanation on how to select debt funds, watch the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!