It’s the season of IPOs with multiple companies going public. While IPOs may seem like a great investment opportunity, investing in each and every IPO out there may not be the best idea. One needs to do a thorough IPO analysis of the company to understand if it is worth the trouble. Thus, this article discusses the basics of IPO analysis that one must definitely check off their list before making an investment. We take the case of Policy Bazaar IPO for this discussion.

Table of Contents

What are the basics of IPO analysis?

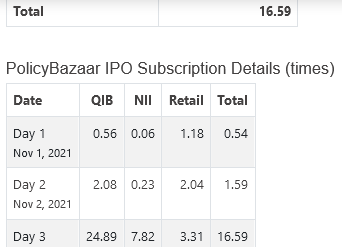

One way of knowing if the IPO is worthy is through the buzz it creates. The buzz and hype of the IPO must retain not only before it launches but also during its subscription period. The first two days of subscription of IPO are extremely important as it shows the market demand for it. The higher the market demand for an IPO, the higher it may list on the stock market. Since IPO allotment is not dependent on a first come first serve basis, one can look at the subscription volume of the first two days and then put forth their allotment request on the third day. To check the subscription for first two days, one can simply Google it as it is easily available on all news websites.

Looking at the IPO subscription data above, we need to take note of Retail Investor (Retail) figures. We can analyze that on Day 1, IPO was 1.18 times and on Day 2, 2.04 times. Generally speaking, if an IPO is subscribed 5-6 times on first two days, then profit-making chances increase by 60%. Next, we can look at Non-Institutional Buyers (NII) figures to analyze oversubscription.

Second method is knowing the grey market premium of the IPO. It may be difficult to find the exact information but one can follow IPO_mantra on Twitter to know the updates. In the case of Policy Bazaar, the grey market premium value is Rs 220 currently at the time of publishing this article.

How to fundamentally analysis company bringing the IPO?

In the case of Policy Bazaar, it is an insurance web aggregator with a 93%-94% market share currently. Hence, they have full market monopoly with no worthy competitors. But in the sector of insurance, most sales happen through insurance agents. Customers usually research insurance plans on Policy Bazaar and then ask their agents to sell them the same at similar pricing. Thus, the actual market share of insurance web aggregators in the country is a meager 0.54% out of which Policy Bazaar has 94% market share.

In the process of IPO analysis, one must know the history behind the company as well. In the case of Policy Bazaar, the co-founder, Yashish Dahiya’s father was fooled by an insurance agent which led him to begin the startup to remove the agents from the entire insurance process. He showcased the prototype and managed to secure initial funding on Rs 20 crore. But keeping in mind the main aim of the company to reduce agents as the middle man, the market penetration of 0.54% is not successful yet. Thus, there is still more scope for Policy Bazaar to grow.

Additionally, Policy Bazaar has applied for Insurance Broking License. This will enable them to sell group insurance with better margins as well as offline insurance plans. Thus, Policy Bazaar plans to open around 200 retail places in the country and sell insurance plans offline. Hence, it would provide a hybrid online-offline model.

Important company figures for IPO analysis

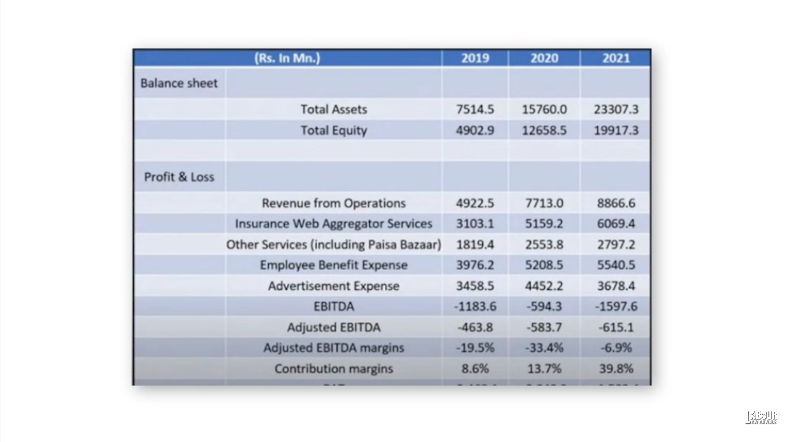

Some important figures to note before investing in the company IPO as well as for longterm are as follows:

- Advertisement expense – Most start-ups spend more on advertising in their early stages.

- Employee benefit expense – The number of employees whose salaries are being paid.

- Revenue from operations – How much money the company is making and whether it is increasing over the years or decreasing.

How to interpret evaluation of company?

If the company is making a profit, then evaluation can be calculated through price to earnings ratio. The other method to evaluate a company is through discounted cash flow. However, neither of these works for evaluating a loss-making company.

For a loss-making company, one can use price to sales ratio to evaluate it. This tells the company’s evaluation as per the sales happening. Since no other web insurance aggregator is listed currently, one can look at Policy Bazaar to any other insurance company for its evaluation. Upon checking the price to sales ratio of other insurance companies, the general rating is 2 with one rated at 5. However, Policy Bazaar’s rating is a staggering 47!

What are the risks to keep in mind for IPO analysis?

In the case of Policy Bazaar’s IPO analysis, the size of the insurance aggregator is not expanding as it ideally should. While Policy Bazaar focuses on selling insurance covers as per the lowest pricing basis, other insurance companies believe that equal focus should also be given to the features offered too.

Is it advisable to invest in Policy Bazaar IPO?

In terms of short-term, one can try subscribing for IPO allotment. In terms of long-term Policy Bazaar has great potential to perform. With the company’s plans to grow in offline insurance and group insurance, it is set to increase its margins even further. But given the company evaluation and IPO analysis, it is better to get listing profits and exit rather than holding it for long-term.

Watch more detail on IPO analysis with our conversation with Finnovationz below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!