Welcome back to the Labour Law Advisor, in this post, we’ll be explaining the complicated topic of TDS. Be sure to check out the Labour Law Advisor on Youtube for more content! How to calculate TDS?

Table of Contents

TDS (Tax Deduction at Source)

TDS stands for tax deducted at source. As per the Income Tax Act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. Calculate TDS has to be deducted at the rates prescribed by the tax department.

The company or person that makes the payment after deducting TDS is called a deductor and the company or person receiving the payment is called the deductee. It is the deductor’s responsibility to deduct TDS before making the payment and deposit the same with the government. Calculate TDS is deducted irrespective of the mode of payment–cash, cheque or credit–and is linked to the PAN of the deductor and deducted.

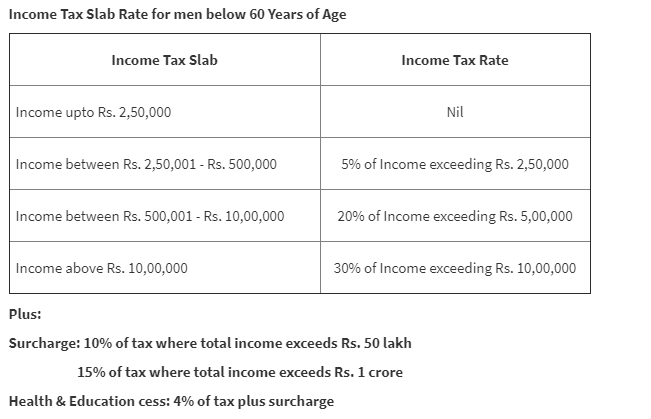

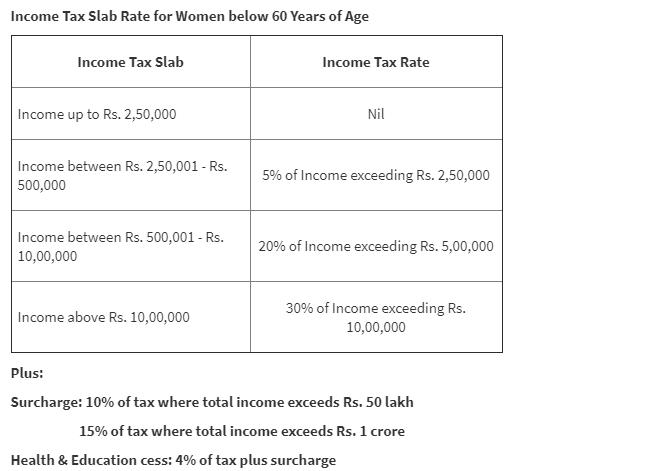

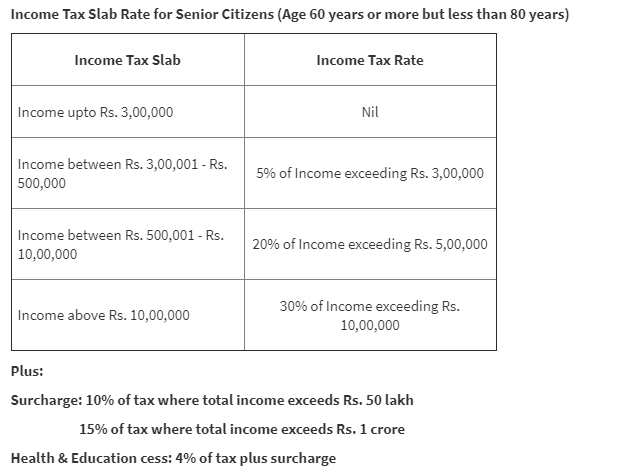

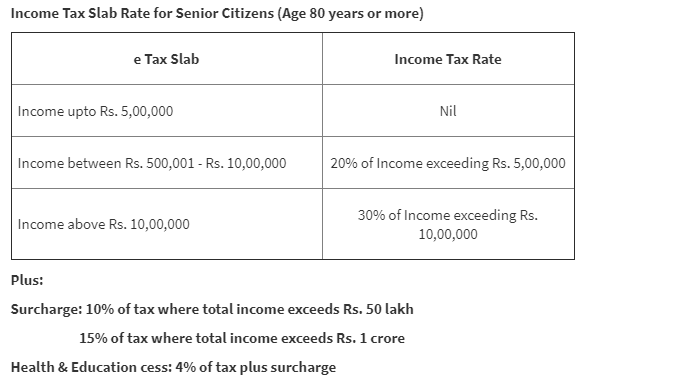

Tax Slab

What is a special exemption

There is ₹5000 exemption on less than ₹5Lac Salary under article 87(A)

How tax benefits can be taken

There are lots of benefits under 80 family

80(C), 80(D), 80(E), 80(EE), 80(DD), 80(U)

Exemption under Article 80(C)

- Exemption can be got under 80(C), In terms of Investment

- Investment in Provident fund

- Exemption on investment in the public provident fund

- Investment in life insurance premium

- National saving certificate

- Investment in post office scheme till ₹20000

- Exemption can be got under 80(C), In terms of Spending Money

- On tuition fees of 2 children

- Exemption on home loan on principal amount

- An exemption can be got of ₹1.5Lac yearly

Exemption Under Article 80(D)

- To take mediclaim policy, the exemption is ₹25000

- For a senior citizen, the exemption is ₹30000

Tax Savings From NPS(National Pension Scheme)

- To investment in National Pension Scheme, the exemption can be availed

- People can invest in NPS, whose age is between 18-60 years

- Exemption of ₹50000 on NPS under 80(CCD)

How to save tax on Salary

- The exemption can be availed on dearness allowance, house rent allowance, convenience allowance, travel allowance, medical allowance, housing prerequisite, car prerequisite

Tax Savings on HRA

- If an employee is living in a rented house then that employee can get exemption under section 13(A) when he/she show rent receipt to their employer or HRA exemption can be got in three conditions.

- 50% of basic salary

- Actual HRA that company is already providing

- Excess of rent pay over 10% of salary whichever is lower.

Exemption Under 80(GG)

- If the company does not provide HRA and the person is living in a rented house then that person can get exemption till ₹60000 yearly i.e. till ₹5000 monthly

or - 25% of salary

Or - Excess of rent pay over 10% of salary whichever is lower

HOW TO CALCULATE TDS ON SALARY

As we know that till ₹2.5Lac, there is no tax

Suppose an employee whom salary is ₹2.45 then we know there will not be any kind of tax on it

And if salary is –

₹2.50-3Lac then we subtract 2.50 from 3Lac then the difference will be 50000

So we use formula

50000*5/100=2500 and 2500₹ is given a rebate to employees by the government so till ₹3Lac there will not be any charge

If salary is-

₹3Lac-5Lac then calculation)- 5Lac – 2Lac= 3Lac

300000*5/100= 15000, so the employee will have to pay ₹15000 as a tax in terms of TDS

If salary is-

₹5Lac-8Lac then calculation-

8Lac-5Lac= 3Lac

First, calculate from ₹2.50Lac-5Lac

It will be above given same formula amount will be –

250000*5/100= 12500

Then calculate from 5Lac-8Lac

So 300000*20/100= 60000

So the total tax will be – 12500+60000= 72500₹

Check out this cool video for more info!

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!