The Government of India announced the Atal Pension Yojana Benefits scheme during the 2015-16 budget. It focuses on providing income security at old age to the working class individuals as well as to help them voluntarily save for life after retirement. The Pension Fund Regulatory and Development Authority (PFRDA) through the NPS structure, together administer the Atal Pension Yojana scheme.

Table of Contents

Highlights of the Atal Pension Yojana Scheme

- Guaranteed minimum monthly pension varying from Rs. 1000 to Rs. 5000 per month, thus guaranteed by the Government of India.

- 50% of the nominee’s contribution or Rs. 1000 per annum, whichever is lower, will be co-contributed by the Government of India. This is available to people who are not covered by the Statutory Social Security Schemes and who are not income taxpayers.

- All bank accounts are eligible to join the scheme.

Eligibility

The nominee must:

- Be a citizen of India.

- Between the ages of 18-40 years.

- Must have a valid Aadhaar card.

- Should make contributions for a minimum of 20 years.

- Must have a bank account linked with your Aadhar.

- Must have a valid mobile number

How to Apply for Atal Pension Yojana Benefits Scheme?

- All national banks provide the scheme. You can visit any of these banks to start your Atal Pension Yojana benefits account.

- Atal Pension Yojana benefits forms are available both online and at the bank.

- You can also fill up the application form and submit it to your bank.

- You need to provide a valid mobile number in case you haven’t already provided to the bank.

- Also, submit a photocopy of your Aadhaar card.

A confirmation message is received as soon as the application is approved.

Monthly Contributions

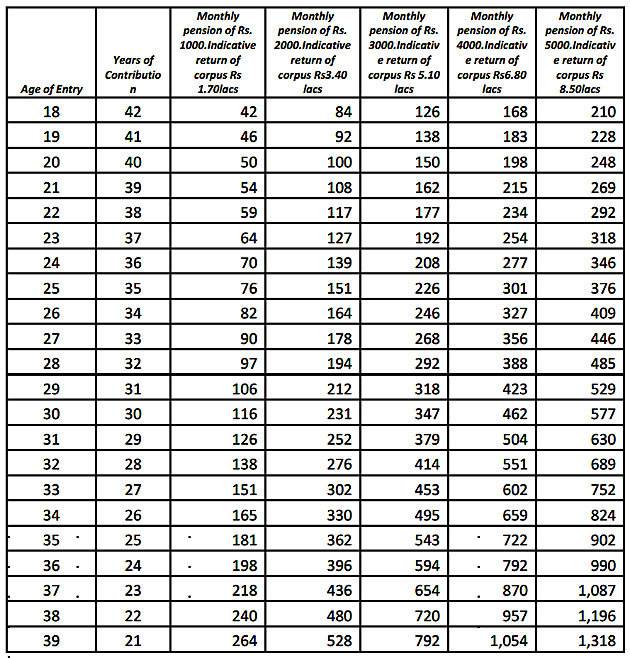

The monthly contribution depends upon the amount of pension the nominee wants to receive upon retirement and also the age at which they start contributing. The following table tells you how much you need to contribute per annum based on your age and pension plan.

Important Facts to know about Atal Pension Yojana

- Periodic monthly debits will be automatically taken from the nominee’s bank account, so need to make sure that the sufficient minimum balance is present before each debit.

- Getting the chosen premium package changed is as easy as just talking to the bank manager.

- A penalty is levied when there is a payment default, as follows:

- Re. 1 per month for a contribution up to Rs. 100 per month.

- Rs. 2 per month for a contribution up to Rs. 101 to 500/- per month.

- Rs. 5 per month for a contribution between Rs. 501/- to 1000/- per month.

- Rs. 10 per month for contribution beyond Rs. 1001/- per month.

- The account freezes when there is a default on payments for 6 months.

- When payment is not made for 12 months consecutively then the account is deactivated and the remaining amount is returned to the nominee.

- An early withdrawal of amount is not allowed generally. Only when there is some dire case then the nominee will receive the whole amount back.

- If for any reason the nominee chooses to close the scheme before the age of 60 years then only their contribution plus interest earned will be returned and they will not be eligible to receive the government’s co-contribution or the interest earned on that amount.

Furthermore, here’s a video to help you with a quick run-through:

Find more such informative articles on our blog: https://labourlawadvisor.in/blog/ and our YouTube channel: https://www.youtube.com/LabourLawAdvisor

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!