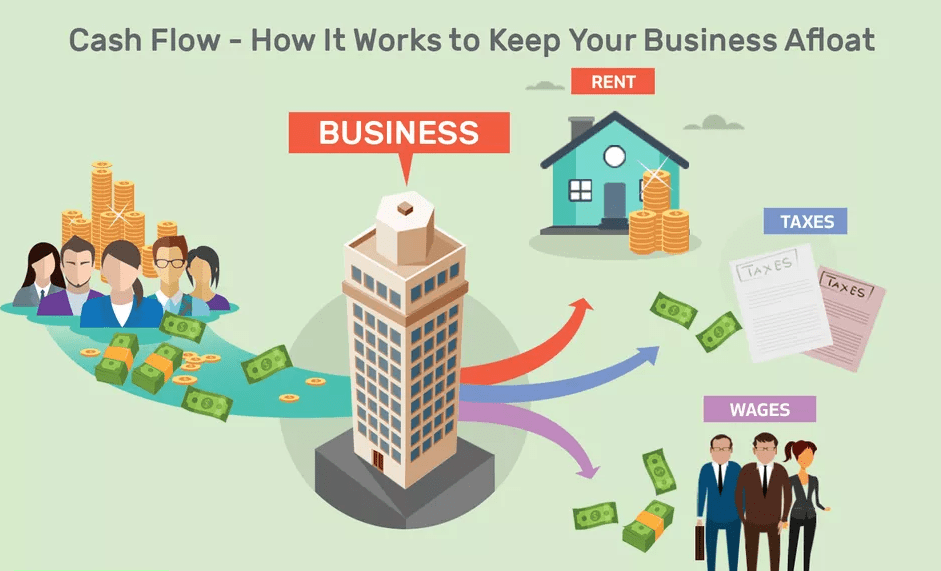

The term cash flow represents the money flowing in and out of your business each month. This movement occurs in two ways – cash comes in through your customers through sale at the time of purchase of your products/service, and cash goes out as payments for rent, mortgage, loan, taxes, employee wages, etc. As a business owner, it is important to always have some balance amount in your business account. If there is a deficit of cash flow, i.e., more money is going out instead of coming in, then you will be unable to pay your employees/vendors which may result in stalling of your business. Thus, cash flow planning plays a major role in running a successful business. In this article, we will learn about some important tips for efficient cash flow planning.

The following cash flow planning tips are helpful for any business or salaried employee. So, let’s get on with them!

Table of Contents

Cash Flow Planning Tips:

1. Pay later

This can be done in multiple ways as follows –

- Utilize the credit period – Every bill which you receive as a business from another vendor or supplier gives you a time period for payment of the bill. This credit period should be utilized to the fullest. Hence, if the credit period is for 30 days, try paying the bills on the 29th day. But be careful not to delay payment further than the credit period, as this will spoil your goodwill in the industry.

- Negotiate hard – Whenever you negotiate with your supplier or vendor, it is usually in terms of the discount on your order. But another point which you can negotiate is the credit period of your bill payment. Instead of a 30 day credit period, try negotiation for a 60 or even 90 day credit period. This is because it is better to have an extended credit period than having to take a loan for your working capital since the interest on the loan would be exponentially high.

- Payment of salary – As per the payment of wages act, a company can pay the salary of employees latest by the 7th of each month. Thus, employers who pay salary by the first of a month lose out on the credit period. As a result, their working capital reduces for the first week of the month. If the business has 100 plus employees, then this salary payment can be done by the 10th of each month.

- Post dated cheques – Usage of cheques might be redundant in this era of online banking, but this is a useful tool nevertheless. Giving a cheque with a future payment date to the vendor or employee gives them the assurance that they will receive their payment. Thus, they trust you as a business person. Additionally, your business account will not lose money immediately. Hence, this is a win-win situation for both parties.

- Utilization of credit card – Purchasing things which don’t provide a credit period for payment via your credit card, will automatically give you 30 days grace period for payment. Since money will get deducted from your bank account only after 30 days. But do not delay your credit card payment. As you will be levied high interest on it.

2. Receive earlier

You might have noticed while ordering things online that there are many offers and discounts available for prepaid payment. But these offers/discounts are not given for cash on delivery mode. This is because the business wants you to pay even before the product leaves its warehouse. Getting the payment after product delivery would extend the period of receiving it for the company. This reduces their working capital in the meantime. So even if your customer is not agreeing to pay the full amount, at least try negotiating 50% in advance. This should cover some of your costs. When the remaining payment comes, you can get your profits. Negotiate this with your customer as a business policy. Also, try offering them some small discounts on the purchase.

3. No investing

Some small businesses might put their extra income into share market or mutual funds. This hampers the cash flow planning because in case they suddenly require some money and their investments are running on a low, then they have only two options. Either take a loan on high-interest rate or sell their investment on a low rate. Both options lead to a loss. Thus, it is a safer option to invest money in a place which is completely liquid. So that you can withdraw money within 24 to 48 hours. The investment option should also be extremely safe.

An easy way for this is to use the EasyPlan app. Learn more about it here.

4. Continuous Sales

Continuous sales are important for efficient cash flow planning. Do not run your business as a linear cycle of separately doing each step – acquiring customer lead, pitching to customer lead, sending quotation to them, selling the product and then receiving payment. Rather run all the steps simultaneously. Frequent sales will lead to frequent cash inflows. Thus, you will not have to wait for long intervals to receive cash. This way, your business’ cash flow planning will run smoothly and without any hiccups.

5. Taking loans

If even after applying all the above tips to your cash flow planning, you run low on your working capital and are forced to take a loan, then the following tips will be helpful.

- Business loans – This requires a good credit rating, no collaterals and a high-interest rate.

- Loan against property (LAP) – This incurs a low-interest rate but you need to have a property on a prime location to avail this. This is not easily given on flat or multiple stake held properties.

- Loan against stocks (LAS) – If you have an investment in some shares then you don’t need to sell them to get money. Rather you can take a loan against them.

- It is also possible to get a loan for your startup from ventures such as Capital First, NeoGrowth, etc.

6. Tax payment

You can use some tips to delay your business’ tax payment which will help in retaining your money in your account. This can be done safely as follows:

- Advance tax – If your business’ overall liability is over Rs 10,000, then you need to pay the advance tax in four instalments. You can try paying tax latest by the due date to retain cash in business for long.

- TDS – When you deduct TDS from another business’ payment then you need to submit it by the 7th of next month. You can try delaying this till the 6th. It again helps with keeping cash in the business for long. TDS for March can be paid by the 30th though.

- GST payment – Under the regular scheme, you need to submit GST by 20th of each month. Under the composite scheme, you need to pay GST by 18th of each month. Similarly, this can be delayed until the penultimate date of payment.

We hope this blog was helpful for you. Catch our video on this below:

Find another interesting method to make money via the Meesho App.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link –t.me/JoinLLA.

It’s FREE!