On 2nd August 2019, the Rajya Sabha passed the Code on Wages Bill, 2019. The Wages Bill was earlier passed by the Lok Sabha and is now awaiting only the President’s assent to become a formal Act. This bill is the first in a series of four labour codes which the government has proposed in its labour reform initiative.

Table of Contents

Code on Wages Bill – A brief introduction:

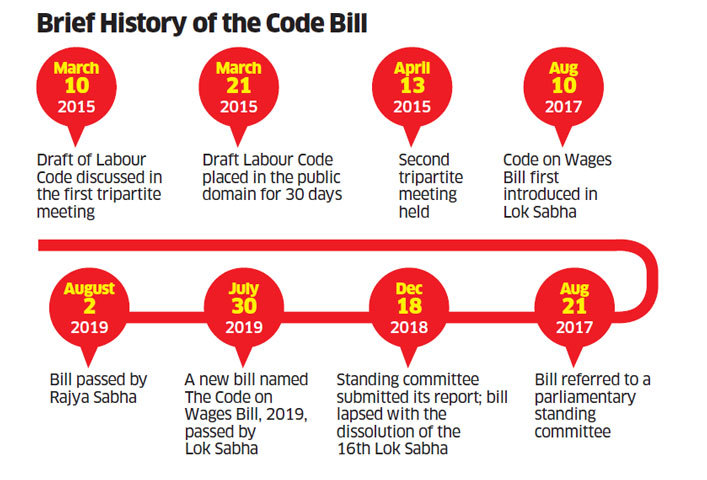

The Code on Wages Bill was introduced in March 2015 as a Draft of Labour Code first. It was later put out for public discussion for 30 days. After some initial changes, it was reintroduced at the Second Tripartite meeting in April 2015. It was first presented in the Lok Sabha on August 2017 but it passed on to the Parliamentary Standing Committee. In December 2018, the standing committee submitted its report but due to the dissolution of the Lok Sabha, the bill lapsed. In July 2019, the bill was reintroduced under a new name, Code on Wages Bill. Lok Sabha and Rajya Sabha both passed the bill.

The Code on Wages Bill is the first out of the following four labour codes which are – Wages, Social Security, Industrial Relations, and Occupational Safety and Working Conditions (OSHWC). When these four labour codes will be passed, they will combine the existing 44 labour laws and ease the pain of employers who are currently maintaining separate compliance for each of the laws. Currently, though, these labour codes will not include the ESI Act, EPF Act and SHOP Act.

The Code on Wages Bill replaces the following four laws:

- Payment of Wages Act, 1936

- Minimum Wages Act, 1948

- Payment of Bonus Act, 1965

- Equal Remuneration Act, 1976

What was the need of the Code on Wages Bill?

There were some major reasons why this Code was introduced, which are as follows:

- Some of our country’s labour laws were made a long time ago. Some even before the Independence, such as the Payment of Wages Act, 1936. As a result, they are quite obsolete in today’s age. It was necessary to update these labour laws to make India rank better in the world’s ease of business rankings. Some irrelevant laws have also been removed from these Codes.

- The earlier Acts only covered 40% of the total employment workforce. This was because the Acts covered only specific schedules and salary ranges. The new Code though will cover all employees and workers. It will benefit close to over 50 crore workers.

- Different old Acts have different definitions for the same thing. Example, the definition of Wage had 12 different variants across all labour laws. This makes it difficult to get appropriate results in court cases and leads to many litigations. So this Code would resolve this issue and cease all confusions.

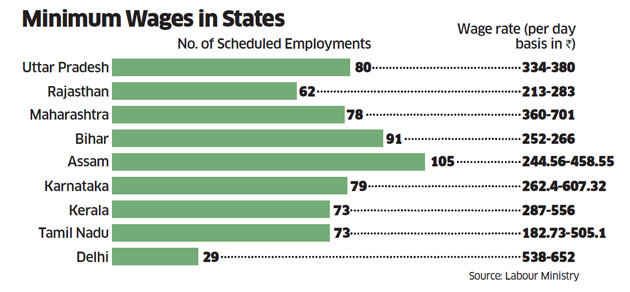

- Our country currently has almost 2000 types of minimum wages. Some from the Central Government and some from the State Governments. This makes compliance difficult. The new Code will reduce this number to almost 300, to further improve compliance of labour laws.

The Existing Acts:

The Code on Wages Bill comprises four different Acts, which we discuss in some detail as follows:

1. Minimum Wages Act, 1948

It determines the minimum wages which employees in this country should receive. This minimum wage is determined according to many reasons such as the skill category of the employee, the

2. Payment of Wages Act, 1936

This Act determines the date of payment of employee salaries along with deductions, allowances and overtime pay. The Act lets the employer knows which registers he has to maintain for his compliances.

3. Payment of Bonus Act, 1965

This Act tells us how much bonus employees shall receive and the correct bonus calculation method.

4. Equal Remuneration Act, 1976

This Act states that both men and women need to be treated the same and paid the same for the same work. There should not be any differentiation in salaries on the basis of gender.

Changes with Code on Wages Bill:

The deviations of the Wage Bill from the earlier bill are as follows:

- Under Section 6 of the bill, it has been mentioned that any person who is an employee under wages and works for an establishment, whether it be skilled, semi-skilled, unskilled, manual, operational, supervisory, managerial, administrative, technical or clerical work, will be considered as an employee. So other than members of the Armed Forces, every other worker will be considered as an employee.

- A single definition for Wages has been given which replaces all other previous definitions of wages. If the payment by employer is made in terms of basic pay, dearness allowance and retaining allowance, then it will be considered as Wages. But the following things will not be taken under Wages – any bonus, house rent allowance, amenities allowance, travelling concessions, pension or provident fund contribution, overtime allowance, gratuity or commission.

- The definition of a Worker: Apprentice, Armed Forces, police officials, managerial or administrative ranking employees and employees drawing over Rs 15,000 as salary every month – all shall not be categorized under Worker.

- The fixation of Minimum Wages shall depend on not only the skill category and geographical location of workers but also conditions like the temperature, humidity and hazard level of the work. It shall not depend on the schedule though. The State Government will have to, as far as possible, keep the no. of minimum rates of wages at a

minimum . - Central Government will fix a floor wage and the other State Governments cannot fix a minimum wage below the floor wage.

- All wage payments will happen by either cheque or bank transfers. No payment will happen via cash.

- The grievance period for employees was earlier six months but now extends to three years. Additionally, an Inspector-cum-Facilitator will replace an Inspector.

You can watch our video on this topic below and drop your queries in the comments section below!

Another interesting read: Paytm Wallet Bad For Economy? | Why You Should Stop Using It Immediately!

Also read: RTI Amendment Bill 2019 | Unfair Play?

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!